Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: February 15, 2025

Updated: February 15, 2025

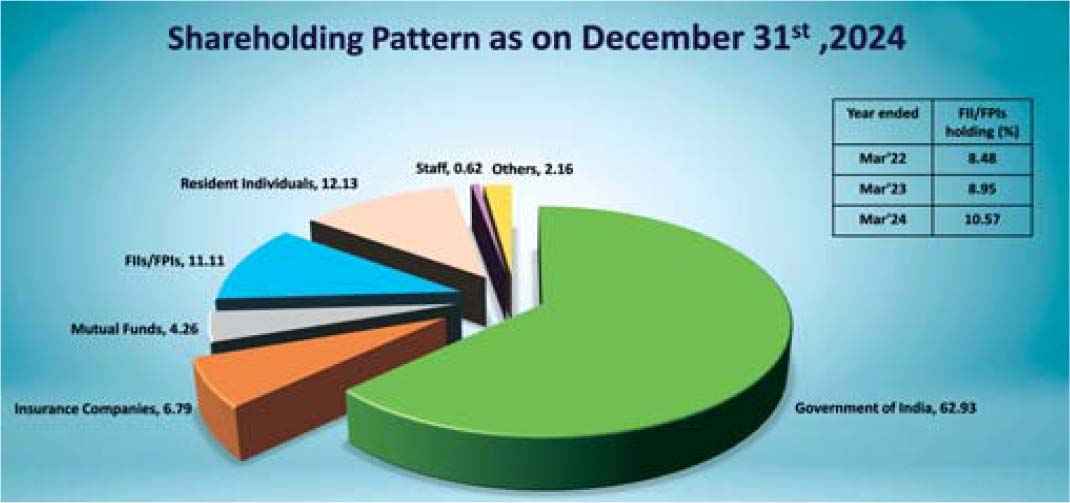

Bangalore-headquartered and the third largest public sector bank in the country, Canara Bank — with 9,816 branches and 12,026 ATMs and recy clers, and spread across all Indian states and Union territories — is on a sound wicket and is poised for impressive growth by charting a firm strategy. As of nine months ended Decem ber 2024, the bank’s global business stood at Rs 24.19 lakh crore, wherein deposits were at Rs 13.69 lakh crore and gross advances at Rs 10.50 lakh crore. Domestic deposits and ad vances stood at Rs 12.57 lakh crore and Rs 9.88 lakh crore respectively.

Interestingly, the retail lending portfolio increased to Rs 2.08 lakh crore (up 35.46% yoy) and the hous ing loan portfolio witnessed a 12.26% growth to Rs 1.03 lakh crore. The net NPA ratio improved to 0.89% as at December 2024, re duced from 0.99% as at September 2024 and 1.32% as at December 2023. The provision coverage ratio is also quite respectable at 91.26% against 90.89% in September 2024 and 89.01% in December 2023. The CRAR (capital to risk weighted assets ratio) at 16.44% indicates the bank’s comfort zone. Similarly, the OPM recov ered and reflected more than a 15.15% yoy growth at Rs7,837 crore whereas net profit grew at 12.25% yoy to Rs 4,104 crore.

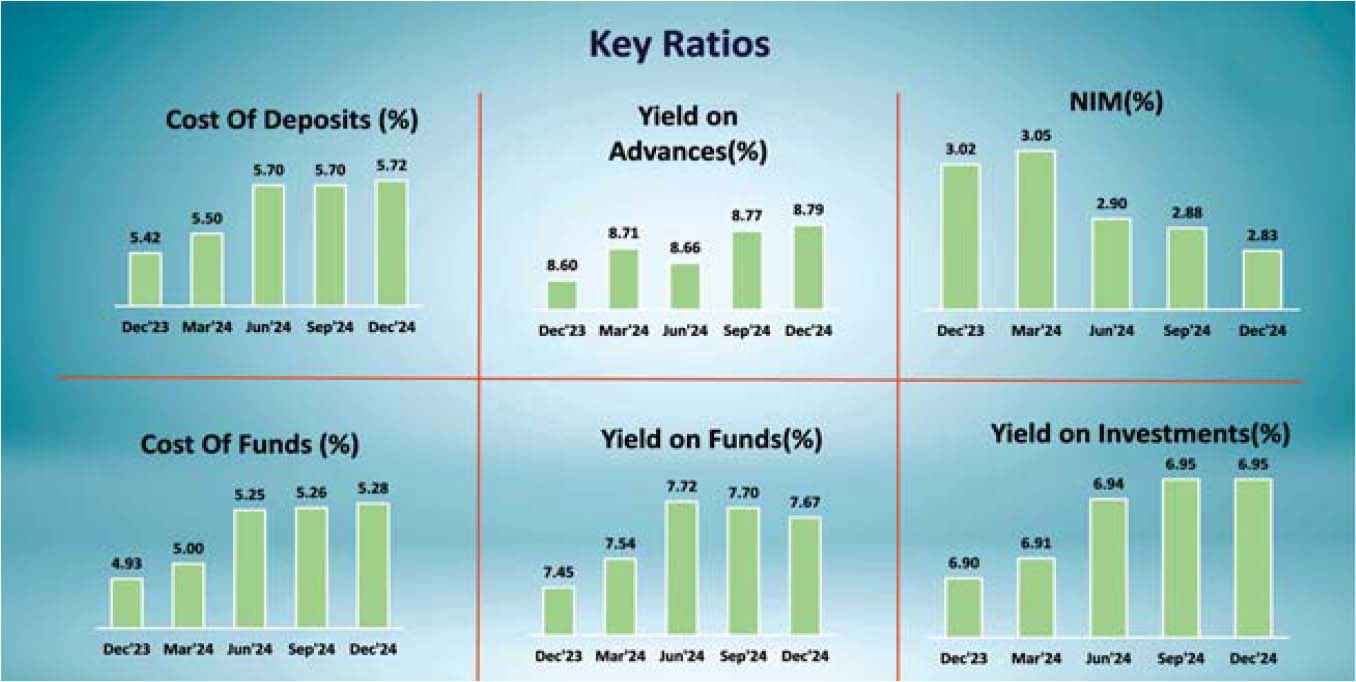

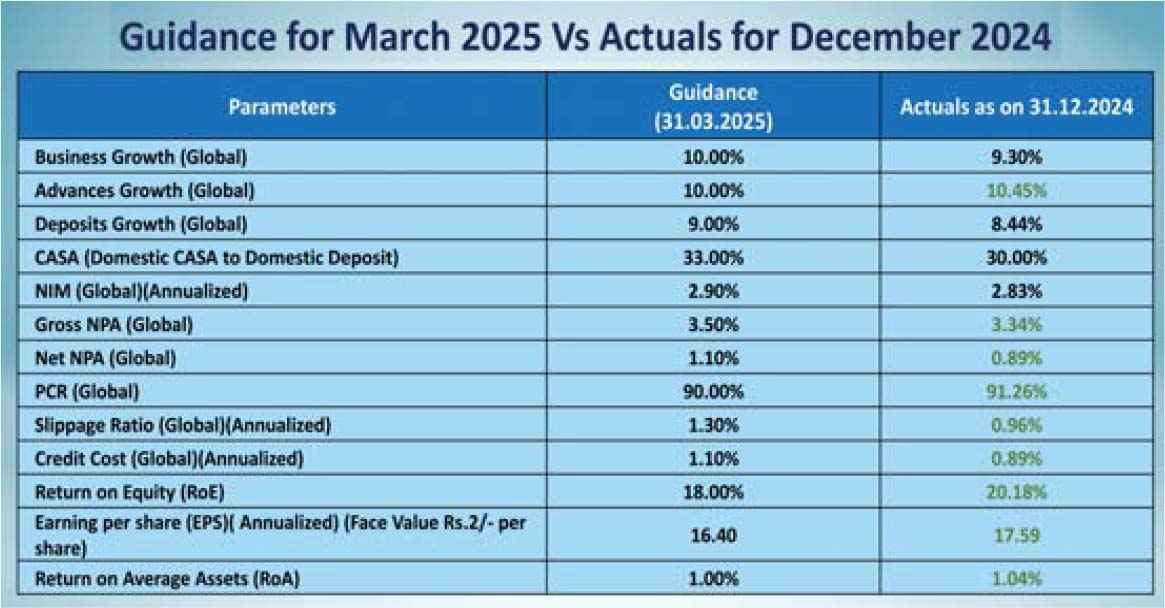

Commenting on the results, K Satyanarayana Raju, MD & CEO, said, “While announcing the last financial year results, we had given a guidance in 13 parameters to investors. Out of these, we have already surpassed 9 parameters or have achieved in line with the given guidance meant for the full year; i.e., till March 2025. In other words, we are 3 months ahead. These parameters are advances growth, gross NPA, net NPA, PCR, slippage ratio, credit cost, return on equity, earn ings per share, and return on average assets.

Mr Raju added, “In 4 parameters, viz., business growth, deposit growth, CASA and NIM, I want to share that though growth is steady, we are facing a constraint as the market has a liquidity problem. We can garner term deposits, it’s not a big issue for the bank, and it’s not even a concern, but the only thing is that we have to raise the interest rate in the ongoing interest war, which could become a costly affair for us. That is why in the last quarter, when we had 8% of excess SLR, we depended on a window available with the RBI by pledg ing our excess SLR and raised it around Rs 40,000-45,000 crore instead of gar nering high-cost term deposits.”

Explaining its benefit, Mr. Raju said, “As we could raise it at around 6.5% only, we have reflected a better performance in the bottomline and because of this, we have shown a deposit growth of 8.4%.” On the growth of 23.31% achieved in fee- based income, Mr Raju said, “Earlier it was stagnant but as of now we are focusing on non-fund based business, and it has started giving us good results. In fact, we have centralised this particular division. Here, we have also started cash management and collection centres. It has helped us in giving Rs 100 crore.” Clarifying on deposits growth, Mr Raju said, “It’s not that we are focusing only on CASA, we are even interested in retail term deposits. However, in the Sep tember quarter, it had muted growth and in Q3 we have grown at least by Rs 5,000 crore, which has put us at Rs 15,000 crore in absolute numbers. We aim to grow in retail deposits as well as CASA. However, the bank is focusing on the cost of mobilization rather than deposits.”

CASA deposits mobilisation is becom ing a challenge for the banking sector in general. To address this issue, the bank has started opening new branches in different geographies across the country. Explaining the bank’s rationale in this regard, Mr Raju said, “Every year, we want to open 250 300 new branches. These new branches will have CASA deposit mobilisation po tential and will be located in places where we have a relatively smaller presence. Hence, we are opening more new branches in northern and eastern India compared to the southern region.”

“Last year, we opened 211 branches. This year, we have opened 180 and our target is to reach 250 branches by year-end. This exercise will continue for 2-3 years, and once these thousand branches become fully operational, it will definitely create a mark,” sum ups Mr Raju. The bank has revised downwards its target for CASA and NIM for the current fiscal 2025. CASA has been re duced from 33% to 31% and NIM from 2.90% to 2.8-2.83%. The bank is faring well on recovering written-off ac counts. In the third quarter, the bank recovered around Rs 2,000 crore. Mr Raju said, “This quarter (Q4) also, we are expecting to recover Rs 2,000 crore and are confident of continuing this momentum for the next two years as well.

We have around Rs 68,000 crore outstand ing on written-off accounts.” Canara Bank has already proposed a divestment to monetise its two subsidiaries — Canara Roboco Asset Management Company (51%) and Canara HSBC Life In surance Company (51%). The bank has re ceived all the required regulatory approv als in this regard. Mr Raju said, “We have communicated to the respective boards of these two companies. They have created sub-board committees for close monitor ing with regard to their IPOs, and have also appointed merchant bankers. We are expecting both IPOs in FY 2026.

Can Fin Homes, a NSE-BSE listed housing finance com pany, is promoted by Canara Bank, which holds 29.99% as its promoter. The company is doing extremely well and has ambitious growth plans. At the current market price of Rs 664, the bank’s stake is valued at Rs 2,650 crore. However, Mr Raju said, “We are watching the market. If we get enough pricing, we may think of coming out of it especially when ever the share price crosses four digits (Rs 1,000).” At the management’s desired price level, it could fetch Rs 4,000 crore. “As per RBI guidelines, a common activity between the parent and subsidiary should be discontinued, but as such there are no stipulated timelines by the regulator,” adds Mr Raju.

Though Canara Bank is desirous of selling its 29.99% holding in its housing finance arm, it is not in a hurry, Mr Raju explained “We feel that certain business initiatives that we have taken with the help of the Can Fin Homes board and top management, will start yielding results in one or two years. We want to wait till then to get the real value of our investment, when we may also think of a strategic sale as well.”

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives