Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: February 15, 2025

Updated: February 15, 2025

THE Union budget for the forthcoming fiscal 2025-26 may have grabbed eyeballs for the sub stantial increase in tax-free income granted to the aam aadmi, but on the other hand the pace of na tional infrastructure development has been sacri ficed at the altar of political expediency by funnelling huge funds to Bihar – the latter’s head honcho Nitish Kumar is crucial to the longevity of the Narendra Modi-led NDA government.

AT a time when the Indian economy is clearly in slow motion, Finance Minister Nirmala Sitharaman has proposed no big-ticket provisions to revive the economy or incentivise private sector investment.

Neither has she signalled any substantive divest ment of the government’s humongous holdings of Rs 30 lakh crore. India Inc too is in a despondent mood, with little indication of big capex outlays apart from the likes of the Adanis and Tatas.

On the face of it, the ‘Viksit Bharat’ road map seems to be on track with its emphasis on zero poverty, high-quality school education and healthcare, and meaningful employment for all.

The Union budget for fiscal 2025-26, presented by Finance Minister Nirmala Sitharaman on Saturday, April 1, is manifestly targeted at the forthcoming assembly elections in Delhi and Bihar. At a time when the Indian economy has stalled with the GDP moving down from 8.2 per cent in fiscal 2023-24 to around 6 per cent in the first half of the current fiscal 2024-25 (and to a projection for the whole fiscal of 6.4 per cent), the budget has not paid any noteworthy attention to re viving the economy. India Inc’s lament is that apart from influencing voters in Delhi and Bihar, the budget does not offer anything extraordinary and the whole fiscal exercise of Ms Sitharaman will do little to boost private sector in vestment.

While Bihar has received a capex largesse so that Nitish Kumar is appeased, remains with the ruling NDA and does not pull the PM’s chair from under Narendra Modi, the question begs an answer: where will the funds for national infrastructure projects come from? As is known, government debt is as high as Rs 177 lakh crore, with the debt-to-GDP ratio reaching around 58.30 per cent in the current fiscal year. The interest outflow is also at a very high level of Rs 12.86 lakh crore, accounting for 81 per cent of the fiscal deficit.

While the government holds physical assets worth Rs 8.78 lakh crore and financial assets worth Rs 21.67 lakh crore, the budget has set a disinvestment target of a rela tive pittance — only Rs 47,000 crore.

Again, there is a sizeable amount of Rs. 31.10 lakh crore in tax dues, including Rs 15.71 lakh crore that is not disputed. Finally, the government’s reliance on domestic savings to finance the fiscal deficit is obviously crowding out resources for the private sector and hence won’t en courage private companies to invest. In fact, the Economic Survey, presented a day before the budget, highlighted the lack of private sector investment in new projects. Bar ring the Adanis, the Tatas and the Sajjan Jindal groups, no other industry group has chalked out any capex programme.

In other words, in its haste to win over voters in Delhi and Bihar, the Modi government may even have slowed down the pace of its much-touted objective of ‘Viksit Bharat’.

Quoting Telugu poet and playwright Gurajada Appa Rao’s famous saying, ‘A country is not just its soil — a coun try is its people’, the Finance Minister presented the Union budget 2025-26 with the theme ‘Sabka Vikas’ symbolizing the balanced growth of all regions.

In line with this theme, the Finance Minister outlined the broad principles of ‘Viksit Bharat’ as encompassing the following: a) Zero poverty, b) Hundred per cent good-quality school education, c) Access to high-quality, affordable and comprehen sive healthcare, d) Hundred per cent skilled labour with meaningful employment, e) Seventy per cent women in economic activities, f) Farmers making our country the ‘food basket of the world’.

The budget promises to continue government efforts to accelerate growth, secure inclusive development, invigo rate private sector investments, uplift household sentiments, and enhance the spending power of India’s rising middle class. It proposes development measures focused on the poor (Garib), youth, farmers (Annadata) and women (Nari).

It aims to initiate transformative reforms in taxation, the power sector, urban development, mining, the financial sec tor and regulatory measures to augment India’s growth po tential and global competitiveness. The budget focused on four major engines — agricul ture, micro, small and medium enterprises (MSME), invest ments, and exports. The biggest highlight of the exercise, however, was the relief extended to middle-class taxpayers. According to the Finance Minister’s proposals, no income tax will be levied on income up to Rs 12 lakh in the new regime. The slab rates have also been changed under the new regime.

As Ms Sitharaman elaborated in her speech, taxpayers in the new regime with an income of Rs 12 lakh will get a benefit of Rs 80,000. People in higher slabs will also ben efit. The benefit for a taxpayer with an income of Rs 25 lakh, for example, will be Rs 1,10,000. The government, as a result, will forgo revenue worth Rs 1 trillion. The impact of these announcements was visible in the stock market, with increased investor interest in consumer facing companies. Shares of Maruti Suzuki, for example, went up by about 5 per cent in trade on a day when the benchmark index, BSE Sensex, remained flat. Further, to increase the ease of paying taxes and simplify the tax law, the government will introduce a new income-tax bill.

The relief to the middle class was extended without compromising on fiscal prudence. The fiscal deficit for the ongoing year is pegged at 4.8 per cent of GDP compared to the budget estimate of 4.9 per cent of GDP. The fiscal deficit for the next financial year is projected at 4.4 per cent of GDP. Assuming the government attains the target, it will fulfil the promise made in the 2021-22 budget. Ms Sitharaman had then said that the government intends to bring down the fiscal deficit to a level below 4.5 per cent of GDP by 2025 26. The fiscal deficit in 2020-21 had increased to 9.2 per cent of GDP because of the pandemic-related disruption.

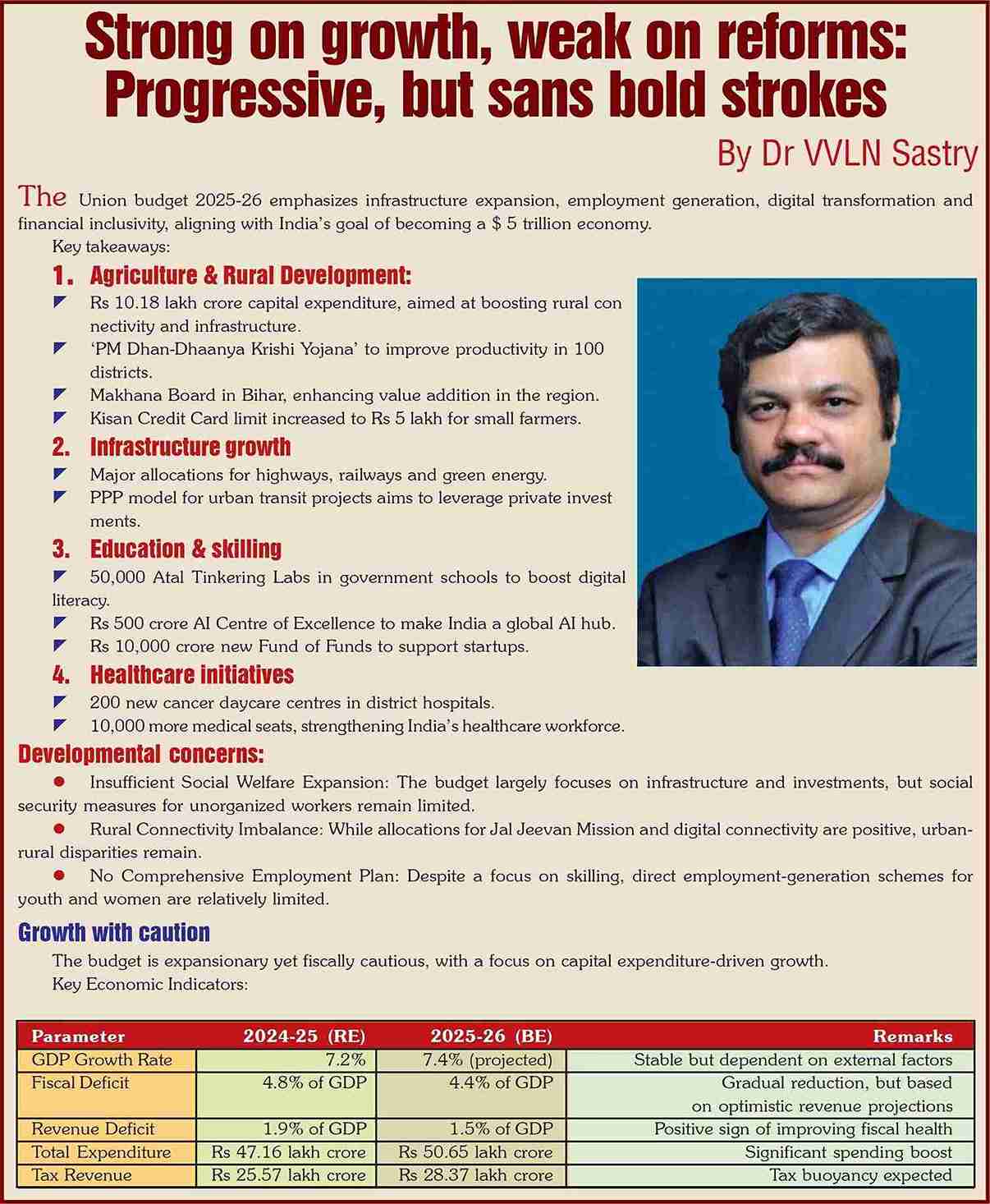

Among other important announcements, in agricul ture, for example, the budget proposed a new programme called ‘Prime Minister Dhan-Dhaanya Krishi Yojana’. In part nership with state governments, the programme will cover 100 districts with low productivity. The aim is to increase productivity, promote crop diversification, and enhance post harvest storage. The programme, which is expected to ben efit 17 million farmers, will also facilitate long- and short term credit. Further, the government will launch a six-year plan to increase pulses production. Central agencies will procure three pulses (tur, urad and masoor) over the next four years from farmers. The proposals are aimed at increasing pro duction and productivity so as to not only augment rural incomes but also contain prices. Food prices have been driv ing the headline inflation rate in recent times, complicating policy choices for the Reserve Bank of India.

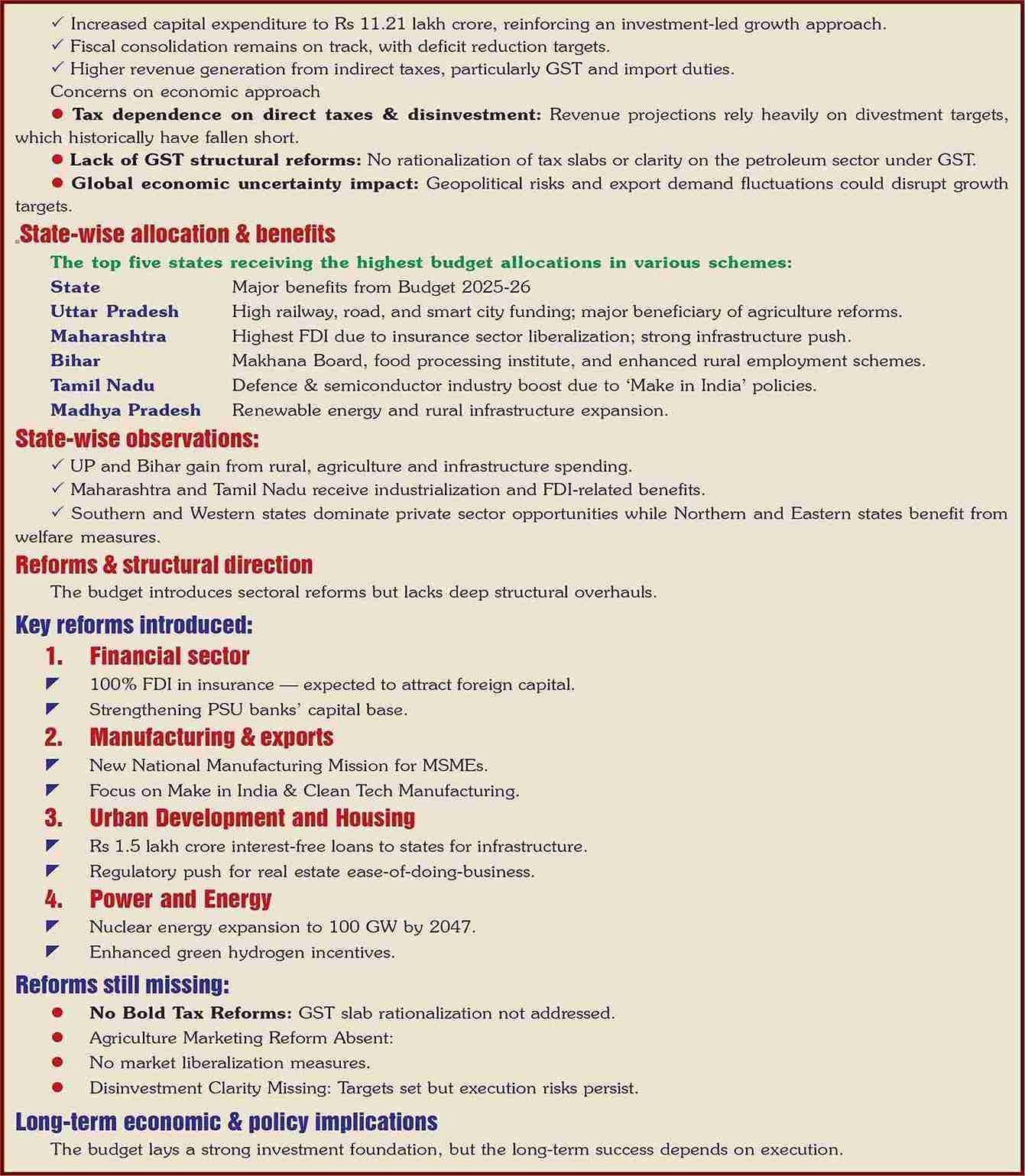

To boost the MSME sector, which contributes 36 per cent to manufacturing, the budget has proposed to increase the limit for classification to help them increase scale and attain efficiency. Customised credit cards will also be issued to micro-enterprises registered on the Udyam portal, with a limit of Rs 5 lakh. This is aimed at improving the availability of operational credit for small enterprises. A new scheme will be launched for women entrepreneurs. To take the ‘Make in India’ programme forward, the budget proposed setting up of a National Manufacturing Mission, which will cover small, medium and large enterprises.

In terms of investment, while the capital expenditure allocation has been pegged at Rs 11.21 trillion, an increase of about 10 per cent from the revised estimates, there is a renewed stress on public-private partnership (PPP). All in frastructure-related ministries will be expected to come up with a three-year pipeline of projects to be implemented through this mode. The ‘PM Gati Shakti’ portal data will also be provided to the private sector to assist in this effort.

Defining reforms as the fuel to the engine of the economy, Ms Sitharaman said that over the past 10 years, the government had implemented several reforms for the convenience of tax payers, such as faceless assessment, tax payer’s charter, faster returns, almost 99 per cent of returns being self-assessment, and the ‘Vivad se Vishwas’ scheme. Continuing with these efforts, she reaffirmed the commit ment of the tax department to ‘trust first, scrutinize later’.

Continuing with the commitment of the government towards ‘Ease of Doing Business’, the Finance Minister pro posed changes across the length and breadth of the financial landscape in India to ease compliance, expand services, build a strong regulatory environment, promote interna tional and domestic investment, and decriminalize archaic legal provisions.

She proposed to raise the Foreign Direct Investment (FDI) limit for the insurance sector from 74 to 100 per cent, to be available for those companies that invest the entire premium in India.

Reiterating the government’s commitment to stay ing the course of fiscal consolidation, the Finance Min ister stated that the government endeavours to keep the fiscal deficit each year such that government debt re mains on a declining path as a percentage of the GDP, adding that the detailed roadmap for the next 6 years has been detailed in the FRBM statement. Ms Sitharaman stated that the Revised Estimate 2024-25 of the fiscal deficit is 4.8 per cent of GDP, while the Budget Estimate 2025-26 is at 4.4 per cent of GDP.

She said that the Revised Estimate of the total receipts other than borrowings is Rs 31.47 lakh crore, of which the net tax receipts are Rs 25.57 lakh crore. She added that the Revised Estimate of the total expenditure is Rs 47.16 lakh crore, of which capital expenditure is about Rs 10.18 lakh crore. For FY 2025-26, the Finance Minister stated that total receipts, other than borrowings, and total expenditure are estimated at Rs 34.96 lakh crore and Rs 50.65 lakh crore respectively. The net tax receipts are estimated at Rs 28.37 lakh crore.

To rationalize TDS/TCS, the budget has doubled the limit for tax deduction on interest earned by senior citizens from the present Rs 50,000 to Rs 1 lakh. Fur ther, the TDS threshold on rent has been increased to Rs 6 Lakh from Rs 2.4 Lakh per annum. Other measures include increasing the threshold to collect TCS to Rs 10 lakh and continuing with higher TDS deductions only in non-PAN cases. After the decriminalization of delay in payment of TDS, delay in TCS payments has now been decriminalized.

Encouraging voluntary compliance, the budget has ex tended the time limit to file updated returns for any assess ment year from the current limit of two years to four years. Over 90 lakh taxpayers have paid additional tax to update their income. Small charitable trusts/institutions have been given the benefit by increasing their period of registration from 5 to 10 years, reducing the compliance burden. Fur ther, tax payers can now claim the annual value of two self occupied properties as nil, without any condition. The pre vious budget’s ‘Vivad Se Vishwas’ scheme has received a great response, with nearly 33,000 tax payers having availed the scheme to settle their disputes. Giving benefits to senior and very senior citizens, withdrawals made from National Savings Scheme Accounts on or after August 29, 2024 have been exempted. NPS Vatsalya accounts also get similar benefits.

For ease of doing business, the budget has introduced a scheme for determining the arm’s length price of interna tional transactions for a block period of three years. This is in line with global best practices. Further, self-harbour rules are being expanded to provide certainty in international taxation.

To promote employment and investment, a presump tive taxation regime is envisaged for non-residents who pro vide services to a resident company that is establishing or operating an electronics manufacturing facility. Further, the benefits of the existing tonnage tax scheme are proposed to be extended to inland vessels. To promote the start-up eco system, the period of incorporation has been extended for a period of 5 years. To promote investment in the infrastruc ture sector, the budget extends the date of making invest ments in Sovereign Wealth Funds and Pension Funds by five more years, to March 31, 2030.

As part of rationalization of customs tariffs of industrial goods, the budget proposes to: (i) remove seven tariffs; (ii) apply appropriate cess to maintain effective duty incidence, and (iii) levy not more than one cess or surcharge. As relief on import of drugs/medicines, 36 lifesaving drugs and medicines for treating cancer, rare diseases and chronic diseases have been fully exempted from Basic Cus toms Duty (BCD). Further, 37 medicines along with 13 new drugs and medicines under Patient Assistance Programmes have been exempted from Basic Customs Duty (BCD), if supplied free to patients.

To support domestic manufacturing and value addi tion, BCD on 25 critical minerals, that were not domestically available, was removed in July 2024. The budget 2025-26 fully exempts cobalt powder and waste, scrap of lithium-ion battery, lead, zinc and 12 more critical minerals. To promote domestic textile production, two more types of shuttle-less looms have been added to fully exempted textile machin ery. Further, BCD on knitted fabrics covering nine tariff lines from 10 to 20 per cent is revised to 20 per cent or Rs 115 kg, whichever is higher.

To rectify inverted duty structure and promote ‘Make in India’, BCD on Interactive Flat Panel Display (IFPD) has been increased to 20 per cent and on Open Cells reduced to 5 per cent. Further, to promote manufacture of Open Cells, BCD on parts of Open Cells stands ex empted. To boost manufacturing of lithium-ion batteries in the country, 35 additional capital goods for EV battery manu facturing, and 28 additional capital goods for mobile phone battery manufacturing, are added to the list of exempted capital goods. The budget also continues the exemption on BCD on raw materials, components, consumables or parts for ship-building for another ten years. It also reduces BCD from 20 per cent to 10 per cent on Carrier Grade ethernet switches to make it at par with Non-Carrier Grade ethernet switches.

For export promotion, the budget facilitates exports of handicrafts, fully exempts BCD on Wet Blue leather for value addition and employment, reduces BCD from 30 per cent to 5 per cent on Frozen Fish Paste and reduces BCD from 15 per cent to 5 per cent on fish hydrolysate for manufacture of fish and shrimp feed.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives