Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2025

Updated: May 31, 2025

Prime Fresh Limited (PFL), the brain child of two first-gen entrepreneur broth ers - Jinen and Hiren Ghelani, has over the last 18 years become a leading player in the fruits and vegetables (F&V) supply chain business. PFL has a huge network of farmers, aggregators, cold storage players, packing houses, logis tics and other supply chain partners, apart from a strong network in six coun tries. Besides, Prime Fresh has built an covetable infrastructure of automated processes which could drive future growth. Significantly, while PFL reached Rs 207 crores in revenues in FY25, with PFL’s current infrastructure and manpower it could easily cross rev enues of Rs 500 crores over the coming 2-3 years. This speaks highly of the founder-brothers’ business acumen and long-term vision.

It’s an inspiring saga of two first-gen en trepreneur brothers, Jinen and Hiren Ghelani, who started their careers with jobs but nursed a burning desire to start their own venture.

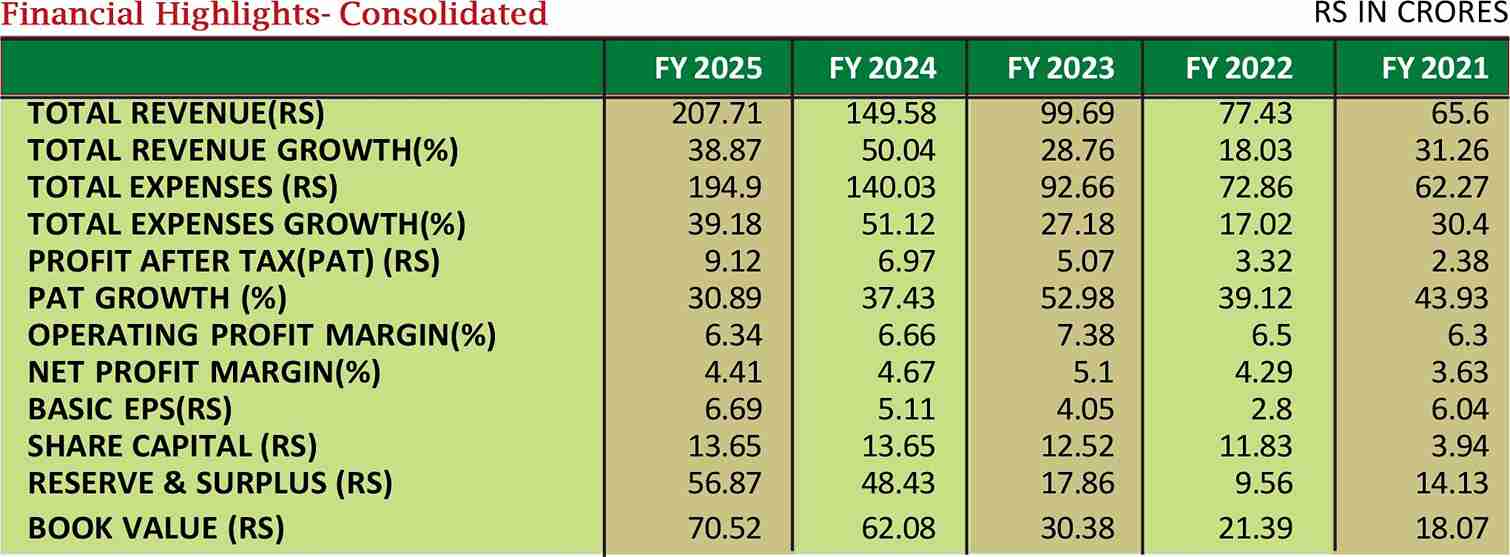

Headquartered at Ahmedabad and listed on BSE, Prime Fresh Ltd (PFL) has started spread ing its wings with an ambitious business plan in place, the company aspires to clock Rs 2,000 crores in agri-revenues by FY 2031. PFL has clocked impressive revenue growth in the year gone by from Rs 150 crores (FY24) to Rs 207 crores. It has also reported a CAGR of 30 per cent over the last 14 years.

Elder brother Jinen Ghelani gained valu able experience while working with Marico Industries and Subhiksha Retail, and became an expert in sales and operational manage ment, whereas younger sibling Hiren Ghelani, who landed in Mumbai in the year 1998 with only Rs 600 in his pocket after completing his BBA degree, gained invalu able experience in equity research and other investment avenues of capital markets. He was equally passionate about starting a busi ness, despite doing well in his stock market career. In the year 2007, the brothers no ticed that the horticulture sector was grow ing fast and offered huge opportunities as it was dominated to the extent of 85 per cent by unorganised players. Importantly, Jinen had already acquired a lot of know-how of the field and supply chain.

Thus, was born Prime Customer Services was later in 2019 renamed as Prime Fresh Ltd., with Jinen working full time while Hiren joined him later in 2008. A decade later in 2017, the company entered the capital market with an IPO of 12.14 lakh shares of Rs 10 each at a premium of Rs 50, and got listed on BSE’s SME platform. On 6th June 2025, the company migrated to the BSE main board, which in itself is a milestone as it will facilitate and attract retail partici pation. Today, the company is one of the leading players in the fruits and veg etables (F&V) supply chain bus iness. Reminisces Hiren Ghelani, founder and whole-time di rector, “Ini tially, the jour ney was a bumpy ride. We overcame all headwinds by learning les sons from them. Hard work, positiv

ity, team-building with a vision, and integrity as a core value has rewarded the PFL im mensely. PFL has earned respect and built a reputation in the Agri Value chain sector. Our role in directly contributing towards reduc ing post-harvest loss in the F&V segment has given us a lot of satisfaction.”

To ensure growth momentum, over the last seven years the company has built around 98 process systems, formats, forms, check lists, SOPs and trackers. This is the method ology which could eventually put the PFL’s business operations in ‘auto mode’. Opined Hiren, “This unique model has been built exclusively for our own captive use, keeping in mind our past experience and future re quirements. This platform will be acting as a spring board for growth of Prime Fresh.” Explaining their focus on quality man power, Jinen says, “It is essential to have a core team of quality personnel in our line of business. Thus, PFL invests in skilled and loyal employees, otherwise it is a big risk to the company’s sustainable growth. Further, the goodwill and credibility which PFL has built all these years could vanish if not dealt with care.”

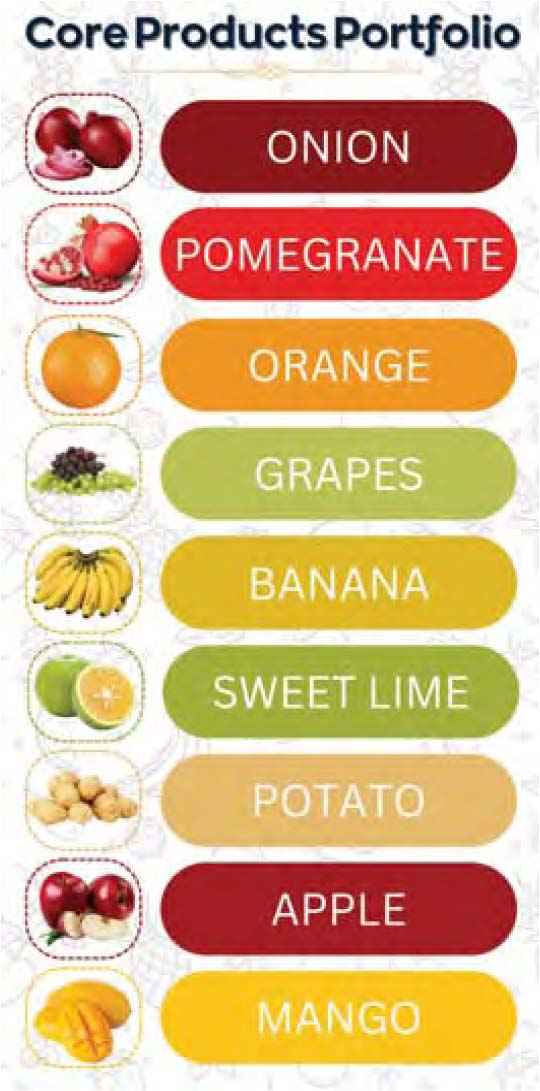

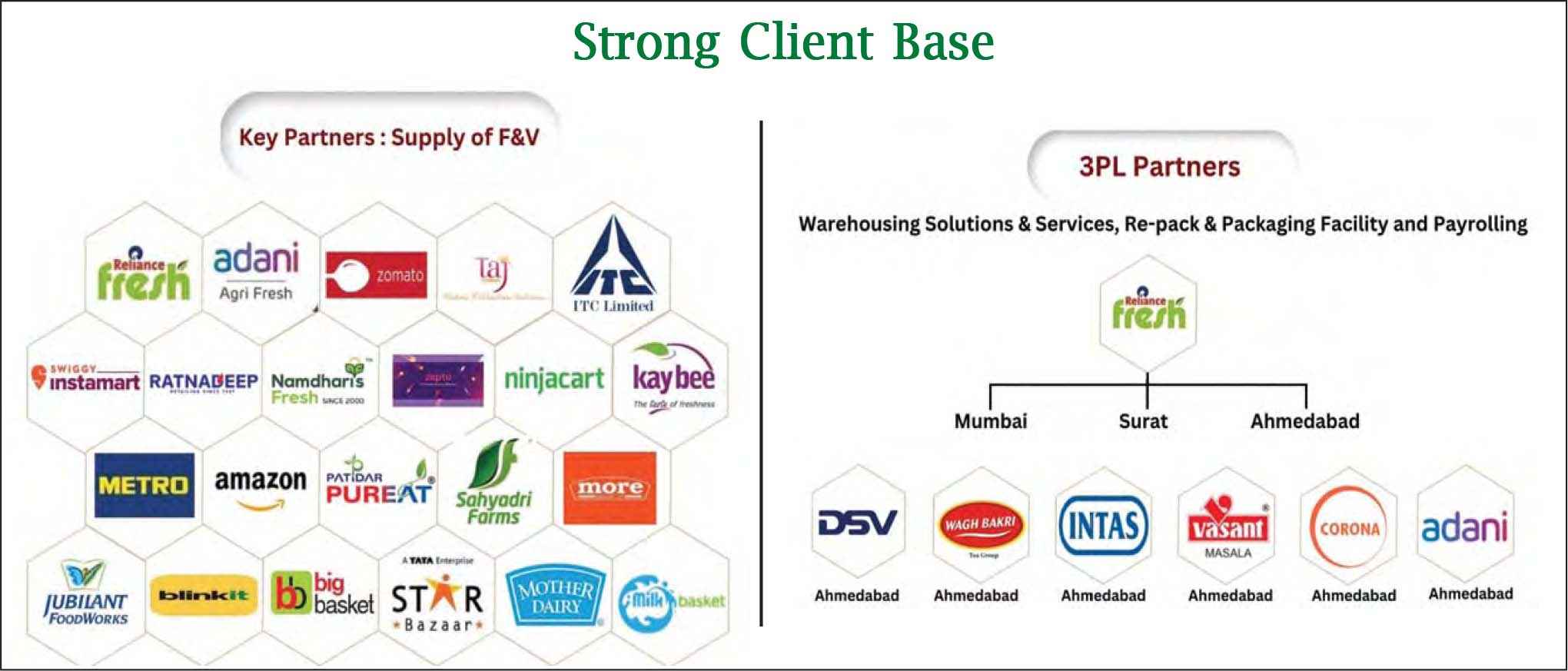

In a span of 18 years, PFL has carved a niche for itself as a leading post-harvest agri-management company. PFL has a huge network of farmers, aggregators, cold storage players, packing houses, logistics and other supply chain partners for F&V. The company boasts of a network of over 1,10,000 farmers, 88+ APMC markets, 2400+ trade part ners, 50+ large corporate B2B buyers, 20+ ex porters, and a strong presence in six countries. PFL’s procure ment capacity has increased significantly from 30,000 MTPA in 2019 20 to 1,80,000 MTPA at present.

PFL’s core team consists of 40+ agri-ex perts with an average experience of 25 years across the entire value chain, from seed to farming to processing & distribution. Whereas, PFL reached Rs 207 crore in rev enues in FY25.

It is worth noting that with the current infrastructure and manpower, PFL could cross revenues of Rs. 500 crores over the coming 2-3 years by utilising them judiciously. This speaks highly of the management’s business acumen and long-term vision. Prime Fresh has an integrated agriculture value chain with a focus on fruits & vegetables, post-harvest market link ages and 3PL (third party logistics) businesses. It operates from Gujarat, Maharashtra, Rajasthan, Delhi, Telangana and another 18 states across India.

During FY25, consolidated revenues reached Rs 207 crores, up by 39% from Rs 149 crores in FY24. Likewise, EBITDA, PBT and PAT were at Rs 12.38 crores, Rs 12.81 crores and Rs 9.21 crores respectively in FY25, vis-à-vis Rs 9.73 crore, Rs 9.55 crores and Rs 7.04 crores in the previ ous year. Currently, the equity capital is Rs 13.65 crores.

PFL has no long-term borrowings. As of March 2025, its bank balance of Rs 477 lakh is more than its short-term debt of Rs 435 lakhs, making it net debt-free. Notes Jinen Ghelani, “We believe in absolute financial discipline and, to the extent possible, we would be happy to maintain our ‘debt free’ status while aspiring to a ‘cash rich’ status.”

It’s worth mentioning that the management is prompt in taking timely corrective and remedial measures. For example, two distribution centres at Ahmedabad and Kolkata were not performing well, they were not cost effective and had other op erational issues and the management took a call and decided to close them down by taking a one-time hit. This shows the spirit of true entrepreneurship as, even if experiments are important for growth, proactive decisions are equally important.

Commenting on the company’s performance in FY25, Hiren points out, “We continued strengthening our strategic foundation during FY25 by achieving key operational mile stones despite challenges. Prime Fresh expanded its pres ence by launching a new distribution centre at Lucknow, which has started giving encourag ing results.”

Explaining the reasons for subdued EBITDA and net profit margins during the year, Hiren explains, “FY25 brought a couple of challenges and testing times. Unfavourable-erratic climate continued across major crops, disrupting sourc ing and impacting both quality and quantity. In addition, inflationary pressure and local com petition also posed hurdles in maintaining the desired profitability. Moreover, due to liquidity constraints in general, we experienced a delay in receivables, disturbing the working capital cycle. As a prudent accounting practice, the management de cided to write off Rs 78 lakh as bad debts and also identified around Rs 400 lakh as slow/non-moving receivables.”

To overcome the slow recovery and fear of potential debts, the company set up a team led by a senior official who would identify such customers well in advance and oversee aggressive follow-up. This initiative has started showing positive results and will help to further improve the working capital cycle. On the company’s outlook for FY26, Hiren says, “Prof itability improvement and revenue growth are our top prior ity. In this regard, we will continue to focus on volume-led growth backed by strengthening the supply chain eco-sys tem. This will de-risk and reduce our dependency on existing customers and markets. A broader customer base and ex panded geographies will certainly brighten the company’s growth dynamics.”

In order to improve profitability further, PFL is looking to scale up capacity utilisation, making the export vertical very strong, joining hands with food processing players, expanding e-commerce and widening the scope of the Omni channel sales strategy.

Overall, farm gate prices are likely to come down in the current financial year, mainly because of a better ex pected monsoon and increased volumes. Some crops are likely to see an improved yoy yield, supported by higher acreage. PFL’s field and market research team has con cluded that the availability of onions, potatoes, tomatoes, oranges, grapes, pomegranates, mangoes, sweet limes, etc., which broadly form PFL’s product basket, will remain fairly improved this year compared to the previous year. This augurs well for PFL.

During the current FY26, PFL is determined to focus on consolidation, cost rationalisation, scaling up, and pro ductivity enhancement with an eye on improved value added products, with an aim to improve EBITDA and NPM. Simultaneously, the company will pursue win-win col laborations with companies that have innovative concepts/ projects, which could complement PFL in its overall growth trajectory. Special efforts will be made for incremental growth in Uttar Pradesh, Maharashtra and southern India. The organised F&V industry has an exponential growth potential. As per one estimate, the industry size could grow from $ 25 billion in 2022-23 to $ 150 billion by 2029-30. However, as per recent market intelligence, the competitive intensity in national B2B F&V industry is expected to slow down. This could also adversely affect fresh investment for some time.

In order to meet the company’s additional capital re quirements after the IPO, it has come out with a couple of preferential issues to the non-promoter and promoter groups. Last year, PFL raised Rs 24.72 crores by issuing 11,22,819 shares to the non-promoter group at Rs 220.16 each (including a premium of Rs 210.16). On 11th June 2025, 9,60,000 equity warrants have been issued to the promoter group at Rs 164 each. Whether big or small – all actions being taken at PFL are towards achieving the revenue mark of Rs 2,000 crores by FY31. Currently, the company’s stock is being quoted at around Rs 200 with a market capitalisation of Rs 270 crores. A strong business model, assured accelerating growth, bright future prospects and, most importantly, experienced promoters with enviable immense integrity will certainly attract investors looking for decent portfolio appreciation.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives