Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: November 15, 2025

Updated: November 15, 2025

Though the primary market is buzzing with frenzy activity and euphoric investor buying, investors will have to be cautious with over-valued stocks and OFS-led IPOs

IN scenes reminiscent of the great California gold rush of yesteryear in a still-young America, investors of all hues are hungering for a slice of the cornucopia of IPOs on offer this year.

IN just the January-September period of 2025, over 240 companies have raised a record $ 10.5 billion, making India the third largest market globally in terms of IPO collections.

AND if market observers are to be believed, the total IPO kitty could reach a humongous $ 20 billion by year-end. But the fly in the IPO ointment is the growing trend of overstretched valuatons and funds being garnered more from Offers for Sale (OFS).

MARKET watchers note that an IPO dominated by OFS is fundamentally a transfer of ownership, not an investment in future growth. In other words, investors are not fuelling the company’s growth, they are just facilitating the exit of previous backers. The time has surely come for market watchdog SEBI to crack down on these investor-unfriendly trends.

The billion-dollar Indian primary market is buzzing with unprecedented activity in the current year. Akin to the famous California gold rush of the mid-1800s, institutional and retail investors are in a race to subscribe to the fund-raising programmes of various companies – large, medium and small. Over 240 mid-and small-cap companies have raised a record $ 10.5 billion in the first nine months (January to September) of 2025, making India the third largest market globally in terms of funds raised via IPOs.

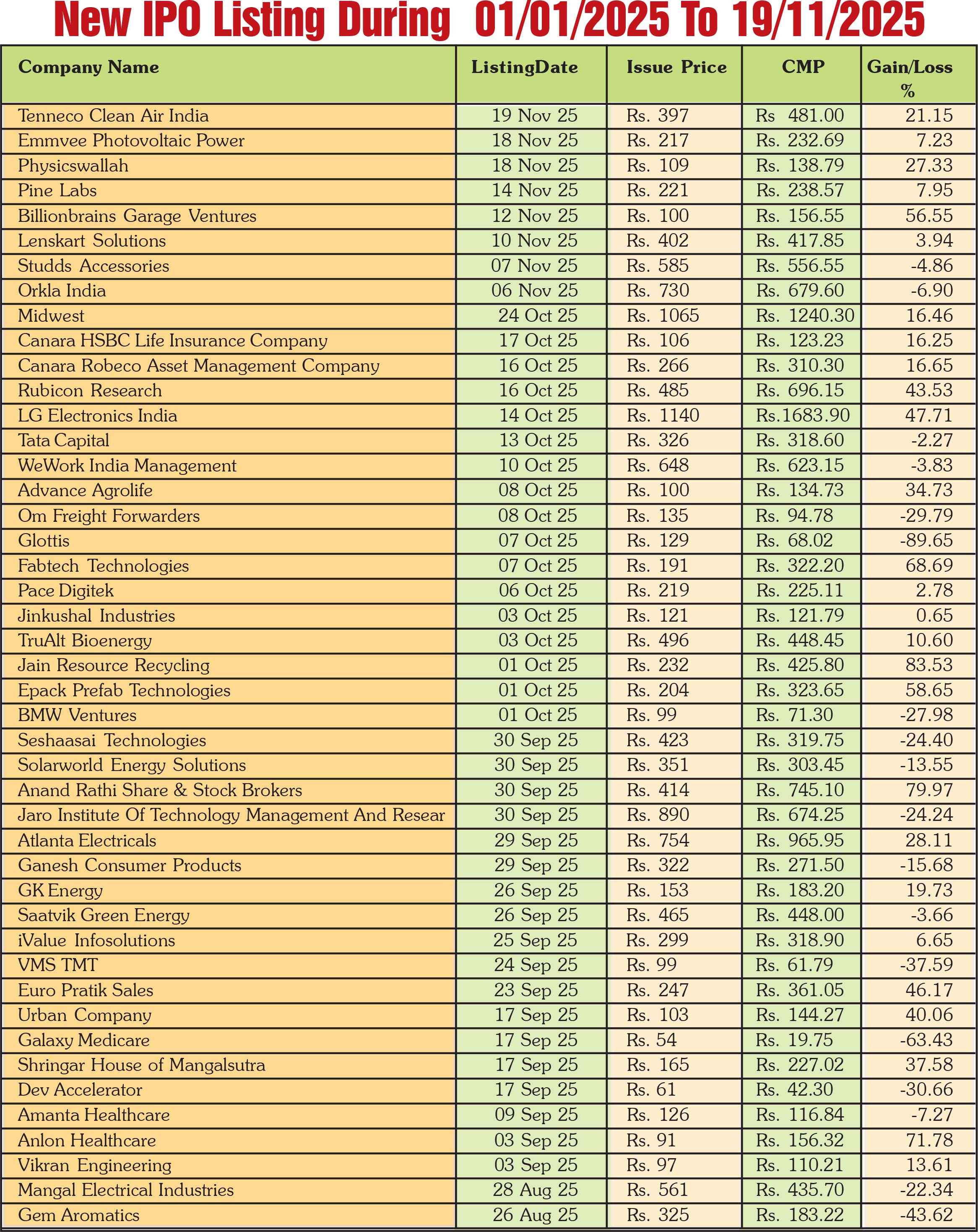

What is more, investor hunger for IPOs is growing by the day. There are some nine or ten large-sized IPOs lined up to enter the capital market in the last quarter (October to December) of 2025. Some eagerly awaited IPOs like Tata Capital and LG Electronics India have already been listed on both the national exchanges. The size of the Tata Capital IPO was the largest for this year at $ 1.5 billion while the South Korean electronics giant’s Indian arm was aiming to raise $ 1.3 billion.

Other companies which have entered of are set to enter the capital market include ICICI Prudential Asset Management, ed-tech firm PhysicsWallah (listed on November 18 on both exchanges), AI service firm Fractal Analytics and non-bank lender Credila Financial, and their bankers are busy with road shows to gauge investor demand. Observers believe the total amount that stands to be raised through the IPO route during all of 2025 could reach a mammoth $ 20 billion.

Multinational companies are not lagging in eyeing the IPO route as there is abundant money supply in India on account of rising incomes and dwindling investor interest in other avenues like real estate, company fixed deposits and bank deposits, while precious metals are seeing a runaway rise in prices. Many investors have already come up trumps by investing in stocks in general and IPOs in particular.

A powerful factor behind this surge is the fact that are no restrictions on fixing IPO prices. Unlike the days of the Controller of Capital Issues, the present regulator of the capital market, Securities and Exchange Board of India (SEBI), does not bother about the offer prices fixed by companies. In these circumstances, merchant bankers vie among themselves to suggest very high, even exorbitant, prices to company promoters, and the latter play along by opting for bankers who can get them extremely high prices for their stocks. Hence, large companies, including MNCs, are eager to take the IPO route as they are assured valuations that are at times far beyond their expectations.

In recent years, investors have minted money through select IPOs. The benchmark Nifty50 index is up just 4.3% in 2025 so far, lagging behind Asian and emerging market peers. By contrast, IPOs have returned 12% on average on listing day in 2025. Of the 59 large IPOs listed on main exchanges this year, as many as 42 rose on debut. Among the IPOs that have ensured high returns to their investors, electric motor maker Ather Energy Ltd has more than doubled since listing. Korean electronics giant LG’s Indian arm, LG Electronics India, made a stellar stock market debut, listing at a premium of 50% to its issue price of Rs 1,140 per piece. Notes an expert, “This is the best listing for a billion-dollar Indian IPO since Eternal, the parent of food delivery and restaurant-listing platform Zomato, debuted in 2021.”

Last year, the Softbank-backed food and grocery delivery platform Swiggy listed at a 5.6% premium and extended gains through the day, signalling growing investor confidence in the segment. NTPC Green Energy, which entered the capital market a year ago in November 2024, saw its shares jump as much as 145% on debut. HDB Financial Services, the non-banking financial arm of HDFC Bank, the country’s largest private sector bank, jumped 13% on listing, notching up a valuation of $ 8.2 billion as investors bet on long-term growth prospects in the world’s most populous country with a head count of 140 crore.

Quick to spot these huge gains, investors have rushed to subscribe to IPOs. At the same time, the surge in IPOs reflects a desire of companies “to seize the window of opportunity after a relatively quiet first half of the year,” notes Kailas Soni, head, India equity capital market, at Goldman Sachs

The resilience in the IPO market has also been driven by a strong appetite from retail as well as institutional investors. Even foreign investors, who have been unloading their holdings in the secondary market, have joined the IPO rush. Little wonder then that many Asian firms are prompted to try listing their local units.

Companies across a range of sectors, from LG Electronics to Tata Capital, are increasingly tapping the primary market. And it’s not just the larger firms. In recent years, smaller and mid-sized companies, and even start-ups like eyewear firm Lenskart, stockbroker Groww and fintech firm Pine Labs are flocking to the market. There are expectations of public offerings this year surpassing those of last year. Globally, India, along with the US and China, accounted for the bulk of IPO activity during the third quarter of the year as per EY. All this indicates the capacity of the Indian market to absorb large issues.

There is a growing IPO ‘appetite’ from both institutional and retail investors, with the latter seeing participation beyond the country’s Tier 1 cities. The sharp increase in the number of demat accounts over the past few years, and the continuing surge in SIP flows, are indicative of the growing share of household savings flowing into the market. Besides, the stock market regulator recently made changes to the IPO framework that would help increase the participation of institutional investors.

However, despite the substantial post-IPO gains for investors in IPOs in the case of select stocks, all is not well with the Indian IPO market. The surge in liquidity sits uncomfortably with concerns over stretched market valuations. Questions have been raised over the steep valuations being sought by some companies. In the recent past, some IPOs have underperformed due to aggressive pricing, with shares of many companies trading around or lower than their offer price.

Knowledgeable market observers note, "In this euphoria, when the IPO market is booming, one should not ignore red flags. Though there is a mad rush to subscribe to new IPOs, investors are not the winners in each case. The reality of the IPO market here is that though a few IPOs dole out rich returns, many others yield negative returns and investors, particularly retail investors, lose their hard-earned money."

Significantly, BSE Ltd's gauge of newly listed firms - which tracks companies for a year after debut - is lagging the broader market and is on course for its first under-performance since 2022. About 40% of the 108 companies in the IPO index are trading below their offer price, with a dozen down more than 25%. The slowdown in post-listing gains - even turning into losses - comes even as fund-raising from first-time shares nears last year's record of almost $ 21 billion, highlighting the quixotic nature of the market, that too in a boom period.

This phenomenon is largely the result of over-valuations. Taking advantage of the IPO boom and strong investor demand, even fundamentally weak companies fix their offer price exceedingly high on the advice of unscrupulous investment brokers. In the days of the Controller of Capital Issues, the offer price was fixed on a scientific basis and merchant bankers were not allowed to fix the price as per their whims and fancies. But under the guise of a 'free pricing' regime, SEBI gives full freedom to promoters and their merchant bankers to fix the offer price as they like, provided they point out in the prospects how they have arrived at these prices. Little wonder that, as per analysts, only a few IPOs from 2023 to 2025 have provided lasting returns. Most have either been stagnant or have traded below their initial listing price. Of the 93 listings in 2025 so far, 57 stocks are currently trading with gains, while the remaining are stagnant or are quoted below their issue price.

According to Ponmudi R, CEO of Enrich Money, overpriced IPOs are emerging as a new warning signal in India's primary market. He notes, "The growing rush to chase lofty valuations, often driven by hype and aggressive anchor participation, blur the line between confidence and complacency. When market prices drift too far from earnings reality, it is retail investors who bear the brunt, undermining the very trust and participation that sustain the market's long-term vitality."

Companies with limited profitability, a modest track record, or uncertain future cash flows have been demanding valuations that even established, well-managed listed companies do not command. This valuation leap is often justified through glossy pitch decks, future projections and narratives of disruption. In many cases, companies adopt an aggressive accounting approach to paint a picture of accelerated growth and expanding margins just before going public.

Another dangerous red flag in the current IPO ecosystem is the OFS ('offer for sale') route. Promoters and early shareholders, including private equity firms, who acquired shares of the company years earlier at vastly lower valuations, and who are close to the promoters, know everything about the company - for instance, whether the stock is overvalued by 10 times or 50 times at IPO time. If these investors sell their shares at the time of the IPO, they in effect commit a fraud on the investing public. When an IPO is dominated by OFS, its purpose changes entirely. Says Tarun Singh, Managing Director of Highbrow Securities, "An IPO dominated by OFS is fundamentally a transfer of ownership, not an investment in future growth. Investors are not fuelling the company's growth, they are just facilitating the exit of previous backers."

In such cases, the company's balance sheet remains unchanged. No new funds comes in for expansion of capacity, product development, diversification of activities, or debt reduction. In other words, this means that this completely alters what an IPO represents. A major promoter sell-down during an IPO often confuses retail investors. Points out Mr Singh, "The promoters' decision is rarely casual. A large promoter sell-down at listing is rarely just about diversification. It is a calculated decision."

Points out Ratiraj Tibrewal, CEO of Choice Capital, "Investors should examine such moves closely. A large promoter sell-down at the time of listing is not automatically a red flag, but it is certainly a signal investors should pay attention to."

Market data through 2025 so far shows a clear shift in the way IPOs are structured. A growing share of the money raised in this year's public issues has come from OFS rather than fresh capital.

CA detailed study of IPOs that have entered the market this year so far clearly indicates that there has been a perceptible shift in the money raised in this year's IPOs as most of the funds have come from OFS rather than fresh capital. In many of the prominent listings, OFS has accounted for the bulk of the issue size, signalling the fact that of late more IPOs are being used as exit routes for existing shareholders than as fundraising tools for the company. Investors and observers often assume that IPO proceeds help strengthen the company, enabling it to expand capacity and/or diversify product range and/or eliminate debt which can improve profitability of the company. But OFS-heavy IPOs do little more than change ownership of shares from early investors to new investors. And of late, OFSheavy issues have crossed all limits.

For example, Korean firm LG Electronics' entire issue of Rs 11,000 crore went to the Korean promoter. In the case of Tata Capital IPO, over Rs 8,600 crore was an offer for sale by promoters and other early investors. The entire Rs 3,000 crore issue of We Work India was an OFS by existing shareholders.

Over-pricing and an increase in OFS are serious warning signals for sustainable growth of the primary market. Unfortunately, SEBI is totally silent on the issue. This is intriguing as SEBI has been set up to protect the interests of shareholders and strive for a robust growth of the stock market. The time has surely come when SEBI should take stern action against investment bankers and promoters who fix exorbitant prices for their IPOs.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives