Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: May 31, 2025

Updated: May 31, 2025

SEPC Limited formerly known as “Shriram EPC Limited” is a listed public limited company in the field of engineering procurement and construction (EPC Contractor) business in water and municipal services, road, industrial EPC & min ing, incorporated in June’2000 and listed in 2008. Its scope of work includes design, procurement, construction and commissioning of projects on turnkey basis.

The company has suite of engineers and employees with sector specific specialised knowledge. The company has also a suite of softwares on project management, design like MS Project, Primavera, AutoCAD, Teckla, and StaadPro etc. The company owns equipment for civil construction and material handling equip ment like cranes, hydra, batching plant etc. Further, the company also owns shaft sinking equipment which are specialised equipment for mine development.

SEPC has a robust clientele comprising of various Central and State Government agen cies such as Ahmedabad Urban Development Authority (AUDA), Kerala Water Authority, Gujarat Water Supply & Sewerage Board (GWSSB), Ahmedabad Municipal Corporation (AMC), Gujarat Water supply & Sewerage Board, Tamilnadu Water and Drainage Board, Karnataka Urban Infrastructure Development Finance Corporation, Bangalore Water Supply & Sewerage Board, Chennai Metro Water Supply & Sewerage Board, Durgapur Steel Plant, Bokaro Steel Plant, SAIL LISCO, Vizag Steel Plant among others.

SEPC implemented a Resolution Plan (RP) on 30th Sept’22 under RBI Circular dated 07th Jun’19 with change of Management. SEPC fully complied with the terms of RP.

SEPC had a Fund based debt of Rs 907 cr on the date of implementation of RP in Sept’22. This was reduced to the extent of Rs 350 cr out of funding by the promoter (Mark AB Capital Investment LLC, Dubai (Mark AB)) and another Rs 350 cr of debt was converted in to long dated securities, NCD & CCD of Rs 175 cr each. The NCDs are to be redeemed over a period of 14 Years and CCDs are to be converted in to Equity at the end of 14 years. As of 31st Mar’25, the outstanding debt was Rs 72.05 cr of Cash Credit and Rs 18.33 cr of Term Loan. In Jun’25 company is going in for Rights Issue of Rs 350 cr out of which Rs 15 cr will go for further reduction in bank debt & Rs 140 cr are earmarked for retiring the NCD of Rs 172 cr outstanding as on 30th Apr’25. Hence, the company will be debt free by Mar’26 with only cash credit limit of about Rs 60 cr and term loan of about Rs 15 cr.

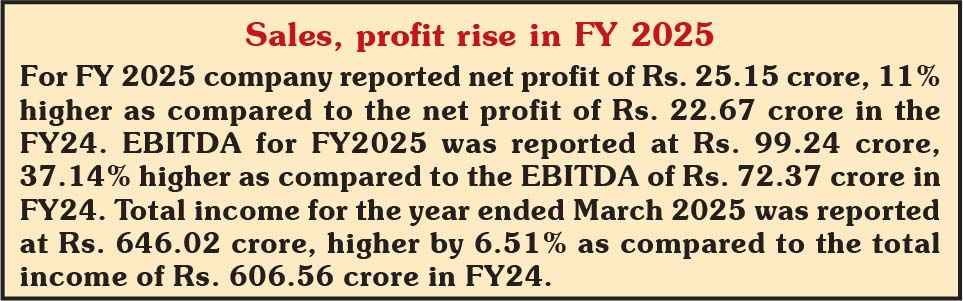

The company has recorded all-round improvement in performance parameters like turnover, profitability and EBITDA Margin etc, post implementation of Resolu tion Plan (RP). The company has come a long way by registering an operating profit of Rs 39.21 cr in FY 25 (9 months) compared to an operating loss of Rs (142.62) cr in FY 22, which are substantiated from the following table:

Successful Rights Issues May 2023: ¹ 50 crore rights issue for working capital, oversubscribed by 2x, highlighting strong investor interest. Dec 2023 & July 2024: Additional rights issues of ¹ 50 crore (Oversubscribed by 5x) and ¹ 200 crore (oversubscribed by 2x) focused on debt reduction and working capital. Proposed ¹ 350 crore rights issue: Reinforces commitment to strengthen the balance sheet and ensure liquidity. Credit Rating: The company has BB+ Rating for the Bank’s Fund and Non Fund Exposure from CRISIL, which is valid till 31st Mar’26. New Initiatives: SEPC has embarked on several initiatives for development of business which are outlined below;

The above initiatives are opportunities for growth in the years to come.

3.0 MTPA Capacity Cement Manufacturing Plant in Uzbekistan – Value in ex

cess of US $ 325 Mn

During FY 25, the company’s wholly owned subsidiary M/s Shriram EPC FZE has re

ceived the notice to commence work on Construction of Cement Project at a total project cost

in excess of USD 325 Million (equivalent to in excess of Rs 2,700 Cr at current Exchange Rate)

from M/s JV OHONGORON SEMENT MS LLC at Tashkent, Republic of Uzbekistan.

The scope of the project will be Design, Engineering, Project Management, Civil

Works Supply, Erection, Testing and Commissioning of a 3.0 Million Tonnes Per

Annum greenfield Cement Manufacturing facility on EPC Basis at Urgaz Village,

Akhangaran District, Tashkent, Republic of Uzbekistan.

The project is to be executed in thirty months with funding from Mark AB LLC,

Dubai (our promoter). As the WOS do not have any manpower this will be executed

with the team from SEPC. This will also improve our top-line as well as bottom-line.

Roshn Infrastructure, Riyadh Saudi Arabia: SEPC Limited has signed a

framework agreement with M/s Roshn, Riyadh, Saudi Arabia to the tune of SAR 893

mn equivalent to INR 2,200 cr for executing Civil Infra works of Housing Projects in

Jeddah region. The project needs to be completed within a period of three years from

the date of award of contract. The call of order is expected in Jun’25.

Tenders in Pipeline: The company has participated in Domestic Tenders / Bids

worth Rs 4,300 cr, which are under various stages of evaluation and approval. Further,

company has also participated in international tenders with the help from promoters.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives