Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: July 31, 2025

Updated: July 31, 2025

This fortnight, we have selected Bengaluru-headquartered Syngene International for our Fortune Scrip laurel. Devoted to research and innovation since its inception in 1993, the company operates as a contract research, development and manufacturing organisation (CRDMO) that provides integrated discovery development and manufacturing services to pharmaceutical, biotechnology, animal healthcare, speciality chemicals, consumer goods, biocon and agrochemical companies.

Its clients are global leaders in their fields, ranging from leading multinationals to small- and medium-sized start-ups, non-profit institutions, academic institutes and government organisations. With a unique business model, a talent pool of 5,656 scientists that includes 500 PhDs and 2,750 scientists with a Master's degree, scientific expertise across new therapeutic modalities, an experienced management team and an independent board, Syngene works for clients across the globe. It spent Rs 2,700 crore during the 5-year period from fiscals 2017 to 2022, and then earmarked and spent $ 205 million in the next 3 years ($ 100 million in 2023, $ 55 million in 2024 and $ 50 million in 2025). An amount totalling Rs 2,900 crore was invested in research services and the balance in automation and digitisation of manufacturing facilities to quicken the pace of growth. This capex will go a long way in sharpening the competitive edge of the company.

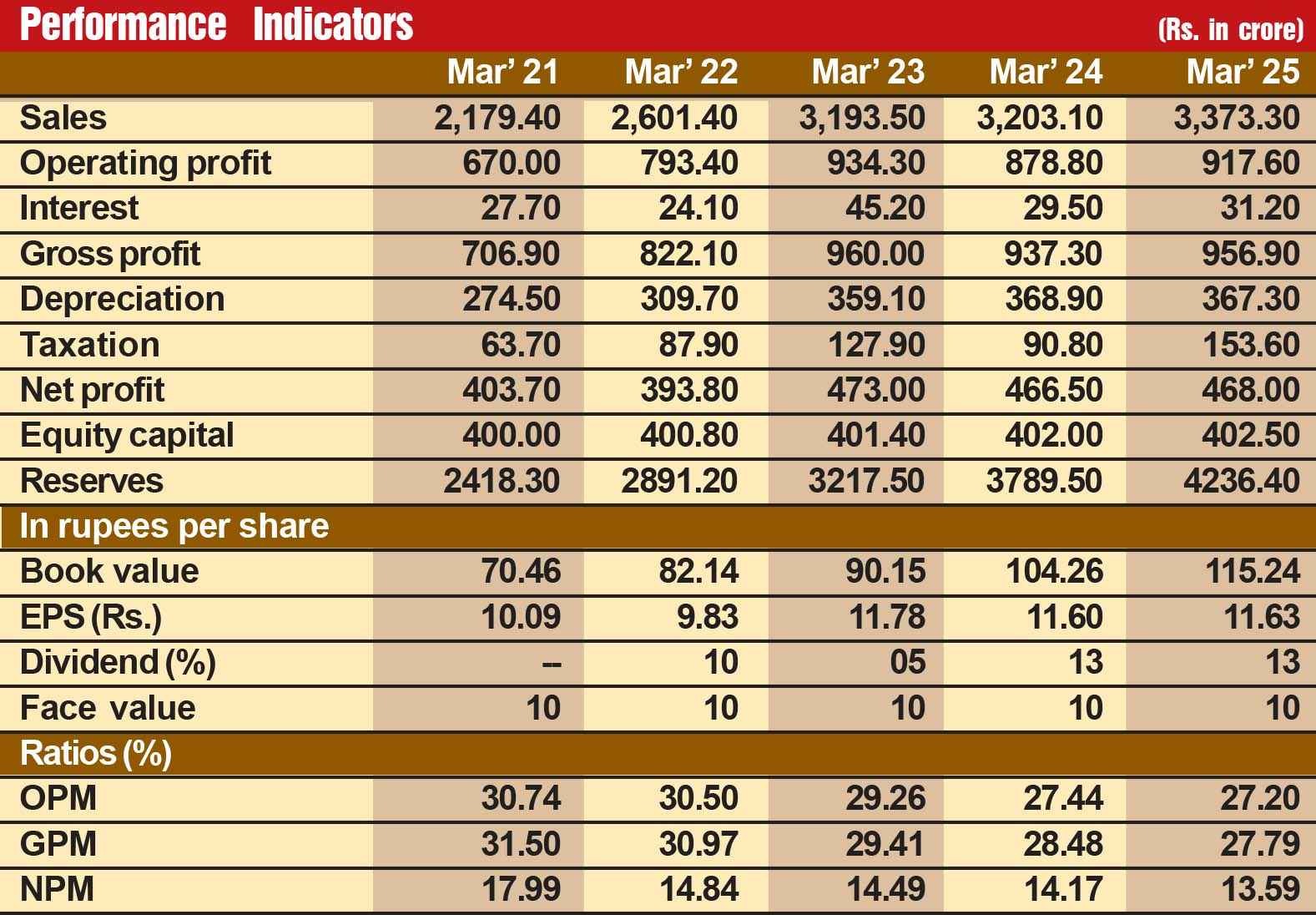

The company is steadily improving its financial performance. During the last eight years, its sales turnover has expanded over five and a half times from Rs 1,423 crore in fiscal 2018 to Rs 3,642 crore in fiscal 2025, with operating profit more than doubling from Rs 474 crore to Rs 1,045 crore and the profit at net level inching up from Rs 305 crore to Rs 496 crore. Its prospects going ahead are so strong that the current pace of growth is bound to quicken, which is why we have picked this stock for the Fortune Scrip slot.

So far, the company has been operating two divisions -- CRO (Contract Reserve Organisation) and CRDMO (Contract Research Development and Manufacturing Organisation). Now, it has launched its third division - a biological facility unit. According to Peter Bains, Managing Director and CEO, this advanced facility will triple Syngene's biomanufacturing services for drug substances and products to biotech and pharma clients. The new division will give a big boost to its top- as well as bottomline.

The company's future prospects are all the more exciting as it has recently undertaken several initiatives to expand its business through expanding existing relationships, developing new partnerships and making investments in manufacturing capacity. Key among them has been the extension of Syngene's research collaboration with leading biotech company Amgen Inc until 2026. Its scope includes Syngene providing integrated drug chemistry and biology, peptide chemistry, antibody and protein reagents, pharmacokinetics, and drug metabolism and pharmaceutical development, in addition to operating the existing Syngene-Amgen R&D centre. Under the new contract, Syngene will also build and operate a dedicated laboratory which will enable R&D project deceleration.

Another notable contract the company signed recently was with leading animal health company Zoetis. The contract, signed in July 2022, is for a period of 10 years and is for manufacturing the drug substance for Librela (bedinwetmab), a first-in-class monoclonal antibody used for treating osteoarthritis in dogs. Initially centred on Librela, this agreement paves the way for developing and manufacturing other molecules in the coming years. Thanks to this contract, Syngene will be able to move from a CRO to a CRAMS (Contract Research and Manufacturing Services) company. It has got an advantage of scale as it has already an established relationship with clients from research to, now, manufacturing, and this transition may prove to be the next trigger of growth. The partnership aims to provide innovative research and development services to Zoetis, focusing on the animal health market. Working with Zoetis enables Syngene to gain access to Zoetis's domain expertise in animal health research.

Little wonder, Syngene's client base has grown from around 256 to 500 over the eight-year period from innovator pharma/chemical companies. The company is known for establishing long-lasting relationships with its customers, and this has emerged as a key strength. Some of the strategic collaborations are with Bristol Myres Squibb, Baxter, Endo Pharmaceuticals and Abbott Nutrition.

In addition to these contract wins, the company has been expanding its manufacturing capacity at its Biocon Park campus in Bengaluru. The company set up and commissioned a new microbial cGMP facility and expanded its mammalian cell manufacturing facility to offer end-toend chemistry, manufacturing and control (CMC) development solutions. With this, Syngene can now manufacture an array of biologics across mammalian and microbial platforms. These include antibodies, bispecific antibodies, fab fragments, fusion proteins, therapeutic proteins, pDNA, mRNA and live biotherapeutic products. Recently, the facility received regulatory approval for commercial biologics operations from the European Union's EMA and the UK's MHRA. The FDA certificate is awaited.

Realising the bright prospects for the company going ahead, knowledgeable HNIs have started accumulating these stocks, and as a result the share price has gone up to Rs 680. We feel the longterm prospects for the company are bright and the stock price can reach the four-figure (Rs 1,000) mark within a year or so.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives