Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Dec 15, 2022

Updated: Dec 15, 2022

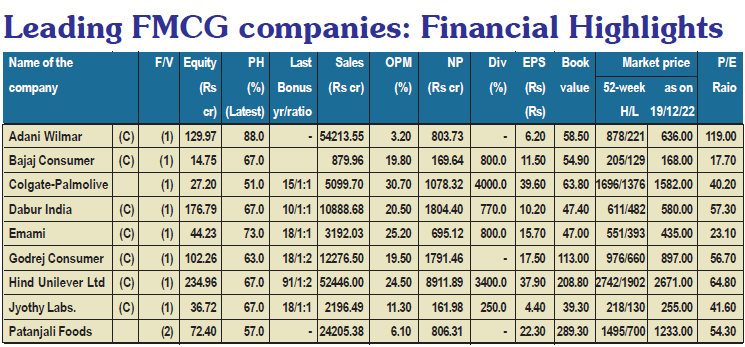

The country’s largest corporate entity in terms of market cap has thrown down the gauntlet to MNC and domestic biggies in the FMCG space by announcing the entry of Reliance Retail in the pcackaged foods space.

To begin with, its umbrella brand ‘Independence’ has been launched in Gujarat and will compete with Adani Wilmar in edible oils, grains and pulses, Parle and Britannia Industries in biscuits, Tata Consumer Products in pulses and packaged water, and ITC in packaged ‘atta’ and biscuits.

However, while brokerage house Nomura predicts that RIL’s entry into FMCG will benefit and grow the staples/packaged foods categories, the jury is still out on whether the Ambani incursion into the food space will create the same disruption as Jio did with the telecom sector.

Finally, Isha Ambani, the dynamic and farsighted director of Reliance Retail, has dropped a bombshell by announcing the arrival of Reliance – the oil & gas to telecom, retail and renewable energy giant – in the fast moving consumer goods (FMCG) segment, to begin with from Gujarat. The news has sent shivers down the spines of existing players in the space like Hindustan Unilever, Tata Consumer Products, ITC, Adani and Patanjali. Ms Ambani had dropped a hint at the last AGM of RIL that the company would enter the FMCG space this year, and the actual entry has now taken place in the last fortnight of December 2022. Ms Ambani has further revealed that Reliance Retail Ventures has set up FMCG arm Reliance Consumer Products Ltd, which has started with staples, processed foods, beverages and other daily essentials under the brand name ‘Independence’.

RIL’s entry into the FMCG segment has spurred market circles and observers of the FMCG space to speculate whether the RIL entry will disrupt the segment and whether it will lead to re-rating of FMCG stocks.

To begin with, it is certain that this development will give rise to huge competition among leading names in the food business like Tata Consumer Products, ITC, Adani Wilmar and Patanjali.

According to sources close to Reliance Retail Ventures Ltd, itself a subsidiary of Reliance Industries, the launch of ‘Independence’ at present is only in Gujarat, possibly on a pilot basis. Says an expert in the FMCG space, “To begin with, the company intends to compete with Adani Wilmar in edible oils, grains and pulses, Parle and Britannia Industries in biscuits, Tata Consumer Products in pulses and packaged water, and ITC in packaged ‘atta’ and biscuits. The company will have products belonging to categories like biscuits, packaged water, edible oil, packaged ‘atta’, ‘besan’ (gram flour), pulses, grains and sugar. Intensive exercises have been undertaken to make these products more affordable as compared to those of its rivals.”

Once the first phase, involving staple processed foods, beverages and other daily essentials, starts yielding favourable results, RIL will enter into beauty products, including lipstick, whitening cream face powder and perfumes. With a view to launching these products, RIL has incorporated another company styled Reliance Beauty and Personal Care Ltd. Sources feel the new company will be a full-fledged FMCG player within a year or so, competing with almost all the other players in the space.

According to experts, RIL’s entry into FMCG will also lead to some positive developments for the economy. Says brokerage house

The Fast-Moving Consumer Goods (FMCG) industry is undergoing a significant transformation in response to the demand for more convenience, the Covid-19 pandemic, and changes in customer behaviour. The major FMCG industry trends that address these changes involve sustainable product development and packaging, solutions improving customer experience, and digitization. To offer a better customer experience and gain a competitive edge, FMCG companies seek omnichannel sales and e-commerce in addition to deploying big data, analytics, and Artificial Intelligence (AI) solutions. The Internet of Things (IoT) devices and 3D Printing technology further enable FMCG companies to enhance direct distribution to meet the growing customer expectations, according to a research report by ‘Startups Sights’.

For this in-depth research on the ‘Top FMCG Industry Trends & Startups’, the research team analyzed a sample of 3,011 global startups and scaleups. The result of this research is data-driven innovation intelligence that improves strategic decision making by giving an overview of emerging technologies & startups in the FMCG industry.

According to this research report, the top 10 global FMCG industry trends are:

Consumers are becoming more conscious of climate change and its impact on the environment. Thus, they pay more attention to companies’ social activities and seek those that offer more responsible product choices. As sustainability comes to the forefront, FMCG companies not only address how they present and package their products but also what materials they use in their products. To meet consumer demand, more and more FMCG companies offer compostable, recyclable and reusable packaging. Additionally, cruelty-free, vegan ingredients are on the rise not only in food but also in non-food items such as cosmetics and cleaning products.

Green packaging: UK-based startup Flexi-Hex produces environmentally-sustainable packaging that allows FMCG companies to reduce the amount of packaging waste. The startup offers adaptable, plastic-free solutions with its patented honeycomb design made from recycled paper. The startup aims to remove plastic from the packaging industry and raise awareness of the threat that plastics pose to the oceans.

Vegan platform: German startup Vegshelf has developed a digital business-to-business (B2B) platform connecting healthy, vegan FMCG brands with online stores, supermarkets and food services. The platform enables round-the-clock exposure and direct access to buyers. Vegshelf shortens the sales cycle, in turn enabling FMCG brands to build and maintain relationships with new and existing customers.

With the demand for convenience increasing in the FMCG sector, companies strive to significantly improve customer experiences. Startups employ Augmented Reality (AR) and Virtual Reality (VR) to make products more engaging and interactive. 3D videos and gamification attract and entertain customers while providing them with more information about the product. Further, investing in improving customer experiences builds trust and increases brand loyalty. To this end, more and more FMCG companies are providing higher convenience with digital technologies.

Consumer Intelligence: Nigerian startup Chekkit offers a consumer intelligence solution to improve customer engagement. The solution brings FMCG companies closer to those buying their products through personalized messaging and communication. Chekkit also enables FMCG companies to push product surveys and messages to consumers based on their purchase behaviours. Further, the solution runs automated reward campaigns and drives repeat purchases using loyalty programmes.

AR solutions for FMCG: Singaporean startup DRNKAR’s solutions are AR Social Media, an AR Mobile App & AR Platform. AR Social Media entices shoppers through ads and social media activity and redirects them to make a purchase on the website. The AR Mobile App offers 2D and 3D animation to display extended product details while the AR Platform enables FMCG companies to control and manage their content and product information, as well as get insights into consumer behaviour. Overall, the startup’s solutions enable FMCG companies to create memorable customer experiences and improve consumer engagement.

Digitization is increasingly becoming a priority for FMCG brands as customers interact with brands across multiple online and offline channels. Companies get access to valuable data from these sources, including various social media platforms, web, and mobile applications. Besides, it also allows FMCG brands to better engage with their customers and convert onetime buyers into repeat customers.

Customer Connect: Indian startup Gladminds offers a cloud-based platform that acts as a two-way communication channel between brands and customers. Gladminds’ Connected Platform allows companies to leverage their brand experience and create value for the customer. For example, the startup enables optimizing and personalizing services, marketing and communication, among other functions. This connects brands with consumers and ensures prolonged product support and engagement.

Smart Replenishment: US-based startup Repeat provides a Smart Replenishment platform to turn one-time buyers into repeat customers. The startup powers frictionless reordering experiences that are easy from the customer end and increase revenue for companies. The solution analyzes order data to determine baseline replenishment intervals and automates replenishment workflows to increase operational efficiency.

The share of sales coming from e-commerce is increasing exponentially. The outbreak of the Covid-19 pandemic has further shifted consumers’ shopping habits towards online channels. Brands are now building their online presence to boost their engagement with consumers. Social media also plays a significant role in the world of e-commerce as more items are sold via social platforms such as Instagram. To this end, FMCG startups actively incorporate diverse media, leveraging mobile and headless commerce, to market their products.

Headless e-Commerce: Norwegian startup Crystallize provides an Application Programming Interface (API)-driven e-commerce platform for subscription-based businesses models. The startup’s software delivers APIs for product information and content management to digitize the sales process. Headless content management is powered by a semantically structured content engine. This enables brands to build and deliver content in different languages, market and sell their products online, and offer product subscriptions.

FMCG companies actively leverage big data to innovate and compete in the industry. As data is becoming more and more accessible with consumers shopping online, brands explore new ways to increase relationships with their customers and gain insights from their behaviour. Data analytics explores customer preferences and behaviour to provide FMCG companies with a deeper understanding of their purchase habits. Big data solutions allow brands to optimize communication with their customers and offer more personalized experiences.

Consumer-based Data Platform: Chinese startup Zhimatech builds a consumer-based data operation platform taking into account offline behaviour data within shopping centres. Through its Re-ID technique, the startup accurately analyzes traffic flow within shopping malls. Combined with online data, Zhimatech creates customer composition insights. The startup also monitors on-site traffic distribution and helps determine the value of individual shops. Further, this data is used to guide marketing activities from planning to promotion.

AI-powered solutions, such as Machine Learning (ML) and Natural Language Processing (NLP), are gaining popularity and creating opportunities for the FMCG industry. For instance, voice-based systems support consumers round-the-clock to find products, in addition to recommendation engines that provide personalized product suggestions. By implementing AIbased solutions, FMCG companies provide an enhanced customer experience, thereby increasing customer satisfaction and retention.

Conversational AI: Canadian startup Letmetalk provides AI-powered chatbots to drive up sales and customer satisfaction. The automated system allows for smooth and personalized marketing, as well as conversations with more than one client at a time. The startup enables FMCG companies to make contact and build relationships with potential customers and improve conversion rates.

More and more FMCG companies are leveraging direct distribution to increase customer loyalty and ensure growth. For example, manufacturers directly interact with their end customers through their own online and offline distribution channels. This increases their profit margin and offers consumers a direct channel to reach their favourite brands. This FMCG industry trend is closely associated with e-commerce growth as well as the penetration of smartphones and the internet.

Sales and Direct Distribution: Singaporean startup Ivy builds an AI- and ML-powered platform to automate sales and distribution in the FMCG industry. The solution enables companies to enhance their customer experience, increase shelf revenue, and improve the productivity of their field force. Ivy offers a Software-as-a-Service (SaaS) enterprise customer relationship management (CRM) solution where users can manage stock, complete in-store selling and process orders. The solutions support multiple types of sales channels simultaneously.

As IoT evolves, its applications gain popularity in the FMCG sector. IoT devices are automated and affordable, enabling FMCG companies to employ them in brick and mortar stores, warehouses and manufacturing facilities. One example of IoT device implementation is to provide targeted messaging to consumers while they are shopping. Another one is inventory management, both in stores and in warehouses, for which IoT is widely used. In combination with related emerging technologies, including ambient intelligence and smart objects, IoT creates new consumer interaction channels and revenue streams for FMCG brands.

iBeacon Solutions: Moving one step ahead of the traditional mobile app development approach, Australian startup Ripen Apps creates innovative applications utilizing iBeacon technology. iBeacons enable add-ons to send customers contextual, hyper-local, meaningful messages and personalized ads on their smartphones as they evaluate a product.

The competition within the FMCG industry is increasing and brands invest in blockchain to gain a competitive edge. Smart contracts and blockchain traceability allows FMCG companies to understand their supply chain bottlenecks and make necessary interventions. It also increases transparency for consumers by allowing them to track the source of their purchases. Additionally, blockchain platforms offer cryptocurrencies and loyalty programmes that allow consumers to collect, exchange and redeem points, increasing customer engagement.

Digital Loyalty Token: Singaporean startup WABI has developed an open platform that supports loyalty programmes and enables a direct two-way communication channel between brands and consumers. Consumers use WABI to authenticate blockchain-protected products and share feedback. FMCG companies, on the other hand, deploy targeted surveys and opinion polls to generate consumer insights and drive effective decision-making. Additionally, brands can run A/B tests with a live audience and test pricing, messaging and colour to optimize their offerings to a specific target audience.

Additive manufacturing and its applications create disruptive solutions for the FMCG industry. The vast amount of waste generated by use-and-throw consumer products, from personal care to food packaging, has prompted FMCG industry stakeholders to find sustainable alternatives. 3D printing allows FMCG brands and manufacturers to design and develop products that use eco-friendly materials and reduce plastic use. To this end, FMCG companies leverage 3D printing for prototyping, designing, tooling and scaling production in a sustainable manner. Further, food companies are able to offer extra nutritional value in their products by utilizing 3D food printing.

3D Printing Platform: US-based startup Essentium offers a 3D printing platform specifically for industrial production. platform allows companies the flexibility to create multiple product iterations without impacting quality, strength or performance. FMCG companies use the platform for rapid prototyping, fine-tune designs, and printing high-precision enduse parts and components.

Austrian startup Mything is an online marketplace that connects companies with local additive and digital manufacturers for on-demand 3D printing. The startup allows FMCG brands to optimize production and lower costs by lowering delivery distances, stock lead times and material waste.

Nomura, “Basically, the entry of another large player in staples/packaged foods will accelerate conversion from unbranded to branded products, thus benefiting and growing the staples/packaged foods categories as a whole.”

The question being discussed in market and industry circles is whether RIL’s entry into the FMCG sector will disrupt the FMCG space the way Jio did with the telecom sector in 2016.

There can be little doubt that India’s largest corporate entity in terms of market capitalization is fully prepared to take the plunge in the huge $ 220 billion FMCG industry currently dominated by global and domestic players like Hindustan Unilever, Britannia, Nestle, ITC, Tata Consumer Products, Adani Wilmar and Dabur. Speaking about Reliance Retail’s achievements during the last one year, Isha Ambani had said, “RR has served over 200 million registered customers — equivalent to the collective population of the UK, France and Italy — at RR’s physical stores and digital platforms. Our digital commerce platforms continued their growth with nearly six lakh orders being delivered every day – an increase of 2.5 times over a year ago. RR has opened over 2,500 stores in the year to take its store count to over 15,000, and has generated 1.5 lakh jobs. We doubled warehousing space to 670 million cubic feet.”

As Ms Ambani put it succinctly, “Last year we sold over 425 million garments, enough to clothe the population of the US and Canada.” RIL supremo Mukesh Ambani is also jubilant over the prospects for Reliance Retail going ahead. He maintains, “RR would like to serve millions daily with unlimited choices, outstanding value propositions, superior quality and unmatched experience through the company’s physical stores or digital and omni channel platforms.”

According to him, the company is capable of establishing a strong technology-enabled supply chain capable of moving products across geographies in India in the most efficient manner.

On a more cautious note, an industry watcher says, “No doubt, RIL is all set to take a plunge in the FMCG sector and, thanks to its size, market reach and financial strength, is capable of making waves in the FMCG space. But we cannot say that it will create the same disruption in the FMCG sector as it did in the telecom sector.”

Adds other market watcher, “The scope and size of the telecom industry was totally different. We cannot expect ’s Jio Finance to make the same impact on the Indian finance sector or the RIL FMCG wing to equally impact the FMCG sector.”

However, it will definitely give tough competition to the existing players. Patanjali, for example, hit giant Hindustan Unilever very hard in its oral care segment, i.e., Close-up and Pepsodent toothpastes, with its powerful ‘Dant Kanti’. Likewise, Patanjali’s Chyawanprash had made an inroad into Dabur’s own Chyawanprash market.

Similarly, RIL will have an adverse impact on the marketshare of existing FMCG players. But it is unlikely to reprise the success it achieved in the telecom sector where it wiped out small and weak units and stole a huge chunk of marketshare from established telecom players.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives