Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: December 15, 2025

Updated: December 15, 2025

Based in Bangalore and listed on both NSE and BSE, TruAlt Bioenergy (TruAlt), one of India’s largest and among the fastest-growing biofuels producers, recently announced the signing of an MoU with the Andhra Pradesh Economic Development Board (APEDB) to develop one of the world’s largest sustainable aviation fuel (SAF) production facilities in Andhra Pradesh. The proposed 80,000 tpa facility will be located around the SrikakulamVizianagaram region of the state. The company will invest Rs 2,250 crore to establish an integrated ethanol-to-SAF manufacturing facility.

The company will also leverage its position as India’s largest ethanol producer to secure reliable, high-quality feedstock and drive efficient, large-scale SAF production through the alcohol-to-jet synthetic paraffinic kerosene (ATJ-SPK) pathway, one of the certified and approved routes under the International Civil Aviation Organization (ICAO) framework. In this pathway, any sugar-based feedstock is converted into ethanol, which is then upgraded to aviation-grade jet fuel. By adopting this technology, TruAlt will produce low-emission, internationally certified SAF and enable a scalable, dependable and globally competitive supply chain built on India’s abundant agricultural and bio-based resources.

Speaking on the occasion, Vijaykumar Murugesh Nirani, Managing Director of the company, said, “This MoU marks a defining moment in India’s clean-energy transition and in TruAlt Bioenergy’s journey of innovation and impact. Sustainable aviation fuel is no longer a future possibility, it is an urgent global necessity. By establishing one of the world’s largest ethanol-to-SAF facilities in Andhra Pradesh, we are taking a decisive step towards enabling low-carbon aviation at scale in one of the world’s most hard-to-abate sectors. We support the nation’s netzero ambitions and will contribute to a cleaner, more resilient future for the aviation industry and the world.”

He added, “India has already set a mandate for blending SAF into aviation turbine fuel, and we look forward to playing a vital role in helping the nation achieve this target. As India’s largest ethanol producer, we are uniquely positioned to integrate our feedstock strength with world-class ATJ-SPK technology and build a reliable, futureready SAF ecosystem. We are honoured to partner with the state government in advancing this national and global decarbonisation mandate.”

Another large player exploring this possibility, Triveni Engineering, is hopeful of an SAF policy roll-out before the end of the current fiscal. Primarily, the players want to ensure a guaranteed buyback of the produced biofuel. Indian companies which are producing ethanol on a large scale seem quite excited about entering SAF, especially after it has gained traction in the US, as this could give them better operating margins, apart from opening up a new avenue.

The company operates five distillery units, all located in Karnataka, with a combined installed capacity of 2,000 kilo litres per day (klpd). These plants primarily produce ethanol, extra-neutral alcohol (ENA), and rectified spirit from molasses and syrup based feed stocks. The company is strategically positioned as a diversified player in the biofuels industry, particularly in the ethanol sector. TruAlt is also among the early adopters of Compressed Biogas (CBG) under the Government of India’s SATAT initiative. Through its subsidiary, Leaniti Bioenergy Private Limited, the company operates CBG plants with a capacity of 10.2 tonnes per day that also generate solid and liquid fermented organic manure (FOM) as by-products, supporting circular agriculture and waste-to-energy innovation.

The company holds a 51% stake in Trualt Gas Pvt Ltd, a joint venture with Japan-based Sumitomo Corporation, which holds the balance 49% stake. Under the terms of the JV, TGPL will set up CBG (compressed biomethane gas) plants at five identified locations, of which construction work for three plants has already commenced and which are expected to be commissioned in Q2 of 2027. Eventually, this JV aims to construct 16 CBG production facilities to reach approximately 320 tonnes, equivalent to the daily gas consumption of around 8,00,000 households in India. Its raw material will include sugarcane and ethanol residue from TruAlt and from other suppliers.

In another development, GAIL (India) and TruAlt Bioenergy have formed a strategic joint venture to develop a network of CBG plants across India. GAIL will acquire a 49% equity stake in TruAlt’s subsidiary Leafiniti Bioenergy (LBPL), with TruAlt holding a controlling stake of 51%. The JV plans to establish six new CBG plants, each producing 12 tonnes per day (TPD), primarily using sugar mill by-products. The estimated investment for these new plants exceeds $72 million and will be financed through a combination of debt and equity. The JV agreement is contingent on fulfilling certain conditions and obtaining approval from the Department of Investment and Public Asset Management (DIPAM).

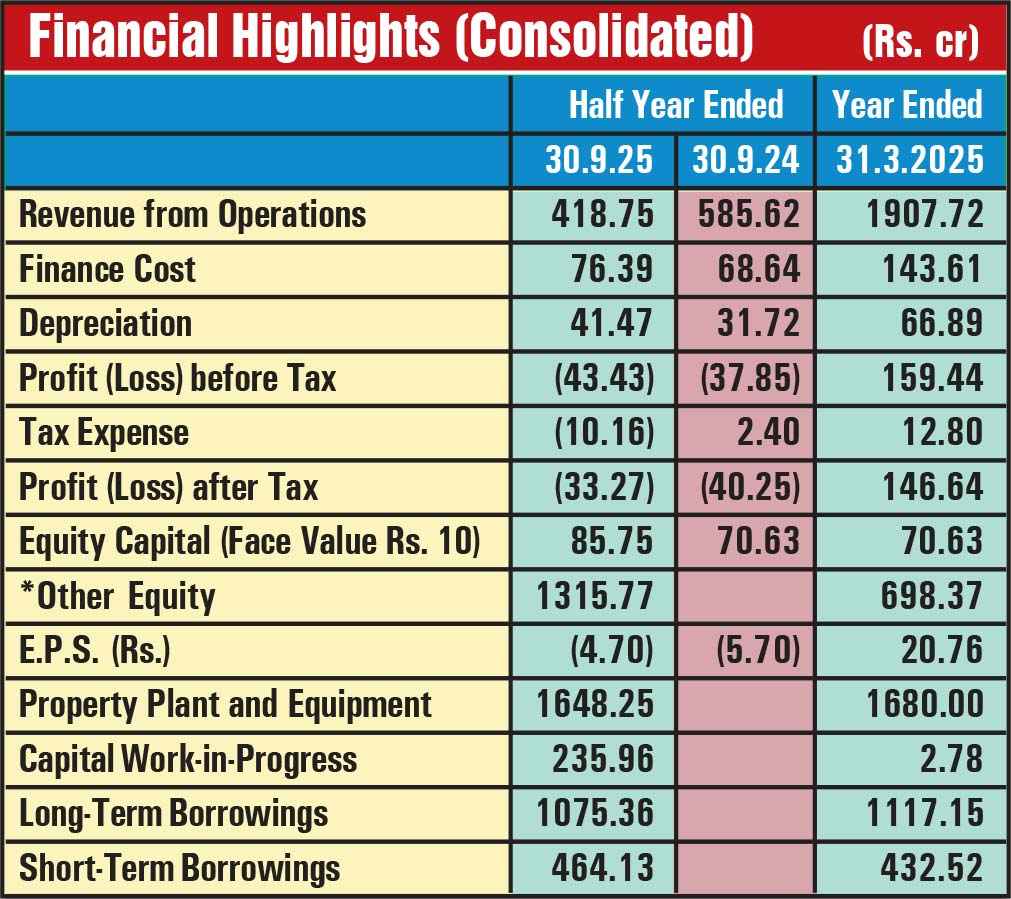

TruAlt had come out with an IPO two months ago with an issue size of Rs 839.28 crore, wherein Rs. 750 crore was the fresh issue to meet its capital expenditure for a multi-feed stock ethanol plant. The shares, with a face value of Rs. 10 each, were issued at Rs 496, and got oversubscribed by 75 times. The stock went up to Rs 549 (3-10-25) and also made a low of Rs 388.45 (9-12-25) before settling down at Rs 404. The equity capital is at Rs 85.75 crore and the book value is Rs 163.40 per share. The current market capitalisation rests at Rs 3,463 crore. During FY25, the company reported sales of Rs 1,908 crore and PAT of Rs 146.64 crore, with RONW of 33.08%. The cash earning per share and net earning per share were Rs 30.23 and Rs 20.76 respectively. The company is owned by the Murugesh Nirani family. Mr Nirani, who is an industrialist-cum-politician and has been Minister of Large and Medium Industries Department in Karnataka, holds a 70.55% equity stake in the company.

During H1FY26 (September 2025), the company reported a net loss of Rs 33.27 crore on net revenue of Rs 418.75 crore, vis-à-vis Rs 40.25 crore and Rs 585.62 crore respectively during the corresponding period in the previous financial year. The ethanol business is historically seasonal, in line with the harvesting of sugarcane, with the April-October period being considered off-season when there is either little or no availability of raw material. Further, during Q2, the company was able to run only Unit 3, as work was in progress for converting the plant into a dual feed plant at Units 1,2 and 4, while Unit 5 could not run because ‘consent to operate’ (CTO) is awaited. Now, Units 1, 2 and 4 have become fully operational since the beginning of October 2025 and will continue at full capacity.

The company holds a promising future and the promoter group is fully committed with a proven track record. However, the IPO priced at Rs 496 per share was not only fully priced but overpriced. But it looks like the success of its joint venture with Sumitomo Corporation for compressed biomethane gas, and with GAIL (India) for compressed biogas, and the proposed 80,000 TPA SAF unit in AP could become a game changer for TruAlt as, together with its own large ethanol capacity, the company has the potential to become a big integrated player in the biofuels industry

The next year is likely to be quite good for Indian sugar and ethanol players in general, largely because of an excellent sugarcane crop which would benefit efficient players in improving their overall operating margins, and TruAlt is one of them.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives