Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: October 31, 2023

Updated: October 31, 2023

Just when one thought the situation couldn’t get worse for global trade and national economies from the ongoing Russia-Ukraine conflict, the Israel-Hamas war erupted in early October and has exacerbated the all-round trade and economic uncertainties. As always, what the US Fed decides has a global impact, and its current shortterm interest rate is likely to have a slowing effect on India’s economy.

Samvat 2079 has seen the key Indian market indices, the Sensex and the Nifty, breaching previous highs despite the global dragdown from the Russia-Ukraine war – thanks to the enthusiasm of FPIs and retail investors.

But the country’s fiscal deficit for H1FY23 has already overshot that for the same previous period, and a further hike in crude prices could worsen the situation. In these circumstances, large-cap stocks with high growth prospects and reasonable valuations are advisable to go for. Corporate India has selected five such safer bets for its readers.

At the time of the last Diwali (Samvat 2079), we were worried about the negative impact on the Indian economy and stock market of the RussiaUkraine war, which erupted in February of 2022 and shows no signs of ending. Now, as we approach Samvat 2080, these concerns have been heightened by the Israel-Hamas war which started in early October and shows no signs of a quick resolution. It’s a nobrainer that the Russia-Ukraine conflict and, to a lesser extent, the Israel-Hamas one, have disrupted normal global trade. This vitiated geopolitical situation has created a lot of uncertainties, resulting in an absence of cheer on both the global and Indian economic front.

In the US, the yield on 10-year government bonds, the benchmark for asset prices across the globe, rose to hit 5.02%, its highest level since July 2022. Interestingly, the GDP of the US expanded at an annualised rate of 4.9% in the third quarter of CY23. This sharp increase is on account of greater consumer spending as well as increased inventories, exports, residential investment and government spending

It is felt that if the US economy is to keep growing robustly, the Fed might have to raise rates further. Its benchmark short-term rate is now about 5.4%, a 22-year high. Though the US has proven resilient to various challenges, most economists expect growth to slow considerably in the coming months, with investors factoring in an unlikely chance of an interest rate hike when the US central bank meets next this November

For its part, the European Central Bank has kept interest rates steady, bringing an end to its unprecedented streak of 10 consecutive increases in borrowing costs and rising concerns over Eurozone growth. In the Eurozone, concerns over inflation are coming up against mounting worries about the weakness of the economy.

Meanwhile, China has targeted GDP growth at about 5% for CY23. However, its sluggish property market, weak consumer spending and slow external trade pose a major threat to its GDP target. In fact, the news is that China is planning to issue sovereign bonds worth 1 trillion yuan ($ 127 billion) to bolster its economy

Seemingly contrarily, Indian capital markets created history during Samvat 2079 by hitting milestone after milestone. The Nifty touched 20,000 on September 11, 2023 and the BSE Sensex surpassed 67,900, with both indices gaining around 6%. The Nifty Midcap and Smallcap indices outperformed and gained ~ 24% and ~ 31% respectively. This upward move in the Indian markets was exceptional, considering the Russia-Ukraine war, high global inflation, rising crude prices, a peak US 10-year yield and a consumption slowdown. The upward move was driven by all classes of investors. While FPIs underlined their faith in the Indian capital market by infusing ~ Rs 96,000 crore in equities YTD, the retail category (via SIPs) wasn’t behind and invested Rs 16,042 crore in September 2023 and Rs 90,312 crore in H1FY24. Samvat 2079 ‘belonged’ – in a manner of speaking — to Nifty real estate (+37.5%), Nifty PSU banks (+42.6%), Nifty CPSEs (+37.6%), Nifty Auto (+18.6%), Nifty FMCGs (+15.7%) and Nifty Pharma (+9%).

On the macro-financial front, India’s fiscal deficit stood at Rs 7.01 lakh crore in the first half of FY23, up from Rs 6.09 lakh crore in the same period last year. The full-year target for FY23 stands at Rs17.87 lakh crore. Revenue receipts stood at Rs 13.97 lakh crore (53.1%, same as the previous year), of which tax revenue stood at Rs 11.6 lakh crore (49.8% of estimates vs 52.3%) while non-tax revenue stood at Rs 2.36 lakh crore (78.5% of estimates vs 58.4%). The spike in non-tax revenue was mainly because of the Rs 87,416 crore transferred by the Reserve Bank of India as surplus to the Central government. Capital expenditure stood at Rs 4.9 lakh crore against the target of Rs 10 lakh crore, which comes to 49% of the yearly target, a bit lower than what was expected. However, the government has plenty of time to get back on track before the financial year ends. Total expenditure during the period was Rs 21.2 lakh crore, or 47.1% of the annual target, which is higher than what was recorded for the same period in the previous year.

Though some Indian stocks are a bit expensive in valuation, it is important to note that retail participation, either directly or through the mutual fund route, has more or less been growing steadily and is a big silver lining for sustainable cash flow into the market. The biggest evidence of retail enthusiasm is the record 12.97 crore D-mat accounts that have been registered. In fact, retail fervour is the sole reason why the market withstands pressure from FII selloffs effortlessly. This in itself shows the resilience, positivity and maturity of the Indian stock market

India will go for general elections in April-May next year and, unlike other years, there will not be a full-fledged Union budget on February 1, 2024. But leaving aside the budgetary exercise, we are in a decent comfort zone in most eco-social parameters. On a note of caution, crude, which is hovering near the $ 100 per barrel mark, could spoil the country’s party with a further price spurt if the ongoing Russia-Ukraine and Israel-Hamas conflicts escalate. That could send the government’s fiscal calculations haywire and it might have to rework its capital expenditure exercise through a balancing act as it cannot afford inflation going up, especially when polls in five states and the general elections are around the corner.

Under these circumstances, large-cap stocks offer a better reward-risk balance with more reasonable valuations versus the hyped valuations of many mid- and small-cap stocks. Corporate India has identified five growth stocks for Samvat 2080 for its valued readers, but at the same time we would also advise investors to go slow in fresh buying and it’s more prudent to keep a cautious approach - till the dust settles.

JFS is the demerged arm of Reliance Industries Ltd (RIL), the flagship company and India's largest conglomerate belonging to Mukesh Ambani. The shareholders of RIL were given JFS shares free of cost in the ratio of 1:1 and the stock got listed on August 21, 2023. Objectively speaking, JFS as of today is nothing much to talk about. Even the current market price of its share at Rs 217

s not justified by its performance. However, toing by its future plans, JFS has the potential to become a leading one- stop financial services supermarket and could make a mark in multidimensional high-growth areas of financial services which are consumer-centric and touch the day-to-day life of millions. As per plans, JFS will be a holding company and will operate its financial services business through its consumerfacing subsidiaries, namely Jio Finance Ltd (JFL), Jio Insurance Broking Ltd (JIBL), and Jio Payment Solutions Ltd (JPSL), and a joint venture, Jio Payments Bank Ltd (JPBL), with State Bank of India.

India is sitting on a tsunami of savings, which could grow to $100-150 trillion in 25 years, says the market veteran. Raamdeo Agrawal, Chairman and Co-founder of Motilal Oswal Financial Services, made a bold prediction at the Business Standard BFSI Insight Summit, suggesting that the Indian markets may double in the next five years and quadruple in the following decade.

“India is in a different cycle right now where we are seeing corporate upgrades. The aggregate earnings of India Inc for Q2FY24 have exceeded expectations, growing by 32 percent, as opposed to the anticipated 26 percent. India is on a roll. The index can double in the next five years and surge fourfold in ten years,” he said.

On September 15, 2023, the S&P BSE Sensex reached a record high of 67,927, while the Nifty50 touched 20,222 levels. Nevertheless, a subsequent drop in US Treasury yields and an unexpected conflict in West Asia led to a nearly 6 percent decline in the index. He further pointed out that investors are not factoring in net profit growth in the coming quarters, thus ignoring emphasizing on the importance of considering corporate earnings.

The borrowing needs of customers will be met through Jio Finance Ltd, which is an NBFC that will focus on unsecured and secured loans. To start with, it has already launched two products -- consumer durable loans and personal loans. These products are present in 300 Points of Sale. The company plans conversion to a CIC and will apply to the RBI in this regard because its formation is as a systematically important non-deposit taking NBFC registered with the RBI.

Likewise, the company continues offering savings and current account products through its payment bank business and insurance products through its insurance broking business. Jio Payment Solutions is engaged in the business of payment gateways and payment aggregator business, including merchant payments.

JFS aims to democratise financial services across the country by offering simple, innovative and intuitive products that are delivered digitally, primarily to two categories - - consumers and merchants. As a first step towards putting customers' investment needs into an asset management company, the company has already announced a joint venture with BlackRock, with an initial investment of up to $ 150 million from each side.

On a consolidated basis in FY23, JFS reported very small operational revenue of Rs 41.63 crore and profit after tax of Rs 31.25 crore. On its then tiny equity of Rs 2.02 crore, the company reported EPS of Rs 60.46 on a Rs 10 face value share. In H1 FY2024, the company has earned revenue of Rs 1,022 crore and PAT of Rs 1,000 crore, translating into EPS of Rs. 1.57.

Now, after its demerger from Reliance Industries Ltd, the equity capital has gone up to Rs 6353.28 crore wherein the promoter group holds 46.77%. It is reported that recently the promoter group acquired about 6.10 crore shares of JFS from the open market. Its book value is Rs 179.60, which broadly reflects its sizeable holding of 6.1% equity shares of Reliance Industries.

JFS has a strong and clear road map, which indicates that the company's vision is to digitally promote a range of financial products on a very big scale. Recent reports have estimated that India will become a $ 10 trillion economy by 2035. Moreover, this growth will be fuelled, among other factors, by a shift towards consumption and digitization, thereby providing an excellent opportunity for broad-based growth across sectors and economic strata. With this likely growth, the financial services sector is expected to grow at larger multiples across the board. This manifold market expansion will provide exciting opportunities for a multi-talented and highly capable potential giant like JFS.

The Mukesh Ambani group is yet to grow in financial services across a wide spectrum. Now, the group is not only determined but also equipped with a comprehensive blue print, which indicates that it will be far more aggressive. Hence, one should not be surprised if it opts for the inorganic route for robust growth to make up for the delay in taking a leadership position in the financial services business, as it has shown with Jio Telecom and Reliance Retail. The stock is currently available at Rs 217, with a highlow of Rs 279-204 since its listing and a market capitalisation of Rs 1,38,025 crore. The equity capital of Rs 6,353 crore is certainly big, but earnings going forward will justify this. Investors with a patience of around one year can buy the stock as one might witness several new and important developments taking place in JFS.

Founded in 1948, Ashok Leyland (ALL) is the flagship company of the Hinduja group and the country’s leading commercial vehicle manufacturer, having completed 75 years of operations. ALL is the 2nd largest manufacturer of commercial vehicles in India, the 4th largest manufacturer of buses and the 19th largest manufacturer of trucks in the world. It has 7 manufacturing plants in India, a bus manufacturing

facility in Ras al Khaimah (UAE) and one at Leeds in the UK. Ashok Leyland has a diversified product portfolio and an international footprint, with a presence in more than 50 countries. ALL has ambitious and aggressive plans for e-mobility and hydrogen-based vehicles in addition to its regular and wide range of vehicles. It has formed a subsidiary, ‘SWITCH Mobility Ltd’ (SWITCH), to implement these new plans. Recently, the company showcased a 9 metre-long hydrogen fuel-cell electric bus developed for National Thermal Power Corporation (NTPC). This is India’s first fuel cell bus that will commercially ply on the country’s roads. Likewise, it also exhibited the country’s first hydrogen internal combustion engine truck, which was earlier launched in collaboration with Reliance Industries.

According to Mobius, investors can find such companies in sectors like software, construction materials and healthcare. For instance, he is betting big on stocks like Persistent Systems, APL Apollo Tubes, Dreamfolks Services and MapMyIndia Sensex is on its way to touching the 1 lakh mark in the next five years, believes global investment guru Mark Mobius of Mobius Capital Partners, who is a big advocate of the Indian equity market in the emerging markets space.

“Given US 10-year Treasury is giving a risk-free return of 5 percent, the case for equities has become a bit weak. That said, the long-term growth story for India remains intact. In fact, if there was a little bit more correction, we would have deployed some more cash into India,” Mobius added. In the past two weeks, Nifty and Sensex have corrected almost 3.5 percent in the wake of rising tensions in Israel, higher bond yields and volatile crude prices.

Having established a strong reputation in the e-bus market, SWITCH has started focusing on the LeV series of electric vehicles and is showcasing pioneering technologies – all of them customer-centric solutions. The management is highly optimistic about the success of its LeV series of vehicles because they are not only India’s first electric commercial vehicles in this category but also provide an incredibly attractive value proposition for MSMEs, cottage industries and e-commerce in India, with their exceptionally low total cost of ownership and high uptime. Moreover, the government’s policy too encourages e-mobility.

ALL recently acquired a 100% stake in OHM Global Mobility Pvt Ltd, owned by OHM International Mobility Ltd. The company will invest Rs 300 crore as equity in this venture. The E-Maas will be a strategy adopted by both the public and private sector to enhance EV penetration

Today, a majority of the EV bus market – especially state transport undertaking orders — are routed under the E-Maas mechanism; hence, this acquisition will be highly beneficial. SWITCH will supply the EV buses and LCVs to OHM for it to deploy under the E-Maas contracts. As the government is pushing for greater EV adoption, this acquisition is most timely. The newly introduced Ecomet Star 1915 truck in the ICV segment, with 18.49T GVW and 12.91T, together with other models, can also contribute favourably in generating higher volumes for the company.

On a consolidated basis during FY23, Ashok Leyland reported net revenue of Rs 42,292 crore and profit after tax of Rs 1,191 crore on an OPM of 12.10%. This has resulted in an EPS of Rs 4.10 on equity capital of Rs 293.61 crore with a Re 1 face value and Rs 29.10 book value. During Q1 FY24, ALL earned net revenue of Rs 9,691 crore and PAT of Rs 584 crore, with an EPS of Rs 1.85. The promoter group holds 51.53%.

Currently, the stock is being quoted at Rs 167.65, translating into a market capitalisation of Rs 49,224 crore. After evaluating its earlier core strength and looking at the new developments in e-mobility and hydrogen-based vehicles, it can be safely concluded that the Hinduja group has become more serious, committed and aggressive in accelerating the growth of ALL, which has several inherent strengths and capabilities. The stock is recommended for buying with a minimum holding period of one year for decent returns.

TML, a part of the Mahindra group, is a $ 6.5+ billion organization with 1,50,000+ professionals across 90 countries and 1,250+ global customers, including Fortune 500 companies. It is focused on leveraging next-generation technologies, including 5G, Metaverse, Blockchain, Quantum Computing, Cybersecurity, Artificial Intelligence and more to enable end-to-end digital transformation for global customers. It is the only Indian company in the world to receive the 'HRH The Prince of Wales' Terra Carta Seal for its commitment to creating a sustainable future. It is also the fastest

growing brand globally in 'brand value rank' and among the top 7 IT brands globally in 'brand strength' with an AA+ rating. TML's Generative Al-powered 'Vision amplifAler' will bring complex technology elements together in a deskilling manner together with consistency and re-usability across the spectrum, empowering enterprises to scale faster and achieve better business outcomes. The company is very excited and positive on its 'Vision amplifAer' and considers it a significant addition to its AI suite of solutions. Of course, it has several other AI lead solutions as well for different applications.

The promoter Mahindra group holds a 35.13% equity stake in the company, of which Mahindra & Mahindra is the single largest holder with 25.43%. The remaining 64.87% public holding is distributed among 8,85,586 shareholders. Some leading shareholders include HDFC Mutual Fund (1.13%), UTI Mutual Fund (1.10%), ICICI Prudential Mutual Fund (2.02%), SBI Mutual Fund (3.35%), LIC of India (9.64%), LIC Pension Fund (1.01%), and 727 Foreign Portfolio Investors in category I (25.60%). Equity capital is at Rs 487.78 crore with a Rs 5 face value and book value of Rs 271.20 per share. During FY23, on a consolidated basis, TML achieved operational revenue of Rs 53,290 crore and net profit of Rs 4,828 crore on an operating margin of 14.60%, resulting in an EPS of Rs 49.50. It paid a dividend at 1,000%

During the H1 ended September this year, the company has reported operational revenue of Rs 26,023 crore against Rs 25,837 crore and PAT of Rs 1209 crore against Rs 2447 crore in the corresponding period of the previous year. YoY, the revenue is being maintained but EBITDA margins have definitely come down drastically. The employee cost and finance cost have gone up by 7.62% and 82.06% respectively compared to H1 of FY23. Especially in its Q2, EBITDA at Rs 1,072 crore is down by 19.9% QoQ and 46% YoY. Likewise, PAT at Rs 494 crore has also come down by 28.7% QoQ and 61.6T YoY. The board has approved an interim dividend of Rs 12 per share.

TML has garnered 52% revenue from America, 24% from Europe and the balance 24% from the rest of the world. Its borrowing as of September at Rs 1,551 crore has remained almost unchanged vis-à-vis the March 2023 figure of Rs 1,578 crore. The company has increased its head count by 2,307 QoQ to 1,50,604.

In general, the IT sector has been witnessing depressed business conditions, especially due to the slowdown in Europe and the US, coupled with the negative geopolitical impact of the Russia-Ukraine and Israel-Hamas hostilities. However, despite these realities, TML has a tremendous potential to bounce back through its strong product/services domain which is highly innovative, specialized and holds a bright future in the global market, including India.

Currently, the stock price is at Rs 1,117 with its yearly high-low of Rs 1,320 and Rs 982 respectively. Investment in the scrip is recommended with a minimum 12-month holding period for good returns.

Tata Steel is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum (tpa). It is also one of the world's most geographically diversified steel producers, with operations and a commercial presence across the world. TSL, together with its subsidiaries, associates and joint ventures, is spread across five continents. It has announced its major sustainability objectives, including 'net zero carbon by 2045'. The company has been on a multi-year digital-enabled business transformation journey, intending to be the leader in 'digital steelmaking by 2025.

For the year ended March, 2023, TSL achieved operational revenue of Rs 2,43,353 crore with net profit of Rs 8,585 crore on an operating margin of 13.30%. EPS worked out to Rs 7 and the company paid a 360% dividend. During H1 FY24, the company clocked revenue of Rs 1,15,172 crore and net loss of Rs 5,986 crore, against Rs 1,23,308 crore and net profit of Rs 9,011 crore in the corresponding period of FY23. EBITDA for H1 was Rs 10,437 crore and EBITDA margin was at 9%. It's worth mentioning that the Indian operations had EBITDA of 20% in Q2, translating into Rs 6,841 crore. The EBITDA loss of 242 million pounds, and impairment charge of Rs 12,560 crore in the standalone statement and Rs 6,358 crore in consolidated statements in relation to the UK business, are the major contributors for reporting net loss of Rs 5,986 crore in H1.

The company has spent Rs 8,642 crore on capital ex penditure during H1. It has given an annual guidance of Rs16,000 crore for FY24, wherein completion of the 5 mtpa Kalinganagar plant expansion has been accorded priority. The net debt stands at Rs 77,032 crore and the promoter Tata group holds a 33.90% stake. During Q2, TSL had crude steel production of around 5 million tonnes. Among the key segments, auto, branded products and retail had the best-ever quarterly sales. The company has started producing FHCR coils at the Kalinganagar CRM complex and has started receiving approvals from automotive OEMs for its cold rolled steel. Tata Steel Aashiyana, its e-commerce platform, services more than 10,000 unique customers per month.

A year ago, TSL had approved the amalgamation of Tata Steel Long Products Ltd, Tata Metaliks, The Tinplate Company of India Ltd, TRF Ltd, (aII four listed), The Indian Steel & Wire Products Ltd, Tata Steel Mining Ltd and S&T Mining Company Ltd (all three unlisted) with the company by way of separate schemes of amalgamation. It has received some approvals while some are awaited. Once this is implemented, it would give a lot of operational convenience and will also bring down overheads. Obviously, the synergies between the individual companies will pave the way to improve revenue and profits through an improvement in efficiencies.

TSL's current equity capital is Rs 1,221.24 crore and the book value for Rs 1 paid-up share is Rs 86.12. Currently, the share's market price is Rs 118.15 with a yearly high-low of Rs 135-100 respectively and a market capitalisation of Rs 1,44,378 crore. Undoubtedly, TSL is not only the oldest private steel company and the lowest-cost producer but is also available at the cheapest price compared to other listed private sector peers. One of the main reasons for the low price is the lossincurring Tata Steel UK, which is not doing well. Moreover, it is difficult to predict when it will start contributing positively

TSL owns one of the largest repositories of iron ore and coal mines in the country, which are its trump cards. Another important factor is the Tata group's integrity, coupled with core competence and bright business prospects in major sectors like construction, infrastructure and automotive. This factor will accelerate its growth with the help of ambitious expansion plans. Investors with patience can buy the stock with a 12-18 months horizon for handsome returns.

After an average and below-average performance for the last couple of quarters, eight-year-old Bandhan Bank, a leading and established player especially in microcredit, has started shown an improvement in its H1 results. The bank has earned interest income of Rs 9,015 crore and net profit of Rs 1,442 crore, against Rs 7,829 crore and Rs 1,096 crore respectively in H1 of the previous year. It has reported an EPS of Rs 8.95 (PY Rs 6.80) during the same period

on equity capital of Rs 1611 crore and book value of Rs 121.58 on a Rs 10 face value share. The promoter group holds 39.98%. The bank expects nearly 20 per cent yoy credit growth in the current FY24 after witnessing a pick-up in credit growth from September this year. During the second quarter, it witnessed a loan growth of 12.3 per cent compared to the previous fiscal. The bank also added six lakh new microcredit customers.

Another positive development is its improved NIM (net interest margin), which has soared by 20 basis points during Q2 to 7.2 per cent. Bandhan Bank's guidance for the full year (FY24) is being kept at 7-7.5 per cent. However, it has also indicated that its cost of funds might go up by around 20-25 basis points for FY24. But the silver lining is its non-performing assets (NPAs), which are currently under control and should result in an increase in interest income. There is a gradual improvement in asset quality as well, whereby the management expects a reduction in fresh slippages in the coming two quarters (Q3 and Q4).

The capital adequacy ratio was at 19.21% and net NPAsto-net advances was pegged at 2.32% as of H1 this year. Over 80% of the revenue is generated through retail banking whereas the remaining 20% is mainly distributed among treasury and wholesale banking. This clearly indicates that the bank is retail-centric and may enhance the retail portfolio, if need be.

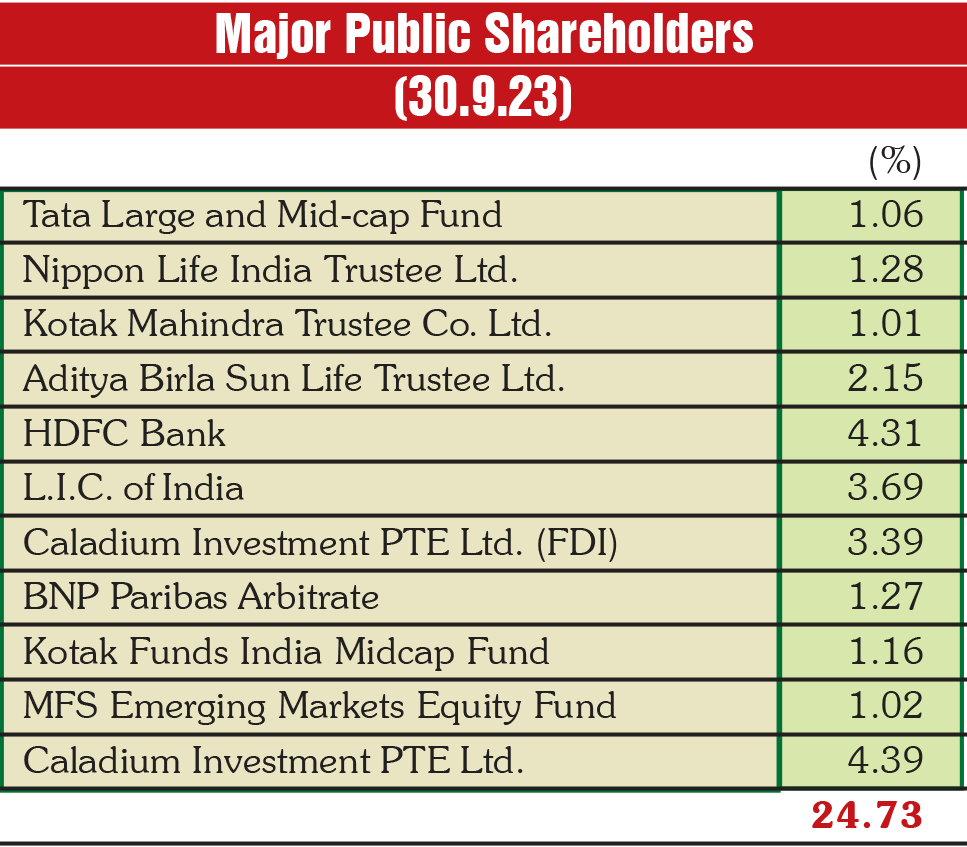

The bank had its IPO in March 2018 at Rs 375 per share, whereas currently the share is available at Rs 213 -- a 43 per cent discount to the issue price. Its all-time and last 52-week high-low price is Rs 741-152 and Rs 272-182 respectively. Importantly, major public shareholders include some heavyweight names (see table) which could strengthen confidence in the stock.

Auguring well for Bandhan Bank is its strong presence in retail banking, improving credit growth and asset quality, 1,621 branches, 4,598 banking units and 438 ATMs, a presence in 35 out of 36 states & UTs, more than 3 crore customers and a strong network of more than 6,100 banking outlets across the country, supported with good management and bright business prospects. The stock is recommended with a minimum holding horizon of one year for good returns

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives