Fortune Scrip

Published: March 15, 2025

Updated: March 15, 2025

Jupiter Wagons

One-stop shop for

railway needs

Is it advisable to recommend a Fortune Scrip at a time when the stock market is passing through a bear

phase? Undoubtedly, market sentiment has been hit hard by adverse national and international devel

opments leading to slowing down of economic growth at home, rising inflation, the manufacturing

sector losing steam, growing unemployment, and declining urban as well as rural consumer demand.

As if these domestic factors were not enough, US President Donald Trump has administered a body

blow to the Indian economy by threatening to impose stiff tariffs on Indian products entering the US.

This threat adds to the uncertain global geopolitical situation. Little wonder then that the stock market

has tumbled under widespread selling pressure led by foreign institutional and portfolio investors.

But our thinking is that if there are solid scrips with robust fundamentals and bright prospects,

why should we not draw the attention of our readers to them? As a precautionary measure, we

would advise waiting for a further fall in prices before picking such promising scrips. With this in

mind, we have picked Jupiter Wagons as the Fortune Scrip for this fortnight.

Kolkata-headquartered Jupiter Wagons is the leading railway wagon manufacturer in the coun

try. Over the past few decades, it has emerged as a one-stop solutions provider within its sector for

coaches and alloy steel castings for rolling stock and track. The group also manufactures other

products like ISO marine containers and refrigerated containers. Its wholly-owned subsidiary, Jupiter Electricity Mobility, is engaged in the manufacture of commercial electric vehicles. The group also

manufactures gears and railway couplers for the Indian Railways and North American roads.

Today, Jupiter Wagons is the most integrated railway engineering company catering to clientele

spread across the Indian Railways, private wagon aggregators, commercial vehicles, OEMs, and Indian

defence logistics companies, among others. It regularly exports to North American markets as well.

TOP CLIENTS

The company’s major customers include Tata Motors, Reliance Industries, Ashok Leyland,

Force Motors, Volvo Eicher Commercial Vehicles, Bharat Benz, Larsen & Toubro, BHEL, Indian

Railways, Ministry of Defence, NTPC, Avia Motors, WP World, Container Corporation of India, and

Adani Port and Logistics.

It is widely respected for its high quality and robust technology, which underpin its status of the

fastest growing company in its space. One of the major factors for this achievement is that the

company has tie-ups with world-renowned companies known for their top technologies. For ex

ample, it has joined hands with DAKO-CZ of the Czech Republic for the manufacture of axle

mounted disc brake systems for LHB passenger coaches. For the manufacture of brake discs for

LHB coaches, it has entered into a joint venture with Kovis DOO of Slovnia. And in order to

manufacture flash butt welded CMS crossings for the Indian Railway, it has entered into a JV with

Talleres Alegutta sa of Spain.

The company has state-of-the-art manufacturing facilities at Kolkata, Jamshedpur, Indore,

Jabalpur and Aurangabad, with complete backward integration of its foundry operations.

SALES BOOM

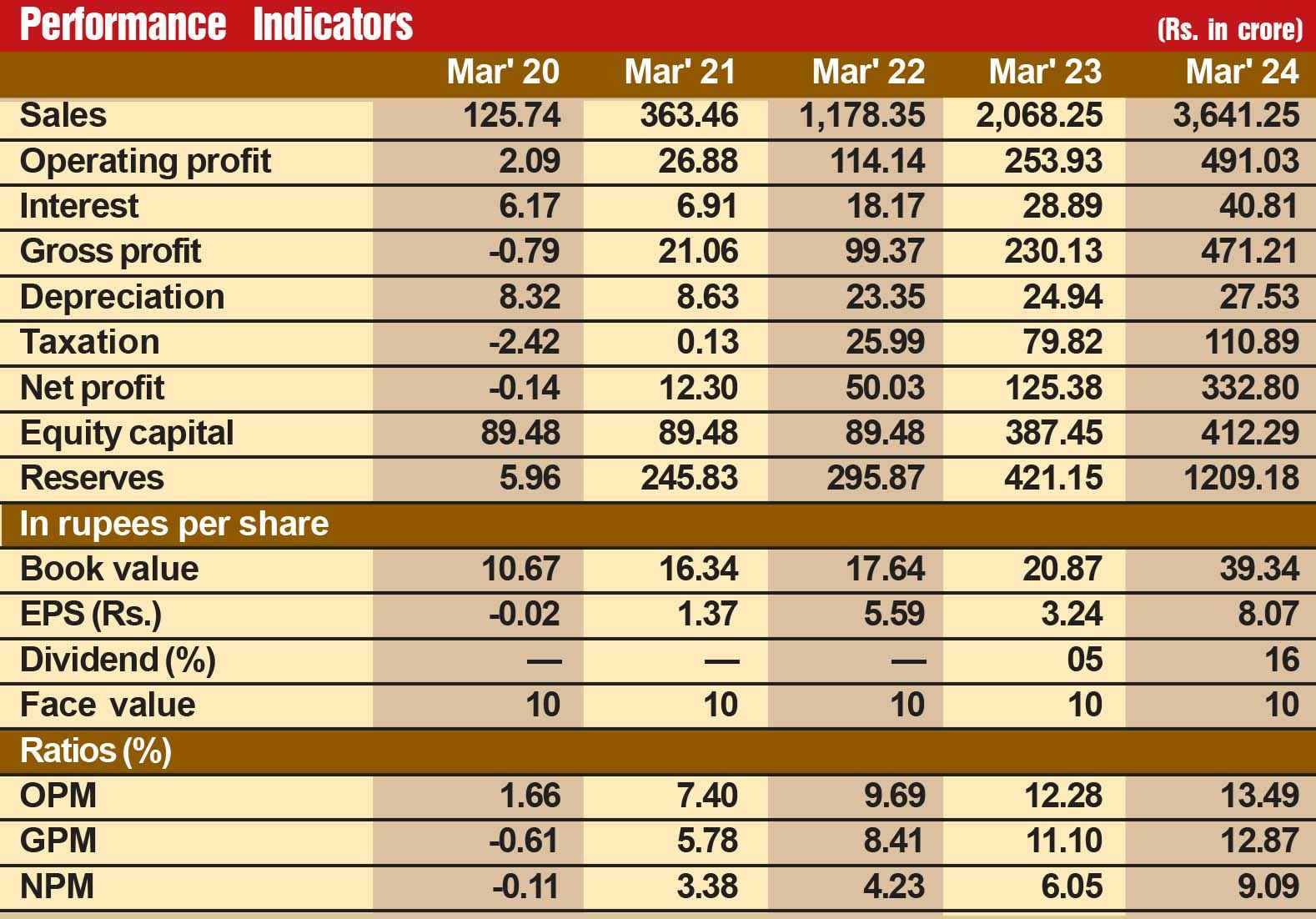

Jupiter Wagons has gone from strength to strength on the financial front, with sales and earn

ings expanding over 7 times each. While sales during the last 12 years has expanded from Rs 502

crore in fiscal 2013 to Rs 3,641 crore in fiscal 2024, operating profit has grown from Rs 65 crore to

Rs 491 crore and the net profit has expanded from Rs 19 crore to Rs 333 crore. But this robust

performance so far is not the only reason why we have picked Jupiter as the Fortune Scrip. We

strongly feel that its future prospects are all the more promising. Consider:

eLCV PLANT

- The company’s wholly-owned subsidiary, Jupiter Electric Mobility, on March 4, 2025 launched

a new manufacturing facility at Pithampur, Indore (MP) for the manufacture of electric light commercial

vehicles. The management claims that the launch of JEM TEZ aims to set new benchmarks in electric

last-mile logistics. Spanning 2.5 acres, the new plant features a fully integrated production line cover

ing everything from skateboard platform development to complete vehicle assembly, with an annual

capacity to produce 8,000 to 10,000 eLCVs. The facility is designed for phased expansion to meet the

rising demand for eLCVs. The company aims to generate revenues of Rs 100 crore in its very first year

of operations. During the last quarter of fiscal 2025, the company expects to produce 500 vehicles.

These vehicles are expected to attract good demand — at present, only Tata Motors has launched a

vehicle in this segment priced at Rs 14-16 lakh. The eLCV production will start form the next month.

- The management believes in taking a disciplined approach with a long-term perspective.

Says Jupiter MD Vivek Lohia, “We are not in hurry — the eLCV business is complementary to our

existing capabilities. Though our capacity is 8,000 to 10,000 eLCVs per year, we will adopt a

phased programme. For the first year, our goal is not to chase volumes and we aim at revenues of up

to Rs 100 crore only. Our goal is to establish our brand and build trust.” This means that the eLCV

business will go on adding sales and profit year after year for the time being.

- At the heart of Jupiter’s foray into electric mobility is battery technology – the single most

expensive and strategically vital component of an electric vehicle. The far-sighted company man

agement has acquired Log9’s technology and business assets for its railways and truck battery

divisions. Bengaluru-based Log9 has been developing advanced high-performance battery solutions for electric mobility, logistics and industrial applications. With this acquisition, Jupiter has

gained access to cutting-edge battery technology and Log9’s state-of-the-art manufacturing facility in

Bengaluru. The acquisition marks a significant step towards vertical integration, allowing Jupiter to

control a critical aspect of EV production while reducing dependency on third- party suppliers.

WAGON BIZ

- The management is confident that the freight business, the company’s primary activity, will

continue to deliver strong numbers going ahead. On account of the rising demand for wagons from

the railways and the private sector, the company raised its production capacity of wagons from 800

per month to 900 per month last year, and will raise it further to 1,000 wagons per month from the

current year. The management has guided for sale of 10,000 wagons in the current year (2025).

- Jupiter, which has carved a niche within the Indian Railways supply chain for high-tech

components – wheels, axles, rolling stock and braking systems – tailored for the country’s gradual

transition to high-speed rail infrastructure, has plans to expand production of all these items. Realising

that with the rapid expansion of freight and passenger rail netorks, there is a critical need for reliable,

high-performance wheelsets produced domestically at scale, the company has set up a new factory

in Odisha which is expected to be a game-changer in this space, ensuring India’s self-sufficiency in

wheelset manufacturing while also positioning Jupiter as a global supplier.

Jupiter Wagons

- As far as the Odisha project is concerned, axle production is slated to commence by Decem

ber 2026 and the full wheel and axle production unit is expected to be in operation by December

2027. This development is a strategic move to reduce the country’s dependence on imported railway

components.

LARGE ORDERS

- The company has a robust order book worth Rs 7,028 crore, reflecting revenue visibility for

around two years. The order book would have been still bigger but for the general election and four state

elections which affected order flow. The situation is improving once again. The demand environment is very

good as the Indian Railways is looking to procure 4 lakh rolling stock in the next five years, of which it has

procured only 1.5 lakh till now. At present, the railways has more than 3.2 lakh wagons running on its

network and is facing a massive shortage of wagons due to the rising demand from a fast-growing Indian

industrial sector. The railways also wants to increase its marketshare in freight traffic from the current level of

27 per cent to over 45 per cent over the next five years. Laying of new tracks, decongestion of current tracks,

and opening dedicated eastern and western freight corridors will further increase the demand for wagons.

Needless to say, the growth prospects for this undisputed market leader in the wagon segment

are robust, with revenues expected to grow at a CAGR of 30 per cent over fiscals 2024 and 2026.

Driven by strong growth in the order book and fast growth in the braking division, the EBITDA

margin is set to improve to 16.2 per cent in fiscal 2026 from 13.4 per cent in fiscal 2024, driven by

backward integration, operating leverage benefits and introduction of new products.

Sharekhan, a leading brokerage house with a strong research wing, expects that Jupiter Wagons

will report a strong EBITDA/PAT CAGR of 42%/44% over FY24-FY26 along with a high return ratio– ROCE/ROE — of 30% and 25% in fiscal 2026

SHARE WATCH

The company’s shares with a face value of Rs 10 are quoted around Rs 315 in the current

bearish phase. As the domestic and international factors are highly disturbing, the share price may

decline further to around the 240/250 level. Discerning investors will do well to wait for some time

and then start accumulating these shares at every decline. The long-term outlook for this stock is

distinctly bullish. Investors who invest in this stock with a long-term perspective will certainly reap a

rich harvest.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access