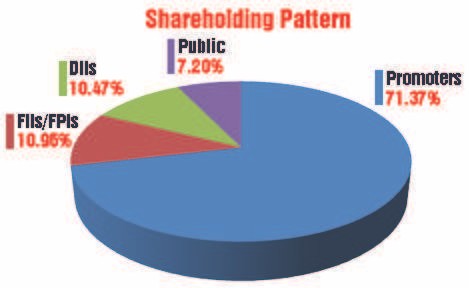

MUTHOOT FINANCE

| BSE ticker code |

533398 |

| NSE ticker code |

MUTHOOTFIN |

| Major activity |

Financial Company |

| Managing Director |

George Jacob Muthoot |

| Equity capital |

Rs. 401.36 crore; FV Re. 10 |

| 52 week high/low |

Rs. 1723 / Rs. 2476 |

| CMP |

Rs. 1045.50 |

| Market Capitalisation |

Rs. 41962.12 crore |

| Recommendation |

Accumulate at declines |

Five-fold rise in sales, net profit: Going well beyond gold loans

Kerala-based Muthoot Finance is India’s largest gold

financing NBFC, with gold loan assets under management

(AUM) of over Rs 60,000 crore. The company has a panIndia footprint with over 4,617

gold-lending branches. Primarily a gold financing company, it

also has a presence in other lending

segments like housing, micro-finance

and vehicle finance via its subsidiaries. Muthoot has made rapid strides

in its financial performance so far and

the prospects going ahead are all the

more promising.

Consider:

-

Having achieved remarkable success in gold financing and

emerging as the largest player in the

field, the company has now decided

to diversify as a one-stop point for varied financial services

to customers, including gold loans, personal loans, home

loans, money transfer, insurance, consumer durable/vehicle

loans and gold coins. It has already entered the housing,

micro-finance and vehicle segments.

-

Muthoot is also expanding geographically. It has

received the Reserve Bank of India’s approval to open 150

new branches across the country. Both its business and geographical expansions

will give a big boost to the topline as

well as bottomline going ahead.

-

The company has been going from strength to

strength on the financial front. During the last 12 years,

its sales turnover has expanded from Rs 2,316 crore in

2011 to Rs 11,082 crore in fiscal

2022, with the operating profit

spurting over five times from Rs

1,814 crore to Rs 9,192 crore and

the profit at net level skyrocketing

almost eight times from Rs 494

crore to Rs 3,954 crore. Overall,

during the last five years, the compounded sales growth works out

to 14 per cent, compounded profit

growth 27 per cent and return on

equity 25 per cent. The company’s

financial position has turned extremely strong, with reserves at the end of

March 2022 standing at Rs 17,943

crore, around 45 times its equity capital of Rs 401 crore.

-

Muthoot Finance’s standing and growth are being

increasingly recognized. Last month, it added another feather

in its cap with the Best Growth Performance award by Dun

& Bradstreet, a leading global provider of business

decisioning data and analytics, at its 22nd edition of India’s

top 500 companies corporate awards.

GOLD LOAN STEADY

The company’s shares are currently quoted around

Rs 1,040, reflecting a sharp fall from its 52-week high of

Rs 1,723. However, prospects ahead are quite encouraging. As the economy gradually

recovers from the impact

of the Covid-19 pandemic, gold loan demand remains

steady and the RBI’s nod for branch expansion has reinforced the management’s optimism

about a growth of

12-15 per cent in the gold loan business. The company

aims at a branch network of 5,000 in the near future.

The new fiscal year 2023 has begun on a disappointing note with net profit during

Q1FY2022 declining 17.4

per cent to Rs 802 crore, as compared to

the corresponding quarter a year ago. As

a result, the stock price tumbled down

from the 52-week high of Rs 1,723 to Rs

1,039. However, this is an attractive price

level to enter as the long-term outlook for

the company is highly promising.

PERFORMANCE INDICATORS (Rs. in crore)

|

Year

|

Net Sales

|

Net Profit

|

EPS (Rs.)

|

Div (%)

|

BV (%)

|

RONW (%)

|

|

2019-20

|

9707.30

|

3139.20

|

78.30

|

150.0

|

313.90

|

28.90

|

|

2020-21

|

11566.40

|

3807.00

|

94.90

|

220.0

|

391.90

|

27.80

|

|

2021-22

|

12237.46

|

4017.10

|

100.10

|

200.0

|

468.40

|

23.38

|

ADVANCED ENZYME TECHNOLOGIES

| BSE ticker code |

540025 |

| NSE ticker code |

ADVENZYMES |

| Major activity |

Other Agricultural Products |

| Chairman |

Vasant L. Rathi |

| Equity capital |

Rs. 22.36 crore; FV Re. 02 |

| 52 week high/low |

Rs. 422 / Rs. 257 |

| CMP |

Rs. 266.75 |

| Market Capitalisation |

Rs. 2982.74 crore |

| Recommendation |

Buy at declines |

Going global with its enzymes

Promoted by second-generation enzymologists, the

Rathi brothers, in 1989, the Thane (Maharashtra)-headquartered Advanced Enzyme

Technologies is one of the largest

Indian enzyme companies with a product basket of 400+ proprietary products developed

from 68 indigenous enzymes

probiotics. Recently, it has emerged as a global enzyme power

house with three wholly-owned subsidiaries, three joint ventures and five stepdown

subsidiaries.

The company offers these products to

700+ customers spread across 45

countries. The company has been doing very well and its prospects going

ahead are all the more promising.

Consider:

-

Globally, the growth of the

enzymes market piggybacks on a diverse spectrum of customers. This, together

with a limited number of meaningful players, has created a conducive

business environment for existing players in the space. Note that enzymes as

‘cost to percentage of sales’ is not material, yet its efficacy is

very important to the end-product, including constituency of

the end- product in terms of its taste, appearance, aroma and,

thus, quality perception, leading to significant supplier stickiness. With a

revenue bandwidth of just Rs 440 crore (~$60

million), AET remains a marginal player in the global enzymes

landscape that is estimated at ~$10 billion and poised to

grow at 6-7% CAGR as more and more applications across

usage industries incorporate enzymatic technologies. Despite

being a smaller player, AET’s product basket of >400 products is testimony to

its proven capabilities.

-

Having pioneered the production of enzymes in India, AET continues to set

trends with research and development of new applications for the use of

enzymes. Today, the

company caters to diversified industries like human nutrition,

animal nutrition and bio-processing. It provides its proprietary and customized

enzyme products to various pharmaceutical and nutraceutical companies in India,

other Asian

countries, North America and Europe. The company has stateof-the-art

manufacturing facilities and R&D centres across

India, the US and Germany.

-

AET faces little competition as it has a specialised

business model with high entry barriers. One of the biggest

challenges facing new companies looking to enter the enzyme

segment is to offer continuous and differentiated solutions as

per the client’s requirement — that demands real time R&D

capability and flexibility in manufacturing. Large manufacturing capacities,

proven capabilities, experienced promoters, customer stickiness, fairly

consistent track record, ability

to develop new products in-house

and quest for unique acquisitions

are some differentiators for AET.

-

AET is poised to capture the growing opportunities in

the enzyme and probiotics space

backed by its proven capabilities

and stable financials that have

been fairly consistent, thanks to a

mix of organic and inorganic

growth. The acquisition route has

contributed significantly in the

company’s growth in the topline

as well as bottomline. AET has

acquired a number of companies, including Advanced

Supplementary Technologies Corporation, JC Biotech, AEM

of Malaysia and EVOII Technologies GmbH, a renowned

German R&D company. While ASTC has enabled the company to consolidate its

position in the US market, the acquisition of the German company has

strengthened the

company’s R&D capabilities with the state-of-the-art Directed Evolution

Technology in creating the desired enzyme

molecules.

-

The company has made slow but steady progress

on the financial front. During the last 12 years, its sales turnover has

expanded from Rs 116 crore in fiscal 2011 to Rs

529 crore in fiscal 2022, with operating profit inching up from

Rs 23 crore to Rs 203 crore and net profit spurting over seven

times from Rs 17 crore to Rs 120 crore. Its financial position

is getting stronger by the day and its reserves at the end of

fiscal 2022 stand at Rs 1,066 crore – over 48 times its equity

capital of Rs 22 crore. Its balance sheet is very healthy as it is

an almost debt-free company.

The company is going from strength to strength, and continues the search for

acquisitions to quicken its pace of

growth. Its shares with a face value of Rs 2 are quoted around

Rs 266.75 – down from the

52-week high of Rs 422 in

line with global trends. Its

shares are available at an

attractive valuation and

long-term investors can

accumulate them at every

decline.

CONSOLIDATED PERFORMANCE INDICATORS (Rs. in crore)

|

Year

|

Net Sales

|

Net Profit

|

EPS (Rs.)

|

Div (%)

|

BV (%)

|

RONW (%)

|

|

2019-20

|

444.00

|

129.30

|

11.60

|

30.0

|

75.20

|

17.00

|

|

2020-21

|

501.80

|

145.70

|

13.00

|

45.0

|

86.80

|

16.10

|

|

2021-22

|

529.38

|

118.78

|

10.60

|

50.0

|

97.40

|

11.53

|

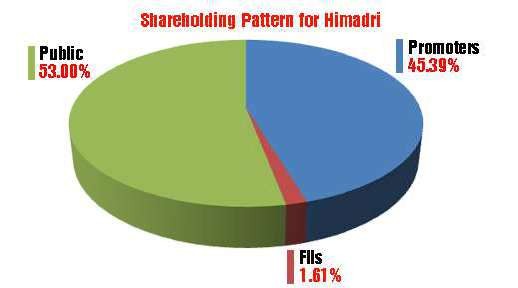

HIMADRI SPECIALITY CHEMICALS

| BSE ticker code |

500184 |

| NSE ticker code |

HSCL |

| Major activity |

Speciality Chemicals |

| Managing Director |

Shyam Sunder Choudhary |

| Equity capital |

Rs. 41.93 ; FV Re. 01 |

| 52 week high/low |

Rs. 105 / Rs. 41 |

| CMP |

Rs. 100.55 |

| Market Capitalisation |

Rs. 4216.46 crore |

| Recommendation |

Buy at declines |

Riding demand for carbon derivatives

Himadri Speciality Chemicals (HSCL) is a completely integrated speciality carbon

company which has leveraged its deep knowledge of one of the most versatile

substances – carbon. Over the years, with its core products

and value-added by-products, the company has established

one of the world’s most extensive value chains in the carbon segment. It is engaged in

the

manufacture of various grades of

coal tar pitch and other value-added

products derived during the distillation process. Prospects for the

company are quite encouraging. At

the current price, this is a safe investment with good chances of appreciation going

ahead.

Consider:

-

Himadri is a leading manufacturer of coal tar which is the by-product derived

from coke oven batteries used in the steel industry while

converting coking coal into low ash metallurgical coke. The

gas thereby derived is converted into coal tar which is distilled and developed

into multiple value-added derivatives.

Himadri is India’s largest coal tar pitch producer and enjoys

a hefty marketshare of 70 per cent, which the management

expects to improve in the coming years by catering to more

than two-thirds of the requirements of the aluminium and

graphite industries. Coal tar

demand is inelastic. Aluminium smelters cannot reduce production/shut down

during a downturn owing to

the significantly high cost of

starting afresh. This gives the

company an edge for roundthe-year stable business.

-

The domestic demand for coal tar pitch grew

at a robust pace of 7.5-8% between 2012 and 2017 and at

around 10 per cent CAGR between 2017 and 2021. The

aluminium industry is the key driver of the domestic coal tar

pitch industry. The company has entered the carbon black

industry by way of forward integration. It has forayed into

speciality carbon black – a segment that has high growth

potential. This has allowed the company to diversify its customer base

and strengthen its high-margin,

value-added product portfolio.

-

Himardri has gone in

for forward integration into SNF, a

next-generation product. SNF is a

product for the construction industry and is an admixture of agro

chemicals, latex and gypsum. It improves the concrete mix workability and its

compressive flexural

strength. The company is India’s

largest manufacturer of SNF, with an installed capacity of

68,000 tpa and a marketshare of 50%. It has also gone in for

forward integration into advanced carbon materials used in

batteries for electric vehicles. Going forward, specialty carbon black and

advanced carbon materials will drive margin

expansion.

The company has rapid

strides on the sales front,

with sale turnover during the

last 12 years expanding

from Rs 700 crore in fiscal

2011 to Rs 7,291 crore in

fiscal 2022. However, its

performance on the profitability front is disappointing.

During the last 12 years, its

operating profit has declined from Rs 199 crore in

fiscal 2011 to Rs 156 crore

in fiscal 2022 and the net profit during this

period has dipped from Rs 113 crore to

Rs 41 crore.

However, the outlook is better going

ahead. Of course, the risk-reward ratio is

high. But cautious investors who invest small

to moderate amounts may do well.

PERFORMANCE INDICATORS (Rs. in crore)

|

Year

|

Net Series

|

Net Profit

|

EPS (Rs.)

|

Div (%)

|

BV (%)

|

RONW (%)

|

|

2018-19

|

5587.30

|

19.00

|

1.40

|

----

|

10.40

|

7.80

|

|

2019-20

|

8386.60

|

44.50

|

3.40

|

----

|

22.80

|

16.00

|

|

2020-21

|

10390.75

|

122.91

|

8.60

|

----

|

32.90

|

16.01

|

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access