Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: December 15, 2025

Updated: December 15, 2025

Inox Wind (IWL), India’s leading wind energy solution provider and a part of the INOXGFL group focusing on chemicals and renewable energy (RE), has reported a strong Q2 performance wherein revenue is up by 56% yoy on a consolidated basis to Rs 1,162 crore, EBITDA up by 48% at Rs 271 crore, PBT up by 93% to Rs 169 crore, PAT up by 43% to Rs 121 crore and cash PAT up by 66% to Rs 220 crore. EPS for the quarter is 70 paise and Rs 1.26 for H1.

The company is a fully integrated player in the wind energy market, with four manufacturing plants spread across Gujarat, Himachal Pradesh and Madhya Pradesh, where it manufactures blades, tubular towers, hubs and nacelles. The new manufacturing plant at Kayangarh, near Ahmedabad, is ramping up operations. Along with 3.3 MW wind turbine generators (WTG), the plant is future-ready for the upcoming 4 MW turbines as well. The company is also setting up a new blade & tower manufacturing unit in Karnataka, its first unit in South India, which is expected to operationalise in 2026.

With its 3 MW series of WTGs, the current manufacturing capacity stands at 2.5 GW per annum, against which its current order book is reported as 3.235 GW, translating into revenue visibility for 18-24 months. During Q2, the order execution increased to 202 MW. In FY26, mid-November, the company had a total order inflow of 400 MW and is targeting a net order book which could meet its execution guidance for the subsequent 18-24 months.

While sharing the financial and operational highlights for the quarter and H1FY26, Kailash Tarachandani, group CEO, Renewable Business, said, “With another robust quarterly performance delivered, a large order book, and multiple strategic initiatives starting to bear fruit, Inox Wind is embarking on its next leg of growth. We are also discussing with multiple customers framework agreements which will provide long-term recurring annual orders to IWL. Further, the upcoming blade and tower manufacturing facility in Karnataka will give us quicker access to large sites across Andhra Pradesh, Tamil Nadu and, of course, in Karnataka itself.”

In its first big move towards establishing renewable energy projects on a partnership basis, IWL has recently signed an exclusive MoU with KP Energy Ltd, a leading balance-of-plant solutions provider in RE, aimed at jointly developing 2.5 GW of wind and wind-solar hybrid power projects across multiple states in India.

Under this arrangement, IWL, along with its subsidiaries, will supply WTGs and associated equipment, provide engineering support, and execute pre-commissioning, commissioning and O&M of WTGs. For its part, KPE will undertake project development activities such as securing connectivity, land and right-of-way, obtaining statutory approvals and execution of balance-of-plant and EPC work. Both companies will be benefited by leveraging their complementary strengths across the RE value chain and will be better equipped to pursue large-scale opportunities and drive operational efficiencies.

Expressing his confidence in the MoU, Dr Faruk G Patel, founder and Managing Director of KPE, said, “KPE is committed to advancing large-scale renewable energy infrastructure, and this partnership with INOX marks a significant strategic step in that direction. We are jointly establishing a robust collaborative platform capable of delivering complex wind and hybrid assets at scale.”

This type of partnership format will be advantageous to IWL as it will push up demand for its WTGs and result in an increase in its capacity utilisation, besides using the services of its subsidiary, Inox Green Energy Services Ltd (IGESL), the only listed pure-play renewable O&M services company, which has a strong portfolio of 12.5 GW of assets, including the investment made to acquire 6.5 GW of operational wind assets of two companies. IGESL is aspiring to become India’s largest renewable O&M company, and IWL holds a 55.93% stake in the firm. Through its other subsidiary, Inox Renewable Solutions, IWL provides EPC services for wind projects and develops common infrastructure, including power evacuation for RE projects.

In its latest earnings conference call, Sanjeev Agarwal, CEO of IWL, pointed out that “hybrid projects are gaining pace to achieve transition to RE. Wind, along with solar, has an important role in hybrid projects. Wind complements solar and Indian conditions make it an important source of power for grid stabilisation as well as higher grid utilisation.

The price arbitrage is also favourable during peak hours compared to merchant power. This makes wind an attractive source.”

He added, “The recently announced reduction in GST for wind components from 12% to 5% is another positive development for the wind sector, including ALMM (approved list of models and manufacturers) for wind and wind turbine components, amendment to CERC (Central Electricity Regulatory Commission) Connectivity and GNA (general network access) regulations for ISTS (inter-state transmission system), and allowing hybridization of existing solar and wind transmission projects, among others. With all building blocks in place, I believe Inox Wind is set to embark on the next leg of growth.”

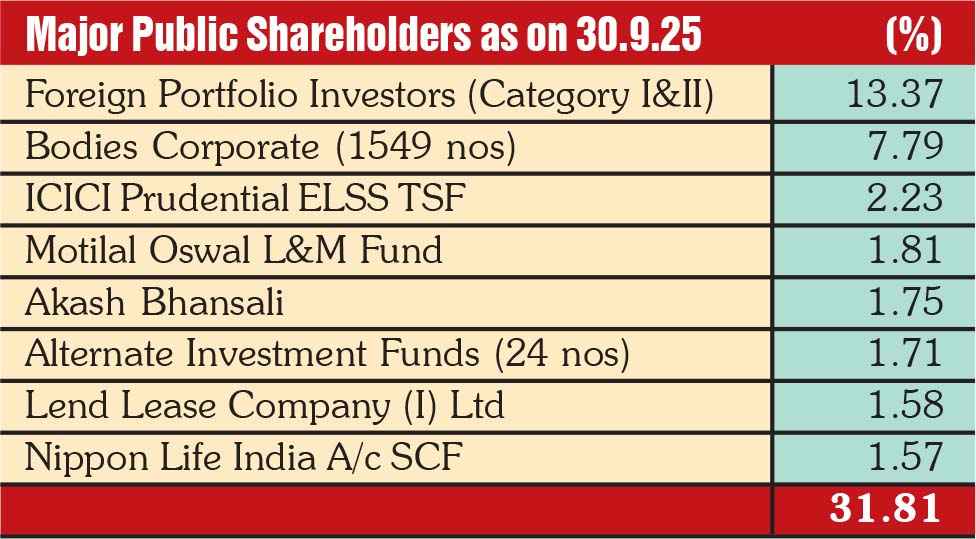

The current equity capital stands at Rs 1,728.24 crore (with the promoter group holding 44.18%) with reserves of Rs 4792.10 crore, translating to a book value of Rs 37.73 per Rs 10 face value. As of September 2025, there is also a pending share warrant conversion of Rs 152.50 crore. Longterm borrowing is almost zero, whereas working capital borrowing is on the higher side at Rs 1,101.56 crore. Trade receivables of Rs 3,271.08 crore is disproportionately high vis-à-vis its H1 sales of Rs 1,945 crore in the current fiscal and Rs 3,557 crore for the full FY25. Capital work-inprogress of Rs 401.75 crore is mainly towards investment being made in the upcoming plant in Karnataka.

At its current yearly low of Rs 124, the stock looks attractive for investment, keeping a minimum period of a year. Its business prospects are bright, considering it is backed by a heavyweight promoter group.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives