Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2025

Updated: May 31, 2025

FROM being an importer of most of its defence require ments till recently, India’s defence scenario has under gone a radical change following the Modi government’s 3 pronged ‘Make in India’ push — opening up the defence sector to private players, restricting defence imports, and dangling the PLI (production linked incentive) carrot.

AS a result, big India Inc names like Tata, L&T, Kalyani, Reliance and Adani are set to raise the competitive bar alongside veteran defence PSUs like HAL, BEL, BEML and Mazagon Dock. In fact, during the last five years, the defence segment has emerged as a sunrise sector in the Indian stock market. A major factor behind this growth is the West’s production shift from China.

IN fact, since the 1990’s, the Indo-US defence agreement has recognised India as a regional force for stability and a key defence partner. In fiscal 2024, the private sector drove defence production past Rs 1.27 lakh crore, with exports reaching Rs 21,000 crore. The target for fiscal 2029 is a humongous Rs 3 lakh crore in production and Rs 50,000 crore in exports.

The $ 17.5 billion Indian defence industry is on a roll. ‘Operation Sindoor’, the country’s recent surgical strike against terrorist bases in our neighbouring country following the Pahalgam massacre of innocent terrorists by Pakistan-based terrorists, has brought into sharp focus the advancements India is making on the home-grown military equipment industry front. This growth path has been in the spotlight especially in the backdrop of the prolonged Russia-Ukraine and Israel-Hamas wars and their resultant geopolitical tensions across the globe.

The Indian defence sector is gaining in strategic importance in the context of our geopolitical tensions with neighbouring China and Pakistan, apart from Chi nese efforts to create an anti-India axis in other neighbouring countries. Little wonder then that India has today one of the world’s largest military forces with a strength of over 1.44 million active personnel. Again, we have the world’s largest volunteer force of over 5.1 million personnel. India’s current defence spending is around 2 per cent of its GDP. Unsurprisingly, the defence budget sanctioned for 2025 is a humongous Rs 6.81 lakh crore ($ 81 billion), the highest ever since independence 78 years ago, and behind only the US ($ 732 billion) and China ($ 261 billion).

Till recently, India was the world’s largest defence equipment importer, ac counting for 9.8 per cent of global arms imports. Today, we have a strong domestic defence sector, of which almost 60 per cent is in the public sector (NTRO, CSIR, PPL, DRDO and its 50 labs, and four shipyards and 12 PSUs like HAL, BEML, Bharat Electronics, Bharat Dynamics, Mazagaon Dockyard and Garden Reach Shipbuilders.) With the government inviting participation from the private sector, companies like Bharat Forge, Larsen & Toubro, Tata Advance, Reliance and Adanis have entered the fray. And with the rising demand for ‘Made in India’ defence gear at home as well as abroad, the government has devised a new policy to boost indigenous development and production in order to reduce imports as well as to promote defence-related exports.

In fact, the demand for defence equipment is growing all over the world. The global defence equipment market was valued at $ 534.96 billion in 2024, is estimated to have grown to $ 563.71 billion in 2025, and is projected to reach $ 795.54 billion in 2033, growing at a CAGR of 4.4 per cent, according to a research report and forecasts for 2025 2033 by Rushabh Rai, an expert on the subject. The spurt in the global industry share during the fore cast period of 2025-2033 is related to increased global se curity concerns, geopolitical tensions and a growing em phasis on military modernisation which is driving more lav ish defence spending by governments worldwide. Europe is boosting defence spending to record highs, driving up regional concerns and NATO commitments. Collaboration efforts like Eurofighter Typhoon production highlight the joint efforts of the European defence sector.

North America’s defence equipment industry share is estimated to grow at a CAGR of 4.2 per cent over the fore cast period of 2025-2033). In recent years, massive spend ing on defence equipment acquisition, training programmes and R&D in the US has helped North America emerge as a market leader. The US’s investment in weapons procure ment and R&D alone is set to exceed China’s defence bud get. North America has also extended the gap between its own defence equipment market and that of Europe’s de fence equipment to four times the latter’s total expenditure.

Asia-Pacific is anticipated to exhibit a CAGR of 4.8 per cent over the forecast period. Asia-Pacific is expected to in crease its defence expenditure due to significant investments by countries such as China and India. Sensitive interna tional borders and escalating disputes between the coun tries in the region are driving up the procurement and de ployment of defence equipment. The European defence equipment market is an integral part of the global defence sector, with European countries investing in defence capabilities to handle regional security issues and meet NATO commitments. A prime example is the Eurofighter Typhoon, a multi-role fighter aircraft pro duced jointly by the UK, Germany, Italy and Spain. World military spending reached a new high as European invest ment increased in 2023. In 2022-2023, military spending in Europe increased unprecedentedly in the last 30 years. The European Defence Agency (EDA) promotes collabora tion and capabilities development among EU member-states.

The Middle East and Africa are projected to account for a sizeable portion of global defence expenditure due to the enormous geopolitical tensions between Israel and Gaza. Israel’s defence industry is in extremely good shape as it has emerged as a large exporter. Today, Israel is home to over 160 active defence enterprises (2023). Israel invested 30 billion NIS (new shekel) in defence expenses, accounting for around 5.7 per cent of its GDP. Its finance ministry has indicated that the country will have to invest a further 30 billion NIS within a year as the fight against Hamas contin ues.

Coming back to India, the Modi government has dra matically transformed the scenario in the country's defence sector by converting what was till recently a top importer of defence equipment globally into a global manufacturing hub exporting defence products. Towards this end, the govern ment adopted a three-pronged approach: (1) Extension of the late Dr Manmohan Singh's 'opening up the economy' initiative to the defence sector and allowing the private sec tor to play its role in this field; (2) Severe restraints on imports of defence gear and reserving several products for domestic players; and (3) Doling out lucrative incentives like PLI (production-linked incentive) to domestic players to promote the 'Make in India' initiative.

Little wonder then that several financially sound, fun damentally strong and well-managed companies like Larsen & Toubro, Tata Advance, Bharat Forge, Reliance and Adani have forayed into the defence sector, which had already earned a good name on account of renowned public sector companies like Hindustan Aeronautics (HAL), Bharat Elec tronics (BEL), BEML, Bharat Dynamics and Mazagon Dock yard. During the last five years, the defence sector has emerged as a sunrise sector in the Indian stock market and has started exporting indigenous products to several coun tries across the globe. Maintains a knowledgeable observer of the Indian de fence industry scene, "India's defence sector has been fast undergoing a major transformation as the country moves from being a major importer to a becoming a global manu facturing hub for defence products. The country is redefin ing its role in the global defence economy with defence exports reaching Rs 21,000 crore in fiscal 2024 - a 20-fold spurt over the last decade. The government has set an ambi tious target of Rs 50,000 crore in defence exports by fiscal 2029."

This growth is fuelled by a strategic push for self-reli ance, with 75 per cent of the modernisation budget allo cated to domestic procurement, leading to a surge in private sector participation. There is a strong emphasis on the in digenous manufacture of fighter jets, missiles, naval ships and UAVs, and private players and defence tech start-ups are spearheading innovations in Artificial Intelligence (AI), drones and cyber warfare technologies.

According to Col (Retd) Ajay Shukla, a senior defence analyst, there are 2-3 key factors that have triggered the growth in defence exports. The strategic orientation of the West has shifted from 'building up' China to 'de-risking' by moving manufacturing and technology to countries like In dia. Pointing out that "the private sector drove defence pro duction past Rs 1.27 lakh crore in 2024," Col Shukla adds, "India's strategic alignment with the West and exciting part nerships with companies like Boeing, Airbus and Lockheed Martin make it a preferred alternative." If a turning point has to be identified, it would be the Indo-US defence framework agreement of 1995 -- which was extended till 2005, then 2015 and then 2025 -- that recognised India as a key US partner, a country that had a certain stature, size, and ability to be a regional peacemaker. For the US, it meant shifting a lot of the manufacturing pro cess from China to India.

Maintaining that there were other turning points as well, Col Shukla reveals that "the Defence Procurement Proce dure (DPP) of 2012 was another major change that galvanised the defence sector, along with increased US-In dian industry partnership which was not there earlier." If any single trend has changed the defence landscape, it is the recognition by successive governments - first the UPA government headed by Dr Manmohan Singh and then the three successive NDA governments led by Narendra Modi -- that India is a country where you cannot leave ev erything to the public sector, and that the private sector should be encouraged to play its role owing to its efficiencies, abili ties and technological prowess. Little wonder then that in the fiscal 2025-26 budget, the Centre has doled out liberal incentives to the private sector for defence gear manufacture, which has galvanised such pro duction in the sector. Notes Col Shukla, "In the past, the private sector acted as a feeder that used to get the overflow from the public sector. But now, they work in tandem."

If the powerful entry of the private sector has injected a new dynamism into India's de fence sector, it is the 'Make in India' initiative that has fuelled the momentum. Thanks to the combination of these two de velopments, the country's de fence production reached a record level of Rs 1.27 lakh crore in fiscal 2023-24, with defence exports shooting up to an all-time high of Rs 23,622 crore in fiscal 2024 2025.

Claims a spokesman of the Defence Ministry, "Once dependent on foreign sup pliers, the country now stands as a rising force in indigenous manufacturing, sharpening its military strength through home grown capabilities. This shift reflects a strong commitment to self-reliance, ensuring that India not only meets its se curity needs but also builds a robust defence industry that contributes to economic growth." Strategic policies have fuelled this momentum by en couraging private participation, technology, innovation and the development of advanced military platforms. The surge in the defence budget from Rs 2.53 lakh crore in fiscal 2013-2014 to Rs 6.81 lakh crore in 2025-26 underlines the nation's determination to strengthen its military infra structure.

With modern warships, fighter jets, artillery systems and cutting-edge weaponry being built within the country, India is now a key player in the global defence landscape. The success of 'Make in India' has not only reinforced national security but has also positioned India as a dependable ex porter of defence equipment. This growing capability re flects India's vision of achieving self-reliance while shaping the future of advanced military technology, adds the De fence Ministry spokesman.

Interestingly, India has started making rapid strides on the export front. In the last 11 years, defence exports have registered an unprecedented growth from Rs 686 crore in fiscal 2013-14 to Rs 23,622 crore in fiscal 2024-25. In this performance, the indigenous arms industry has put up an excellent show by exporting defence equipment worth Rs 15,233 crore with public sector establishments contributing Rs 8,389 crore. India's diverse export portfolio includes bulletproof jack ets, Dornier aircraft, Chetak helicopters, fast interceptor boats and lightweight torpedoes. By now, the country exports defence equipment to over 100 countries, with the US, France and Armenia emerging as top buyers. The govern ment aims to achieve exports worth Rs 2,50,000 crore by 2029, reinforcing India's status as a global defence manu facturing hub while boosting economic growth. India has achieved the highest-ever growth in indig enous defence in value terms as defence production has surged to a record high of Rs 1,27,434 crore, recording an impressive 174 per cent spurt from Rs 46,429 crore in 2014 15. According to the defence ministry, 65 per cent of de fence equipment is now manufactured domestically, a sig nificant shift from the earlier 65-70 per cent import depen dency.

By now the country has set up an enviable defence industrial base with 16 defence PSUs, over 430 licenced companies and approximately 16,000 MSMEs. With the opening up the defence industry to the private sector and encouraging MSMEs to enter the sector, the In dian defence industry has started growing at a fast pace. With rising demand for defence equipment the world over in view of growing geopolitical tensions, and with rising exports from India, investments have started pouring into the sunrise sector. Little wonder, in recent years, the Indian defence manufacturing sector has seen several major in vestments and developments. The following are notewor thy:

It can then truly be said that the Indian defence sector is on the growth autobahn on the back of strong government backing, increasing private sector participation and highly liberalised FDI norms - all of which have enhanced domestic manufacturing capabilities, attracted international investment in defence innovation, and driven notable growth in exports of military equipment. On the strength of these developments, Care Edge Ratings estimates the Indian defence sector is set to grow at a CAGR of around 20 per cent during fiscal years 2025 to 2029, while maintaining a PBILDT margin of around 20 per cent. Indian defence sector companies are set to fur ther enhance the country's defence capabilities, reduce im port dependency and elevate its global stature.

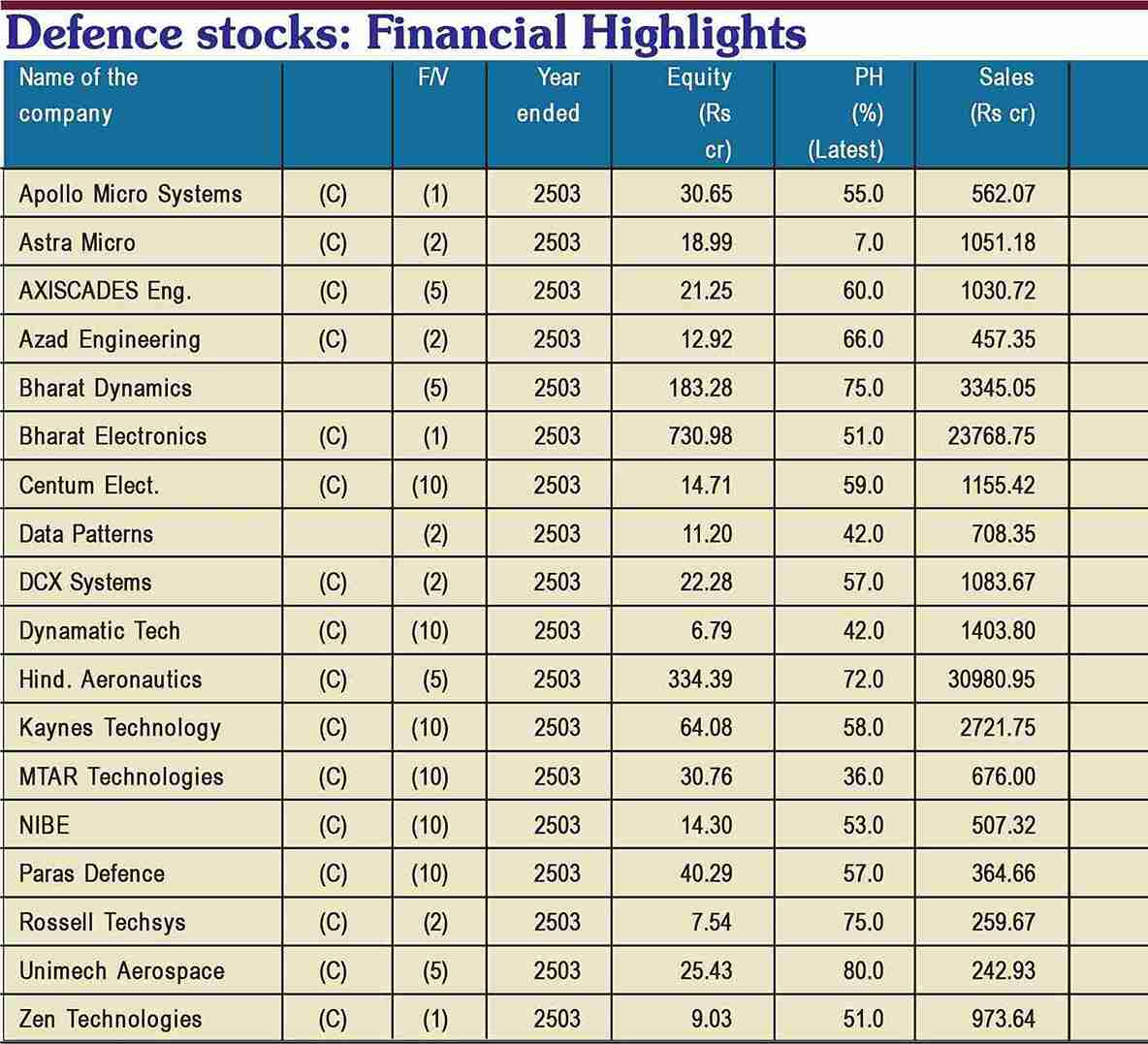

Little wonder that the defence industry has emerged as a new sunrise sector on the Indian stock exchange and in vestors rushing to add these stocks to their portfolios. These stocks had been moving up slowly and steadily, but during the last one year they have more than doubled. During the last one year, Astra Microwave Products has shot up from Rs 584 to Rs 1,130 and Centrum Electronics from Rs 1,140 to Rs 2,319, Data Patterns has spurted from Rs 1,350 to Rs 2,961, Cochin Shipyard from Rs 1,180 to Rs 2,307, Mazagon Dockyard, consolidating around Rs 1,545 a year ago, is in demand today around Rs 3,366 and Paras De fence is attracting buyers around Rs 1,605/1,610 as against Rs 802 a year ago, while Hindustan Aeronautics, which was resting at around Rs 3,045 a year ago, has buyers today around Rs 5,000/5,200.

The rush for defence stocks is quite understandable. First of all, the defence stocks sector is known for receiving a steady revenue stream. Very often, defence companies se cure long-term contracts, with the government providing a stable and predictable revenue stream. This stability may help buffer the companies against economic downturn and market volatility.

As India is facing geopolitical tensions on account of China strengthening its influence over our neighbours, in cluding Bangladesh, Sri Lanka, Nepal and Bhutan, besides Pakistan, China and Pakistan are continuously harassing India. It is not surprising that India feels the need to steadily increase its defence budget year after year. What is more, throughout the world geo-political ten sions are mounting. Russia and Ukraine have been at war for the last three years, the enmity between Israel and Arab coun tries is well-known, and China is continuously eying Taiwan and other neighours. In such a situation, it is obvious that the demand for defence equipment will continue to rise. In the 21st century, defence technology stocks are typi cally at the forefront of innovation. By investing in these companies, investors can gain exposure to cutting-edge tech nologies and developments in aerospace, cyber security and advanced weaponry. Investors in defence stocks are thus assured of robust returns.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives