Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: January 31, 2024

Updated: January 31, 2024

As contentious global issues from 2024 spill over into 2025, the common Indian investor, much like Shakespeare’s Hamlet, may be wondering what investment avenue will help grow his funds. Even as the Russia-Ukraine and Israel-Hamas conflicts continue, several countries are in the pincer grip of an economic slowdown couple and an inflationary price spiral.

India has not been unaffected, with the rupee continuing its fall against the US dollar and foreign institutional and portfolio investors pulling out massive amounts from the Indian stock market in favour of China.

But even in such a challenging environment, the Indian stock market has remained unfazed and has delivered solid returns, notably on September 27 last year when the BSE Sensex and NSE Nifty50 posted record highs of 85,978.25, and 26,277.35 respectively.

However, as opposed to 2024, when small- and mid-cap stocks were flying high, 2025 promises to be the year of large-cap equities. Corporate India Research Bureau has compiled a list of promising stocks for the consideration of our readers.

As 2024 is behind us and its successor has got underway, the investing public faces a major question of where to invest in the new year. As we enter CY 2025, investors face a scenario shaped by highly disturbing geopolitical issues that have been adversely affecting the world at the economic, political and environmental level for the last one year. The Russia-Ukraine war refuses to come to an end. The Hamas-Israel and Iran-Israel conflicts continue to be global spoilers. As if these geopolitical issues are not enough, several countries have been facing an economic slowdown, while an inflationary price spiral continues to make the lives of low- and middle-income groups miserable.

As far as India is concerned, its currency – the rupee – is under tremendous pressure and continues to seek lower and lower levels against the US dollar. With a perceived threat to the country’s political stability premised on the apparently declining popularity of Prime Minister Narendra Modi, following his party/ alliance’s relatively poor performance in the 2024 Lok Sabha elections, foreign institutional investors (FIIs) and foreign portfolio investors (FPIs) have started withdrawing their funds from the Indian stock market, reversing what was hitherto a distinctly bullish trend in the market. As interest rates remain high, fresh investments in India Inc are negligible. And with rising inflation dampening consumer demand, corporate profitability is also under pressure.

Driven by protracted and escalating geo-political tensions, rising crude oil prices and spiralling price inflation, precious metals like gold and silver have started hogging the limelight. During CY 2024, gold continued to shine as a strategic asset and a reliable hedge in uncertain times. Furthermore, the ongoing de-dollarization and a strong demand from central banks led by China continued to bolster its long-term prospects. During 2024, spot gold rose 0.1% to $ 2,608.09 per ounce on the last day of the year, December 31, while US gold futures gained 0.1% to $ 2,620.60 per ounce. In India, the price of 24-carat gold shot up to Rs 78,183/10 gm, up by Rs 1,800, while 22-carat gold was priced at Rs 71,683 per 10 gm, recording a rise of Rs 1,700.

Commenting on the performance of the precious yellow metal in 2024, Tim Waterer, chief market analyst at KCM Trade, has remarked, “Gold enjoyed a stellar year in 2024, driven by central bank buying, interest rate policy easing, and prolonged geo-political tensions, which helped propel prices higher.” Prospects for CY 2025 are all the more promising, with experts predicting that gold is set for the best year in a decade. According to them, gold and silver prices were set for a strong finish to 2024, with gold on track to deliver its best annual performance in over a decade and silver poised for its best return since 2020. Gold has surged more than 26 per cent year-to-date and silver has seen a 34.4 per cent spurt during the last one year. According to Mayank Bhatnagar, co-founder and COO of FinEdge, “These prices have been driven by geopolitical uncertainties and inflation concerns that shaped the global landscape over the past year.”

Maintains Colin Shah, Managing Director Kama Jewellery, “The key reasons driving the rally of gold can be majorly attributed to the prolonged geopolitical tensions in the Middle East and Russia-Ukraine, which escalated in the second half of 2024. He adds, “This boosted the long-term appeal of precious metals, which provided support to their prices. Another reason is the anticipation pertaining to rate cuts by the US Fed, which further added sheen to precious metals.” Looking ahead, the outlook for both gold and silver remains positive. Analysts predict that these metals will continue to attract investors as safe-haven assets, with central bank policies and inflation concerns continuing to drive demand.

Points out Jigar Trivedi, senior research analyst at Reliance Securities, “Gold prices are expected to remain elevated in 2025, supported by central bank buying and safe-haven demand amid geopolitical tensions. Silver prices have the potential to outperform the yellow metal on account of robust industrial demand. Thanks to the dual role of silver as a precious metal as well as an industrial metal, the gold-silver ratio is likely to lighten as silver benefits from robust industrial demand.”

As we enter 2025, the global economic landscape presents unique opportunities, particularly in India. With its dynamic market and potential to become one of the largest economies in the world, India offers a myriad of sectors that are ripe for investment. Whether you are an experienced investor or just starting out, understanding where to allocate your resources can lead to significant returns. Here’s a comprehensive guide to investing in key sectors in India over the next few years to maximise your wealth.

1. Embrace the infrastructure boom: India’s ambitious infrastructure development plan is a strong pillar of growth. The Indian government is set to invest over Rs 100 trillion (approximately $ 1.2 trillion) in infrastructure projects across various domains, including roadways, railways, ports and urban development. This massive investment will create a ripple effect, enhancing connectivity, reducing transportation costs and ultimately improving economic growth. Investors should focus on companies that are involved in infrastructure development, such as construction firms and companies specialising in materials and engineering. As these projects roll out, they are expected to yield substantial returns, making infrastructure a cornerstone of a well-rounded investment strategy for the coming years.

2. Banking sector, compelling opportunity: Indian banks are showing strong resilience, marked by low non-performing asset (NPA) levels and high-quality loan books. This robust financial stability is crucial, especially as private capital expenditure is anticipated to experience significant growth. Investing in banking funds or stocks can enhance your portfolio’s performance. Numerous banks are currently available at attractive valuations, providing the potential for solid payoffs as the economy continues to expand. Look for banks that have proven management teams, sound lending practices and a strategic focus on growth sectors.

3. Navigating interest rates: Interest rates play a pivotal role in shaping an investment strategy. With inflation on a downward spiral, the Reserve Bank of India (RBI) is likely to lower interest rates, stimulating economic activity. A decline in interest rates can encourage private investment and boost consumer spending, both of which are beneficial for the economy.

This scenario presents a golden opportunity for investors, particularly in the fixed-income market. A reduction in interest rates will positively affect bond prices, which means that the value of your existing bonds will increase. This makes it an opportune time to reassess your debt portfolio. If you have investments in bonds or fixed deposits, consider the timing of entering new debt instruments to maximise returns as rates potentially decline.

4. Investing in large caps: The large-cap segment has recently witnessed corrections due to sustained foreign institutional selling. However, many of these large-cap stocks have now fallen below their intrinsic valuations, which is the perceived true value of a company’s stock, and are trading at reasonable prices. This presents a prime opportunity for investors looking to build a robust portfolio. Large-cap companies offer stability and pay dividends, making them a safer investment choice during market fluctuations. When constructing a portfolio, focus on companies with strong fundamentals, solid management practices and a track record of profitability. These stocks will likely rebound as market conditions improve, providing solid long-term growth prospects.

5. Evaluate the infotech sector: India’s IT sector continues to shine on the global stage. While Indian IT companies may not be at the forefront of explosive growth, they offer resilience and stability in an evolving market. Currently trading at attractive valuations, these companies serve as a reliable hedge against market volatility, providing a sense of security and confidence in your investment decisions. As businesses worldwide look to digital transformation, demand for services provided by Indian IT firms is likely to increase. Monitoring order books and business expansions within this sector can provide hints about future growth trajectories.

In summary, charting out investment strategies for 2025 requires a thorough understanding of the shifting economic landscape, particularly in India. You can create a diverse and robust investment portfolio by embracing the opportunities presented by infrastructure development, resilient banking, favourable interest rates, large-cap stocks and a strong IT sector. Successful investing necessitates continuous research and staying informed about market trends and economic indicators. Diversifying your investments across these key sectors will help mitigate risks and enhance the potential for high returns in the years to come. As India continues to grow and evolve, so too should your investment strategy. By staying informed and proactive, you can ensure you maximise your wealth in this land of opportunities.

Investors are concerned over the prevailing economic and geopolitical situation and their likely impact on investments, and are increasingly inclined towards new opportunities where their investments can be safe and rewarding. The erstwhile popular option of fixed deposits has lost its magic after several companies turned defaulters and failed to repay the deposit amounts and the interest thereon. Real estate as a form of investment has lost its glamour after a sharp fall in values a few years ago. Investment in real estate for residential and business requirements continues to be buoyant, but buying property for investment purposes is not that lucrative now. Art (paintings) as an investment avenue is a big deal in the West, but does not have too many Indian takers as yet. In these circumstances, equity remains the first choice as an investment avenue. And thanks to fraught geopolitical issues, with even the United Nations more or less a helpless bystander, precious metals like gold and silver have been growing in prominence as investment avenues (See Box).

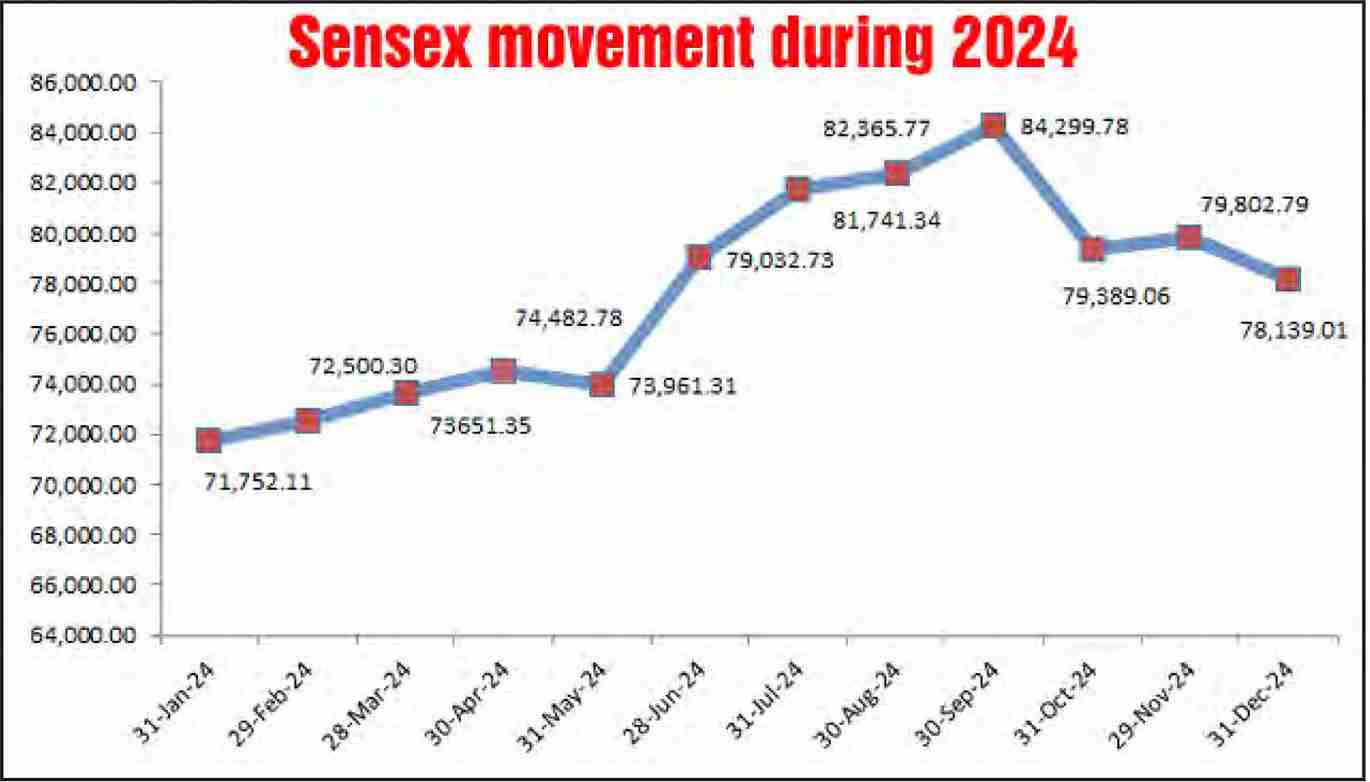

The Indian stock market, which had started CY 2024 on a buoyant note, was forced to wind up the year on a distinctively bearish note with investors suffering a severe jolt. The market, which witnessed an unprecedented boom during all four quarters of CY 2023 and first two quarters of 2024, turned distinctly volatile with a downward inclination. The year gone by witnessed a persistent inflationary price spiral, FII and FPI outflows, continuing geopolitical uncertainties, the relatively poor showing of Prime Minister Narendra Modi and his party/alliance in the general elections, and a subdued corporate performance resulting in lower earnings. These trends are worth elaborating on.

Concerned over the declining popularity of the Prime Minister Narendra Modi and fearing political instability in India, FIIs started offering their holdings, emerging net sellers for almost seven out of 12 months. As they sold more shares than they bought, which led to a net outflow of Rs 2.87,235 lakh crore (by November 2024), the heavy outflow had a clear impact on market sentiment, especially in the later half of the year.

Domestic institutional investors ‘upped their game’ to play a crucial role in supporting a market shaken by the FII and FPI unloading. In the first 11 months of 2024, they Bought stocks worth Rs 4.93,243 lakh crore, reducing the impact of the heavy outflow by foreign investors who are reportedly moving to China where equity valuations are more attractive than in India. Clearly, Indian valuations have been too high to attract overseas investors.

Interestingly, as market sentiment was buoyant for more than half of the year, the IPO (Initial Public Offering) market made history in 2024 with as many as 298 companies going public to raise a massive Rs 1.40,600 lakh crore – reflecting a huge 139% spurt over 2023. Retail investors played a major role in this record growth, driving a spurt in both mainboard and SME platforms listings. However, the craze for IPOs petered out towards the close of the year with market sentiment turning distinctly volatile with a downward price inclination

Thus, CY 2024 was a year of volatility with bulls and bears battling it out against a canvas of disappointing global economic data, geopolitical tensions and heavy FII outflows. Despite all the uncertainties, the Indian stock market held its ground and delivered solid returns. Little wonder that September 27 2024 turned out to be a golden day for the Indian stock market and investors as on that day the most popular stock market index, the BSE Sensex, hit a record high of 85,978.25, while the darling of analysts, the NSE Nifty50, shot up to a lifetime high of 26,277.35. As one expert remarked, this was a significant milestone, marking the ninth consecutive year of gains for the Indian equity market.

And even with a challenging last quarter, the market succeeded in wrapping up 2024 on a strong note with an annual gain of over 9 per cent – with Nifty50 posting a return of 9.97 per cent and the Sensex 9.33 per cent. The Nifty midcap was even more impressive, surging by 23.52 per cent, while the Nifty small cap climbed up to a return of 23.86 per cent. Thus, despite continuing geopolitical tensions and ris-geopolitical tensions could unleash a wave of optimism across global markets, India included

In a year marked by shifting global winds and domestic trials, India’s equity markets proved their mettle in 2024. The year began with a flourish, buoyed by a robust macroeconomic framework, stable high-frequency indicators, and a steadfast earnings trajectory. Investor sentiment was bolstered by expectations of policy continuity and strong liquidity flows from both domestic and foreign sources. However, as the calendar turned, the second half of the year brought turbulence. The cocktail of weaker economic data, corporate earnings downgrades, and valuation concerns soured the mood. The ruling party’s less than expected performance in the general elections added to market jitters, while foreign capital pivoted to China and the United States. Despite these challenges, Indian equities ended the year on a resilient note, with large-cap indices gaining 9-11%, and mid- and small-cap stocks delivering stellar returns of 23% and 26%, respectively. Among sectors, Pharma, Auto, and IT shone brightly, while Metals, Banks, and FMCG languished.

As we stride into 2025, the Indian equity market faces a labyrinth of possibilities. On the global front, the re-election of Donald Trump as President of the United States casts long shadows. Immigration policies, trade relations, and environmental stances now hang in the balance, with potential ripple effects for India. Compounding these challenges are escalating U.S.-China tensions, which threaten to upend the delicate global economic equilibrium. Domestically, concerns loom over a slowing GDP growth trajectory, tepid corporate earnings, and frothy valuations in mid- and small-cap stocks. Yet, India is not without its silver linings. Resilient domestic investment flows, bolstered by rising SIP contributions, continue to underpin market stability. Large-cap stocks, which dominate over 65% of India’s market capitalization, offer attractive valuations and better earnings visibility, providing a cushion against potential downturns. The prospect of declining global and domestic interest rates could further energize corporate earnings and risk appetites. Early whispers of peace in Europe and the Middle East add a glimmer of hope. Should these materialize, the easing of

The medium- to long-term prospects for Indian equities remain promising, underpinned by superior GDP growth, a robust fiscal position, and healthy corporate earnings. While large-cap indices have corrected more sharply (~10% from their peak) than mid- (-6%) and small-cap (-5%) segments, the valuation dynamics favour a tilt toward large- and small-cap stocks over the midcap space. The Nifty 50 trades at a reasonable 18.4 times forward earnings, aligning closely with its five-year average, while midcap indices continue to command a rich premium over their historical average—a divergence that demands caution. Sector-wise, 2025 could see agrochemicals, cement, consumer durables, hospitality, large banks, and real estate leading the charge, propelled by structural demand tailwinds and post-election government capex. Export-oriented sectors such as IT may regain momentum, courtesy of a favourable currency trajectory. Conversely, four-wheelers, FMCG, specialty chemicals, and metals may face headwinds due to valuation and demand challenges.

In a world where uncertainty is the only constant, India’s equity market continues to offer a compelling narrative. The nation’s resilience, supported by domestic liquidity and structural growth drivers, makes it a standout in an increasingly fragmented global economy. For investors, the message is clear: focus on quality, exercise discipline in valuations, and stay the course. While volatility may persist, the longer-term arc for Indian equities points decisively upward.

For discerning investors, quality stocks remain the lodestar. From a longer-term perspective companies like Chalet Hotels, Eicher Motors, KNR Construction, LTIMindtree, and United Breweries are poised to outperform, thanks to robust fundamentals and favourable macro trends. Our broader list of top picks for 2025 includes Arvind Fashion, ICICI Bank, Polycab, Ultratech, and Zomato—offering a blend of growth, resilience, and value. Before I sign off, I would like to like to remain our readers the sage words of Pandit Narayana in Hitopadesha - Endeavours do not succeed merely by wishful thinking. Just as prey does not enter the mouth of a sleeping lion, success requires effort and action.

ing economic uncertainties, the Indian stock market has, during the last five years, generated broad-based and exceptionally high returns especially in small- and mid-cap stocks, and investors can certainly tap this avenue for investment in CY 2025 too. Needless to say, selection of stocks should be made after taking into account the risks visible for the new year. As we enter 2025, investors face a year being shaped by continuing geopolitical tensions, growing economic uncertainties (like US interest rate policies, US trade policies, the crude oil price situation, political and economic developments in India).

In this context, selection of sectors should be broadbased in order to ensure both returns and stability. For 2025, the best sectors to invest in will be green energy, pharmaceutical, technology, healthcare, li-ion battery and automation, and money & banking.

In 2024, small- and mid-cap stocks ruled the roost. During 2025, interest rates are expected to peak on account of the ongoing inflationary price spiral. Hence, in this environment, large-cap equities rather than small- and mid-cap stocks show promise. Supporting this contention, one expert says the exuberance of recent years in the equity market is giving way to a period of moderation. Urban demand has slowed and corporate earnings are stabilizing, signalling the need for tempered expectations. Large-cap stocks are poised to lead the charge in 2025. As far as individual stocks are concerned, the Corporate India Research Bureau has selected the following / //– investing

January 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives