Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: June 30, 2023

Updated: June 30, 2023

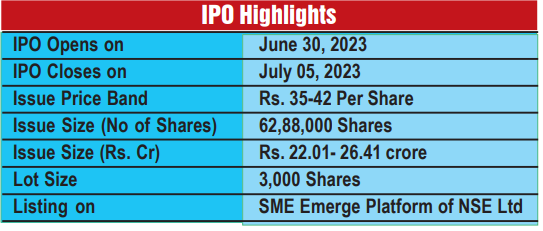

Ahmedabad (Gujarat)-based Tridhya Tech Ltd., a software development company which entered the market on June 30, 2023 to raise Rs 26.41 crore from its SME public issue, will close on July 5, 2023. The company will be listed on the SME Emerge platform of the National Stock Exchange.

The initial public offering comprises a fresh issue of 62.88 lakh equity shares of the face value of Rs 10 each at a price band of Rs 35-42 per share (including a premium of Rs 25-32 per share). The minimum lot size for the application is 3,000 shares, which translates to a minimum application amount of Rs 1.05-1.26 lakh per application. As part of the IPO, the retail investor and HNI (high net worth investor) quota is kept at not less than 3 per cent and 15 per cent respectively, while the QIB quota is kept at a maximum of 50 per cent of the issue. The marketmaker reservation portion is 3,15,000 equity shares.

Incorporated in 2018, Tridhya Tech is a full-service software development entity that believes in technological empowerment and offers its services in e-commerce, web and mobile application development and provides end-to-end tech solutions. The company also serves a global clientele by helping them revolutionise the idea of their business through impeccable services, and provides IT consultancy services to industries like e-commerce, real estate, transport and logistics, and insurance. The company also provides customised software products which start from the initial concept of the product requirement, designing the architecture coding and testing to the total deployment of the product.

Tridhya has made remarkable progress on the financial front. For fiscal 2022, it reported a total revenue of Rs 14.07 crore on which it earned a net profit of Rs 3.39 crore. For the first three quarters of fiscal 2023 (April to December 2022), it reported a total revenue of Rs 15.08 crore and earned a net profit of Rs. 2.85 crore. As on December 31, 2022, the company’s net worth amounted to Rs 59.69 crore, while reserves and surplus stood at Rs 18.60 crore.

Future prospects for the company are highly promising. Says Ramesh Marand, Managing Director, “The company has taken important strategic initiatives with a focus on expanding the company’s footprints and services. The company has a vision to emerge as one of the leading companies in the software development space with the best tech infrastructure to provide end-toend tech solutions.”

The IPO proceeds will be utilised for the repayment of unsecured and secured loans as well as general corporate purposes for the company’s business activities.

Maintains Mr Marand, “We are confident that after the issue, we will be able to execute our growth strategy in a manner that creates exponential value growth for all stakeholders. Proceeds of the issue will further strengthen the company’s balance sheet and help fund its strategic growth initiatives.”

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives