Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: March 15, 2025

Updated: March 15, 2025

INDIAN consumers are set to be spoilt for choice as the hitherto ‘elite club’ of the paints and coatings sector is being eyed by new, cash-rich players.

TILL now, the Rs 86,500-crore industry was monopolised by the likes of market supremo Asian Paints, with players like Berger Paints, Kansai Nerolac, Akzo Nobel and Indigo Paints following in its wake. But other biggies are now getting their paintbrushes ready, among them Grasim Industries, JSW Paints, JK Cement, Pidilite Industries of ‘Fevicol’ fame, and pipes and-fittings lion Astral.

THIS has set the stage for a seismic shift in the sector in terms of marketshare, a development which will unfortunately further limit the growth of unorganised small players. Interestingly, this development is unfolding at a time when the industry is growing at a CAGR of 10 per cent and is expected to cross $ 20 billion by the next decade.

THE growth drivers include the ‘pull’ factor of rising Indian incomes and lifestyle aspirations, and the ‘push’ factor of the government’s mega initiatives on the housing, infrastructure and Smart Cities front.

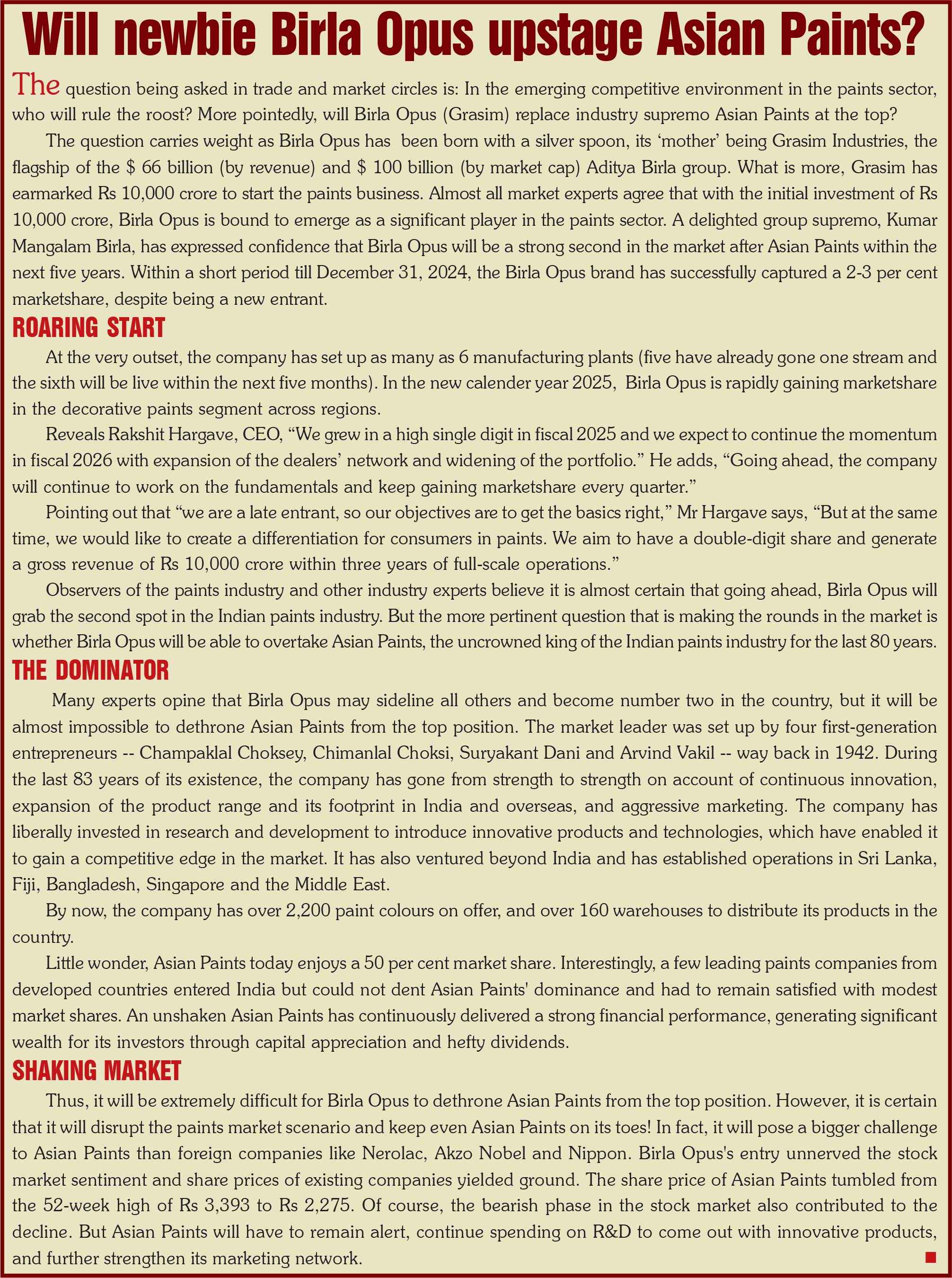

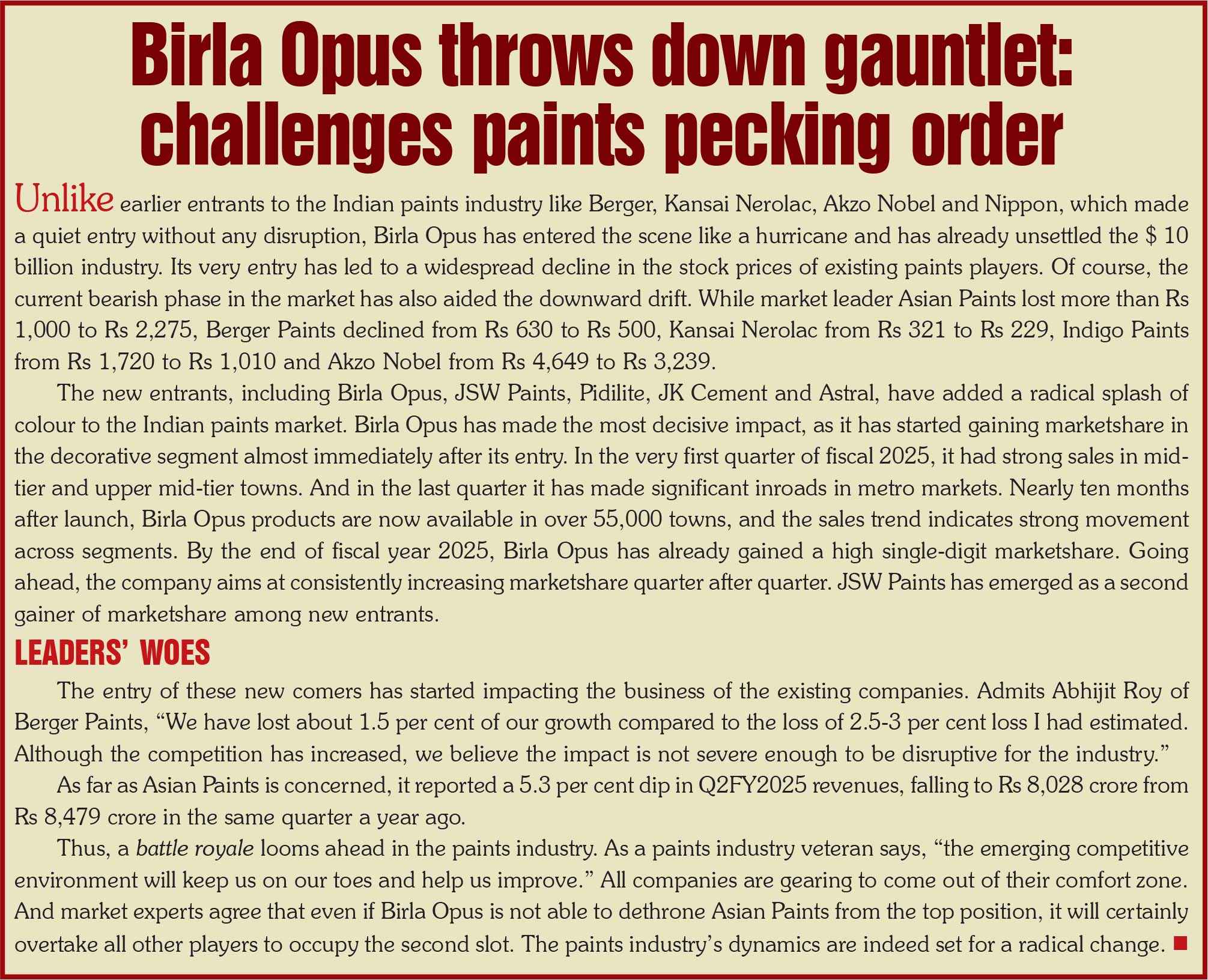

The contours of the Rs 86,500-crore Indian paints and coatings industry are undergoing a distinct change. The sector, which was relatively ‘mono chrome’ (read, an oligopoly of a few big players) for the last several decades, is now experiencing a ‘riot of colours’ (read, gatecrashers to the party). Asian Paints has been dominating the paints and coatings market space for the last 80 years, with players like Berger Paints, Kansai Nerolac, Akzo Nobel and Indigo Paints, bringing up the rear, for a whopping 90 percent marketshare of the domestic business. But they have been jolted out of their market complacence with the recent entry of half a dozen large and rich corporates. The latter include Grasim Industries, flagship of the Birla conglomerate, JSW Paints of the fast-growing JSW group, JK Cement, flagship of one section of yesteryear’s large industrial house of the Singhanias, Pidilite Industries, uncrowned king of the adhesive industry which is known for its ‘Fevicol’ brand, and Astral, which has earned a very good name in the space of pipes and fittings. All these ‘newbies’ are well-man aged, resourceful companies.

With their financial muscle and technological in novations, the existing pole players in paints have kept the unorganised sector confined to a small space. And now, the resources-rich new entrants will hit the unorganised sector even more. That apart, the indus try as a whole is set to undergo a seismic shift as the new players seek to steal marketshare from the exist ing market leaders – notably, the most ambitious among the newbies, Grasim, could pose a challenge to the supremacy of Asian Paints. In any case, it is crystal clear that the hitherto quiet and predictable landscape of the Indian paints industry is set for a highly competitive makeover.

The dynamics of Rs. 86500-crore Indian paint ings and coatings industry are undergoing a decisive and dramatic change. Interestingly, this seismic shift is taking place at a time when the paints and coatings industry is flying high. The $ 10 billion industry is growing at a CAGR of around 10 per cent and is ex pected cross $ 15 billion by 2029, and $ 20 billion by 2035. The factors driving this growth include growing urbanisation, rising disposable incomes, improving aspirations and standard of living, and government initiatives like 'Pradhan Mantra Awas Yojana', Smart Cities which will bolster housing demand, and fast growing infrastructure development.

While decorative paints dominate the sector with around 70 per cent and industrial paints contribute the balance 30 per cent, both segments are thriving on ris ing demand. Growth in the decorative paints segment is further supported by a consumer shift towards water-based and premium paints, and rising per capita consumption. Demand dynamics are largely shaped by the real estate sec tor, which commands approximately 70 per cent of total market demand. The remaining demand of around 30 per cent is from diverse sectors like automotive, oil & gas, aero space and marine.

Thus with the Indian paints and coatings industry ex periencing robust growth driven by extensive infrastructure development and urbanisation initiatives, the size of the industry, which is around $ 10 billion today, is expected to reach $ 16.40 billion by 2030, growing at a CAGR of around 10 per cent during the period 2025-2030, according to a forecast by a research agency.

Little wonder that the organised sector's lead ing companies, including Asian Paints, Berger Paints, Concise Nerolac Paints, Akzo Nobel Paints and Indigo Paints, have been growing at a fast pace and making India the fastest growing paints country in the Asian continent.

All these companies have doing very well, with their investors enjoying the fruits of their growth.

However, there is a twist in the story at this juncture. Realising the tremendous growth prospects and excellent return on capital employed, several deep pocketed conglomerate com panies have decided to throw their hat in the ring, posing a serious challenge to the existing order. Those who have entered the fray include JSW Paints, Grasim Industries, JK Cement, Pidilite and Astral.

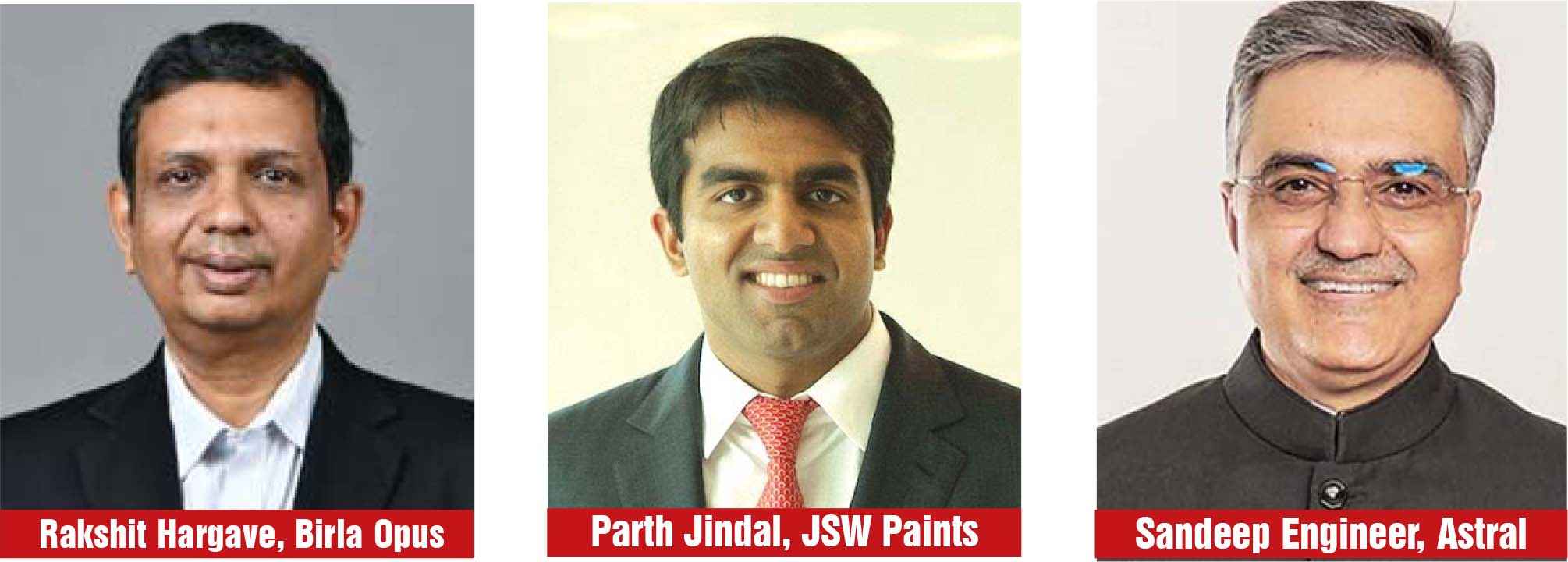

JSW Paints: Launched five years ago and part of the diversified $ 23 billion JSW group, which has interests in steel, energy, infrastructure and cement, the company cur rently has two manufacturing units - an industrial coatings facility at Vasind in Maharashtra and a decorative paints facility at Vijaynagar in Karnataka, with a combined capacity of 150,000 kl per annum. Says Parth Jindal, managing di rector, "Our pioneering efforts to build a strong, holistic, water-based paints portfolio has placed us in a command ing position to service the fast-evolving preferences of In dian consumers. It is a moment of great pride that the JSW group's first true consumer-facing business has been so well received across the country, enabling us to cross Rs 2,000 crore in revenues in fiscal 2024, so soon after we entered the market." The company's revenues in the cur rent year ending March 31, 2025 are ex pected to be around Rs 3,100-3,200 crore.

According to Parth Jindal, man aging director of JSW Paints, "Our pioneering efforts to build a strong holistic water-based paints portfolio has placed us in a commanding position to service the fast-evolving preferences of Indian consumers. It's a moment of great pride that JSW Group's first true consumer facing business has been so well received across the country enabling us to cross the INR 20 billion revenue so quickly from when we entered the market. We are committed to our vision of building JSW Paints as the leading paints company of the future that will continuously set new trends in the industry. Our core strategy of continu ous innovation and wide-ranging disruptions are deliver ing promising results."

JK Cement: A flagship of the Singhania group and a leading cement manufacturer, JK Cement fast-tracked its entry into the world of paints and coatings by acquiring a majority stake in Rajasthan-based Acrow Paints for Rs 1,530 million. Acrow Paints is a manufacturer of architectural and high performance paints and coatings. This acquisition will en able JK Cement, which is manufacturing and marketing white cement putty, to expand its product offerings and poten tially foray into new markets.

Pidilite Industries: Pidilite, which enjoys a virtual mo nopoly in adhesives like Fevicol and Feviquick, has de cided to enter the paints sector. The company already has a presence in waterproof coatings and lower-priced dis temper. In order to complete its range, Pidilite has launched its decorative paints in smaller towns in Andhra Pradesh, Telangana and Orissa. The company's standing and vast network will prove highly beneficial in the new business, and initial reactions from the market have been quite good. The response in first three months (Decem ber 2024-February 2025) has enthused the management. The company will now extend its marketing network to other regions.

Astral Ltd: Astral, a reputed PVC pipe maker and lead ing innovator in the building construction segment, has launched Astral Paints after acquiring a majority stake in Bengaluru-based Gem Paints for Rs 1,940 million. The com pany now offers a vast array of options to meet the needs of every painter, designer and home owner, featuring a di verse range of colours, finishes and specialised formations. After acquiring Gem Paints, Astral has strategically launched its first phase in Bengaluru, leveraging three state-of-the-art paint units. Subsequently, the company will expand its paint line across India in phases, starting with Karnataka and Gujarat.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives