Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: July 31, 2025

Updated: July 31, 2025

Platinum, which has for long played second fiddle to its more attractive cousins like gold and silver, is coming into its own in recent times.

The triggers include recent global conflicts like Russia-Ukraine and Israel- Hamas, newer conflicts like Israel-Iran, and growing demand from the petrochem, automotive and jewellery sectors and investors, even as supplies dwindle.

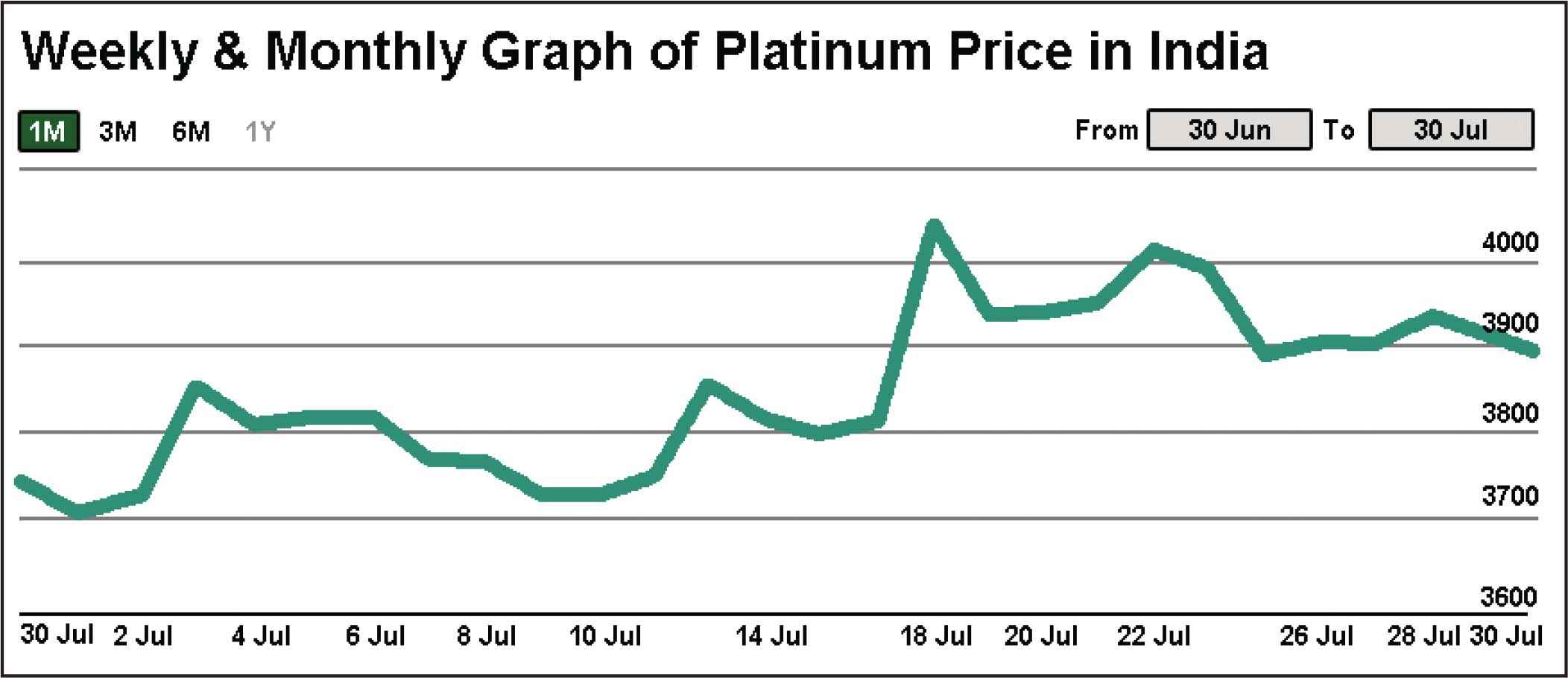

These, combined with the natural tendency of most people to lose confidence in their national currencies and invest in precious metals, has sent the price of platinum soaring even as supplies are expected to further dwindle from the 2023 deficit of 7,49,000 ounces. Currently, the precious metal’s price in the international market is around $ 1,330 per ounce and in India around Rs 3,587 per gram — both of which indicate a 10-year high.

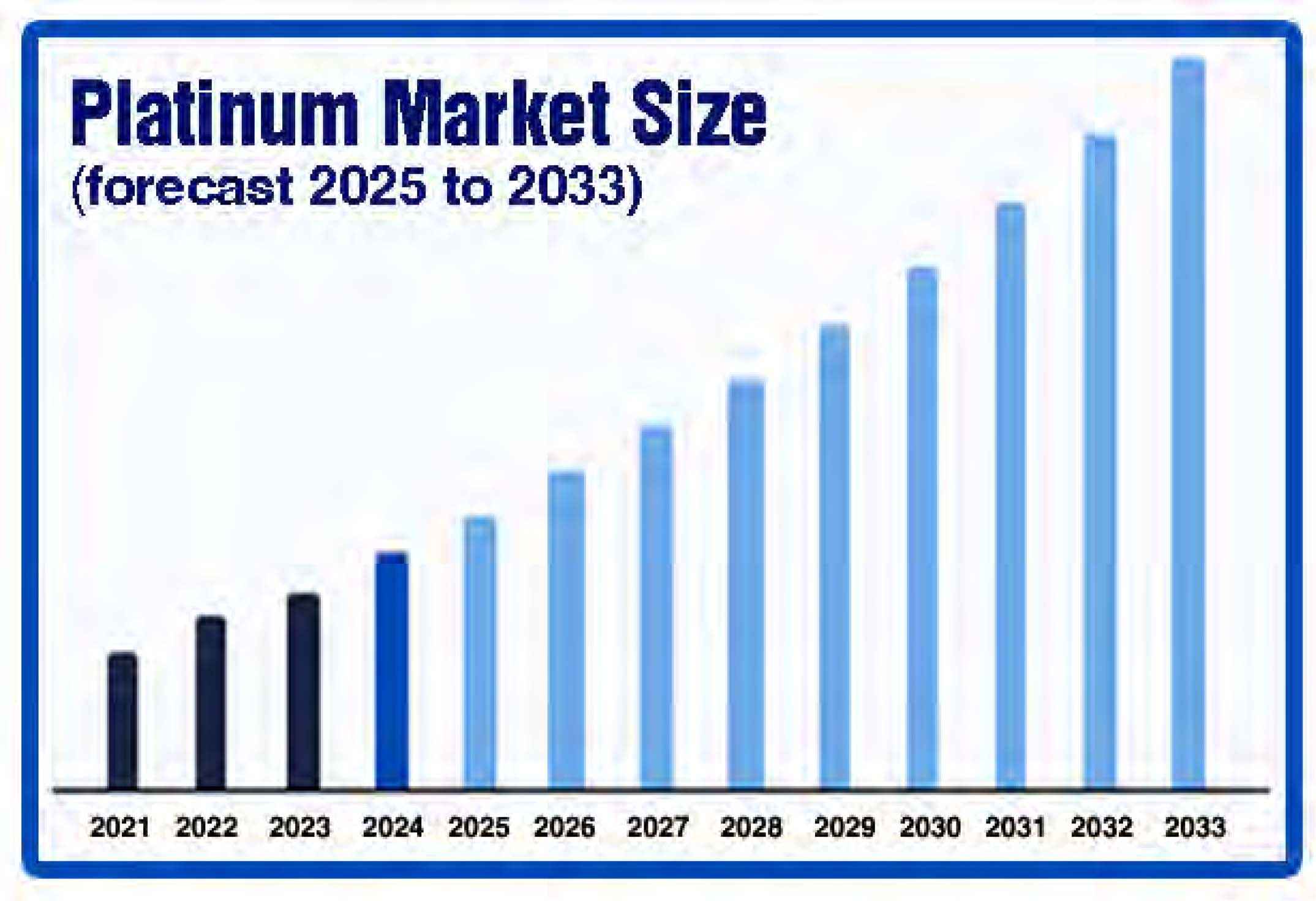

As a result, the size of the platinum market, which was valued at $ 7.10 billion in 2024, is expected to touch $ 7.42 billion this year and $ 10.55 billion by 2033.

recent times, there has been a remarkable spurt in demand for precious metals like gold, silver, platinum, palladium, rhodium, ruthenium, indium and osmium. Correspondingly, the most popular of them all — gold and silver — have reported a record spurt in prices, with gold and silver seeing an annual price uptick of 40 per cent and 15 per cent respectively.

The past three years have seen domestic prices of gold and silver increase sharply. Both metals reached all-time highs in June 2025, with spot prices crossing the Rs 1 lakh mark – gold touching Rs 1,05,000 per 10 gm and silver reaching Rs 1,10,000 per kg.

It’s well-known that both these precious metals have served as currency and have been turned into objets d’art since before even recorded history. However, the third most sought-after precious metal – platinum – is in a competitive mood, suggesting that the metal and its group members like palladium and indium are gaining in ‘preciousness’. South Africa is the uncrowned king of platinum production, accounting for the lion’s share of 80 per cent, followed by Russia and North America. The metal is mostly traded on the New York Mercantile Exchange, the Tokyo Commodity Exchange and the London Bullion Market.

In recent times, platinum has followed ‘precious cousins’ gold and silver with its price in the international market spurting to a 10-year high of $ 1,330 per ounce, and in India to Rs 3,587 per gram, rallying by over 45 per cent so far this year (July 29, 2025). But before we turn to platinum, it will be interesting to discuss the widespread spurt in demand for precious metals and the record spurt in prices of these metals. Widespread growth in geopolitical tensions throughout the world, marked weakening of the Indian rupee particularly against the US dollar, and rising industrial demand are major factors propelling India’s precious metals boom.

Of late, growing geopolitical tensions have played havoc with global peace, stability and prosperity. The prolonged war between Russia and Ukraine refuses to come to an end. The Israel-Hamas conflict continues despite intermittent ceasefire efforts. The undercurrents from the recent Israel-Iran conflict are still active. India and a China-backed Pakistan resorted to a military conflict post the Pahalgam atrocity, which ended with a ceasefire, credit for which was claimed by maverick US President Donald Trump.

As geopolitical tensions are mounting and spreading in various parts of the globe, the investment tribe is turning to precious metals, mainly gold and silver, and now platinum is emerging as a top investment option. In such an environment, investors prefer to turn from even strong currencies like the dollar and the euro to precious metals. Explains an expert, "One reason for the steep domestic surge in demand and prices of precious metals is the weakening rupee, which dropped to Rs 86 per dollar in 2025 from Rs 79 in 2023. Since India imports nearly all its precious metals, any depreciation of the rupee inflates local prices of precious metals even when global prices remain constant. This primary effect has contributed to India's domestic gold, silver and platinum hitting record highs faster than the global average."

Growing and spreading geopolitical tensions across the globe have made precious metals a preferred hedge. From the collapse of SVB and Credit Suisse in 2003 to economic policy volatility under US President Donald Trump, investors have been treating precious metals as an insurance against volatility. International rating agencies' downgrades of US sovereign debt and trade frictions with China have deepened risk aversion. Every major geopolitical flashpoint -- whether it is Russia- Ukraine, Red Sea tensions or US-China tariff battles - has pushed global investors further towards precious metals. This is already reflected in the price graph - after stagnating through mid-2024, gold shot up steeply starting November 2024, climbing nearly Rs 9,000 in 3 months domestically.

Unlike gold, silver's fundamentals are driven largely by industrial demand. Roughly two-thirds of global silver use comes from industries like semi-conductors, photovoltaics (solar panels), water purification batteries and touchscreen displays. The solar PV sector alone is growing at 12 per cent annually, creating secular demand for silver, especially in Asia.

Interestingly, platinum has beaten both gold and silver this year so far. Knowledgeable observers of the global precious metals market agree that after gold and silver, platinum is emerging as a top investment option in 2025. Little wonder that in the first seven months of the current calendar year (2025), platinum prices have soared ahead of both gold and silver. Year to date, both gold and silver are up 30 per cent and 26 per cent respectively. However, platinum has stolen the show, spurting by a stunning 40 per cent since January 1, 2025.

In fact, the big surge in platinum came in June 2025. While gold and silver prices moved up by 7 per cent and 13 per cent respectively during this period, platinum shot up by a staggering 30 per cent. The obvious question arises: what is fuelling this bull run in platinum? First of all, it should be made clear that platinum has a higher risk-reward ratio than gold and silver, as seen by its long period of stagnation followed by surges and then quick reversals.

Platinum is currently quoted around $ 1,350 an ounce - a four-year high last seen in April 2021. The white metal's all-time high was $ 2,166 in April 2008. Before that, the previous 'peak' occurred in February 1989 when the price shot up by as high as 350 per cent, from $ 190 in 1978 to $ 900. Elaborates an expert, "Two things stand out. In both instances, when prices hit a peak, the slide was equally fast. From the peak price of the 1980s, platinum crashed 70 per cent in just 30 months. In 2008, the crash was much more dramatic - in just 10 months, platinum prices tumbled by over 50 per cent.

"Secondly, over a long period, platinum prices remained in a range except for the spikes. Since January 1980, the price of platinum has fluctuated significantly. As recently as January 2025, the price hovered around $ 900. "The pattern looks clear - a long period of silence and then a big spurt with an equally fast downfall." Platinum is one of the rarest precious metals and is used an investment avenue worldwide, along with gold and silver. Moreover, compared to other metals, platinum is far rarer. According to experts, reserves of this precious metal are 15-20 times less than gold and 100 times less than silver.

However, gold has taken the lead in attracting investment while platinum has remained somewhere on the periphery. But if the spurt in demand and price of platinum in the first half of 2025 is any indication, prospects for the third most traded precious metal are bound to undergo a dramatic change.

Of late, the demand for platinum around the world has been increasing remarkably due to its rising use in important industries. For example, this precious metal is used in the manufacture of hard disks, electronics and medical equipment. Applications of platinum have also been found in the automotive, agriculture, chemical and pharmaceutical industries, apart, of course, from jewellery. In other words, platinum is not only a beautiful and rare metal but is also incredibly useful. All this makes platinum a good asset to invest in and a metal worth buying. However, from a trader's point of view, it is important to consider other factors:

1. Platinum is an indispensable metal in emerging hightech sectors of the economy. 2. Platinum is difficult to mine, and the existing supply barely covers the growing demand. 3. Platinum is much rarer compared to gold - for every ounce of platinum mined, about 10 ounces of gold are extracted. 4. Platinum is recognized as the most valuable metal in the jewellery industry. For the last five years, global sales of platinum have amounted to about $10 bn, three times less than silver. At the same time, the volume of investment purchases is ten times less than silver, which shows the unrealized investment potential of this metal.

The platinum industry continues to undergo significant transformation amid evolving global economic conditions and shifting market dynamics. The precious metals sector has witnessed substantial volatility in recent years, with platinum maintaining its strategic importance across various industrial applications. Supply chain realignments and geopolitical tensions have prompted major market participants to diversify their sourcing strategies, with South Africa's mining production experiencing a notable decline of 14.9 per cent annually, highlighting the ongoing challenges in traditional supply markets. The jewellery sector has demonstrated remarkable resilience and growth, particularly in key consumption markets. Saudi Arabia's jewellery sector reported an impressive 36 per cent increase in sales during Q2 2022, reflecting strong consumer confidence and a growing preference for precious metals in the region. This trend has been complemented by strategic trade agreements and policy initiatives across various markets, including the proposed Free Trade Agreement between India and the UAE, which aims to boost jewellery exports and establish new trade corridors for precious metals.

Global platinum recycling and sustainability initiatives have gained significant momentum, with major refiners and manufacturers implementing advanced recovery processes. The industry has witnessed increased investment in recycling infrastructure, particularly in Europe and North America, where stringent environmental regulations are driving the adoption of circular economy principles. The World Platinum Investment Council reports that jewellery demand showed positive momentum with a 5 per cent yoy growth in Q2FY22, reaching 496 Koz, demonstrating the market's recovery potential and sustained consumer interest.

The market landscape is being reshaped by technological advancements and emerging applications across various sectors. Zimbabwe's platinum sector exemplifies this evolution, with output growing by 6 per cent to 475,000 ounces in 2021, showcasing the potential for growth in emerging production regions. The industry is witnessing increased collaboration between technology providers and traditional platinum producers to develop innovative applications and improve production efficiencies, while maintaining focus on environmental sustainability and responsible sourcing practices.

Platinum's exceptional properties, including high stability at extreme temperatures and pressures, superior absorbing and adsorbing capabilities, and remarkable inertness to oxygen, air, moisture and numerous chemicals, have driven its increasing adoption across diverse industrial applications. The chemical and petroleum industry represents the largest industrial application, accounting for approximately 40 per cent of total industrial platinum usage, where it serves as a critical platinum catalyst for various reactions, including hydro silylation, hydrogenation, and cycloaddition. Major applications span the production of detergents, fertilisers, benzene, plastics, explosives, silicones and high-octane gasoline. Recent developments showcase growing industrial demand, as evidenced by significant capacity additions like Sinopec Jiujiang Petrochemical's new paraxylene plant and Shandong Ruiz Chemical Technology's propane dehydrogenation unit commissioned in 2022.

The glass manufacturing sector represents another crucial industrial application, where platinum materials and platinum- based alloys protect various components from erosion by molten glass during the production of LCD screens, plasma displays and other glass products. In the medical and biomedical field, platinum's biocompatibility, radiopacity, and electro-conductivity properties make it invaluable for pacemaker electrodes, aural and retinal implants, and anti-cancer drugs. The electronics industry extensively utilizes platinum as a magnetic coating for computer hard drives, with over 90 per cent of all computer hard drives now coated with platinum alloy to enable higher information storage capacity. The aerospace and defence sectors also rely on platinum alloys for jet and rocket engines operating in extremely hot and corrosive conditions, as well as for missile nosecones and satellite maneouvering motors, highlighting the metal's expanding industrial applications.

The automotive sector represents one of the largest demand drivers for automotive platinum, accounting for approximately 37 per cent of total platinum demand, primarily due to its critical role in catalytic converters for reducing harmful emissions. Platinumbased catalytic converters are essential components that convert over 90 per cent of harmful exhaust emissions, including carbon monoxide, nitrogen oxides and hydrocarbons, into less harmful compounds through chemical reactions. The implementation of increasingly stringent emission regulations globally continues to drive platinum demand in this sector. For instance, the Environmental Protection Agency of the US strengthened automotive tailpipe emission limits, requiring passenger vehicles to achieve 55 miles per gallon of gasoline by 2025, up significantly from 38 miles per gallon currently.

The demand for platinum in automotive applications is further bolstered by the increasing substitution of platinum for palladium in gasoline engines as manufacturers seek cost-effective alternatives. According to the Johnson Matthey PGM report of 2022, US and Chinese automakers have emerged as early adopters of tri-metal technology, accelerating the use of platinum in gasoline applications.

The trend toward higher platinum loadings in both gasoline and diesel vehicles is expected to continue as environmental concerns and regulatory pressures drive automakers to enhance fuel efficiency and minimize pollutant pollutant emissions. This is evidenced by developments like China's implementation of China-6 emission standards for heavy-duty vehicles, which mandate diesel particulate filters on all new diesel heavy-duty vehicles, aiming to reduce particulate matter and NOx emissions by 82 per cent and 86 per cent respectively by 2030.

Demand for platinum on all counts - investment demand, industry demand, jewellery demand - is on the rise and so are shares of platinum companies. As per a report by the World Platinum Investment Council, speculations and global ETF demand have further strengthened the platinum market. While demand for platinum is on the rise, the supply side is tottering. According to World Platinum Investment Council, as there is increasing demand in the face of dwindling supplies, the price of the precious metal is charting a distinctly bullish chart. In 2023, the market saw a huge deficit of 7,49,000 ounces. Experts fear that we will see another big deficit this year (2025).

Many factors, led by growing and spreading geopolitical tensions, have affected market sentiment adversely, pushing demand for platinum. At the same time, demand from the car industry - a big user of platinum - has spurted, particularly in Asian countries like China and India. The outcome was obvious: platinum prices started moving up and up, shooting up in the international market to $ 1,330 per ounce and in India to Rs 3,587 per gram, both marking a 10-year high and rallying over 45 per cent or so for this year (till July 25, 2025). Growing demand and rising prices have pushed up the size of the platinum market, which was valued at $ 7.10 billion in 2024, to the projected level of $ 7.42 billion in 2025, and research experts project it to scale up to $ 10.55 billion by 2033, growing at a CAGR of 4.5 per cent during the forecast period 2025-2033.

Little wonder, platinum has beaten both gold and silver so far in the current year (2025) and observers of the market scenario have started thinking seriously about whether platinum has emerged as the next big investment idea. Observers point out though platinum prices have been rising steadily, gold prices have recorded a runaway rise during the last 3 years or so, overtaking platinum. Does this indicate that as gold pauses, platinum is ready to shine for investors?

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives