Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: December 31, 2023

Updated: December 31, 2023

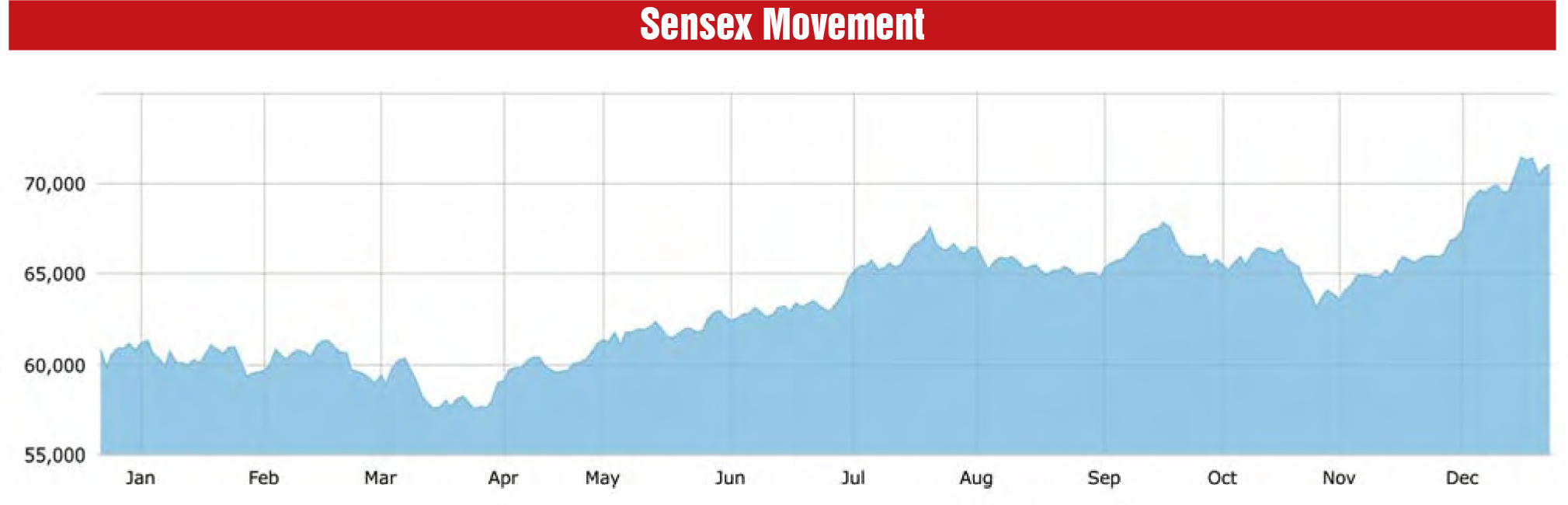

Despite the recent one-day December-20 meltdown in the Indian stock market, when the BSE Sensex and the Nifty50 fell considerably below their all-time highs seen in the same month, experts point out that there is no reason to feel the current bullish phase – fuelled by the country’s supercharged economy and the heightened feeling of stability following elections in five states –is being replaced by a bearish one.

They put down the December 20, 2023 drop in the two popular market indices to a ‘necessary technical correction’ which will not halt the rising graph of the stock market. According to a Reuters analysis, India’s economic and geopolitical picture is currently capturing the imagination worldwide.

Apart from India Inc’s robust performance across virtually all sectors of the economy, the equity cult is spreading far and wide in the country, government policies like ‘Atmanirbhar Bharat’ are acting like growth engines, and foreign investors and companies are enamoured of India’s economic and political stability.

All these are pointers to the stock market keeping step with the economy. The renowned ace investor Mark Mobius insist the Sensex will reach 100,000 mark within the next five years.

The investing public may be tempted to describe December 20, 2023 as ‘Black Wednesday’ – the day when the runaway rise in the stock market was not only abruptly arrested but popular market indices plummeted. The Sensex, based on 30 pivotal stocks quoted on the BSE, tumbled down by over 930 points below the historic threshold seen earlier in December after the results of the polls in five states were announced. Likewise, the Nifty, a broader index based on 50 leading stocks quoted on the National Stock Exchange, slumped by 303 points to 21,150.15 on December 20 after a record-breaking run in the stock market had taken it to the 21, 200 mark. In fact, the day marked the worst session of the Nifty in the previous nine months.

Few market watchers could have known what was to come. The market was in a jubilant mood till the previous day, Tuesday, December 19. Even ‘Black Wednesday’ had started off with both benchmark indices reaching new all-time high levels. However, during the afternoon, there was an avalanche of selling touched off by heavy profit booking by foreign institutional investors (FIIs) and high net individuals (HNIs) as well as retail investors – all of whom wanted to capitalize on the dream run and the resulting overheated market. One of the factors which prompted profit-taking was a buoyant primary market which had retail investors as well as HNIs rushing to subscribe to attractive IPOs. The renewed rise in Covid-19 cases in south India and elsewhere also dampened investor sentiment and many investors preferred to unload their stocks to book profits.

This unexpected downturn may lead some to think that the bull run in the stock market is over and the bearish phase may continue. But experts pooh-pooh such negative assumptions. They say the market was so overheated that intermittent technical corrections like the recent one are inevitable for a sartorial boom to sustain.

According to an expert, “this technical correction was overdue over stretched valuations, particularly of small cap and mid cap stocks. This is a short-term reaction and very soon the market will resume its rising trend.”

Analysing the sudden and sharp break in values on ‘Black Wednesday’, Parth Nyati, founder of Tradinggo, says “The easy money sentiment buoyed by a buoyant primary market may have set the stage for a correction. Additionally, light liquidity among HNIs due to their heavy involvement in IPOs could have contributed to the selling pressure. The recent rise in Covid cases may also have served as a convenient excuse for some investors, particularly FIIs, to exit.”

Admitting that “such technical corrections are part of the game in stock markets,” another market expert maintains that “this does not mean that the bullish phase is over. On the contrary, such selling-fervour avalanches and technical corrections are normal in a bull run and go a long way in sustaining the bull run on a healthy basis.”

The undercurrents in the market are still bullish. According to a recent Reuters poll of equity strategists, the Indian stock market will hit new all-time highs in the next six months and rise over 10 per cent, driven by sustained expansion in the world’s fastest growing major economy. Maintains one equity strategist, "India’s economy is the fastest growing among major economies and is expected to grow over 6 per cent in the next couple of years. This is likely to push up domestic equities further, going ahead."

Maintaining that “the outlook for the Indian economy looks exciting on account of positives like diversity and demographics”, legendary veteran investor Mark Mobius adds, “Though a lot of people say that India’s different languages (means) they are all separated, but that is a strength and the creativity is incredible. And most importantly, the young population is going to be very important going forward. So I think the future of India and the Indian stock market is very exciting. The BSE Sensex, which has risen above 70,000, will touch the 100,000 mark within the next 5 years.”

Addressing an investment conference in Mumbai last month, Mr Mobius, the founder of Mobius Capital Partners which invests in 70 countries (India is the second highest exposure in his firm’s portfolio), expressed confidence in India’s economic growth and added, “India’s future is exceptionally promising. It is a land of opportunities and innovation, with the potential to play a pivotal role in the global financial arena.”

Describing India as a “beacon of promise in the financial landscape”, he predicted that the Indian stock market would touch new highs going ahead and the benchmark BSE Sensex would soar to the 100,000 mark within the next five years, notwithstanding intermittent technical corrections. Market corrections and downturns are inevitable; in fact, they are not so much a source of concern as an opportunity. As the market fluctuates, it provides us with a chance to seize undervalued assets and conserve cash for strategic investments, he noted. Pointing out that “in a world where technological expertise is the driver of growth,” Mr Mobius added, “India’s vast population with an average age of 27 years positions it as a key player. This demographic dividend, combined with the country’s enterprising spirit, makes India not only an exciting market but also a beacon of hope in the ever-evolving financial landscape.”

Reiterating that “we are very excited about India,” Mr Mobius said that “India is the second largest (in terms of country exposure) in our portfolio and we have made a lot of money in India in the last few years.”

Points out Rajat Agarwal, equity strategist at Societe Generale, “The year 2023 was a good year for growth in the Indian market and next year we would see some moderation in growth. But having said that, I think India remains one of the well-favoured markets.” He adds, “Growth is resilient and the macro momentum has been strong and that should continue to be the case in 2024 as well.” Says another equity strategist with Reuters, “Investors in India have a good story and India’s economic and geopolitical picture is currently capturing the imagination. Last month (November 2023), the market capitalisation of the NSE nudged past the flagging Hong Kong Stock Exchange to become the world’s seventh largest equity market. It neared $ 4 trillion, almost doubling in value since the start of 2020.”

Comments one equity strategist, “Previous speculation over India’s prominent take-off to superpower status has ended in several false dawns. But recently, the bullish narrative for the country’s stocks has gathered momentum as economies, politics and policy have all aligned in its favour. Both institutional and retail investors have ploughed cash into its companies. While domestic investors have been the driving force, foreign equity inflows are estimated at over $ 4 billion so far this year. Initial public offerings have soared too. The economic case for India is certainly compelling.” He adds, “Earlier this year, India overtook China to become the world’s most populous country. By the early

2030s, it could also have one of the largest working-age and middle-class populations that will support continued urbanization and industrialization, and drive strong consumption and investment. It has already been the world’s fastest-growing major economy in the past two years. We expect this to continue, projecting annual growth to top 6 per cent in both 2024 and 2025.”

Official statistical data also support an optimistic view of the Indian economy. The Union Finance Ministry’s monthly economic report and the RBI’s bulletin claim the arrival of ‘green shoots’ in private investment triggered by higher government capex. Their assessment is based on: (a) Crisil data showing a CAGR of 7 per cent in private industrial investment during fiscal years 2018 to 2022; (b) CMIE data showing new investment announcements that are 11.6 per cent higher in Q1FY2024 and are the highest in the last 14 years; (c) Private GFCF (gross fixed capital formation) rising from Rs 17.4 lakh crore in fiscal 2018 to Rs 23.7 lakh crore in fiscal 2022; (d) capacity utilization rising by 76.3 per cent in Q4FY2023; (e) IIP moving up by 4.5 per cent in fiscal 2024; (f) imports of capital goods going up by 20.3 per cent in fiscal 2023 and 4.1 per cent in Q1FY2024; (g) Non-food bank credit growing in double digits since April 2022; and (i) PLIs for new-age sectors (like green hydrogen, semi-conductors, wearables and solar modules) expected to account for 17 per cent of capex between fiscals 2023 and 2027.

According to the International Monetary Fund (IMF), India will emerge as the world’s third largest economy in 2027, leapfrogging over Japan and Germany to a GDP of $ 5 trillion, and aspiring to become a developed country by 2047. According to experts, India will need at least 6.5 per cent growth to reach its first target in 2027 and 8-9 per cent growth to hit the second target in 2047. The visible buoyancy in the economy, at least given the 7.8 per cent GDP growth in Q1 of this fiscal, instills confidence that the country will likely fulfill these predictions. Given the growth in Q1 of this fiscal, it can be expected that the economy will grow in the range of 6.5-6.8 per cent this year, primarily due to festive spending followed by higher government spending before the forthcoming general elections. Next year too, GDP growth can be expected around 6.5-6.8 per cent as geopolitical uncertainties subside and the global economy bounces back stronger.

As per the Centre for Monitoring Indian Economy (CMIE), the expenditure database shows a strong jump in the first quarter of FY2024. Moreover, the pipeline of incoming projects appears quite strong. The manufacturing and construction sectors have been buoyed by the pick-up in capital expenditure by the government, while demand for new residential properties and falling input prices of raw material witnessed robust yoy growth of 4.7 per cent and negative growth of 7.9 per cent respectively. But the biggest boost in growth has come from the services sector, which grew 10.3 per cent yoy in Q1FY2024.

The fortunes of the stock market are directly linked to corporate performance. India's corporate sector put up a strong performance in fiscal 2022, when sales of select companies grew by 27.5 per cent, as compared to degrowth of 1.9 per cent in fiscal 2021 and 0.8 per cent in fiscal 2020, with operating profit inching up by 17.3 per cent. Based on the actual performance in the first half year (April-September 2023) HSBC forecasts earnings growth of 17.8 per cent in 2024 -- among the fastest in Asia. Sectors such as banks, healthcare and energy, which had already done well in fiscal 2023, are best positioned for fiscal 2024, according to HSBC. Again, sectors like automotive, retail, real estate and telecom are also relatively well-positioned for 2024.

A robust corporate performance in 2024 is bound to push up stock prices to further high levels. Along with the upswing in stock prices, the equity cult is also spreading far and wide in the country, with more and more new investors in stocks emerging from not only metropolitan and big cities but also from tier 2 and tier 3 cities and even from wealthy villages. With various investment avenues losing their charm during the last few years, the stock market has emerged as the most popular avenue for investment. By now 12.97 crore Demat accounts have already opened as one cannot buy or sell stocks without a Demat account. The number of investors in stocks was not more than 2 crore 20 years ago. During the last two decades, the number has grown tremendously more and more people will be turning to the stock market going ahead.

Besides Indian investors, there has been a rush of foreign investors. And heavy and widespread buying by millions of investors is bound to keep stock prices at high levels.

Favourable business and monetary policies have also gone a long way to inject buoyancy in the stock market. The government's economic reforms of opening up sectors like defence and aerospace have buoyed market sentiment. At the same time, policies to push economic growth like 'Make in India', 'Atmanirbhar Bharat' and PLI have contributed significantly in pushing up the stock market. Now, marketmen are expecting a cut in interest rates on bank credit. As inflation is coming under control, the Reserve Bank of India, which had adapted a tight money policy so far, is expected to turn to a soft money policy. The main lending rate (Repo rate), which after being raised to 6.5 per cent is being maintained at that level, is likely to reduce going ahead. "We expect the current policy pause extended for a few months and expect 100 bps of cumulative rate cuts starting from August 2024," maintain analysts at Nomura Securities.

And the most important factor that has been playing a significant role in keeping the stock market at high levels is political stability. As the country gears up for the general elections in April-May 2024, the investing public's confidence, which is a plus factor for economic growth, is most likely to continue, especially in the wake of the results of the recent elections in five states. For their part, foreign investors prefer political stability in a country where they would like to invest. The country's stocks are so hot that India is now home to the world's fourth most valuable equity market behind only the US, China and Japan. That should put to rest any pessimism about the future of the stock market. Maintaining that "India's dynamic and diverse economy is a testament to the strength," the legendary veteran investor and emerging markets investment guru Mark Mobius adds "the BSE Sensex could rise to 1,00,000-mark in the next five years."

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives