Fortune Scrip

Published: February 28, 2025

Updated: February 28, 2025

Granules India Ltd

Leading Player In

Integrated Pharma Spac

This time, we have picked Granules India, a Hyderabad-headquartered, vertically integrated

high-growth pharmaceutical company, as the Fortune Scrip for the fortnight.

The company offers the entire value chain in the manufacturing of active pharmaceutical ingre

dients (API), pharmaceutical formulation ingredients (PFI) with finished dosages (FD), and a great

product mix of paracetamol, ibuprofen, metformin, methocarbamol and guaifenesin.

Founded in 1984 as an API manufacturer, the company has made rapid strides and has

emerged as a leading integrated manufacturer of pharmaceuticals. It operates 7 manufacturing

units, of which six are in India under the name of Granules India and one in the US under the name

Granule Pharmaceuticals Inc. The company has emerged as a global pharma entity with a presence

in 80+ countries and 300+ customers.

A-Z OF APIs

Its APIs are used in various therapeutic categories and include anti-retrovirals, anti-hypertensives, anti-histamines, anti-infectives, anti-gesics, anti-coagulants, anti-fibrotics and inhibitors. It also of

fers various F&Ds such as tablets, caplets and press-fit capsules in bulk blister packs and bottles,

and speciality oncology products.

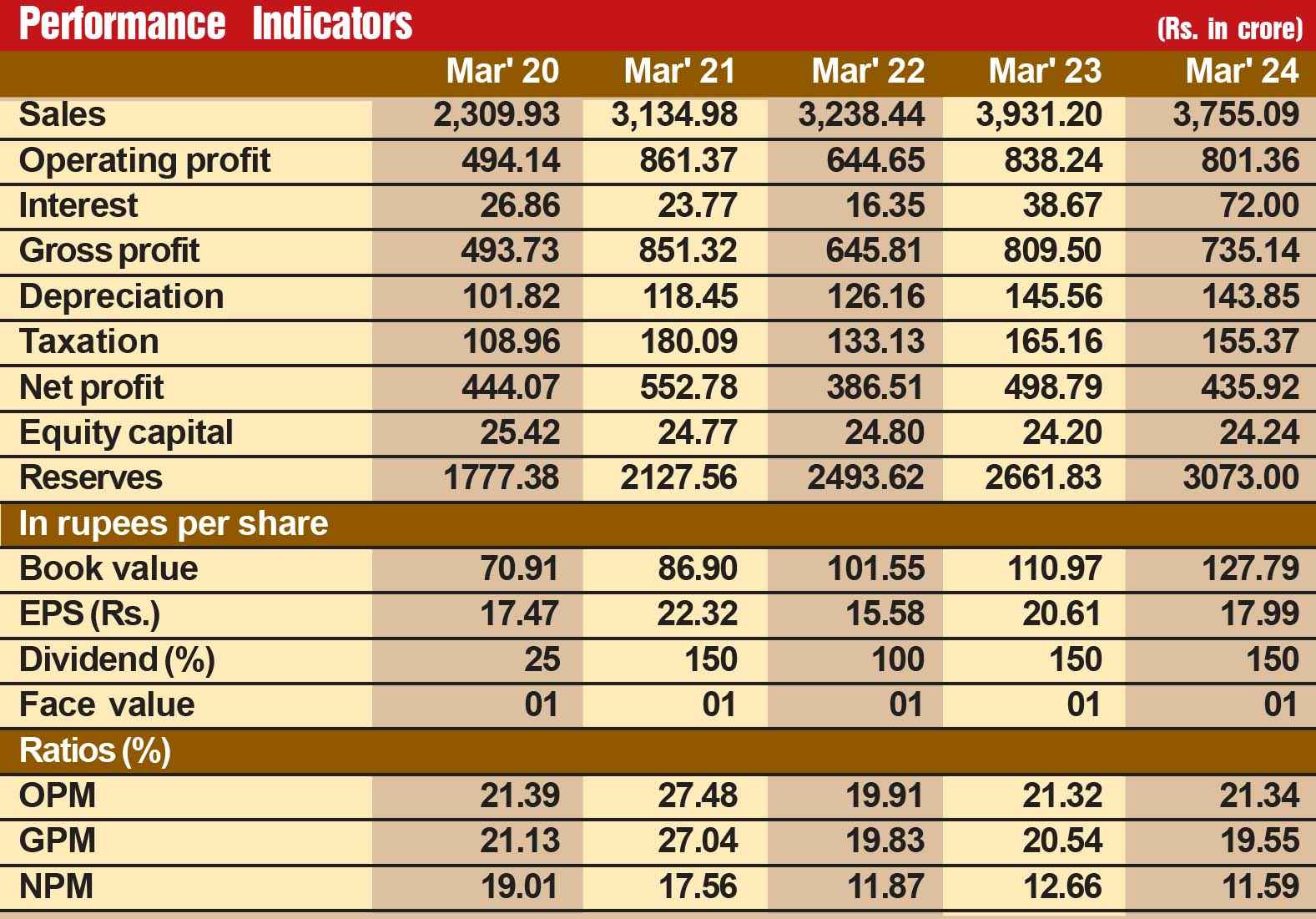

Granules has made rapid strides in its performance. During the last 14 years, its sales turnover has

expanded almost 10 times from Rs 455 crore in fiscal 2011 to Rs 4,506 crore in fiscal 2024, with operating

profit shooting up 15 times from Rs 57 crore to Rs 858 crore and the profit at net level surging ahead 99

times from Rs 21 crore to Rs 405 crore. Its financial position is extremely strong, with reserves at the end of

March 2024 standing over 142 times to Rs. 3403 crore against the equity capital of Rs. 24 crore.

But we have not picked up Granules as the Fortune Scrip on account of its past laurels. We are

confident that its future prospects are all the more promising. Consider:

- Granules has emerged as a key player in the global pharma space, evolving from an API

manufacturer to a fully integrated pharma entity with strong finished dosage capacities and a strate

gic focus on innovation, sustainability and global expansion. The company has achieved significant

milestones in recent years, including a growing presence in ‘regulated masses’, a diversified product

portfolio and advancements in green manufacturing practices. In short, a solid base has been

established which can lead to rapid growth going ahead. The company management acknowledges

that robust finished dosage capabilities have been a key driver of the company’s remarkable suc

cess. The increasing contribution of finished dosages, which now account for 76 per cent of the

company’s revenues, and its strengthened presence in North America where revenue share has

grown to 77 per cent from 66 per cent a year ago, reflect this evolution.

NEW SEGMENTS

- Granules has gone for strategic portfolio diversification and has expanded into high-value

segments such as oncology, CNS/ADHD and anti-diabetic. This will lead to further growth going

ahead.

- Regulatory compliance has raised the stature of the company. Successful inspections by

USFDA, ANVISA, Health Canada and PMDA Japan have not only enhanced the company’s market

access in these critical regions but also significantly improved its brand reputation and instilled

greater confidence among its customers.

- The company has increased its R&D investment. At Rs 1,986 million (4.4 per cent of

revenues), its focus is on developing complex generics and geographic diversification to boost the

topline and bottomline continuously. While North America is its primary market, it is expanding in

Europe, Canada and emerging markets. In the last year, it secured multiple regulatory approvals

seven from USFDA, three in Europe, three in South Africa and one in Europe. At the same time, the

company is continuously expanding its product portfolio. With 69 approved ANDAs (38 under

Granules India and 31 under Granules Pharmaceuticals), it has strengthened its presence in high

value therapeutic segments like CNS, oncology and metabolic disorders.

HIGH-MARGIN AIM

- Going forward, the company’s focus will be on high-margin formulations, exploring select

non-OSD (oral solid dosage) forms and developing strategic alliances to accelerate global market

penetration. This will also be a high-value exercise. Future prospects for are highly encouraging as Granules is evolving into a leading pharma

company driven by a strategic focus on innovation, operational excellence and sustainability. The

company has committed to achieving sustainable growth, reflected in its investments in capacity

expansions. Cutting-edge R&D initiatives are expected not only to drive long-term value creation

for its stakeholders but also enhance customer satisfaction.

The company’s shares (FV Re 1) are quoted around Rs 509 on steady buying after moving

between Rs 725 and Rs 382. Further prospects are buoyant after the current bearish phase in the

market gets over. Investors with a long-term perspective should have these stocks in their portfolio.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access