Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: June 30, 2025

Updated: June 30, 2025

This time we have picked as our fortnightly Fortune Scrip a unique corporate entity which has a highly interesting history spanning around 150 years! The company has performed under various names and different managements. It has passed through several rises and falls. At one time, it was even on the verge of extinction. But like a phoenix, it has risen from the ashes! The name: CG Power and Industrial Solutions – all of 88 years old!

Its earliest avatar was as REF Crompton and Co, set up in 1878 by an Englishman, Col Crompton. After 47 years, in 1927 it was merged with FA Parkins and the name of the company was changed to Crompton Parkinson Ltd. Then, it was changed to Greaves Cotton and Company when James Greaves was appointed as the company’s concessionaire. In 1937, Crompton Parkinson Ltd set up a wholly owned Indian subsidiary, styled Crompton Parkinson Works Ltd.

After Independence in 1947, the Indian business group of Karamchand Thapar acquired the British company and renamed it Crompton Greaves. As it happened, Mr Thapar’s children could not manage the company in the face of serious challenges. In 2014, it was demerged, with its consumer goods business separated and sold to Advent International and Temasek Holdings for Rs 2,000 crore. The separated company was named Crompton Greaves Consumer Electricals Ltd, and the remaining company was known as CG Power and Industrial Solutions Ltd. Subsequently, this remaining company was acquired by the Murugappa group, a leading industrial house of south India.

An engineering conglomerate, CG Power is a leader in the electrical engineering sector and offers an impressive and diverse portfolio of products, solutions and services for power and indus trial equipment, catering to myriad needs across varied industries in India and globally.

Since its inception, the company has been a pioneer and has retained its leadership position in the management and application of electrical energy. Enjoying a reputation of stature for almost nine decades, CG Power, which originated in India, has transformed itself into a global corporation with world-class manufacturing facilities across 9 locations in India and one in Sweden, and a pan-India network of 5 regional and 14 branch offices with over 3,113 employees.

The company’s unique and diverse portfolio includes induction motors, drives, transformers, switchgears and other allied products for the industrial and power sectors, as well traction motors’ propulsion systems, signalling relays, etc., for the Indian railways. The company has also made a foray into electrical goods such as fans, pumps and water heaters.

Very recently, it entered the highly lucrative space of semiconductors. The company has joined hands with Renesas Electronics of Thailand for setting up a state-of-the-art facility at Sanand in Gujarat, with a capacity to manufacture 15 million semiconductors per day. CG Power will have the lion’s share of 92.3 per cent, with Renesas holding 6.8 per cent and Stars Micro Electronics of Thailand having the balance of 0.9 per cent. The total investment in the Sanand plant will be to the tune of Rs 7,600 crore, spread over a period of five years.

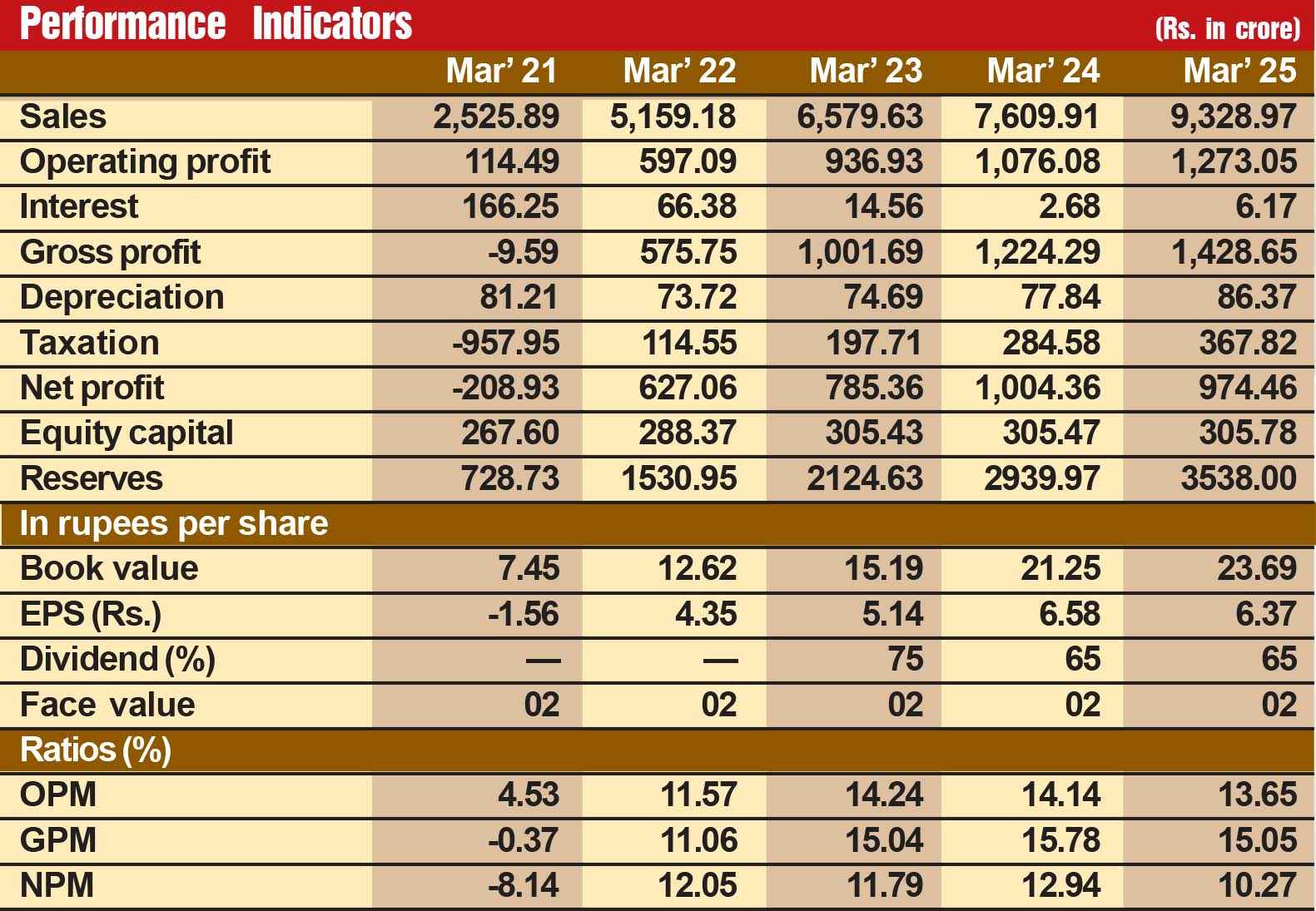

The company has faced fluctuating fortunes, alternating between robust finances at one time and plunging into the red at another. Mirroring its mixed fortunes, its stock price ruled at a sky-high level of Rs 3,000 (31-03-1992) and remained untouched at a throwaway price of Rs 4.69 (13-03 2020).

During the last 12 years, its financial performance has undergone tremendous fluctuations. Sales turnover slumped from Rs 13,632 crore in fiscal 2014 to Rs 2,964 crore in 2021, when the Murugappa group acquired the company. What is more, operating profit slumped from Rs 612 crore in fiscal 2014 to Rs 88 crore in 2016, and then plunged into the red in 2017 with a loss Rs 128 crore. It turned the corner subsequently, but its profit in fiscal 2020 was only Rs 31 crore, and at the net level it incurred a loss of Rs 1,331 crore.

Vellayan Subbiah, who headed the Murugappa group and was appointed Chairman of CG Power, selected Natarajan Srinivasan as ‘corporate doctor’ to bring the company out of the woods and back on the growth path. Mr Srinivasan resorted to imaginative and effective measures to stage an impressive turnaround. The sales turnover shot up to Rs 9,909 crore in fiscal 2025, with operating profit shooting up to Rs 1,305 crore and net profit of Rs 973 crore.

However, we have selected this company as our Fortune Scrip not only because it staged a turn around. It is now set to make rapid strides with its foray in the lucrative space of semiconductors. While there is a severe shortage of semiconductors globally, demand is galloping. In India itself, indigenous production currently meets only 10 per cent of domestic requirements and the country has to import the remaining 90 per cent from leading manufacturers like Taiwan, South Korea, China and the US. The entry into semiconductors will prove to be a game changer for CG Power on account of its size, stature and character, as well as the tremendous scope for semiconductors going ahead. Consider:

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives