Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 15, 2025

Updated: April 15, 2025

Needless to say, it is a tough call for us to select a Fortune Scrip at this juncture, when the market sentiment and environment are unsettled on account of disturbing news from all sides – from Washington where US President Trump is playing his ‘Tughlaqi’ games, from the Middle East where Israel is determined to free the Gaza strip of Hamas, from Ukraine where Russia is bent on ravaging an entire country, and from the home front where the current political and economic uncertainties are leaving most Indians clueless.

But we have taken our courage in both hands, and with the help of reliable indicators, have selected a stock for the Fortune Scrip title. Our choice may lead to headaches in the next 2-3 quarters, and may even put investors in the red in the short term, but it will emerge as an extraordinary multi-bagger in the long run, allowing investors to reap a rich harvest.

The stock we have selected is DCX Systems, a leader in the defence manufacturing space that offers a full suite of electronics systems and subsystems, and cable and wire harness assemblies, for both international and domestic customers. The company’s system integration (SI) services encompass electronics and electro-mechanical assemblies in areas such as radar systems, sensors, electronic warfare, missiles and communication systems. These services are crucial to in-house quality testing such as vibration and environmental stress testing of complex RF products utilised in radar, communications, surveillance and missile systems.

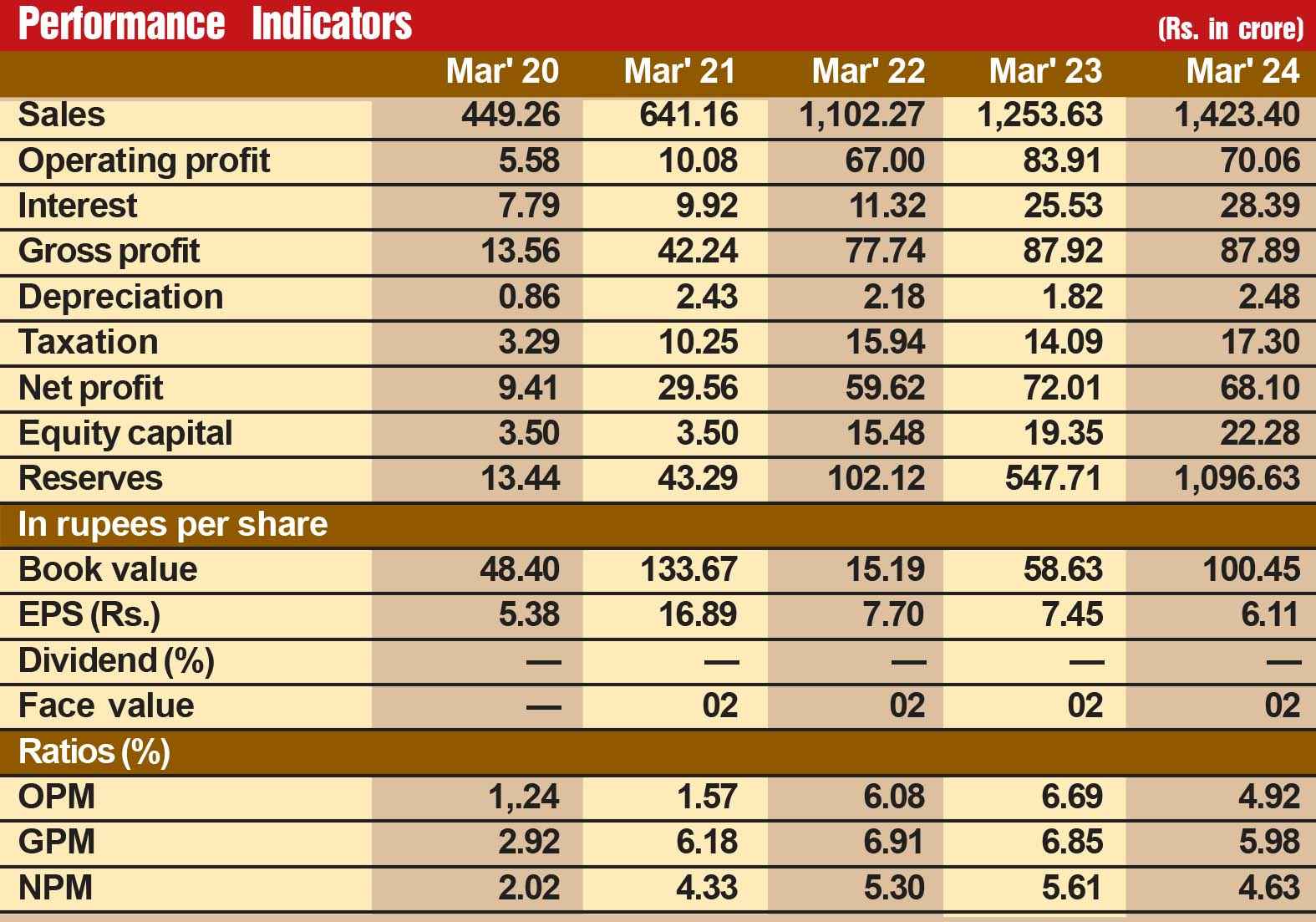

SI services constitute a comprehensive array of electronics and electro-mechanical assembly and enclosure assembly services. DCX also provides product repair support for the parts it manu factures. This is a unique listed company offering SI services to OEMs. Originally, DCX started as an Indian offset partner (IOP) for foreign OEMs, primarily generating revenue as an IOP for Israel. Now, it caters to India, Israel, the US and Korea. DCX operates through a modern manufacturing facility located at the Hi-tech Defence and Aerospace Park in Bangalore which is spread over an area of 30,000 sq ft and has a complete in house environmental and electrical testing and wire processing facility. The company has made rapid strides on the financial front. During the last six years, its sales turnover has expanded more than four and a half times from Rs 300 crore in fiscal 2019 to Rs 1,423 crore in fiscal 2024, with operating profit shooting up 14 times from Rs 5 crore to Rs 70 crore and the net profit surging from Rs 5 crore to Rs 68 crore.

But we have not picked DCX for the position of Fortune Scrip on the basis of its existing laurels. We strongly feel that future prospects for the company are all the more promising. Consider:

The company’s shares were going strong at around Rs 450. But the recent massive bearish mood in the market administered a body blow to its shares and the price tumbled to Rs 215-220. The share price is most likely to remain subdued in the overall bearish phase, and DCX may even go down to near Rs 200. But once the bearish phase is over, the price is bound to resume an upward journey and reach even the Rs 500 mark.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives