Fortune Scrip

Published: November 15, 2025

Updated: November 15, 2025

Flying high on backward integrated model: Poised for re-rating

With the stock market unnerved by national and global uncertainties, stock prices have been

dawdling aimlessly with a downward inclination. And with the US dollar getting stronger by the day

and the rupee steadily losing ground, foreign investors have been inclined to unload their holdings. Moreover, taking a cue from dishonest market operators, unscrupulous promoters are playing

dirty games.

In these circumstances, selecting a Fortune Scrip becomes a challenge. In order to protect the

interests of our readers, we did a good deal of searching and found a small-cap scrip with strong

fundamentals and sustained growth prospects. Not many investors may be familiar with the name

– it is south-based Hariom Pipes Industries.

Mehboobnagar (Telangana)-headquartered Hariom Pipes is a vertically integrated leading

manufacturer of a wide range of iron and steel products, including various types of pipes, tubes and

coils, scaffolding, HR strips, MS billets and sponge iron. The company uses iron ore to produce

sponge to manufacture its final products — MS pipes and scaffolding — making the manufacturing process cost-effective. In fact, Hariom is one of the lowest-cost producers of MS pipes in the country.

According to our research, the company is poised for an exceptional growth trajectory, fuelled

by a ramp-up in capacity, accelerated galvanised product sales via an established and extensive

dealer network mainly in northern and western India, and favourable industry dynamics. Its backward integrated model stands as a testament to its strategic execution and is primed to scale effortlessly with rising capacities. Its tandem mill further strengthens Hariom’s market edge of production

of sub-2 mm pipes – a true differentiator. With a turbocharged combo of an improving cash conversion cycle, rising return ratios, debt-to-equity metrics and resilient margins, Hariom is all set for

robust growth and we strongly feel that the small-cap (equity capital Rs 31 crore) stock is poised for

a re-rating as soon as the uncertainties in the market environment start declining.

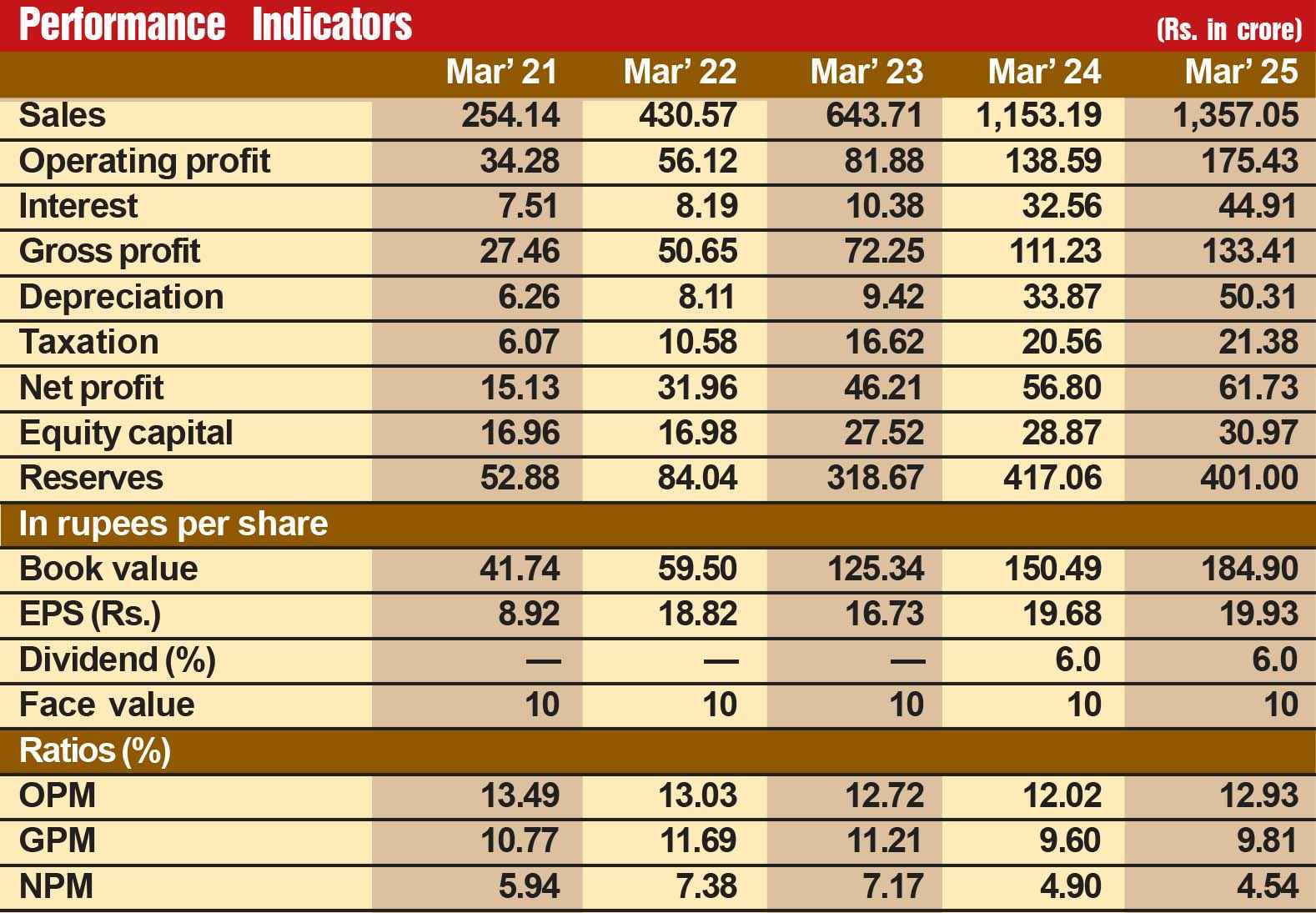

SALES SURGE

Despite a challenging market situation, Hariom is going from strength to strength in its financial

performance. During the last 10 years, its sales turnover has continuously risen from Rs 87 crore in fiscal

2017 to Rs 1,604 crore in fiscal 2025, suggesting a spurt of over 18 times. In the same period, its operating

profit has spurted 25 times from Rs 7 crore to Rs 175 crore, with the profit at net level shooting up 31 times

from Rs 2 crore to Rs 62 crore. The company’s financial position is also very strong, with reserves at the end

of March 2025 standing at Rs 574 crore — over 18 times its equity capital of Rs 31 crore.

But we have not selected this company as the Fortune Scrip only on account of its laurels so far.

We are confident that Hariom’s prospects are robust going ahead, once the challenging market

environment comes to an end. Consider:

-

The company’s differentiated strategy of a backward integrated manufacturing chain, spanning sponge iron to billets, HR strips and MS pipes & tubes enables it to clock industry-leading

margins, while also allowing it to optimise value addition at each stage of production and make agile,

market-driven decisions on internal use versus external sales. Moreover, the company’s dealer-based

distribution model eliminates distributor commissions. All intermediate products required for the

manufacture of its final products are produced in-house, such as sponge iron, MS billets and HR

strips. The finished product from each of its processes acts as an input for the next alternation of its

product mix, as per market demand and supply, market price and the available gross margins. For

example, its induction plant output – MS billet — can be segregated and sold independently or can be

an input for its rolling mills. Further, the output of its rolling mills – MS strips – can be sold independently or can be an input for manufacturing MS pipes. This ability to change the product mix as per

market demand and supply dynamics is a major strength and differentiator of Hariom.

IN-HOUSE

-

The integrated nature of its operations is a major plus point for Hariom. It uses iron ore to

produce sponge iron, which is then processed across various stages for the manufacture of its final

products - MS pipes, billets and scaffoldings -- making its manufacturing process cost-effective. All

intermediate products required for the manufacture of its final products are produced in-house,

such as sponge iron, MS billets and HR strips. The finished product from each of its processes acts as an input for the next product as per market demand and supply, market price and the available

gross margins. Thus, the company is able to face competition from other industry players effectively

as its products are a result of backward integration. Backward integration has its own cost and

savings advantages which competitors may be lacking, giving the company a competitive advantage.

It has also built into its manufacturing process some flexibility as to thickness, length and quality of

its products, which enables customisation and leads to better margins for its products. Hariom constantly endeavours to improve its productivity levels through optimum resource

utilization, improvements in the manufacturing process, skill up-gradation of its workers, and modernization of machinery to achieve better asset turnover. Its continual improvement of manufacturing processes helps identify bottlenecks and correct them. This helps the company improve efficiency and put its resources to optimal use. It has a team of chemists and engineers who strive to

improve the production methodologies by conducting experiments and creating innovative prototypes to enhance its manufacturing processes.

MORE PRODUCTS

- Hariom is expanding the product range to add more value-added products. MS pipes and

scaffoldings are the end products that are manufactured from the conversion of sponge iron to HR

MS billets and HR strips. It provides a range of product specifications in MS pipes and scaffoldings in

terms of thickness, length, quality, availability, and customisation. The company intends to further

enhance its value proposition by manufacturing value-added products which have better margins

and wider markets. Some value additions to its existing products include the following:

MORE PRODUCTS

- Hariom is expanding the product range to add more value-added products. MS pipes and

scaffoldings are the end products that are manufactured from the conversion of sponge iron to HR

MS billets and HR strips. It provides a range of product specifications in MS pipes and scaffoldings in

terms of thickness, length, quality, availability, and customisation. The company intends to further

enhance its value proposition by manufacturing value-added products which have better margins

and wider markets. Some value additions to its existing products include the following: (a) Rust-Free MS pipe: These are anti-rust oil coated MS pipes which prevent rusting of MS Pipes. (b) End facing of MS pipe: This process provides a softer finish to the MS pipe thereby avoiding

injuries due to sharp edges. (c) Packaging: It use packing strips/tapes for packing its MS pipes to enable easy movement from

one place to another. Hariom continues to invest in increasing its operational efficiency throughout the organization. It is addressing the increase in its operational output through continuous process improvement,

QC/QA activities, customer service, consistent quality and technology development.

STEEL PLANT

-

The company has embarked upon an ambitious expansion programme. It has signed an

MoU with the Maharashtra government to establish an integrated steel plant in Gadchiroli by investing

up to Rs 3,135 crore. The state government will facilitate necessary approvals and assist in accessing

fiscal incentives. The plant will have an initial capacity of 1.5 mtpa, will be implemented in phases, and

will be completed within eight years. The new project represents a significant expansion of the company's

manufacturing capabilities and could potentially strengthen its position in the steel industry.

-

Hariom has also announced its entry into the renewable energy sector with a 60 MW solar

power plant project and the incorporation of a new subsidiary - Hariom Power and Energy Ltd.

GROWTH TARGET

The company's future prospects are highly promising. For the next two years, it has targeted a

30% volume CAGR. Its focus on value-added projects and strategic expansion positions it well for

strong growth in the coming years. With capacity expansion, market reach, and entry into the

renewable energy sector, the company is poised to capitalise on the growing demand for steel

products in India's infrastructure and construction sectors. Its emphasis on sustainability and operational efficiency is likely to contribute to its long-term growth and profitability.

In the current bearish phase in the stock market, the Hariom stock is quoted around Rs 368.

Discerning investors with a long-term perspective should take a chance and invest in the stock,

which we are confident is all set for rerating.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access