Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: February 15, 2025

Updated: February 15, 2025

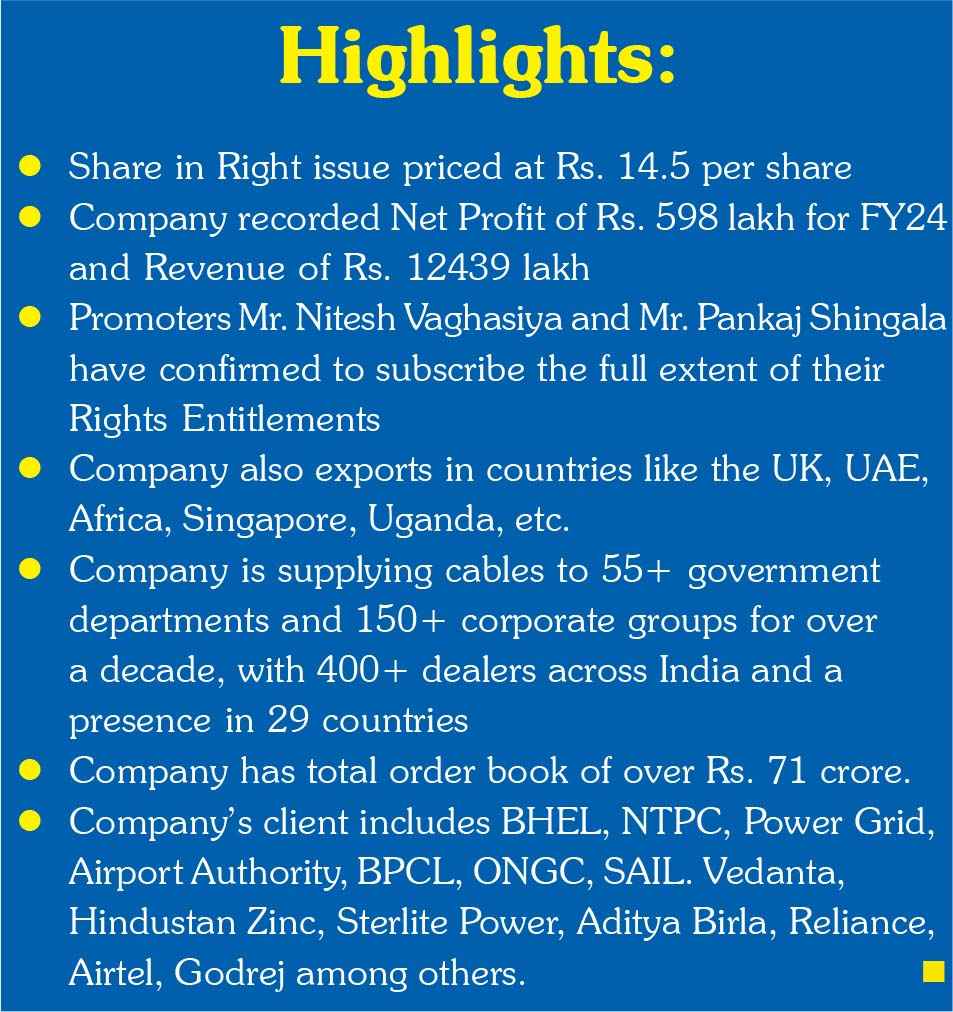

Rs.4981 lakh Right Issue of Ultracab (India) Ltd (BSE 538706) engaged in the manufacturing and exporter of elec tric wires and cable opened for subscription from January 28, 2025. Right issue of the company are attractively priced at a Rs.14.5 per share and will close on February 11, 2025.

Investors may also buy Ultracab (India) Ltd Rights En titlements (BSE Symbol: 750951) from BSE to participate / subscribe in the company’s right issue. The last date for On market Renunciation of Rights Entitlements is till 5 February 2025. The Rights entitlement ratio for the issue is fixed at 9:25 (9 Rights equity shares for every 25 equity share held by shareholders on the record date – January 16, 2025). The Company will issue 3.43 crore fully paid-up Equity Shares at a price of face value of Rs. 2 each. .

For the FY24 ended March 2024, Net profit of the com pany increased to Rs. 598 lakh as compared to the net profit of Rs. 582 lakh in the corresponding period last year. Rev enue of the company during FY24 was reported at Rs. 12439 lakh as compared to the revenue of Rs. 10767 lakh in FY23. The funds raised through the right issue will be utilized for the pre-payment / repayment of Loan, For augmenting the working capital requirements of the Company, and for General Corporate Purposes.

Mr. Nitesh Vaghasiya, Chairman & Managing Director, Ultracab (India) Ltd said, “Our Rights Issue reflects our com mitment to responsible growth, financial resilience, and sustainability. By empowering existing shareholders to ex pand their stake, we honor their trust and loyalty while se curing vital funds for strategic expansion and acquisitions that align with our vision for sustainable and environmen tally responsible growth. These milestones reaffirm our dedi cation to quality, innovation, and a customer-first approach. Looking ahead, we will build on this momentum by priori tizing sustainability, digital transformation, and targeted prod uct and market expansions. Our focus remains on creating long-term stakeholder value and driving sustained growth.”

Founded in 2007, Ultracab (India) Ltd is a Gujarat based manufacturer and exporter of high-quality electric wires and cables, serving domestic, industrial, solar, and elevator applications. Renowned for reliability, the company leverages advanced technology and rigorous quality con trol to ensure superior products. Company is supplying cables to 55+ government departments and 150+ corpo rate groups for over a decade, with 400+ dealers across India and a presence in 29 countries. Company has total order book of over Rs. 71 crore.

Promoters Mr. Nitesh Vaghasiya and Mr. Pankaj Shingala have confirmed to subscribe the full extent of their Rights Entitlements and have also confirmed that they shall not re nounce the Rights Entitlements. The other promoters and members of the promoter group have agreed to renounce their entitlement in favour of Mr. Nitesh Vaghasiya & Mr. Pankaj Shingala for 33,65,192 Shares. Therefore, Total Promoter Right Entitlement 95,82,881 Shares will be subscribed.

Company offers wide product portfolio of 6000 plus products including domestic cables (house wires, PVC/XLPE power cables), international cables (auto cables, welding cables), and specialized cables (super flat, elevator, and solar cables). With a state-of-the-art manufacturing facility in Shapar (Rajkot, Gujarat), Ultracab remains committed to excellence and innovation in the cable industry. Company’s products are sold not only in India but also in countries like the UK, UAE, Africa, Singapore, Uganda, etc. Company’s government clientele includes BHEL, NTPC, Power Grid, Airport Author ity, BPCL, ONGC, SAIL. Its corporate client includes the likes of Vedanta, Hindustan Zinc, Sterlite Power, Aditya Birla, Reli ance, Airtel, Godrej among others.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives