Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: August 31, 2025

Updated: August 31, 2025

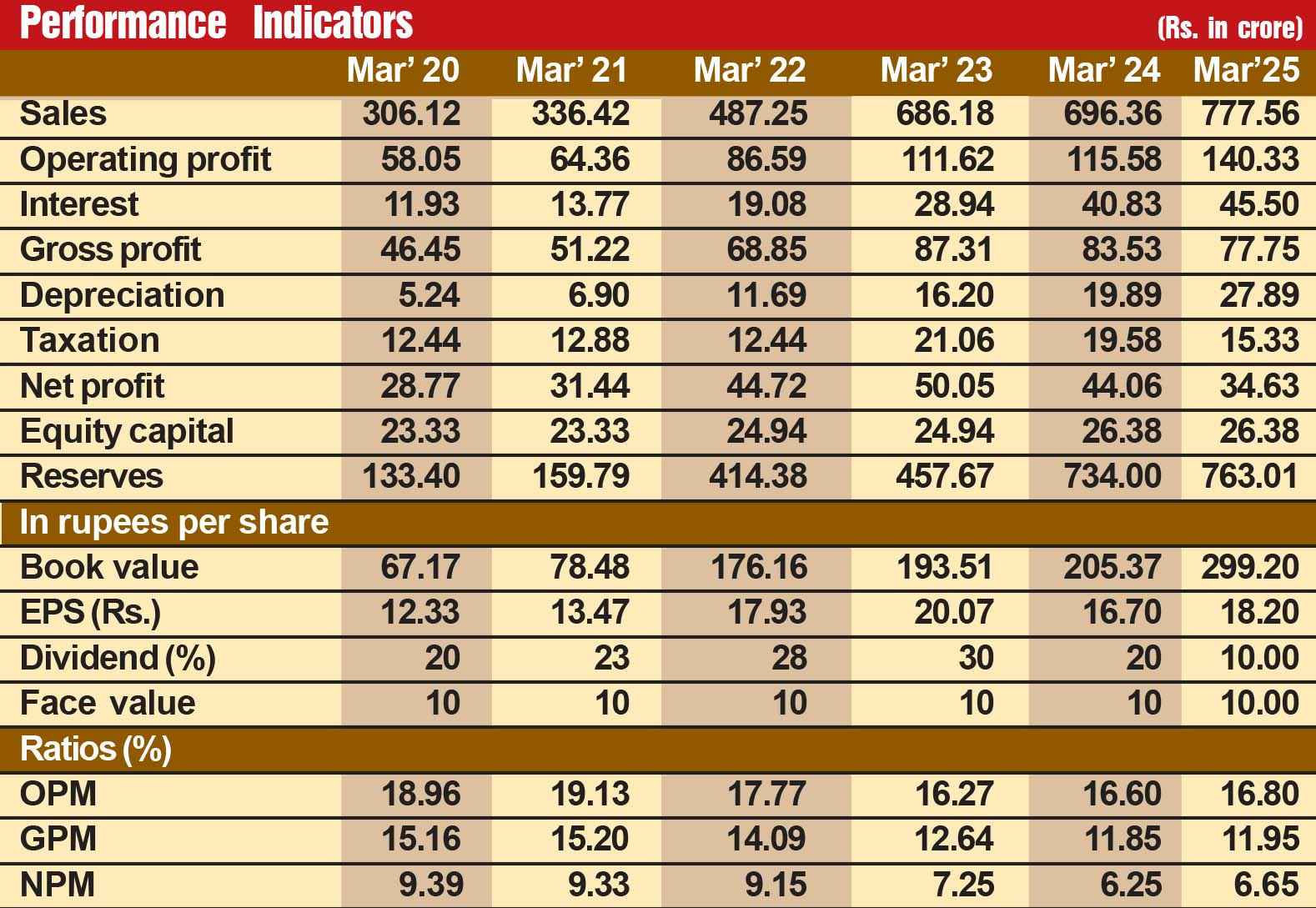

Many eyebrows will be raised when our readers see that we have selected Neogen Chemicals (NCL) as the Fortune Scrip for this fortnight. Their sense of disappointment is a legitimate one, as the small cap speciality chemicals company has not been doing well of late. A steady fall in earnings during the last three years has resulted in net profit declining from Rs 50 crore in fiscal year 2023 to Rs 36 crore in FY24 and further to Rs 35 crore in FY25. Neither are its prospects for the current fiscal (2026) very promising.

As if the challenging marketing conditions were not enough, a disastrous fire incident in April 2025 caused extensive damage to the warehouse and the entire MPP3 structure. This has forced the management to lower its base business revenue guidance for fiscal 2026 to Rs 775/850 crore from Rs 950/1,000 crore announced earlier before the fire mishap. Needless to say, the stock price of NCL has lost around Rs 1,000 per piece during the last 52 weeks, from Rs 2,415 to Rs 1,450. The question will naturally be asked how a company with declining profitability has been selected as the Fortune Scrip, that too in an environment of economic slowdown, growing geopolitical tensions, and the tariff sword being wielded by US President Donald Trump.

Thane (Mumbai)-headquartered NCL is a small cap speciality chemicals company and a leading player in the manufacture of bromine-based and lithium-based speciality chemical compounds. Established in 1991, the company made rapid strides in these two segments and subsequently developed competencies in other related chemistries such as alkylation, acylation, amination, oxidation, dehalogenation, silylation, halex reaction, Friedel-Crafts coupling, and chlorination. Further, Neogen has obtained the licence from MU Ionic Solutions (MUIS) (a JV between Mitsubishi Chemical Corporation (MCC) and UBE Corporation, which is part of the Mitsubishi Chemical Group Japanese conglomerate) for availing its proprietary and confidential manufacturing technology for Neogen’s electrolyte solutions at its manufacturing facility in India, with a planned installed capacity of upto 30,000 mtpa. These electrolytes will be targeted by Neogen to meet the growing demand of lithium-ion cell manufacturers in India. The technology licence will allow Neogen to ensure that the manufacturing plant meets stringent global standards for quality, reliability, safety and efficiency for electrolytes production. It will also help Neogen greatly reduce approval times with lithium-ion battery makers. Neogen is honoured to be a recipient of this first-ever licence issued by MUIS.

Established in 1991, the company made rapid strides in its two legacy business viz. bromine-based and lithium-based speciality chemical compounds segments and subsequently developed competencies in other related chemistries such as alkylation, acylation, amination, oxidation, dehalogenation, silylation, halex reaction, Friedel-Crafts coupling, and chlorination. Further, Neogen has obtained the licence from MU Ionic Solutions (MUIS) (a JV between Mitsubishi Chemical Corporation (MCC) and UBE Corporation, which is part of the Mitsubishi Chemical Group Japanese conglomerate) for availing its proprietary and confidential manufacturing technology for Neogen's electrolyte solutions at its manufacturing facility in India, with a planned installed capacity of upto 30,000 mtpa. These electrolytes will be targeted by Neogen to meet the growing demand of lithiumion cell manufacturers in India.

During the last three decades of its existence, Neogen has expanded its range of products to over 250, which find applications across various industries in India and globally. By now, its products have gained a strong footprint in around 30 countries, including the US, the UK, France, Germany, Spain, Italy, Japan, Mexico, Canada, South Korea, the Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, Poland, the Czech Republic, the UAE, Saudi Arabia, Israel, Egypt, Taiwan, Australia, Iceland and Ghana.

The company operates out of five state-of-the-art manufacturing facilities located at Mhape, Navi Mumbai (Maharashtra), Karakhadi in Vadodara (Gujarat), Dahej special economic zone (Gujarat), Sangaready in Hyderabad (Telangana) and Pakhajan in Bharuch (Gujarat). Together, these five facilities occupy 122 acres of land. In 2023, Neogen also acquired Buli Chemicals India Private Limited which has a 5-acre facility in Hyderabad. With the completion of the Phase I and 2 expansions at the Dahej SEZ, other brownfield expansions and the recent acquisition of the facility at Hyderabad, the total organic chemicals manufacturing capacity of the company has increased from 1.30 m3 to 4.63 m3 of reactor capacity, and the aggregate manufacturing capacity of inorganic chemicals has increased from 2.40 m3 to 39 m3A.

In pursuit of its expansion strategy and as an integral step in establishing a greenfield project, Neogen Ionics Limited, NCL’s wholly-owned subsidiary, completed a land acquisition totalling 65 acres in Pakhajan, Dahej PCPIR, Bharuch (Gujarat). This greenfield site will house a world-class, state-of-the-art battery material facility, set to be the company’s largest, dedicated to battery materials and emerging business opportunities. As part of this project, the company will set up a plant to manufacture 30,000 mt of electrolytes and 3,000 mt of electrolyte salts and additives. Once operational, the plant is expected to meet the increasing demand from lithium-ion cell manufacturers in India and address the growing international OEM demand for electrolyte salts and additives. With the completion of the greenfield facility at the Dahej SEZ, Neogen can carry out multi-step synthesis in equipment of various sizes. Neogen is also focussing on custom synthesis and manufacturing. Work has already commenced in this area with customers in Japan and Europe.

During the last three decades of its existence, Neogen has expanded its range of products to over 250, which find applications across various industries in India and globally. By now, its products have gained a strong footprint in around 30 countries, including the US, the UK, France, Germany, Spain, Italy, Japan, Mexico, Canada, South Korea, the Netherlands, Denmark, Belgium, Switzerland, Sweden, Greece, Poland, the Czech Republic, the UAE, Saudi Arabia, Israel, Egypt, Taiwan, Australia, Iceland and Ghana.

The company has made rapid strides on the financial front. During the last 12 years, its sales turnover has expanded almost 10 and a half times – from Rs 74 crore in fiscal 2014 to Rs 778 crore in fiscal 2025, with operating profit shooting up 12 and a half times and net profit surging eight and a half times from Rs 4 crore to Rs 35 crore. The company’s financial position is very strong, with reserves at the end of March 2025 standing at Rs 763 crore – almost 30 times its equity capital of Rs 26 crore.

But we have not selected NCL as the Fortune Scrip only on the strength of its past performance. We strongly feel that the current market challenges and the loss on account of the fire at Dahej will be wiped out within a year and the company will be back on the growth path from fiscal 2027. We are confident that prospects for the company are extremely bright going ahead, and this small cap company will emerge as one of the top multibagger investment companies within the next five years or so. Consider:

Again, this wide range of products helped the company build a diversified and stable customer base. Today, it caters to diverse customers across a wide array of user industries such as pharmaceuticals, agrochemicals, electronic chemicals, construction chemicals, speciality polymer and VAM original equipment manufacturers. By now, the company has established a customer base of over 1,500 customers, including around 1,350 domestic customers and around 150 international customers. Major customers include Austin Chemical Company Inc US, CBC Company Ltd Japan, Divi’s Laboratories India, Laura’s Laboratories India, Solvay Specialities India and Voltas India.

The company will come out of the woods in 2026 and will be back on the growth path from 2027. According to research analysts at HDFC Securities, the growth momentum in the company's legacy business will remain intact owing to: (1) the ramp-up in the organic chemicals business, and (2) impending capacity augmentation in the organic and inorganic chemicals business.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives