Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: Apr 15, 2023

Updated: Apr 15, 2023

Not unlike their global counterparts, Indian speciality chemicals stocks, which were flying high on the Indian stock market during in fiscals 2020, 2021 and early 2022, have seen price dips of 20-40 per cent from their 52-week high levels.

The headwinds buffeting these stocks have come from different quarters: the belated impact of the Covid-19 pandemic, the geopolitical tension on account of the Russia-Ukraine conflict and the resultant supply chain bottlenecks, non-availability and the resultant high prices of raw materials, the global economic slowdown and fears of the US and European economies slipping into a recession.

However, most analysts and industry observers feel the setback is temporary and the long-term outlook for these speciality chemical companies and their stocks remains promising.

They are confident that as soon as the global geo-political and economic situation starts improving – and with the added advantage of global sources turning from major supplier China to an equally competitive India, the country’s speciality chemicals sector will re-enter the growth path with ‘double force’. Clearly then, discerning investors can judiciously pick Indian speciality chem stocks with a longterm perspective.

Speciality chemicals stocks, which were ruling the roost in the Indian stock market during fiscals 2020 and 2021 and the early part of 2022, have of late suffered a severe setback with prices correcting by 20 to 40 per cent from their 52-week high levels. The belated impact of the Covid-19 pandemic, the geopolitical tension on account of the Russia-Ukraine conflict and the resultant supply chain bottlenecks, non-availability and the resultant high prices of raw materials, the global economic slowdown and fears of the US and European economies slipping into a recession were the key headwinds pushing down stock prices from their high levels.

Atul tumbled down from Rs 10,188 to Rs 6,750, Aarti Industries from Rs 908 to Rs. 482, Vinati Organics from Rs 2,373 to Rs 1,693, Deepak Nitrite from Rs 2,390 to Rs 1,682, Alkyl Amines from Rs 3,450 to Rs 2,119, Fine Organic Industries from Rs 7,327 to Rs 4,028 and Galaxy Surfactants from Rs 3,446 to Rs 2,217. Navin Fluorine International, the stock with a face value of Rs 2 which was bid upto Rs 4,848, came down to Rs 3,438, Gujarat Flurochemicals from Rs 4,173 to Rs 2,105 and Balaji Amines from Rs 3,842 to Rs 1,925. Clean Science and Technology dropped from Rs 2,033 to Rs 1,227 and Rosari Biotech from Rs 1,051 to Rs 536.

Of course, it is not that only Indian speciality chemicals companies are facing headwinds — it is in fact a global trend. Industry experts and research analysts believe that speciality chemicals companies’ sales and earnings are closely tied to the global economy, which is on the down path. Again, the weakening economic outlook has taken a toll on the valuations of these stocks. Little wonder, stock prices of Celanese, Dupont, Eastman Chemical, Ecolab, Ingredion, and International Flavours and Fragrances have suffered a sharp setback. Some research analysts recommend that investors buy these stocks, pointing out they are undervalued at present.

Coming back to the Indian scene, speciality chemicals stocks moved into top gear in recent years on account of bumper exports and rising demand at home. However, they have now tended to stop rising and have started seeking lower levels on account of reduced demand, while the profit margins of manufacturing companies have also contracted on account of a spurt in the cost of raw materials.

Research analysts as well as other industry observers feel that the setback is temporary and the longterm outlook for these speciality chemical companies is buoyant. Hence, discerning investors should selectively pick these stocks with a long-term perspective.

Of course, the short-term outlook is cautious as world economic growth is weak and geopolitical issues are not settled as yet. According to a Nuvama Research report, though Q3FY2023 (the December 2022 ending quarter) earnings of speciality chemicals companies showed healthy volume growth and stable operating margins, chemicals companies with a higher exposure to commodity prices such as Deepak Nitrite and Aarti Industries faced some duress due to subdued demand, moderation in product prices and pinched margins. However, the good part is that the industry’s margin outlook is largely comforting as companies are expected to benefit from price increases and a better mix. Analysts at ICICI Direct Research maintain that most cost headwinds were addressed by chemicals companies by using a better product mix with a higher proportion of CRAM’s execution and value-added products.

Though near-term commentary is cautious and points to some moderation in growth, chemicals companies focused on industries such as textiles and automobiles are seeing some demand pressure, while firms catering to industries like dyes and paints endured a double whammy of weak demand and lower realization.

According to analysts at Jefferies India Pvt Ltd, despite the strong showing in Q3, consensus FY24 earnings estimates for key chemical companies such as Navin Fluorine Ltd and SRF Ltd have seen cuts indicating stretched growth expectations. “Valuations prevail at premiums to the 5-year average possibly on optimistic earnings estimates. We would consider becoming more constructive, were valuations to turn more reasonable,” added the Jefferies report.

Meanwhile, with the recent correction in stock prices of speciality chemicals companies, valuations have cooled off. Prices are turning attractive as long-term growth prospects are bright.

Insist market analysts and industry experts, “The speciality chemicals sector is down but not out.” The add, “As soon as the political and economic situation starts improving, the sector will re-enter the growth path with double force.” Notwithstanding the recent setback, speciality chemicals are very much the flavour of the season. These products account for around 22 per cent of the total chemical sector in India, have specific end-users and are usually manufactured in low volumes. These chemicals find their applications in a wide variety of industries like tyres, manufacturing, agrochemicals, pharmaceuticals, personal care, etc. During the last two to three years, this sector has seen an unprecedented boom mainly on account of the fact that speciality chemicals companies in China, a major manufacturer, were shut down due to the ‘Blue Sky Policy’ strictly implemented in that country in order to protect the environment.

After global importers started reducing their dependence on China – widely seen as the origin of the deadly coronavirus – they have turned to India. After all, India has a strong base in agrochemicals, dyes & pigments, and intermediates for active pharma ingredients, which constitute 27, 19 and 18 per cent respectively of the country’s speciality chemicals exports in value terms.

Little wonder then that during fiscal 2020, when India’s overall exports shrank by 5.1 per cent on account of the outbreak of Covid-19, exports of speciality chemicals, including drug formulations, bulk drugs & drug intermediates, organic chemicals, agrochemicals and fertilisers rose 3 per cent to $ 45 billion. In fact, the country turned a net exporter of chemicals as imports stood at $ 44.3 billion – a feat achieved for the first time during the last one decade.

Demand for speciality chemicals continued to rise in fiscal 2021, driving prices to sky-high levels in the process. The easing of lockdown restrictions around the world has improved the outlook for the sector. The winter storm that disrupted chemical supplies from Texas, Louisiana and other parts of the US, and rising crude prices thereafter also caused a surge in prices. Indian manufacturers have also benefited significantly from a rise in demand from global consumers who aim to reduce their dependence on China. Western consumers’ stance, in trade lingo ‘China plus one’, has gone in favour of India as the country has proved to be a quality manufacturer, that too at competitive prices.

Market experts and industry analysts believe that the outlook for the Indian speciality chemicals industry is highly robust, as continuing logistics issues and fears of a third wave of the pandemic are going to push prices northwards in the coming months. Among the chemicals that have seen major price increases in recent months are butadine, ammonia and benzene. Some chemicals such as acetonitrile, aniline and acetone have also seen a rise in prices. According to a research analyst with Motilal Oswal Financial Services, the Indian speciality chemicals industry is expected to deliver a compounded annual growth rate (CAGR) of 12.4 per cent over the next five years.

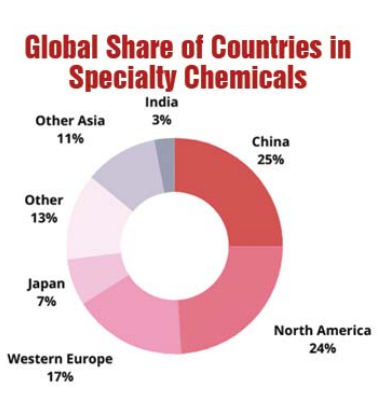

Interestingly, it is China which has given a big boost to the Indian speciality chemicals industry. China is the largest manufacturer of chemicals in the world and accounts for 25 per cent of the global trade in speciality chemicals. In 2015, on a cool Tuesday morning, a disturbing alert came from the US embassy's pollution monitor in Beijing that said "the intensity of the tiny particles known as PM 2.5 was at 291 micrograms per cubic meters" -- a level described as "very unhealthy".

Stunned by the revelation, the Chinese government banned all even-numbered cars on roads and shut down schools that had no air filters on their premises.

In 2019 the coronavirus pandemic swept the country - many suspect China was itself the origin of the virus. During the period from 2015 to 2020, air pollution was reportedly killing 1.6 million people a year, or on average 4,000 people in a day. Covid-19 pushed up the death rate even more. The Jin Ping government took matters seriously and decided to shut down all pollution-emitting plants in the country. The axe fell on several industries, among which chemicals was the topmost. During this period, the number of chemical companies in the largest chemical manufacturing province of Jiangsu fell sharply from 6,000+ to just 2,000. As a result, the production of speciality chemicals in China came down significantly.

As China was responsible for supplying over 25 per cent of the global requirements of speciality chemicals, global consumers had to turn their attention to other suppliers and India was top of this list as it has the required technical knowhow to manufacture high quality chemicals and, like China, enjoys a low-cost labour situation. It was thus that China unwittingly paved the way for India to shine in the global market for speciality chemicals! As global consumers rushed to India and signed long-term contracts with Indian speciality chemicals companies, the latter had to augment their production capacity 3-4 times. India's chemicals exports, which were slightly over $ 14 billion in 2015, shot up to $ 3 billion in fiscal 2022.

At the same time, domestic consumers of speciality chemicals, who were partially dependent on Chinese goods, have had to depend on local suppliers. Thus, with increasing sales of speciality chemicals at home as well as abroad, domestic manufacturers started putting up a robust performance, pushing up the prices of their stocks to sky-high levels.

Even though, on account of the global economic slowdown and the rising cost of raw materials, speciality chemicals companies' balance sheets are under pressure of late, the declining price trend is seen as a temporary phenom-enon. As the macro level situation improves a little, growing domestic demand and increased exports will continue to fuel the growth of the Indian speciality chemicals industry.

According to CRISIL, a well-known rating agency, "Revenue growth is likely to improve sharply to 19-20% yoy this fiscal, compared with 9-10% in the pandemic-marred last fiscal, driven by a recovery in domestic demand, higher realisations owing to rising crude oil prices, and better exports. With Western nations becoming more environmentfocussed, production is increasingly getting outsourced to India, which has also emerged as an efficient and cost-effective alternative to China."

Little wonder that speciality chemicals industry is poised to grow in India as the current share of India in global exports is 3%, while that of China is 25%. The latter's attempt to curb pollution and its not-so- good relations with the US should benefit India in the long run and India's share of global exports is likely to shoot up 3-4 times from the current level of 3 per cent.

According to an industry expert, "While a stagnant or slowing economy will put pressure on speciality chemicals companies's earnings in the short term, we think there is a long-term opportunity in higher-quality speciality chemicals stocks that are tied to several secular growth trends."

There are such five growth trends for the new year ending March 2024. These are:

(1) The electrification of automobiles. It is predicted that by 2030, two-thirds of new automotive production globally will be for electric vehicles (either hybrid or battery-driven). Electric vehicles are estimated to require between 2.5 and 3 times more speciality chemicals in their manufacturing process than those powered by internal combustion engines.

(2) Increasing demand for semiconductors. Automakers are incorporating additional features such as self-driving capacities and entertainment systems that require more computing power. Furthermore, a greater number of electron and consumer products incorporate features that require semiconductors.

(3) The transition to plastics. Manufacturers are continuing to transition the manufacturing of parts to highstrength plastics from metal. For example, auto makers look to these lighter-weight parts to help extend the battery range for EVs and increase mileage.

(4) Scarcity of freshwater. According to a forecast, by 2030 the cost of fresh water will double. In order to offset these costs, manufacturers will look to increase efficiency of their water usage, wastewater recovery and filtration.

(5) Demand for healthier, more natural and enhanced prepared foods. Consumers want healthier choices of prepared foods, including those enhanced with vitamins and other healthy additives. Yet, they are not willing to give up on taste, texture and richness.

Continues the expert, "While we expect that stocks for speciality chemicals companies that are leveraged to these long-term secular themes have significant appreciation potential over time, they can be volatile in the short term. In that light, they are best suited for long-term investors who can withstand that volatility."

All this means that speciality chemicals stocks will not move in any one direction. For example, most crop protection companies are likely to report a decline in their earnings, barring a few that have specific drivers working in their favour. High channel inventory was one of the biggest challenges faced by crop protection players during Q3 FY2023. Point out research analysts at Kotak Institutional Equities, "Erratic climatic conditions impacted farmer demand for agro chemicals and resulted in lower sales returns to companies, impacting growth and margins."

Companies which are doing very well on the export front will benefit on account of the currency fluctuations. The Indian rupee has depreciated by 2 per cent against the US dollar and by 11 per cent against the euro, which will likely favour companies in the export segment.

Some companies have specific drivers pushing their performance up. Among them, Vinati Organics is uniquely positioned to deliver strong earnings with improved yoy margins led by improved demand for its products like ATBS, IBB and Butyl phenol. Navin Fluorine has entered into a partnership to manufacture Honeywell's proprietory range of hydro fluoro olefins (HFO) in India, which will aid the performance of the company. Further, there is the potential of Navin Fluorine winning an additional contract from Honeywell for HFOs, possibly a scale-up of its molecules under the CDMO business, and new product additions in its speciality chemicals business. According to JM Financial, Navin Fluorine has a very high EPS growth at 39 per cent over fiscal years 2022-2025.

With supply chain disruptions on account of the Russia-Ukraine war, uncertainties in China on account of that government's strict policy to protect the environment, and global consumers seeking to diversify their sourcing in line with their 'China+1' policy stance, India provides strong alternatives with scale, technology, raw materials, competitive pricing and supportive government policies.

Well-known brokerage house Motilal Oswal Financial Services is bullish on Galaxy Surfactant, which had nosedived from the 52-week high of Rs 4,173 to Rs 2,105 but renewed demand has pushed up the stock to recover to Rs 3,129. We believe in the long run the price should cross the Rs 4,000 mark. Another 'good buy', according to MO, is NOCIL -- an Arvind Mafatlal group small cap rubber chemical company. Despite the recent market turbulence in the speciality chemicals segment, when NOCIL slumped from Rs 295 to Rs 199, its share price has recovered moderate ground to Rs 220. In the long term, the price could cross the Rs 300 mark.

However, the drop in demand on account of the economic slowdown may lead to subdued performance in the case of Atul, SRF and Aarti Industries. Analysts at Kotak expect Rallis India and Bayer Cropscience to report subdued results on the back of declining demand in export markets as well as inventory overhang. They expect UPL to fare much better in terms of growth, given its global diversification, but increasing finance costs and promotional spending on the football World Cup could curb its earnings growth.

Today India is a favoured country for supplying speciality chemicals to global consumers in the wake of the 'China+1' and now the 'Europe+1' policy stance. Even before the recent ups and downs in the wake of global developments, the chemicals industry in India had organically grown on the back of some favourable government policies, including a reduction in the corporate income tax rate (in 2019), customs duty reduction and BIS standards implementation. What is more, further policy support from the lowest tax rate for newly formed companies at 15 per cent, development of PCPIRS, feedstock availability and the expected PLI scheme in the chemicals segment will foster growth for the sector going ahead.

The Chinese chemical industry, which is considered the topmost in the world, accounting for over 25 per cent contribution to global exports of speciality chemicals, is on the decline. This follows the Chinese government's determined policy prescription to curb pollution, protect the environment and close down pollution-emitting factories in order to lower the carbon footprint. With China following the Western mindset on the environmental protection front and India encouraging the promotion of the chemicals sector while ignoring environmental issues, prospects for leading, fundamentally sound and well-managed growth-oriented Indian speciality chemicals companies are buoyant. Though the global economic slowdown has administered a body blow to this sector, pushing down stock prices of these companies, this is only a short-term phenomenon and the industry will be heading for robust health in the long term.

Investors with a longer-term perspective can certainly invest in the likes of Vinati Organics, Fine Organics, Alkyl Amines, Navin Flourine, Galaxy Surfactant, Balaji Amines Clean Science and Technology, Gujarat Flurochemicals, SRF, Aarti Industries, Deepak Nitrite, Anupam Rasayan, NOCIL and Atul.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives