Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2023

Updated: September 30, 2023

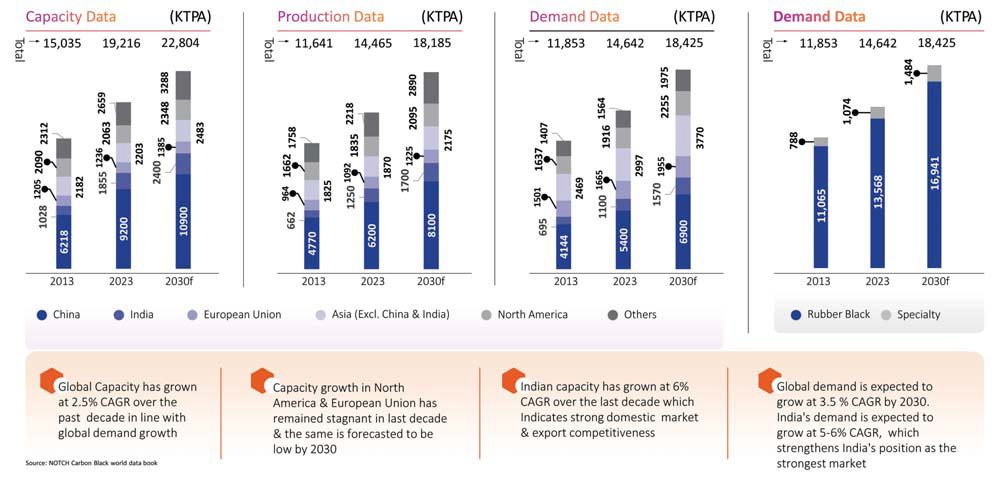

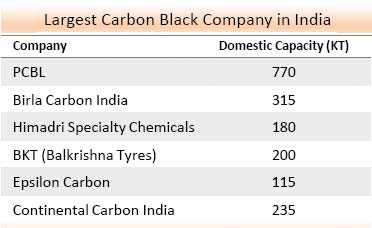

Farfrom being the most visible or glamorous segment of India’s economy, the domestic carbon black segment is growing by leaps and bounds on the back accelerating growth in automobiles, rising disposable incomes and a growing population. That is unsurprising, given that carbon black is an essential component in the manufacturing of parts such as tyres, belts and hoses, making it an essential cog in the automotive supply chain.

Not only automobiles, a growing rubber sector is leading to a rising demand for carbon black in the production of moulded and extruded rubber products like air springs, gaskets, hoses and belts. Another push factor is the global general preference for ‘black’ in electronics products, making carbon black a preferred choice for computers, televisions, laptops and smartphones. In fact, renowned research organization Marc has estimated that the Indian carbon black market will grow to Rs 13,300 crore by 2028, exhibiting a growth rate of 20 per cent during the five-year period.

The Rs 8,350-crore Indian carbon black industry is on a roll. Looking at the sustained growth of the industry on the back of ontinued demand, renowned research organization Marc has estimated that the Indian carbon black market will grow to Rs 13,300 crore by 2028, exhibiting a growth rate of 20 per cent during 2023-2028. Some of the key factors driving the domestic carbon black market today and going ahead include the automobile industry moving into top hear, an enhanced focus on infrastructure development, and considerable growth in the manufacturing sector.

The rapid expansion of the automotive industry is a primary driver, resulting in increasing sales of disposable carbon black, which is an essential component in the manufacturing of parts such as tyres, belts and hoses, thereby making it a vital ingredient in the automotive supply chain. The transition towards electric vehicles (EVs) is propelling the demand for carbon black for the manufacturing of specialized carbon black-based tyres. It goes without saying that higher disposable income levels, rapid urbanization and improved infrastructure, are leading to a growing demand for automobiles, which in turn is stimulating demand for carbon black.

According to one automobile industry expert, the automobile industry’s growth is driving the carbon black market as the product is extensively used in sidewalls, inner liners and treads of tires to enhance their strength and durability. Besides, the rubber sector is also growing, leading to a rising demand for carbon black in the production of moulded and extruded rubber products like air springs, gaskets, hoses and belts.

Maintains a research analyst on the carbon black industry, “There is an elevated need for carbon black in plastic items to provide conductivity and UV protection, which is also propelling the product demand. Furthermore, the expanding paints and coatings industry, where the material is utilized for producing jet black paints and ensuring colour stability, thermal stability, and solvent resistance, is expected to fuel the Indian carbon black market in the coming years.”

He notes, “The product is mainly used in plastics as a conductive filler material, pigment and particulate reinforcing agent. As a filler, it is used in manufacturing a variety of plastic products such as industrial bags, pipes, photographic containers, films, and stretch wrap. The demand is attributed to its antistatic properties, thermal conductivity and high strength. Furthermore, it acts as a UV light absorber that aids in protecting plastic from discolouration, chalking, fading and cracking.”

Black is the preferred colour for most of the electronics produced across the globe. This makes carbon black a preferred choice for most electronics products, including computers, televisions, laptops and smartphones. This further increases the product demand from the electronic industry. These are some of the factors boosting carbon black consumption in the manufacturing of plastic goods Alongside, the rubber industry is growing rapidly owing to increasing demand from the automotive, electronics, consumer goods and construction industries. In these industries, rubber goods are much utilized in producing wires & cables, tyres, hoses, air springs, windows & doors, belts and gaskets. Nearly every rubber compound consists of carbon black as a filler to reinforce and enhance its physical characteristics. Additionally, it aids in strengthening the volume and vulcanization of rubber. Besides, it conducts heat away from the tread and belt area of tyres. This leads to improving the lifespan of rubber products. Carbon black is extensively added to various parts of tyres such as inner liners, sidewalls and carcasses. The increasing product adoption of rubber products, coupled with the rapid growth of the tyre industry, is certain to drive the global market for carbon black.

According to an analyst, the Indian carbon black market is primarily driven by an enhanced focus on infrastructure development such as road construction, bridges and buildings. This can be attributed to rapid urbanization along with the growing population of the country. In addition, the augmenting demand in the production of rubber as a filler in tyres on account of the exceptional physical characteristics offered by carbon black, including reduced thermal stress, enhanced strength and longevity, is influencing the growth of the market across the country. In line with this, the considerable growth in the manufacturing sector in India, particularly in the plastics and textile industries, is propelling the demand for carbon black across numerous industrial applications. Moreover, the escalating demand for speciality carbon black, including conductive carbon black and high-performance carbon black, in the electrical and electronics industries is also acting as a significant growth-inducing factor for the market.

Apart from this, favourable initiatives undertaken by the Indian government to support industrial growth and attract investments is creating a positive outlook for the carbon black market. Some of the other factors contributing to the growth are the advent of renewable carbon black products manufactured using industrial-grade, plant-based oils and extensive R&D activities. According to a research analyst who has studied the carbon black industry for the last 12 years, “The future of the carbon black market in India looks highly promising, with opportunities in the transportation, industrial building and construction sectors. The major drivers for this market are increasing tyre production and growth in the plastics and coatings market. Emerging trends which will have a direct impact on the dynamics of the industry include the growing usage of recycled and bio-based carbon black and a shifting focus from commodities to more specialized grades of carbon black.”

According to research agency Marc which has analysed the Indian carbon black market based on the type (Furnace, Acetylene, Channel, others), Furnace black represents the largest segment due to the rising demand for construction and infrastructure development requiring raw materials with high reinforcing and strengthening properties. In addition to this, the growing consumption of various rubber goods, including tyres, hoses, belts and seats, among the masses is propelling the market growth in this segment. According to the regional analysis of the carbon black market in India, the Marc report notes that south India is the largest market for carbon black. Some of the factors driving the carbon black market in south India include an enhanced focus on infrastructure development, rapid urbanization and growing population levels. Apart from this, considerable growth in the manufacturing sector, escalating demand for speciality carbon black and flourishing electrical and electronics industries in the region have also impacted the market positively. In line with this, numerous favourable initiatives undertaken by the Indian government to support industrial growth in this region, rapid industrialization and the rising sales of automobiles are further contributing to the growth of the carbon black market.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives