Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 15, 2024

Updated: May 15, 2024

India’sfascination with gold is probably as old as the country’s hoary history. The precious yellow metal remains the first choice of investment for millions of Indians of all socio-economic backgrounds. Apart from its jewellery- and bullion-related qualities, its indisputable advantage over other investment avenues lies in its historic and continuing appreciation over time.

As an example, at the time of India’s independence, the gold price was Rs 88 for 10 grams, while today the same weightage costs a whopping Rs 76,000! Another ‘Believe it or Not’ fact about the country’s tryst with the yellow metal is that the aggregate holding of 21,000 tonnes by Indian households puts even the World Bank’s holdings in the shade! Globally, gold’s price movement is influenced by factors like demand from the electronics and jewellery sectors, its value as a solid asset in good times and bad, its value as a hedge against inflation, and the continuing purchase of the metal by central banks to back their national currencies.

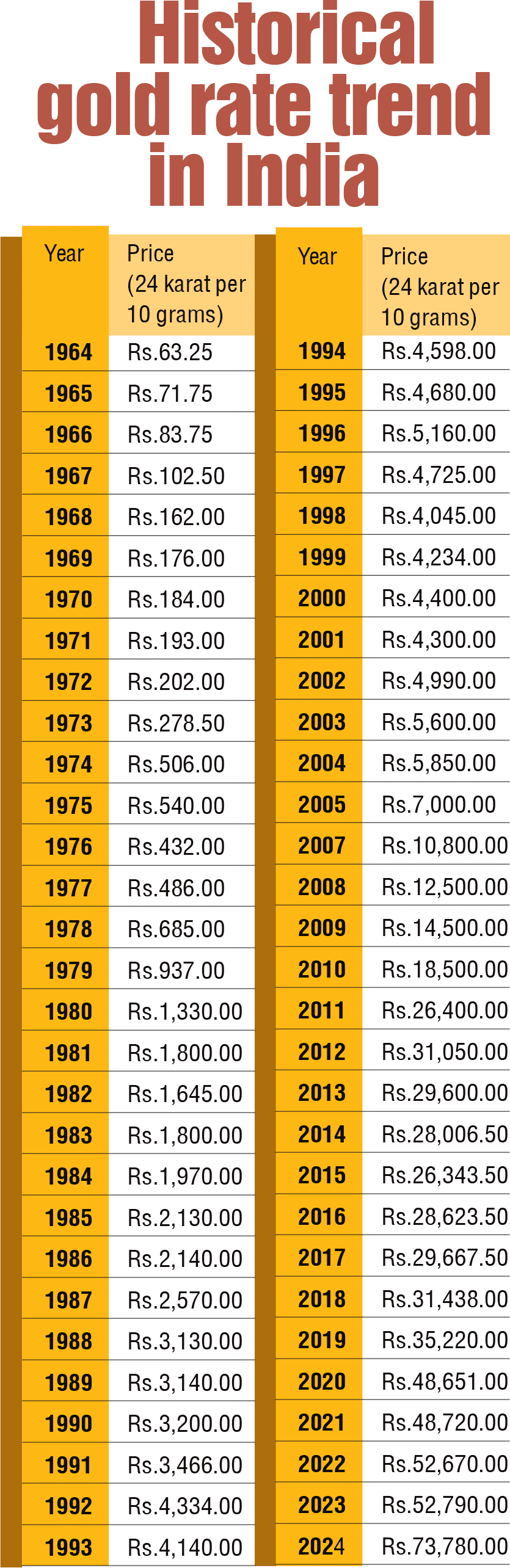

fortunes of other commodities may fluctuate with time and circumstance, but gold – humankind’s ‘precious yellow metal’ – stays more or less constant in its sky-high firmament. Market sentiment in gold has remained robust and its price has been an upward journey most of the time. In 1947, when India got independence, gold was available for what now seems a throwaway price of around Rs 88 per 10 grams (24 carat). Thereafter, the yellow metal’s price continued to move upward and crossed Rs 1,000 in 1980, Rs 5,000 in 1996, Rs 10,000 in 2007, Rs 20,000 in 2011, Rs 25,000 in 2015, Rs 50,000 in 2022 and Rs 75,000 in 2024. Most recently, in May 2024, it is quoted at around Rs 76,215 per 10 gm. Market circles and experts expect its price to hit a historic Rs 1,00,000 in the near future and optimists feel that the price will even reach a stratospheric Rs 2,00,000 within a decade.

As is well-known, India is the world’s leading ‘repository’ of gold. There is hardly any family in the country which does not possess even a gram of gold. Indian households reportedly hold an astonishing 21,000 tonnes of gold — surpassing even the World Bank’s reserves! What is more, the Indian government holds gold stocks of 876 tonnes – the 9th largest gold reserves in the world, ahead of the UK and several Middle Eastern countries.

The answer to this Indian obsession with gold is obvious. The precious yellow metal is a cherished asset for Indian households because it consistently delivers impressive returns, besides acting as a hedge against inflation compared to other investment avenues. The yellow metal is also regarded as a safe stock of value.

India continues to be one of the largest consumers. According to the latest World Gold Council global report on gold demand trends for Q1FY2024, the country’s total gold demand, including jewellery and in vestment, shot up to 136 tonnes as compared to 126.3 tonnes in the same quarter a year ago.

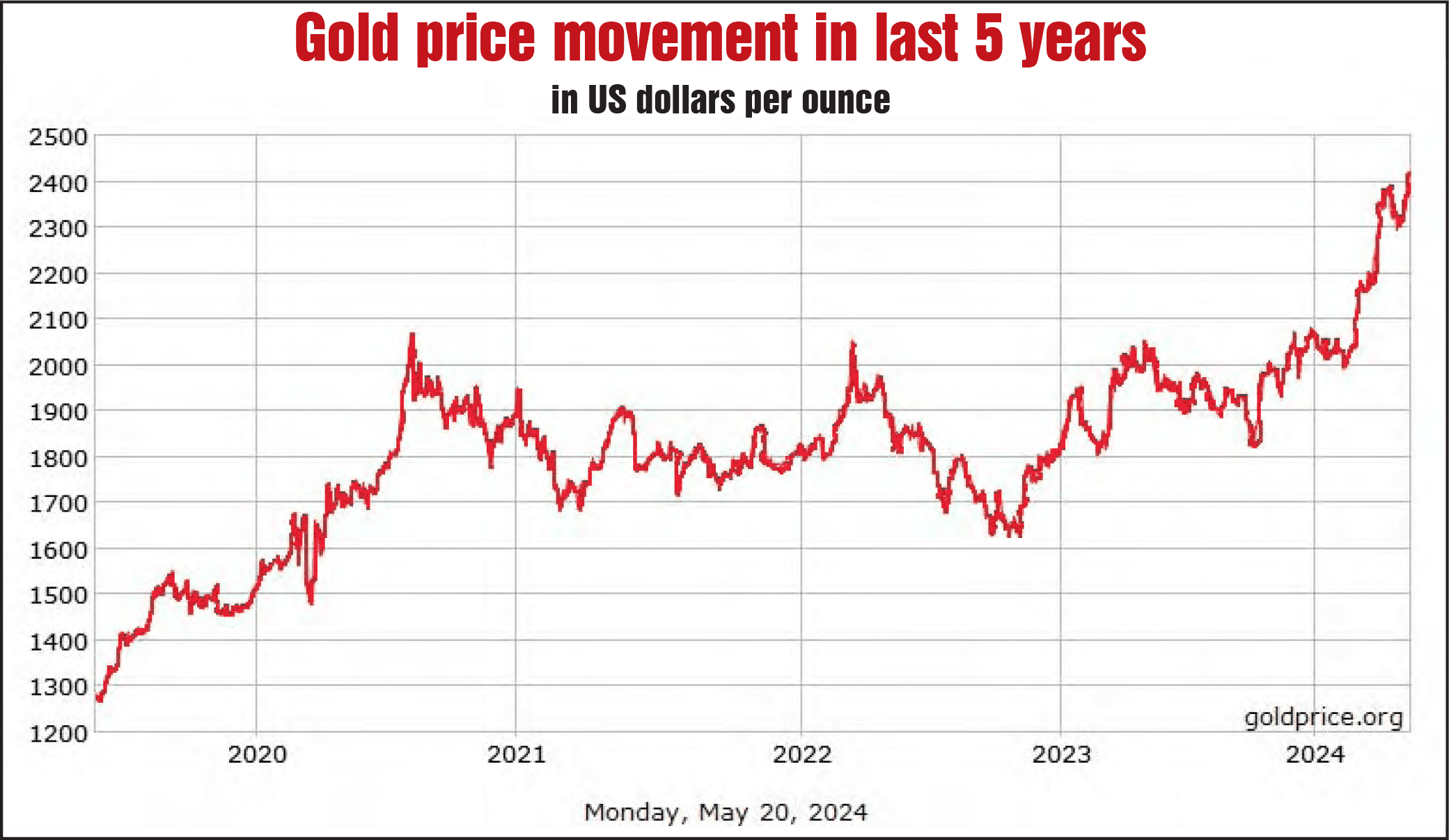

No doubt, consumer demand influences gold prices but they are also highly sensitive to global events such as geopolitical tensions and economic crises. Serious political or economic crises are ‘golden’ periods for gold markets as they trigger a rapid increase in gold prices in relatively short periods. During the last 10 years, events like the global financial meltdown, the Covid-19 pandemic, the RussiaUkraine war, the Israel-Hamas conflict and the more recent Iran-Israel ‘eruption’ have contributed to a 75 per cent spurt in gold prices – from Rs 40,000 to over Rs 76,000. In 2015, gold was priced around Rs 24,740 and was Rs 40,000 in 2020. In other words, during the last 10 years the price of the yellow metal has more than trebled.

Experts believe that it is only a matter of time when the gold price in India crosses the Rs 1-lakh mark. And if the price trend witnessed during the last decade is sustained in the current decade, gold could even breach the Rs 2-lakh mark.

Globally, gold is considered to be a safe haven asset. Historically, the precious yellow metal has been around since thousands of years as an important metal. But it was not used for money until around 650 BC. At first, people carried around gold or silver coins. If they found gold, they could get the government to make tradable coins out of it.

Interestingly, it played an important role through the Roman empire, where Emperor Augustus, who reigned from 31 BC to 14 AD, set the price of gold at 45 coins to the pound. In 1257, Great Britain set the price for an ounce of gold at 0.89 pounds. But then in the 1800s, most countries printed paper currencies that were supported by their values in gold. This system was known as the Gold Standard. But in 1971, then US President Richard Nixon told the Federal Reserve Bank, the central bank of the country, to stop honouring the dollar's value in gold. Thus ended the Gold Standard and its primary value as a currency value and helped drive the asset to more of a store of value. This saw the price of gold start to take off as an ounce was $ 40 when depegged from the dollar, but in less than a decade it rose to be worth $ 2,250 in 1980. In recent years, gold has gone from strength to strength in charting a distinct upward course.

What are the factors that influence gold prices? There are a number of factors, and these include: (A) Consumption demand: As the electronics industry is growing at a fast pace, the demand for gold is also going up. Demand for gold from the jewellery sector is ever-present as women all over the world delight in wearing ornaments. Moreover, demand in Asian countries is all the more visible as there is a tradition to offer gold to the new bride. There is also a custom of buying gold jewellery during festivals.

(B) Investment demand: Besides consumption demand, gold also attracts investment demand as the yellow metal is considered a solid asset for good times and bad. Most investors would buy gold, whether the domestic economy is growing or in recession. And the public considers it a cherished asset, consistently delivering impressive returns compared to other investment options.

(C) Inflation rates: Gold is widely regarded as one of the most effective hedges against inflation. Maintains Harsh Gahlaut, CEO of Fin Edge, "The gold price is directly correlated to inflation. Inflation has been high across geographies and will take time to cool off. As long as inflation remains high, gold prices will continue to get support and see an upward trend in the future." Says Mr. Hareesh V of Geogit Financial Services, "The trajectory of inflation will also play a crucial role in determining the pace at which gold prices increase. Inflation and gold prices often have a complex relationship. Gold is often seen as a hedge against inflation because its value tends to hold relatively steady or even increase during times of inflation."

(D) Government buying: As governments are supposed to have sufficient gold stocks in order to print currency notes, there is frequent buying of the precious yellow metal by central banks on behalf of their governments. The growing demand from central banks is expected to persist and may contribute to rising prices. Says Mr Gahlaut, "There has been large-scale buying from some large central banks as they are considerably increasing their gold holdings, like Russia, China and India. Since the supply of gold is limited, this increase in sovereign treasury holdings will continue to put pressure on supply and will support gold prices. We do not see the supply-side pressure easing in the near future as the risk of geopolitical conflicts does not seem to be easing."

While jewellery has traditionally remained a significant driver of demand for gold, it may not continue to play the same role in the future. However, the demand for bullion (for investment by investors and central banks) is anticipated to increase. Maintains Mr Surendra of India Bullion and Jewellers Association, "I can see that in a country like India, gold is converting its orbit from a consumption item to an investment item at a much faster pace, so sales of jewellery will keep drop ping with improved sales of bullion due to the financialisation of gold."

(E) Geopolitical, economic crises: Gold prices are highly sensitive to global events such as geopolitical tensions and economic crises, which can cause rapid increases in relatively short periods. In the past five years, factors like the rupee's weakness, geopolitical issues like the Covid-19 pandemic, the Russia-Ukraine war, the Israel-Hamas conflict, and latterly the Israel-Iran tensions have contributed to no less than a 75 per cent spurt in gold prices - from Rs 40,000 to Rs 76,000 in just 3.5 years. In contrast, from 2014 to 2018, gold prices only increased by 12 per cent from Rs 28,000 to Rs 31,250.

Where will gold prices go from here? In general, it is believed that the gold market will continue to attract inflows. Central banks' buying of gold will by itself continue to support gold prices. Most analysts have a gold price forecast for 2025 of well over $ 3,000 an ounce.

According to a gold expert, considering that the market reached the $ 2,000 an ounce price in March 2023 alone, it seems there is a lot of momentum. Some analysts are much more bullish, but $ 2,000 has been a major psychological barrier, so it could be difficult to get far above there.

However, a short squeeze may happen once the price goes above that level, thereby opening the door to much higher prices by the time we get to 2025, and most certainly by the time we get to 2030.

If we take a five year view (until 2029), it can be said that the movement of gold is primarily upwards, but at a slow pace. That being said, the price of gold could rocket at this important juncture and influence gold price predictions for the next 5 years.

Gold could be forming a bull flag pattern that could send prices soaring much higher. For example, 'Rich Dad, Poor Dad' author Richard Kiyosaki has a gold price forecast of $ 5,000 an ounce in the next few years.

Most experts' and analysts' expectations on the gold price for the next few years are also positive, but gold price predictions are difficult to call due to unforeseen circumstances.

Christopher Lewis, Senior Analyst at FXEmpire, explains why gold looks so healthy as an investment right now. "The most important thing that traders are looking at recently has been geopolitical concerns. The debasement of multiple currencies around the world, and the potential need of central banks around the world to loosen monetary policy after cracks in the banking system does suggest that gold is one of the purest plays for safety, and could be attractive to most traders around the world for the next several years if we go into a major recession."

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives