Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Jun 30, 2022

Updated: Jun 30, 2022

Based in Mumbai, with its two manufacturing units at Vapi and Silvassa supported by a state-ofthe-art R&D division duly approved by DSCIR, Government of India, Modison Metals (MML), an NSE-BSE listed company, has created a niche for itself in electrical contacts for switchgear in India and abroad. The company is amongst a handful of companies that manufacture electrical contact materials and finished contacts for the switchgear industry, including for low, medium, high and extra-high voltage requirements. It also produces goods for dominant sectors such as automotive, engineering, aerospace and railways. MML has evolved an aggressive strategy to accelerate its pace of growth.

The size of the domestic switchgear industry, which was Rs 183 bn in FY18 and which is growing at a steady pace of 9.3%, is expected to reach Rs 286 bn in FY23. The low-voltage switchgear market (MCBs, DBs and RCCBs) is in demand from both the residential and industrial sectors whereas the medium/high voltage segments are used in industry and power utilities. Retail sales comprising the residential sector constitute more than 50% of the low-voltage switchgear market.

The industrial offtake in India rebounded by 28% last year to 34.2 MOZ (million ounces) (1,065 tonnes) from 2020’s low base as economic activity improved. However, demand was still lower by 9% than in 2019 and nearly 30% below to its record high in 2011, but is now expected to recover in FY23. MML will be benefited from this because it caters to all the segments of the switchgear industry. Moreover, its plant is amongst the largest single sites for high-voltage electrical contact manufacturing globally and hence enjoys a low-cost advantage.

Despite the 2nd wave the Covid-19 pandemic and the Omicron variant impacting manufacturing operations and leading to higher inventory costs, an unfavourable silver process movement and a volatile geopolitical situation, the company continued its growth trajectory during FY22 by streamlining operations and recorded an increased market presence amongst its customers. Adverse input cost movements, including silver, impacted profitability in the short term. “Given Modison’s organisational efficiency, we remain optimistic that this growth will continue in the coming year,” informs GL Modi, founder and Managing Director.

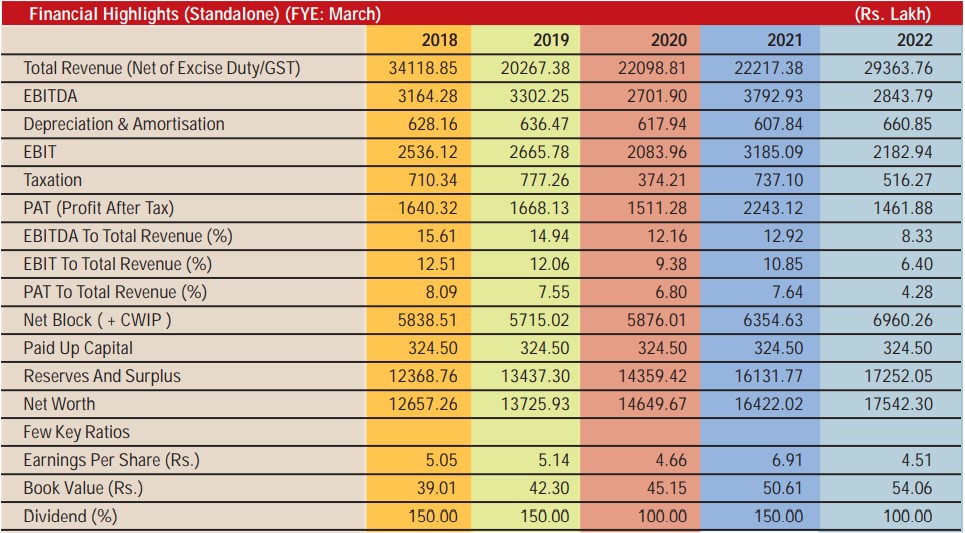

During FY22, on a standalone basis, the company achieved a sales turnover of Rs 293.64 crore with EBITDA and PAT of Rs 28.44 crore and Rs 14.62 crore respectively, translating into an EPS of Rs 4.51 on its tiny equity capital of Rs 3.24 crore with a face value of Rs 1 each. In contrast, in its previous financial year, the company clocked a turnover of Rs 222.17 crore, EBITDA of Rs 37.93 crore and PAT of Rs 22.43 crore, giving an EPS of Rs. 6.91. Exports stood at Rs 55.28 crore with a nominal increase of 7.69%, against Rs 51.33 crore in the previous year.

The board declared and paid an interim dividend of 100%; i.e., Rs 1 per share against 150% in the previous year. MML has a net fixed assets base of Rs 66.50 crore and capital workin-progress of Rs 3.03 crore at year-end. Its short-term borrowings (working capital) are Rs. 17.42 crore whereas there is no long- term borrowings. Reserves and surplus of Rs 172.52 crore has resulted in a book value of Rs 54.06 per share.

Elaborating on the existing business plans, Mr Modi says, “We have started our capex plan for upgradation of existing facilities by infra expansion, both green and brownfield, procuring automated machinery and robots, etc. This will augment efficiency and enable us to cater to increasing product demand. We also plan to build a new factory at our existing premises for increasing the HV segment assembly line. The said capex involves an outlay of Rs 25 crore, which will be funded through a mix of internal accruals and debt.”

Speaking of the company’s salt, bullion and other segments, Mr Modi adds on a positive note, “We manufacture silver nitrate, silver sulphate and silver oxide. These are high-grade precious metal compounds with diverse applications in industries such as silver plating, pharmaceutical catalysts, mirror manufacture, inedible inks, explosives, fine chemicals, performance chemicals and silver oxide batteries. We booked the first export order for salt from Indonesia.”

MML also operates in the consumer bullion segment, where its manufactures and sells silver bars and coins. These are being promoted through a partnership with the post office as well as via leading online websites and distribution networks. Commenting on this smaller contributor to its revenues, Mr. Modi says, “FY22 was a mixed year for our bullion and salt markets segment on account of the lockdowns and prevailing uncertainty. We expect to record growth in the coming years on account of increased silver demand.”

“We have started our capex plan for upgradation of existing facilities by infra expansion, both green and brownfield, procuring automated machinery and robots, etc.

- G.L. Modi, Founder and Managing Director

Revealing the company’s short-medium term plans, Mr Modi explains, “We believe in a fourpronged strategy for growth, which includes employees’ well-being, innovation and automation, financial stability and lean implementation, and employees’ upskilling and development. Under innovation and automation, we include product development, digitalisation, new market development and keeping operating costs in check. This will sharpen our focus on profit generation.”

Continuing on the promising prospects ahead in EVs, Mr Modi says, “India is moving towards building a robust EV ecosystem with this year’s Union budget announcing significant reforms. We have taken several steps towards strengthening our EV infrastructure offering. The board has approved a business plan for a battery energy storage system (BESS) and an EV charging infrastructure. The company has entered into an MoU with RENERA and LDrive (L-Charge), leaders in BESS and EV charging infrastructure respectively. These expansion plans are currently in the feasibility stage.”

Giving an insight on MML’s new and robust people management system, Mr Modi says, “Our new flat organization structure enables streamlined decision-making and lowers transactional costs. We have also implemented a new ‘reward & recognition’ scheme to create a motivational environment of performance excellence, which has started showing the desired results and is expected to add significant value to our organization. We are on target to enhance our production capabilities through modernization of our factories. This will enable us to meet dynamic market challenges.”

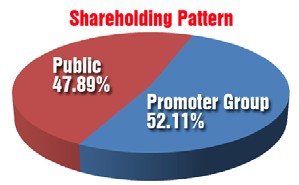

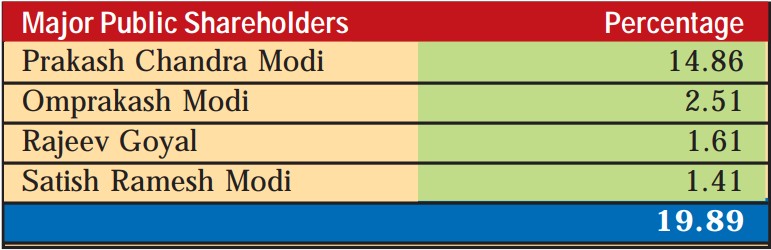

The promoter group holds a 52.11% equity stake in the company whereas 16,917 public shareholders hold the remaining 47.89%. Of this, four individual shareholders hold nearly 20 per cent.

January 31, 2026 - Second Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives