Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: April 15, 2025

Updated: April 15, 2025

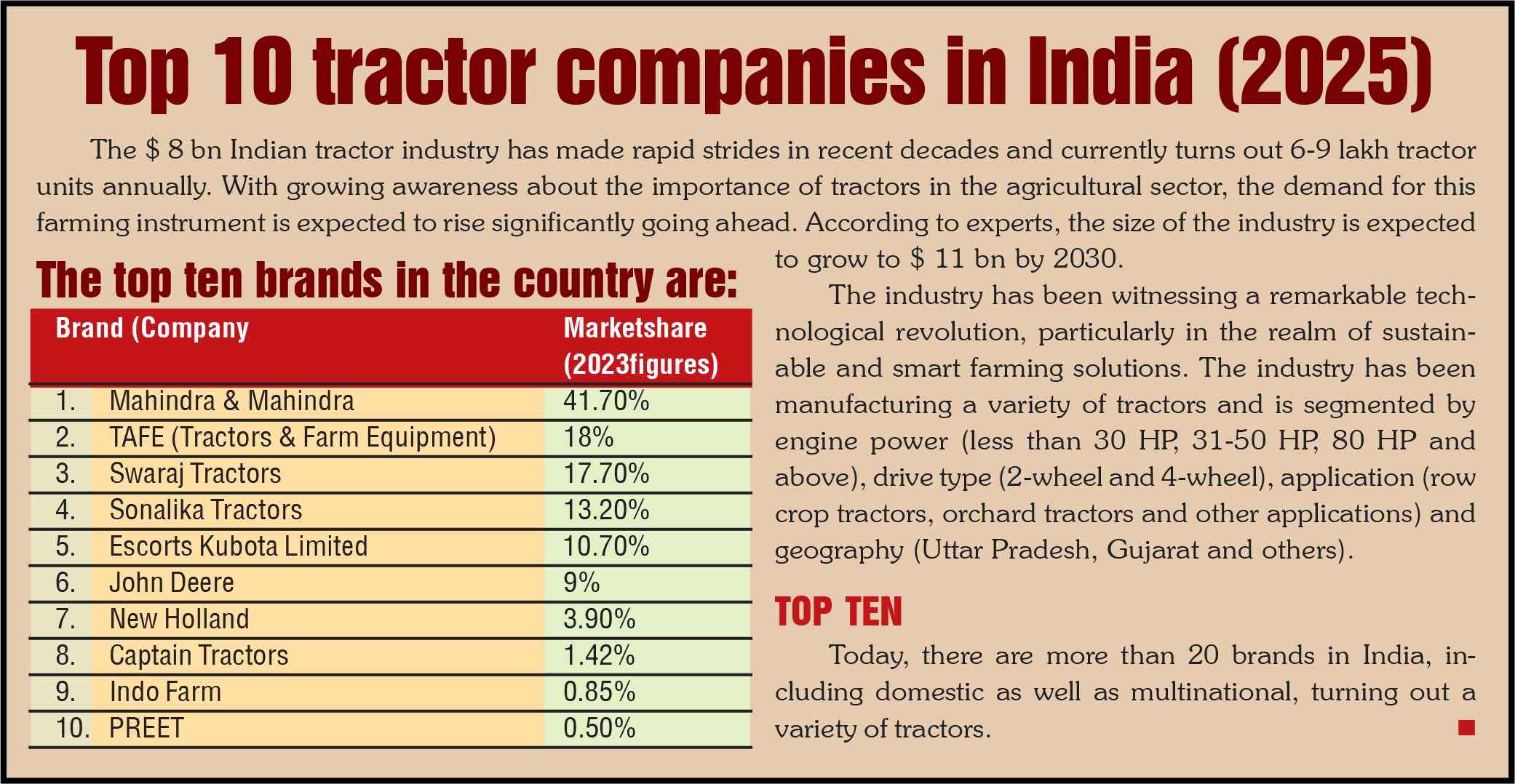

From a post-independence era when tractors were a novelty on the country’s agricultural scene, these 4 wheeled workhorses have slowly but surely become ubiquitous companions of Indian farmers. Key drivers for this trend have been shrinking land and water resources, a decreasing agricultural labour force, and increasing power availability. Valued today at $ 8 billion, the tractor sector is flying high on the back of supportive government policies and cutting-edge technological advancements.

The $ 8 billion Indian tractor industry is in fine fettle. The industry is witnessing a robust growth trajectory, driven by increasing farm mechanisation, rising awareness about the need for modernisation of agriculture, government sup port, and technological advancements with a growing focus on 4WD tractors, mini-tractors and smart tractors.

Going back in time, Indian agriculture on the eve of independence was in a primitive stage, suffering from stag nation and constant degradation. Even after India achieved independence on August 15, 1947, old-fashioned technol ogy and outdated methods continued to be used, and very few farmers in the country had heard the word ‘tractor’. Not only was there a lack of machines, there was also an ab sence of growth enhancement ingredients such as fertilisers.

After independence, the situation started changing slowly. The partition of the country was an inadvertent cata lyst, as a shortage of foodgrains forced the government to start focusing on agricultural mechanisation. Other factors which spurred the demand for tractors were shrinking land and water resources, a decreasing agricultural labour force, and increasing power availability. As a large number of farmers were not in a position to afford buying tractors, the gov ernment came to their help, promoting farm mechanisation through various initiatives and subsidy programmes, which in turn gave a boost to the tractor segment

With the passage of time, the increasing adaptation of precision farming techniques and smart tractors equipped with ToT sensors and connectivity features started revolutionising agriculture as well as the tractor industry. As Indian agriculture is characterised by a large number of small and marginal farmers, small tractors, with their affordability and versatility, took centre-stage. The custom- hiring model also started gaining ground as small and marginal farmers took advantage of the pay-per-use system without having to buy a tractor.

At the other end of the income scale, well-to-do farmers plumped for 4WD (four-wheel drive) tractors, having recognised their versatility particularly in challenging terrain and wet con ditions, leading to a surge in demand for these models. Thus, the tractor industry started growing at a fast pace.

According to market experts, the Indian tractor market is expected to continue its growth trajectory, with projections indicating a significant in crease in sales and market value in the coming years. In fiscal 2022-23, tractor sales reached a record level of 9,40,985 units. However, the next year there was a fall of 7 per cent to 8,74,504 units on account of re duced kharif crop production due to a weak monsoon. But after fiscal 2024-25, tractor sales have re bounded.

Prospects for this fiscal (2025 26) are highly encouraging. After the 7 per cent decline in sales during fiscal 2024, tractor sales recovered half the ground -- around 4 per cent -- in fiscal 2024-25. And the outlook for fiscal 2025-26 is considered highly promising as India's monsoon forecasts for the cur rent year are highly optimistic.

Meteorological forecasts indicate a favourable outlook for the country's monsoon season, with a low likelihood of an El Nino event in the coming months. This suggests that the Indian monsoon could be close to normal, which is vital for the country's rural economy - a key driver for overall consumption in recent quarters. Little wonder that there is a renewed demand for tractors in the country. What is more, leading companies have also started exporting tractors.

The industry is witnessing a remarkable technologi cal revolution, particularly in the realm of sustainable and smart farming solutions. In early January 2024, Trac tors and Farm Equipment Ltd (TAFE) achieved a signifi cant milestone by introducing electric tractors equipped with auto-steer and advanced farm management systems. This innovation reflects the industry's commitment to environ mental sustainability and techno logical advancement. Soon there after, Sonalika Tractors launched a new range of 10 advanced heavy-duty tractors under the 'Ti ger' series, featuring cutting-edge technologies like CRDS and HDM+ engines, demonstrating the industry's focus on innovation and efficiency.

The horticulture sector has emerged as a significant driver of trac tor demand, with the area under horticulture production expanding from 28.04 million hectares in fiscal 2021-22 to over 30 million hectares by now. This growth has led to an increased demand for specialised agricultural equipment designed for orchard and vineyard operations. Manufacturing compa nies are responding to this trend by establishing strategic partnerships and expanding their production capacities. For instance, towards the end of 2023, VST Tiller Tractors and HTC Investments (owner of the Zetor brand) formed a stra tegic alliance to deliver a high-quality tractor specially de signed for Indian farmers' needs.

The Indian government's focus on agricultural mechanisation, coupled with shrinking land and water re sources, a decreasing agricultural labour force and increased power availability, is driving the demand for tractors. The government is actively promoting farm mechanisation through various schemes like substantial sub sidies for crop residual management and greenhouse tech nologies, boosting both farm mechanisation and the tractor industry. Some key programmes include:

Going a step further, financing options have made trac tors affordable. The availability of attractive financing op tions has been a significant factor in the tractor industry's growth. Bank and financial institutions are offering com petitive tractor loans with features such as:

With the increasing value of agricultural machinery, trac tor insurance has become an essential consideration for farm ers. Insurance providers are offering comprehensive cover age options. The availability of tailored insurance products has given farmers peace of mind and has encouraged them to invest in higher-end tractor models.

The tractor industry boom has been accompanied by significant advancements in agricultural technology, such as (a) GPS: Guided precision farming systems; (b) Telematics for remote monitoring and diagnostics; (c) Automated trac tor operations, and (d) Integration with farm management software. These technological advancements are not only improv ing the efficiencies of tractor operations but also contribut ing to overall farm productivity. Key factors driving the Indian tractor market are the burn ing need for enhanced food production, increased kharif sowing, favourable cash flow, and timely monsoons.

An increase in mechanisation in agricultural equipment such as tractors in states like Telangana, Tamil Nadu, Haryana, Punjab, Maharashtra and Madhya Pradesh is driv ing the growth of the Indian tractor market, coupled with a rise in demand for highly efficient tractors for various applications such as planting and sowing. Major players such Mahindra & Mahindra and Escorts are engaged in offering tractors with a power output range of 50-100 HP. For in stance, Mahindra & Mahindra offers Mahindra NOVO with a power output of 64 HP. With a powerful engine and an efficient cooling system, this tractor is popular for mulcher applications.

In addition, a rise in demand for high- performance tractors for muddy and heavy soil conditions is driving the growth of the Indian tractor market. For instance, a few years ago Swaraj Tractors - a subsidiary of Mahindra & Mahindra-- launched a Swaraj 963 FE series tractor with both 2 and 4W drives. It has a powerful engine, is cost- efficient and offers high productivity. Mini tractors have proved to be a game- changer for small farms. While larger tractors continue to dominate the market, 2024 has seen a significant uptick in mini tractors. These compact machines are proving to be a game-changer for small and marginal farmers, offering several advantages like affordability, ease of manoeuvrability in small plots, versality of various agricultural tasks and lower operational costs. The sale of mini tractors in India has surged in the last couple of years. The main drivers of this increase are technological advance ments in agricultural production and the growing demand for mechanisation in agriculture. Additionally, the quest for higher yields, the increasing scarcity of land, and improvements in the financial standing of farmers are also boosting this niche market. Popular mini tractor models like Mahindra Yuvrej215 and Kubota B2420 have seen a surge in demand, particularly in regions with a high concentration of small landholding.

But the 45-50 HP tractors have emerged as the most popular among farmers. Today in India tractors are avail able in various ranges, each distinguished by its features and capabilities. However, farmers have started preferring 45-50 HP tractors. The special appeal of these tractors is their versatility - they can easily handle many commercial tasks, including farming. Farmers prefer these 45-50 HP tractors because they consume less fuel than heavy-duty tractors and can operate almost all agricultural equipment.

All in all, prospects for the tractor industry are buoyant going ahead. Maintains Ms Mallika Srinivasan, Chairman and Managing Director of TAFE (Tractors and Farm Equip ment) who is known as the tractor queen of India, "Demand for tractors is likely to be strong in the coming months due to the forecast of normal or above-normal rainfall. According to the WION channel, meteorological forecasts indicate a favourable outlook for India's monsoon season 2025-26, with a low likelihood of an EL Nino even in the coming months. This suggests that the Indian monsoon could be close to normal or even above normal. The Indian tractor industry, which had posted a modest growth of 4- 5 per cent last year, is expected to register a higher growth this year on account of normal rainfall, growth in agricultural input companies, robust minimum support price for almost all ma jor crops announced in the Union budget, and uptick in demand. All these augur well for the industry."

According to her, sales in Haryana, Punjab, Uttar Pradesh, Chhattisgarh, Jharkhand and West Bengal have started showing positive results. However, sales of tractors in southern states last year were down by 30 per cent. It is picking up slowly and is yet to recover fully.

Talking about her company's JFarm services, that facilitates rental of tractors and farm equipment for small and large farms through a digital platform, she says it posted a farmer2farmer business trans action of Rs 1,200 crore in fiscal year 2024 and still higher in fiscal 2025. According to Ms Srinivasan, this is a free service offered on the digital platform as part of a CSR initiative by TAFE. The entire business transactions are between farmers without our intervention. "We are the biggest players in this area," she says. By now, India has emerged as one of the largest markets for tractors in the world, and its growth prospects going ahead are all the more robust. It is worth restressing the point that since independence, farm mechanisation in the country has been experiencing significant growth due to several intercon nected factors, including shrinking land and water resources, a decreasing agriculture labour force, increasing power avail ability and supportive government policies.

However, farm mechanisation, which was negligible be fore independence and has shot up to 44 per cent by now, is still relatively very low compared to other major agricul tural nations. For example penetration of farm machinery in the US is as high as 95 per cent, and in Brazil around 75 per cent. This means that there is a tremendous opportu nity for the growth of farm mechanisation in India, especially considering that approximately 80 per cent of Indian farmers are small and marginal land holders with less than five hectares. In order to address this, the Indian government has implemented the Submis sion on Agricultural Mechanisation (SMAM) policy, focusing on increasing mechanisation and technical advancement initiatives. This will give a push to de mand for tractors. The booming tractor industry is having a profound impact on Indian agriculture. Some of the key benefits include (a) Increased farm productivity and efficiency; (b) Reducing labour dependency; (c) Improved timelines of agricultural operations; (d) Enhanced crop quality and yield, and (e) Better resource management. These improvements are contributing significantly to the overall growth and modernisation of the agricul tural sector in India.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives