Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 30, 2024

Updated: April 30, 2024

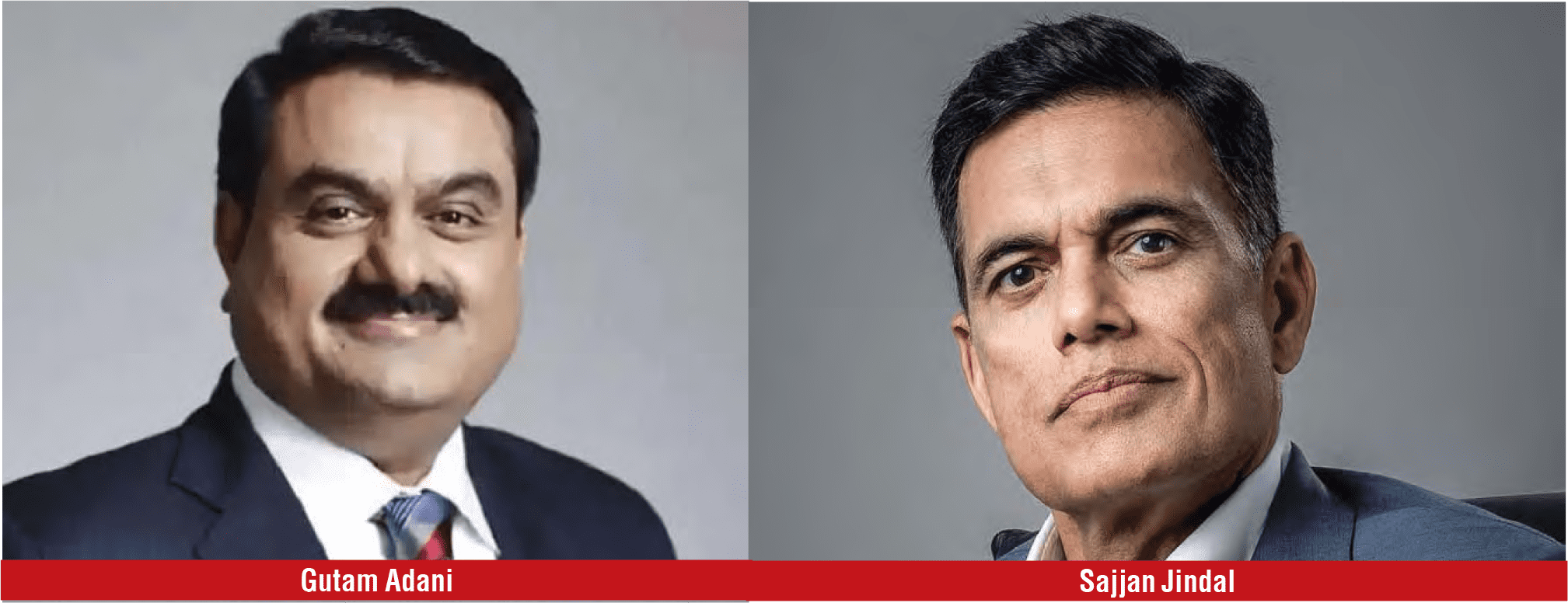

The Adani and JSW groups are in a race to provide world-class infrastructure assets as these assets are becoming critical networks for the movement of people, goods, and ideas translated into utilities, energy, transportation, communication, and social infrastructure. Analysts say these assets play an indispensable role for economic productivity and sit at the heart of global structural trends like deglobalization, changing demographics, digitalization, and decarbonization. These trends require significant infrastructure investing to meet future needs. Indeed, the infrastructure investment gap is expected to widen to $ 15 trillion by 2040.

Moreover, achieving net-zero objectives by 2050 will need roughly $ 2.6 trillion of annual investments in green infrastructure, according to IEA estimates. This will require expanding efforts in technologies such as solar, wind, and hydropower.

Analysts believe the current market environment favours investments in renewables as governments globally create a supportive environment for private infrastructure investments. From the Inflation Reduction Act in the US to the European Green Deal, this support should spur renewables’ capacity expansions while enhancing current and future project economics and competitiveness

In India too, expect all top companies like the JSW and Adani groups to vie for these projects, especially in the renewables sector

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives