Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 15, 2025

Updated: April 15, 2025

US President Donald Trump has well and truly set the cat among the pigeons with unprecedented reciprocal tariffs on the US’s trading partner countries.

Global equity markets have crashed across the board after his announcement of stiff tariffs on imports from across the globe, including major trading partners like China (84 per cent), India (26 per cent) and EU (20 per cent). Virtually on the heels of his announce ment on April 2, global equity markets closed with heavy losses.

And although Mr Trump has paused his tariff hikes for 90 days and softened them with a 10 per cent levy for all countries (except China, which faces a 125 per cent levy and which has responded with 84 per cent levy for US imports), the global panic is far from over.

In the Indian context, it is intrigu ing that the government has been ‘unvocal’ on the Trump imposts even as the country’s benchmark indices have plunged and left Indian investors poorer by around Rs 20 lakh crore in the immediate aftermath of his tariff hike announcement. Experts feel that though reciprocal tariffs will send global shockwaves, but India may came out least vulnerable and least unscathed.

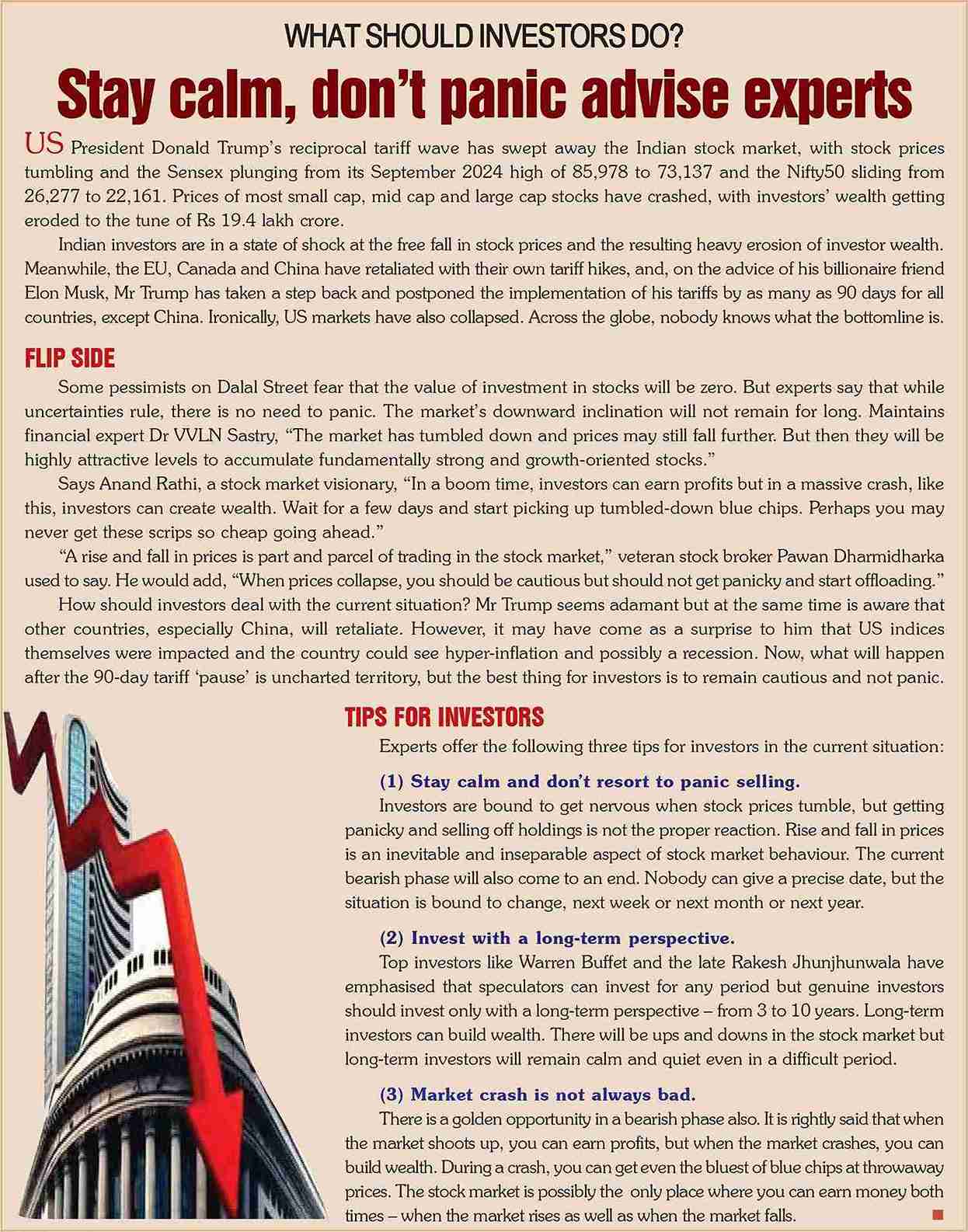

CALL it a ‘bloodbath’, ‘worst trade session of the decade’, ‘Black Monday’, ‘market earthquake’, ‘global market mayhem’, ‘body blow to mar ket sentiment’, market mayhem… Whatever descriptive you use will certainly not overstate the situation in the global stock market after US President Donald Trump’s sweeping re ciprocal tariffs on America’s trading partners have sent global equity markets tumbling like a pack of cards. Mr Trump announced trade tariffs of far-reaching impact on major global economies – 84 per cent on imports from China, 26 per cent on imports from India, and 20 per cent on shipments from the EU. Apart from these three, several other major coun tries have been slapped with high US tariffs. Fearing economic disruption, inflationary impact and global recession, fi nancial markets are in a tizzy. Stock prices tumbled with such speed that many global equity markets closed with heavy losses in the first week of April 2025.

Global financial markets were in a state of shock as Mr Trump’s moves and their impact were unprecedented and totally unexpected. There has been a com plete global sell-off across markets – Asia Pacific, Japan, Hong Kong. There is nowhere to hide right now, commented Kranthi Bathini, Director – Equity Strat egy, Wealthmills Securities.

Asian markets were the worst hit. Hong Kong’s Hang nosedived nearly 11 per cent, Kokyo’s Nikkei 225 plunged nearly 7 per cent, Shanghai SSE composite index tumbled by over 6 per cent and South Korea’s Kospi index declined 5 per cent.

As far as India is concerned, when Mr Trump announced the 26 per cent tariff and his ‘friend’, Prime Minister Modi, maintained a stony silence, the country’s popular indices – a barometer of the Indian economy — collapsed. The most popular Sensex, based on prices of 30 pivotal stocks quoted on the BSE, gave way under a massive selling avalanche, from an all-time high 85,978.25 (Sep tember 27, 2024) to 73,137.90 on April 7, 2025, while the Nifty50, the darling of research analysts, based on prices of top 50 stocks quoted on the National Stock Exchange, plunged from 26,277.35 (September 27, 2024) to 22,161.60 on April 7, 2025. The collapse reportedly wiped out investors’ wealth to the tune of Rs 20.16 lakh crore in early trade.

Interestingly, much to the chargin of President Trump, the American markets were no exception. Nasdaq further dropped 4 per cent and S&P 500 further lost 3.1 per cent. European markets were also poised for a sharp decline.

A week after his April 2 announce ment, Mr Trump has seemingly soft pedalled on his initial decision by put ting his reciprocal tariffs on hold for 90 days and instead imposing a 10 per cent tariff across the globe. The predictable ex ception is China, which now faces 125 per cent tariffs and which has hit back with reciprocal 64 per cent levies on US goods.

But markets across the globe con tinue to experience nervous sentiments and heightened volatility caused by ex treme uncertainty. “No one has a clue to how this turbulence caused by the Trump tariffs will evolve,” says Dr Vijaya Kumar, Chief Investment Strategist, Geojit Finan cial Services.

Markets are now pricing in a likely global recession. Investors are rushing to safer assets like US treasuries, pushing the 10-year yield down by 8 basis points to 3.91 per cent. Traders are betting the Federal Reserve could cut rates as early as May 2025.

The widespread sell-off was ampli fied by falling global commodity prices. Brent Crude oil lost 6.5 per cent, WTI fell 7.4 per cent, and industrial metals also took a hit as demand worries grew in view of a looming recession.

The sharp sell-off in stock markets across the globe indicates that countries are worried about the possibility of a full blown recession due to the tariffs un leashed by Mr Trump.

The Indian authorities are keeping mum on this global crisis. When Presi dent Trump announced his sweeping tariffs, several coun tries, including Canada, Mexico and China, expressed shock and anger, and threatened to retaliate. But, surprisingly, the Indian government is seemingly more concerned over is sues like the Waqf Act, and nobody in the government is even referring to the tariff issue. Prime Minister Modi and Home Minister Amit Shah, who were just before a few months ago exhorting Indian investors to invest in Indian stocks, have been tight-lipped on the issue.

While global markets are facing an unpredictable future, President Trump remains unfazed by the chaos un leashed by his unprecedented step and has reported re marked that “sometimes you have to take medicine to fix something.”

If Mr Trump remains unbending, China is in an equally hostile mood and experts opine that a Chinese retaliation will lead to crippling trade wars. The Chinese Commerce Ministry has described its retaliation as a ‘counter to US aggression’, escalating fears of a prolonged trade stand-off.

Striking a note of caution, US Fed chairman Jerome Powell has warned both parties that “a trade war could lead to higher inflation and lower growth.” Ironically, the US too has not gone unscathed. After the recent debacle with S&P 500 losing 6 per cent, Dow 5.5 per cent and Nasdaq 5 per cent, US futures point to more losses going ahead. But Mr Trump is fixated on his decision, and has report edly said, “This is a great time to get rich.” In a more graded response, Mr Powell has remarked that “our (US Fed) obligaton is to keep longer- term inflation expectations well anchored.”

In US ally Taiwan, where the index plunged around 10 per cent, the authorities swung into action and introduced temporary curbs on short selling. Taiwanese President Lai Ching-He pointed out, “Taiwan will not impose retaliatory tariffs but will aim to negotiate a zero-tariff deal with Wash ington.” A $ 2.7 billion stimulus was announced to cushion the domestic impact.

Thanks to the Trump tariffs, the global economic and social environment is vitiated with interest rate and inflation concerns raising their ugly heads. With global economic uncertainty mounting, central banks face pressure to act, but Mr Powell urges caution, saying, “A one-time increase in the price level must not become an ongoing inflation problem. The Federal Reserve now faces a trade-off – cut rates to cushion economic pain, or stay firm to prevent run away inflation.” In this scenario, experts opine that trade wars will not be in the interest of anybody. The trillion-dollar question agitating observers is: Can diplomacy replace confrontation?

Some experts opine that even though Mr Trump's re ciprocal tariffs may send global shockwaves, India may emerge among the least vulnerable. Meanwhile, several countries led by the US's arch-rival China have started re taliating fiercely and there is criticisim of the tariffs within the US too. The US President has played a tactical game by postponing the implementation of his tariff plan by 90 days. Incidentally, India is one of the few countries which has not opposed the Trump tariffs. Prime Minister Modi has been silent on the developmnts, and it is possible that this 'tactical discreetness' could go in favour of India with Mr Trump's ire directed at opponents like China, Europe and Canada.

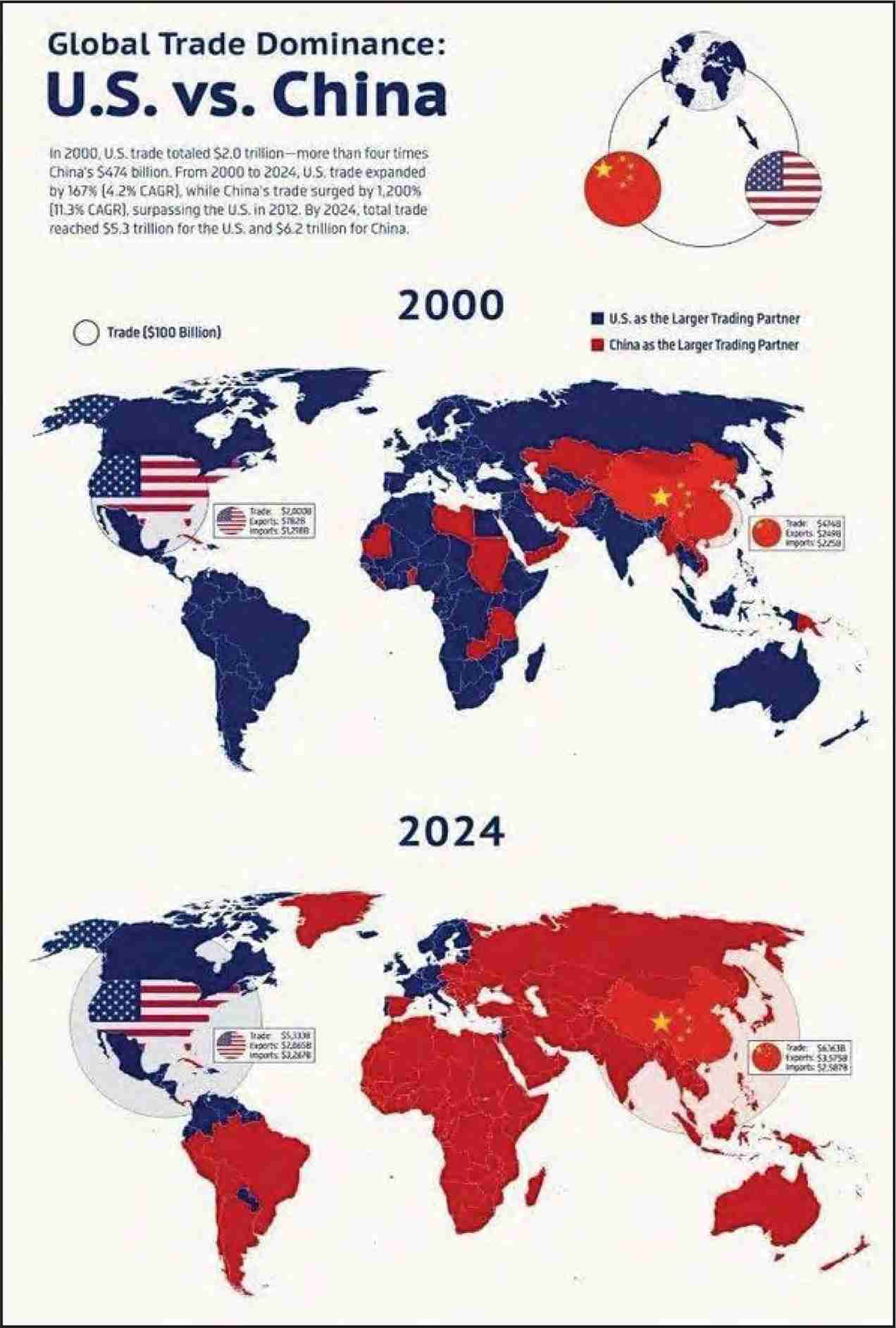

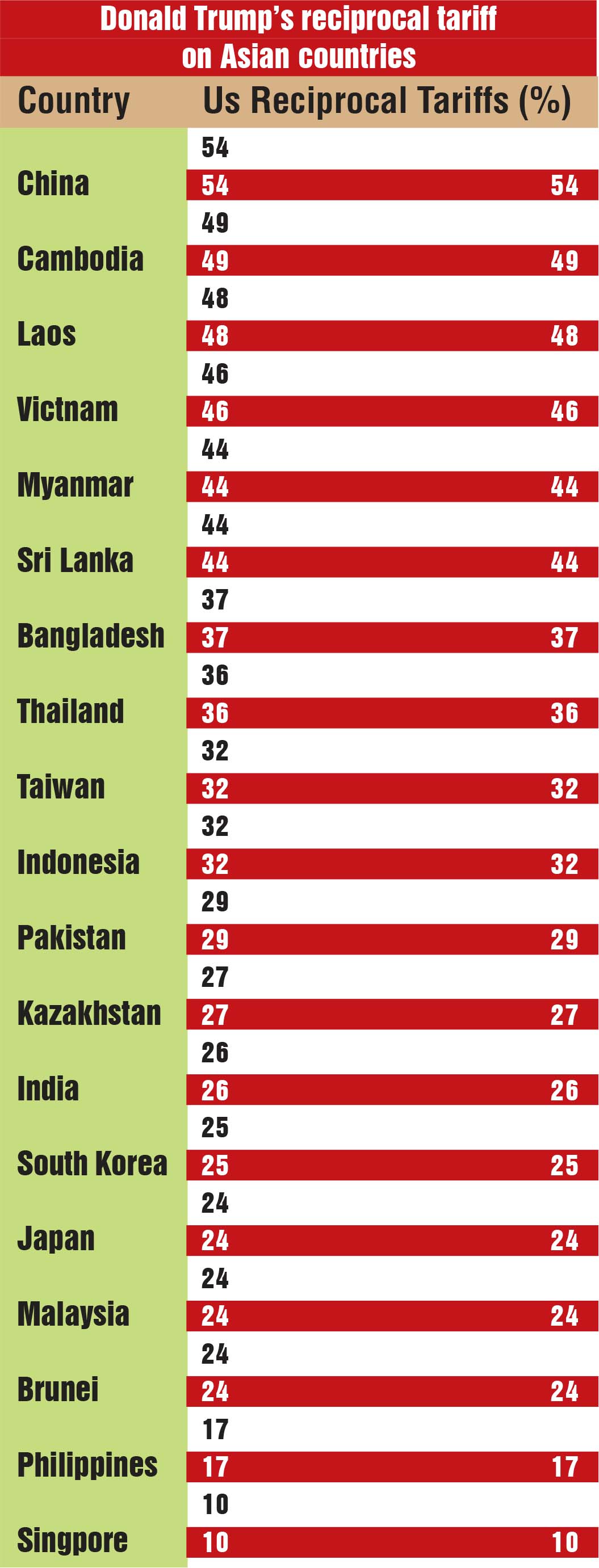

For Indian goods, Mr Trump has fixed a 26 per cent tariff, which aligns with rates for the EU (20 per cent) and Japan (25 per cent), and is considerably lower thann the tariffs for China (54 per cent) , Vietnam (46 per cent), Sri Lanka (44 per cent) and Bangladesh (37 per cent). According to an exercise undertaken by an economics expert, Niven Winchester, who has analysed the possible impact of the Trump tariffs on the GDP of major countries, the change in the GDP of India works out to just 0.19 per cent with a negative impact of $ 28 annually per household.

According to another scenario by Prof. Winchester, which illustrates the economic impact when other countries refrain from responding to the American tariffs, the impact on India's GDP would possibly be a positive 0.01 per cent, translating into a household-level positive effect of $1 an nually. According to Sujan Hajra, Chief Economist at the Anand Rathi group, "While America's new reciprocal tariff regime could shake up global trade, India emerges relatively un scathed and will see only a modest impact on exports." He adds, "India may even gain from supply chain shifts. Do mestic growth, inflation and equities remain on solid ground- turning a global trade headwind into a potential strategic tailwind."

According to him, even in a worst-case scenario of a 10 per cent decline in exports to the US, the hit to India's GDP would be limited to around 0.02 per cent. Despite global trade friction, with relatively resilient domestic demand and much greater weightage of domestic versus foreign demand, India's growth is expected to re main robust in the 6.5-7.5 per cent range over the next 2-3 years, notes Mr Hajra. Though Mr Trump had aimed a broadside at Mr. Modi for India's trade surplus with the US, in reality the Indian surplus ($ 64 billion) is far lower than that of China ($ 320 billion), Mexico ($ 180 billion), Vietnam ($ 120 billion), and Germany and Ireland ($90 billion each).

Not just that, Mr Hajra believes that given the low im port components of India's inflation basket, the tariff impact on consumer prices is expected to be minimal. In its analysis, HDFC Bank says that while Mr Trump has imposed universal tariffs, the fact that India faces lower tariffs compared to the likes of China, Vietnam and Thai land provides it with a tariff arbitrage that could make India's exports more competitive. Referring to the downward drift in the Indian stock market, Dr VK Vijayakumar, Chief Investment Strategist at Geojit Investment, maintains that "the short-term impact on the stock market will be negative. Since the tariffs will lead to higher inflation in the US, the Federal Reserve will be in a tight spot, unable to cut rates as markets had expected and factored in."

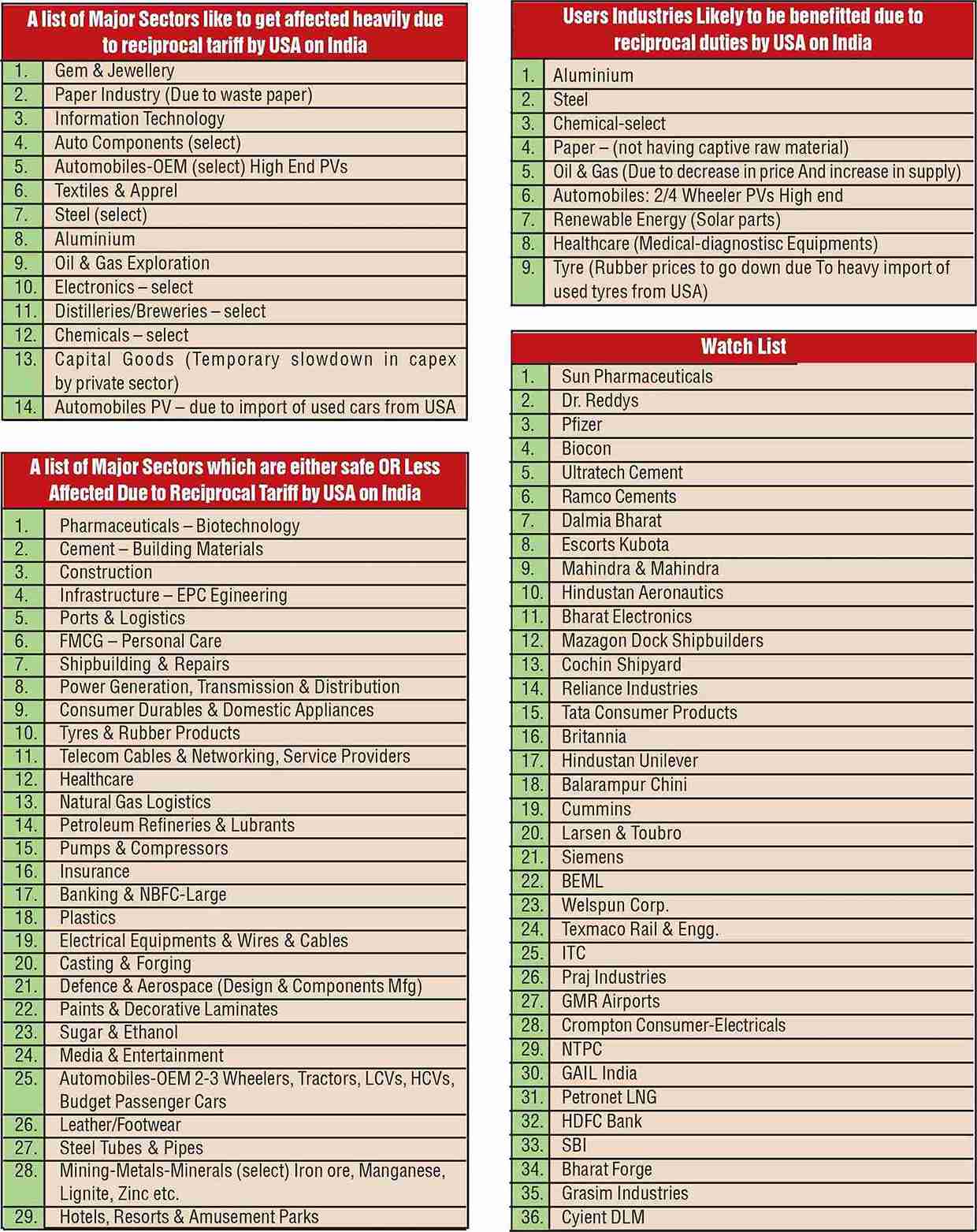

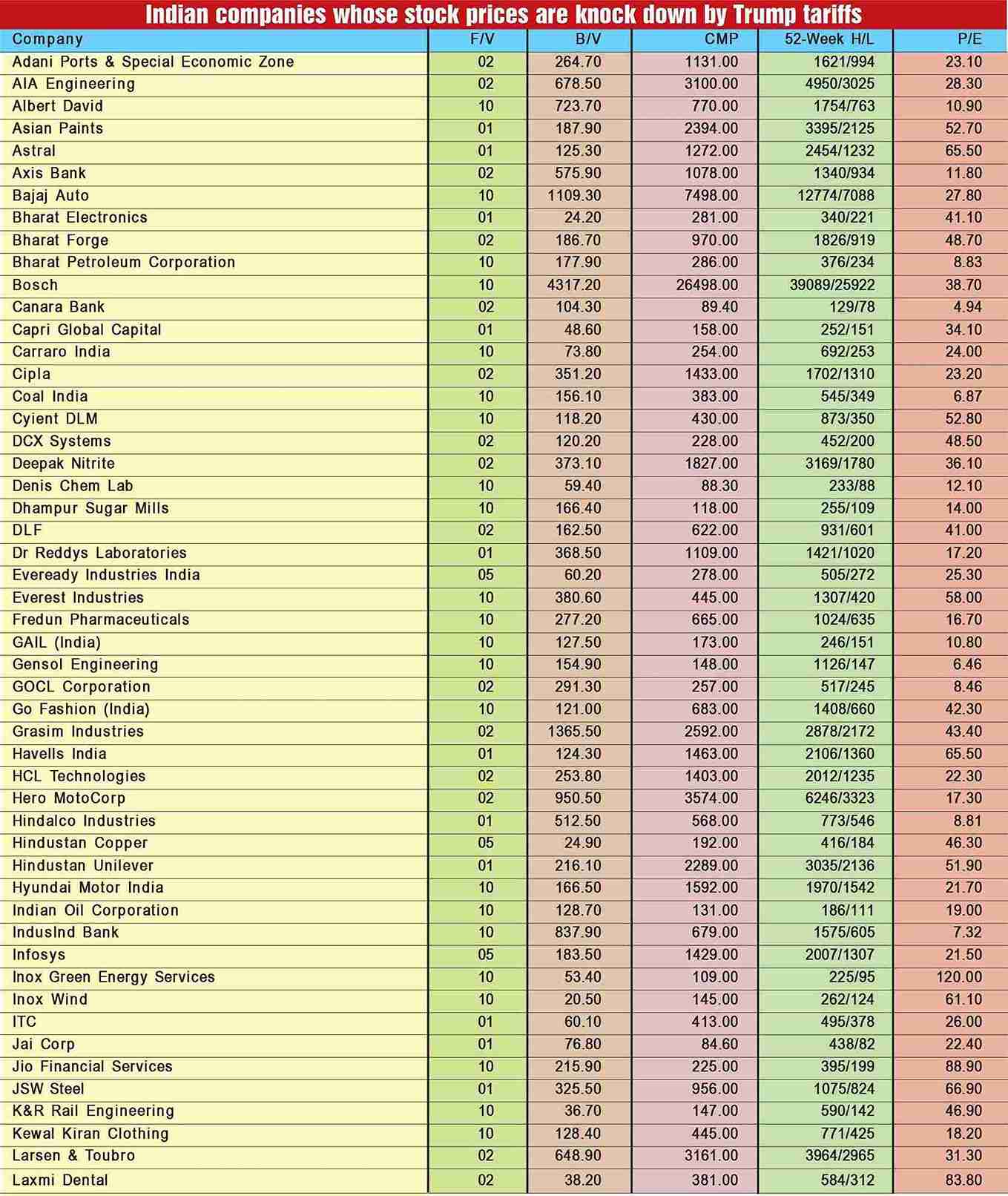

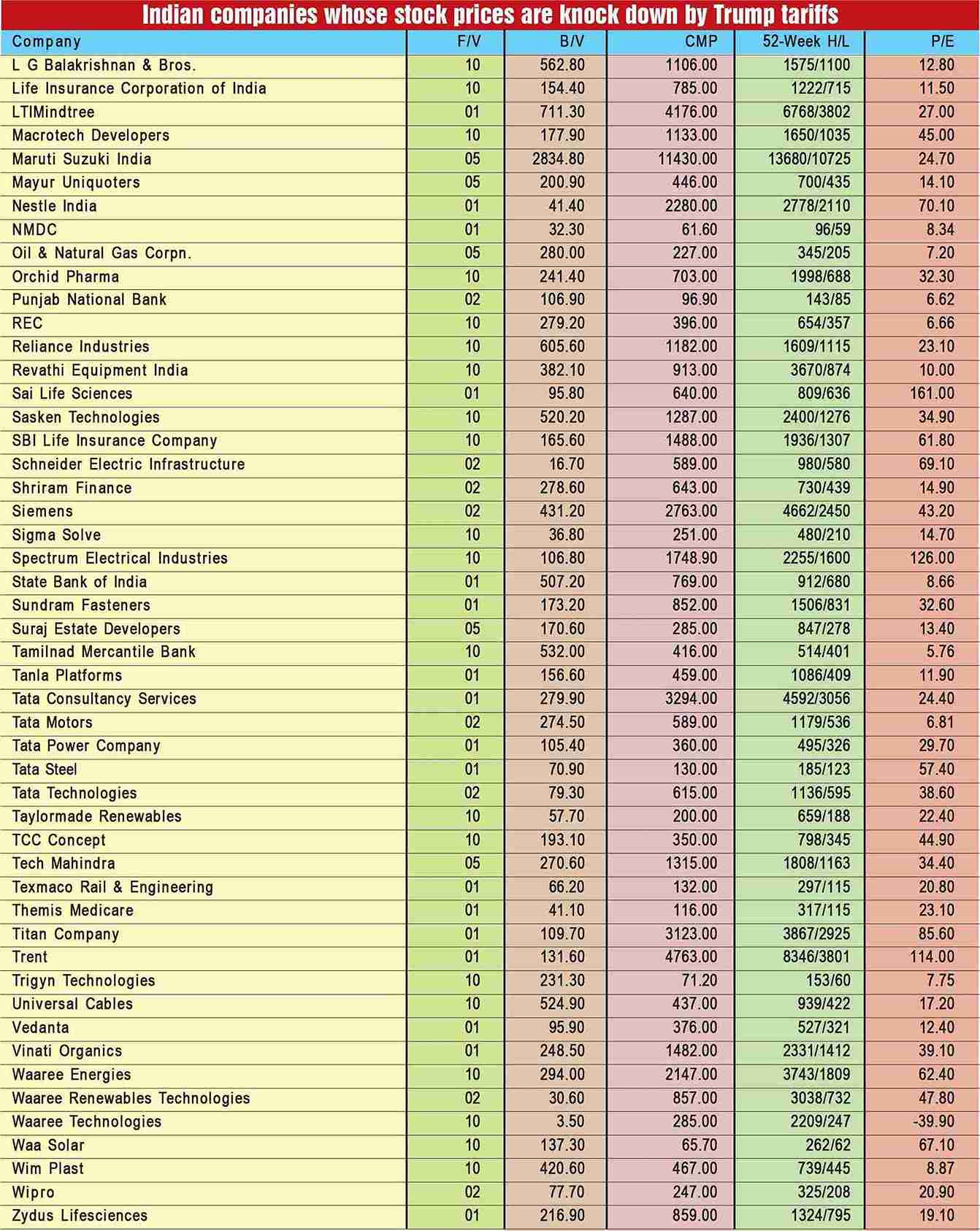

Sector-wise, the number of sectors hit hard by the tariffs will be fewer than those that remain unaffected (see the list on these pages). No doubt, information technology stocks will suffer the most amid concerns over a potential eco nomic slowdown in the US due to the new tariffs. In fact, pivotals like TCS, Infosys, Tech Mahindra and HCL have already plunged over 5 per cent, with TCS and Infosys ac counting for the majority of the Sensex's decline. Other weak sectors include metals, autos, oil & gas, and gems & jewellery.

The pharmaceuticals sector, which has been exempted at this juncture, is in good health. Pharma stocks performed well after select companies like IPCA Laboratories, Lupin, Natco Pharma, Sun Pharma and Cipla received tariff ex emptions in the US. Many other sectors are minimally least affected (see the list on these pages).

The downward drift in the Indian stock market intensi fied in the first seven days of April, following a selling ava lanche by foreign institutional investors (FIIs). Even in the run-up to the announcement of tariffs, FIIs had dumped stocks worth Rs 10,255 crore in just two days. And in the period from January to March 2025 alone, they had un loaded shares worth Rs 1,22,910 crore. In fact, during those 16 consecutive weeks the outflows continued unabated. Interestingly, this was the longest such streak in the last 25 years. Surprisingly, during the week-to-March 28, FIIs once again turned buyers. But in the first week of April, their behaviour changed again after the announcement of the Trump tariffs.

There are some experts who believe that the US tariffs may prove a blessing in disguise for India as these tariffs may encourage inflows in the longer run. For example, Dr Vijayakumar of Geojit says that while the Trump tariffs will have a negative impact on global trade, from the Indian perspective there are some positives. He adds, "Since the Indian economy is largely domestic consumption-driven, the impact on the Indian economy will be lower than in most large economies. This can lead to capital inflows into India from FIIs, as a weakening dollar has always been posi tive for emerging markets. India has the best macros and growth prospects even in these uncertain times." Meanwhile, the Indian government does not seem to be very serious about promoting exports. In fact, only around 15 per cent of Nifty50 companies have a significant export presence, with most relying on domestic demand. This implies low reliance on exports for India. Developing import substitutes and strengthening services exports can aid in countering the tariff impact in the medium term and attracting further investment. According to Sanjay Kathuria, visiting Senior Fellow in think tank Centre for Social and Economic Progress, "India should now aim at accelerating its proposed free trade agree ments with major countries and regions in the world and look afresh at Asian countries for stronger trade ties. India must also focus on becoming a trusted supplier and a reli able market to major trading partners because imports and exports go hand in hand."

Little wonder, most experts opine that Mr Trump's tariffs are unlikely to have a major adverse impact on the economy, which is reassuring for the domestic market. They note that India's exports in the most impacted sectors account for just 1.1 per cent of the country's GDP, thus minimising potential risks. According to an expert, the maximum hit to India's ex ports to the US is likely to be around $ 3.6 billion, which is only 0.1 per cent of India's GDP. According to Dr Vijayakumar, "The bigger concern was that these reciprocal tariffs would trigger retaliatory action from other countries, leading to a full-blown trade war im pacting global trade and global growth. India's growth will also suffer in the context of global growth slowdown, mak ing it challenging for India to achieve a growth rate above 6.5 per cent in FY26." The Trump tariffs may not significantly affect Indian businesses overall, but could impact sectors with high de pendence on the US market. These include electronics (15.6 per cent), gems & jewellery (11.5 per cent), pharmaceuti cals (11 per cent), nuclear reactor machinery (8.1 per cent), and refined petroleum products (5.5 per cent).

But experts see this as a key growth opportunity for India as well. Saurabh Agarwal, Partner & Automotive Tax Leader, EY India, believes the rising US tariffs on automo biles could benefit the electric vehicle segment of India. He says, "With US automotive tariffs rising, India's electric vehicle sector has a prime opportunity to cap ture a larger share of the US market, especially in the budget car segment. China's 2023 auto and component exports to the US stood at $ 17.99 billion, while India's were only $ 2.1 billion in 2024, highlighting the poten tial for growth. To accelerate this, the government should enhance the PLI scheme by including more auto com ponents, opening it to new players, and extending it by two years." Similarly, the pharmaceutical industry, which is cur rently exempt from the tariffs, has a bright opportunity for trade expansion. Dr Vijayakumar says, "From the Indian stock market perspective, the exemption to pharmaceuti cals is a positive. The pharma stocks are likely to rally. Domestic consumption- focused sectors will be preferred by investors.

While analysts agree that reciprocal tariffs for India are much lower than for other East Asian countries, they add that India should now focus on building a mutually benefi cial trade agreement with the US. According to Mr Agneshwar Sen, Trade Policy Leader at EY India, "India must not only negotiate with the US to maintain market access, but also collaborate with FTA part ners in Asia to restructure supply chains and seize new op portunities."

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives