Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: August 31, 2025

Updated: August 31, 2025

The most populous country in the world, with a continentsized domestic energy demand, India is betting big on its power sector with an outlay of Rs 9.15 lakh crore ($ 109.50 billion) to enhance power infrastructure and meet the projected peak demand of 458 GW by 2032.

Motilal Oswal’s research centre sees an investment opportunity of Rs 40 lakh crore ($ 461.95 billion) over the next decade, driven by rising demand, infrastructure upgrade and the transition to clean energy.

On the solar power front, the Union cabinet has approved ‘PMSurya Ghar: Muft Bijli Yojana’ for installing rooftop solar power units in one crore households by fiscal 2027. The country plans to invest Rs 9,15,920 crore ($ 107 billion) by 2032 to develop additional transmission lines, supporting its goal to nearly triple its clean power capacity.

has selected ten promising power stocks from which investors can expect steady, attractive and sustained returns.

India power sector, with an installed power generation capacity of 472.46 GW (as of April 30, 2025) is awaiting a powerful thrust going ahead. The government has already unveiled a comprehensive growth plan worth Rs 9.15 lakh crore ($ 109.50 billion) to enhance its power infrastructure and meet the projected peak demand of 458 GW by 2032. This initiative, led by the Union Ministry of Power, aims to strengthen the national power grid and boost energy security. The all-India peak power demand in fiscal 2026 is expected to generate attractive opportunities.

After an analytical study of the investment opportunities in the Indian power sector, Motilal Oswal’s research centre has maintained that the Indian power sector presents an investment opportunity worth Rs 40 lakh crore ($ 461.95 billion) over the next decade, driven by rising demand, infrastructure upgrade and the transition to clean energy.

The country’s consumption of electricity is on the rise. During fiscal 2025, India consumed 1,964 billion units of electricity, reflecting an increase of 33 per cent over fiscal 2021, translating into a 5-year CAGR of 7.4 per cent. According to rating agency ICARA, India’s energy demand is expected to grow in the range of 6- 6.5 per cent over the next five years.

The government has unveiled a comprehensive plan worth Rs 9.15 lakh crore ($ 109.50 billion) to enhance its power infrastructure and meet a projected demand of 458 GW by 2032.

The Union cabinet has approved ‘PM-Surya Ghar: Muft Bijli Yojana’ for installing rooftop solar power units in one crore households, with the aim of powering one crore homes by fiscal 2027. Among the states, Gujarat leads with 3.51 lakh solar powered households (18.14%), followed by Maharashtra (1.92 lakh, 22.79), Uttar Pradesh (75,602, 8.69%), Kerala (65,423, 7.73%) and Rajasthan (26,622, 3.14 per cent).

The country plans to invest Rs 9,15,920 crore ($ 107 billion) by 2032 to develop additional transmission lines, supporting its goal to nearly triple its clean power capacity. India’s energy storage sector is poised to cross $ 56.07 billion mark by 2032, as per the India Energy Storage Alliance.

At the same time, the country’s wind energy sector is making significant strides towards achieving the ambitious target of 100 GW of power generation by 2030, according to the Wind Turbine Manufacturing Association. The sixth largest globally, Indian power sector is continuously evolving to meet the pace of accelerated manufacturing, rapid urbanisation and expanding agriculture activities. The rising domestic energy demand has driven notable advancements in power generation, with a dynamic shift towards renewable energy sources such as solar.

India's power sector is one of the largest and most diverse in the world, playing a pivotal role in the country's economic development. According to the US Energy Information Administration (EIA), as of 2023 India ranks sixth in terms of total energy production with 126.567 quadrillion British Thermal Units (BTU). With a rapidly growing economy, increasing urbanisation and rising energy demand, India has made substantial advancements in power generation, transmission and distribution.

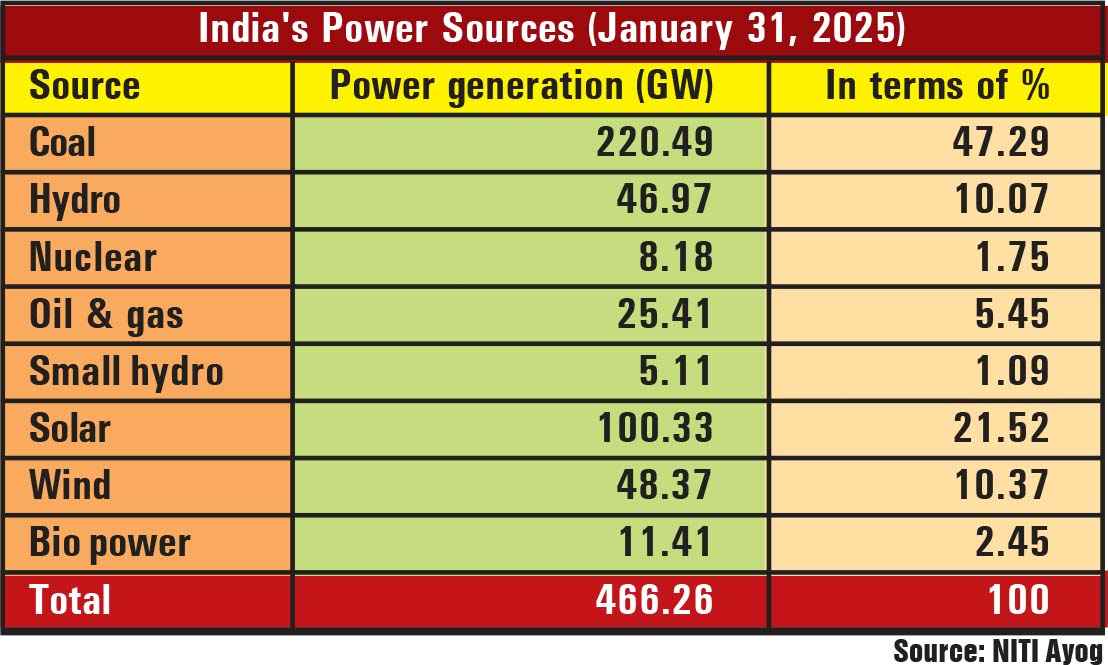

Of late, power capacity in India is in expansion mode. According to a report by India Briefing, coal-based power remains critical for India's energy security, increasing from 211.86 GW in 2022-23 to 220.49 GW in 2024-25. Renewable energy sources, particularly solar power, have witnessed the most rapid expansion, growing from 66.78 GW in 2022-23 to 100.33 GW in 2024-25. Wind energy has seen moderate growth, contributing 10.37 per cent to total capacity, while hydropower has remained relatively stable at 46.97 GW.

Despite the expansion of renewables, challenges such as grid integration, storage solutions and financial investment persist. Hydropower is crucial for balancing renewable intermittency, though environmental concerns and project delays hinder its growth. Nuclear power, while accounting for just a small share of the total, has increased from 6.78 GW in 2022-23 to 8.18 GW in 2023-24, with plans for further expansion.

India is increasingly focusing on nuclear power as a stable, low-carbon source. With growing electricity demand and the need for reliable baseload power, nuclear energy is becoming an essential component of India's clean energy transition, complementing renewables such as solar and wind. Collaborations with the US and other international partners are expected to accelerate nuclear infrastructure development. The country's National Electricity Plan - NEP (2022-32) outlines India's strategy for power expansion over the next decade.

While renewables remain central to the NEP, coal-based capacity is expected to increase by 80 GW by 2031-32 to ensure stable baseload power. Nuclear energy is projected to grow to 100 GW by 2047. The electricity blueprint also includes objectives to promote private sector participation in India's power sector. Peak demand forecast: 277.2 GW by 2026-27, 366.4 GW by 2031-32. Installed capacity target: 609 GW by 2031-32. Renewable energy goal: 500 GW of non-fossil fuel capacity by 2030. Investment requirement: Rs 33.6 trillion ($ 384.5 billion) over the next decade. Private investments: The plan encourages domestic and foreign private investments in solar, wind and energy storage projects through policy incentives, Production-Linked Incentive (PLI) schemes, and viability gap funding (VGF).

Public-private partnerships (PPPs): The Indian government promotes PPP models in power transmission and distribution to enhance efficiency and attract capital. India's power distribution comprises Central, state and private entities. The Central government primarily oversees power generation and transmission through entities like State Electricity Boards (SEBs), which manage distribution across states. Some key state-owned companies include: Andhra Pradesh: Andhra Pradesh Southern Power Distribution Company Limited (APSPDCL), Andhra Pradesh Eastern Power Distribution Company Limited. Uttar Pradesh: Madhyanchal Vidyut Vitran Nigam Limited (MVVNL), Paschimanchal Vidyut Vitran Nigam Limited

(PVVNL), Purvanchal Vidyut Vitran Nigam Limited (PuVVNL), Dakshinanchal Vidyut Vitran Nigam Limited (DVVNL). The major private-owned power companies operating in India are: Tata Power Company Limited (Mumbai, Delhi, Odisha), Adani Electricity Mumbai Limited (AEML), BSES Rajdhani Power Limited (BRPL) and BSES Yamuna Power Limited (BYPL) (Delhi).

India's energy security: PLI schemes for India's power sector aim to strengthen domestic manufacturing, reduce import dependence and enhance the country's energy security. These schemes primarily focus on renewable energy, including solar power, battery storage, green hydrogen and wind energy. With an allocation of Rs 181 billion ($ 2.07 billion), this initiative seeks to establish 50 GWh of battery manufacturing capacity, enhance energy storage solutions for renewable integration, and reduce battery imports from countries like China and South Korea.

Green Hydrogen PLI scheme: Launched in 2023 under the National Green Hydrogen Mission, this scheme focuses on promoting the domestic production of green hydrogen and electrolyzers. With a budget allocation of Rs 174.9 billion ($ 2 billion) as part of the larger Rs 197.44 billion ($ 2.25 billion) mission, this scheme aims to produce 5 million tonnes (mmt) of green hydrogen annually by 2030. It will also establish 60-100 GW of electrolyzer manufacturing capacity, accelerating India's hydrogen economy.

As of 2025, India does not have a dedicated PLI scheme exclusively for wind energy. However, domestic manufacturers have shown strong interest in a proposed initiative aimed at supporting the production of offshore wind turbine components. This scheme would encourage the local manufacturing of essential wind energy equipment, such as gearboxes, generators and blades, to strengthen the domestic supply chain. Foreign investment inflows: India has witnessed a steady rise in FDI inflows into its energy sector, with a particular emphasis on non-conventional energy sources. According to the latest data from the Department for Promotion of Industry and Internal Trade (DPIIT), investors are increasingly attracted to renewable energy, driven by policy incentives, global sustainability goals and India's commitment to achieving net-zero emissions.

FDI in the non-conventional energy sector has been increasing at a remarkable pace. The cumulative FDI inflows into this segment reached $ 21.33 billion as of December 2024. This rise underscores investor confidence in India's clean energy transition, supported by favourable government policies such as the PLI scheme for solar manufacturing and foreign investor-friendly regulations. In contrast, FDI in the power sector, which includes conventional electricity generation and distribution, totalled $ 19.68 billion cumulatively. The sector recorded a yearon-year growth of 144 per cent in FY2023-24, with inflows reaching $ 1.7 billion from $ 697.92 million in the previous year. This growth suggests increasing foreign interest in India's power infrastructure, likely driven by modernization efforts, smart grid initiatives and the expansion of transmission networks to integrate renewable energy sources.

The overall trend in FDI inflows indicates a growing global interest in India's energy transition. Notable aspects are increasing financial commitments, investor-friendly policies, and a clear roadmap toward sustainability. Several foreign companies operating in India's power sector are also contributing to renewable energy, thermal power and power distribution. These companies bring advanced technology, expertise and investments, supporting India's energy transition.

Siemens (Germany) - A key player in power transmission, grid automation and renewable energy solutions, the company provides technology for power distribution and smart grids in India. GE Renewable Energy (USA) - A major supplier of wind turbines and hydroelectric equipment, GE supports India's renewable energy goals and works on grid modernization. EDF (France) - The French energy giant is involved in solar and wind power projects and has partnered with NTPC for renewable energy ventures.

Enel Green Power (Italy) - Enel Green Power operates in India's renewable sector, particularly in solar and wind energy projects. Vestas (Denmark) - Vestas, a global wind turbine manufacturer, supplies equipment for India's growing wind energy market. First Solar (USA) - A key player in India's solar energy sector, focusing on manufacturing and deploying high-efficiency solar modules. ReNew Energy Global (backed by Goldman Sachs, Abu Dhabi Investment Authority, and Canada Pension Plan Investment Board) - Although the company is India-based, ReNew has received notable foreign investment and is a major player in wind and solar energy. TotalEnergies (France) - Partnered with Indian company Adani Green Energy for solar and wind projects, TotalEnergies is working towards India's renewable energy expansion. Brookfield Renewable Partners (Canada) - Invests in solar and wind power projects in India, focusing on largescale renewable energy assets. Shell (UK-Netherlands) - Involved in India's energy transition through investments in EV charging, battery storage, and solar energy projects.

India's power sector is on a path of transformation, with increased focus on sustainability, digitalization and decentralization. Key initiatives include smart grids, battery storage and green hydrogen projects. With continued policy support and technological advancements, the country aims to become a global leader in clean energy transition and reliable power supply for the nation's growing energy demands.

Realising the tremendous growth potential for the power sector in the country, several companies have entered the fray and are doing very well. During the last two decades or so, China's power demand increased at a compounded rate of 9.4 per cent and at the same time the GDP compounded at 8.7 per cent. This reflected that power demand in China has grown by 1.1 x GDP. However, India's power demand has grown 0.9 times the real GDP growth in the last three years though the multiples for India averaged 1.2x. According to an expert there is good reason to believe that India's power multiplayer ratio will be a critical indicator of India's economic trajectory in the coming decade. Globally, electrification of automotive energy has been a key driver of power demand. Further, to reduce the share of fossil fuels and meet the zero emission status in 2050, electric mobility needs to rise to 30 per cent by 2030. As per Ola Electric, in India electrification is most evident in the 2-wheeler space, which would see EVs account for 50 per cent of total sales by fiscal year 2028.

But EVs are not the only power guzzlers. Growing urbanisation and rising per capita incomes in India are driving higher household ownership of electrical appliances, like refrigerators, air-conditioners, microwave oven, toaster etc. Then comes manufacturing automation. Factory shop floors in India are undergoing a significant transformation to cope with the requirements of globalisation, shorter product life cycles, changes in market and demand, and rapid technology advances. The size of the industrial automation But EVs are not the only power guzzlers. Growing urbanisation and rising per capita incomes in India are driving higher household ownership of electrical appliances, like refrigerators, air-conditioners, microwave oven, toaster etc. Then comes manufacturing automation. Factory shop floors in India are undergoing a significant transformation to cope with the requirements of globalisation, shorter product life cycles, changes in market and demand, and rapid technology advances. The size of the industrial automation

And then there are data centres. With over 880 million internet users and a thriving technology sector, India's data centre capacity has seen a massive explosion. It is poised to accelerate further with the use of Artificial Intelligence (AI). Global cloud service providers such as Amazon Web Services, Google Cloud and Microsoft Azure have established their presence in India. The demand for power from the data centres has grown at around 5 per cent annually on an average. However, with demand growing exponentially, there could be significant stress on the powergrid. Given the strong power demand outlook and the need to transition to green power, the government has outlined an ambitious capacity growth outlook for the power sector.

As per the National Electricity Plan (NEP) released by CEA in 2023, India's total installed power capacity will rise from 400 GW in 2022 to over 600 GW by 2027. Thermal will account for 39 per cent of this installed capacity, with solar and wind making up 35 and 12 per cent respectively. Further, by the end of fiscal year 2032, total installed capacity is projected to rise to 900 GW, with solar and wind together accounting for 53 per cent of total installed capacity even as thermal's share is expected to fall to 29 per cent.

This indicates a bullish fervour in power stocks, but in reality there are also some critical challenges that could hinder the performance of the power companies. The timely completion of generation and transmission projects is vital for companies to achieve their earning targets. However, generation and transmission companies may face issues related to land acquisition, and project delays can also be a result of supply chain issues and high debt levels for new power plants. Renewal energy projects face the problem of low profitability as in the case of these projects, the tariff is fixed in advanced -- generally up to 25 years. Such projects have their own set of challenges, such as lower-than-expected plant load factor, delays in transmission connectivity, cost overruns or quicker-than-expected decline in efficiency for solar panels/wind turbines. At the same time, competition has risen in power generation and transmission over the years. Given the strong capex outlook, companies across the sector have strong growth plans since competition intention has risen over the years.

So, though there are around 30 good companies which are listed on recognised stock exchanges, investors will have to analyse these stocks from various angles and then select a few for investment. For the convenience of our readers, Corporate India's research wing has selected ten promising power stocks, from which investors can expect steady, attractive returns in a sustained manner. Here goes the list:

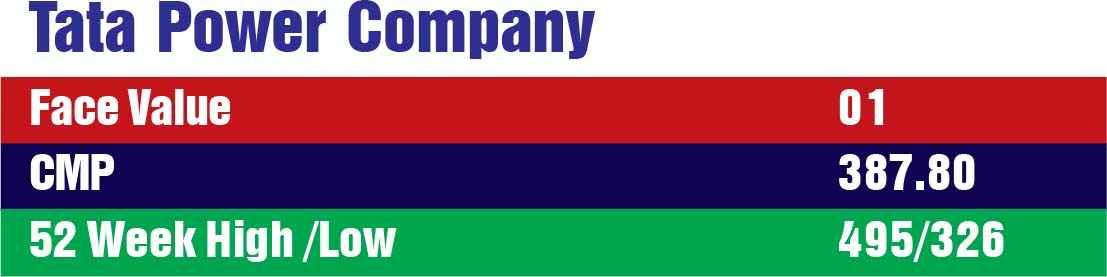

A member of the illustrious industrial house of the Tatas, Tata Power is one of the oldest and largest integrated power companies in the country. Among the best utility stocks operating across the electricity value chain, it specialises in generation, transmission, distribution and renewable energy, with a strong focus on sustainability and innovation. Of late, it is expanding its business in the renewable sector. In fact, it is building one of the best RE (renewable) platforms - a mix of asset-light and asset-heavy businesses. It has built renewable assets of 10 GW, (2) solar manufacturing of 4 GW, (3) solar EPC arm, (4) rooftop solar, (5) two pumped storage systems. It also has the first-mover advantage in the electrical vehicle charging market.

The company has a sizeable 13 per cent marketshare in the solar rooftop market, which is entering a new era of growth with the revamping of policies to give a boost to the segment with higher subsidies and a 40 GW target over the next couple of years. Tata Power will benefit substantially from this opportunity. The company is performing very well on the financial front. During the last 12 years, its sales turnover has expanded from Rs 35,726 crore in fiscal 2014 to Rs 65,478 crore in fiscal 2025, with operating profit almost doubling from Rs 6,916 crore to Rs 12,166 crore and the profit at net level skyrocketing almost 400 times - from Rs 12 crore to Rs 4,775 crore. Prospects for the company going ahead are all the more promising, as the company has set up a 4 GW solar cell and module manufacturing plant. This plan will give a boost to the topline as well as bottomline of the company. What is more, the company has also received PLI worth Rs 2 billion for this project. Shares of the company are being quoted in the range of Rs 385/390. We expect the price to touch the Rs 500 mark within the next 2 to 3 years.

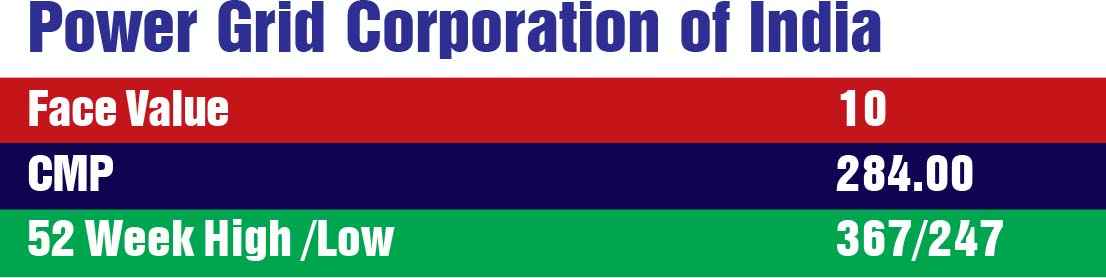

Power Grid Corporation of India is the country's central transmission utility, responsible for operating and maintaining the country's extensive power transmission network. As one of the top power stocks in the transmission segment, Power Grid specialises in facilitating bulk electricity transfers and ensuring grid stability. The company transmits power through its EHVACH VDC transmission network. Of late, the company has diversified into the telecom business by leveraging its pan- India transmission network stringing of the optical ground wire (OPGW) network.

The company has made rapid strides in its financial performance. During the last 12 years, its revenues have trebled from Rs 15,555 crore in fiscal 2014 to Rs 45,792 crore in fiscal 2025, with operating profit more than trebling from Rs 12,967 crore to Rs 39,837 crore and the profit at net level surging three and a half times from Rs 4,548 crore to Rs 5,573 crore. The stock price is placed around Rs 284 (face value Rs 10).

NTPC, India's largest power generation company, specialises in producing electricity through thermal, hydro and renewable energy projects. With a significant contribution to India's energy requirements. NTPC is a major player among power generation stocks, driving the nation's transition towards greener energy. The company has registered steady growth in its financial performance. During the last 12 years, its sales turnover has more than doubled from Rs 78,330 crore in fiscal 2014 to Rs 188,138 crore in fiscal 2025, with operating profit inching up almost three times from Rs 19,727 crore to Rs 54,392 crore and net profit more than doubling from Rs 11,403 crore to Rs 23,953 crore.

Going ahead, the company's prospects are highly en-couraging. It will embark on an expansion plan to raise its capacity to 149 GW by fiscal year 2032, revising its earlier target of 130 GW. This expansion will include investments in pump storage projects, green chemicals and battery energy storage systems (BESS), with a total investment outlay of approximately Rs 7 lakh crore.

NTPC has set an ambitious goal of installing 30 gigawatts of nuclear capacity by 2047, contributing significantly to the nation's 100 gigawatt target. The company is also focusing on renewable energy, aiming to expand its portfolio from 8 gigawatts to 60 gigawatts by 2032. The RBI has allowed NTPC to raise ECBs up to $1 billion to finance its capex requirements. The company has reduced its forced outage from 4.18 to 3.42 per cent in Q1 and to 3.75 per cent in the entire year, compared to 4.03 per cent in the previous year.

Ahmedabad-headquartered Adani Power is a leading Indian private sector power generation company. Among thermal power stocks, Adani Power focuses on thermal power production with plants across the country and is expanding into renewable energy, aligning with India's growing green energy ambitions. The company has made rapid strides on the financial front. During the last 12 years, its sales turnover has expanded over three and a half times from Rs 15,328 crore in fiscal 2014 to Rs 56,203 crore in fiscal 2021, with operating profit surging over five times from Rs 4,543 crore to Rs 21,418 crore and net profit shooting up over 43 times from Rs 291 crore to Rs 12,750 crore. The stock price of the company is quoted around Rs 965. Discerning investors will do well include this stock in their portfolios.

A prominent player in India's power sector, JSW Energy is engaged in thermal and renewable energy generation. The company is focused on building a sustainable energy portfolio, leveraging advanced technologies to meet the nation's growing electricity demand efficiently and responsibly. The company has been growing steadily on the financial front. During the last 12 years, its sales turnover has expanded from Rs 8,648 crore in fiscal 2014 to Rs 11,745 crore in fiscal 2025, with operating profit rising from Rs 3,255 crore to Rs 5,221 crore and the profit at net level more than doubling from Rs 760 crore to Rs 1,983 crore. What is more, prospects for the company going ahead are all the more promising. The new fiscal year (2026) has started on a buoyant note with revenues during Q1FY2026 (April to June 2025) surging to Rs 5,143 crore, reflecting a 79 per cent spurt over Rs 2,879 crore achieved in the corresponding quarter a year ago. While EBITDA shot up 97 per cent to Rs 836 crore, the profit at net level rose 56 per cent to Rs 836 crore.

Going ahead, the company has planned an ambitious capex plan for the current year, involving an amount of Rs 15,000 crore. The capex plan includes expansion of capacities in various sectors such as renewable energy, solar and wind. The company is developing a 20 MW floating solar plant in Karnataka, along with setting up wind blades manufacturing facilities in southern and western India to improve supply chain efficiency. Shares of the company are placed around Rs 520. The price is expected to gradually move up to the Rs 800-900 range within the next 2 to 3 years.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives