Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: October 31, 2025

Updated: October 31, 2025

All of 66 years old, Oil India (OIL), a Maharatna CPSE that is listed on NSE and BSE, is fuelling India’s energy needs. The company is into the upstream segment of the oil & gas industry, primarily dealing with the exploration and production of hydrocarbons, i.e., crude oil and natural gas. It also has a majority stake of 69.63% in the Numaligarh refinery (NRL) in Assam. The government of Assam and Engineers India Ltd hold the remaining stake in the ratio of 26% and 4.37% respectively.

NRL has a current capacity to process 3 million mtpa of indigenous crude oil and an expansion project is underway to increase this to 9 million mtpa at an investment of over Rs 28,000 crore. The capex also includes setting up a crude oil import terminal at Paradip port in Odisha and laying a 1,640 km pipeline for transporting imported crude oil to the Numaligarh refinery.

OIL has completed the mechanical portion of one of its flagship infrastructure projects — upgradation of facilities of the Numaligarh-Siliguri Product Pipeline (NSPL). The project aims to enhance the transportation capacity of the existing pipeline from 1.72 mmtpa to 5.5 mmtpa, thereby strengthening OIL’s midstream infrastructure to handle increased product flows from NRL.

This achievement underscores OIL’s capability for successful execution of the ongoing NRL expansion project, which will increase refinery capacity from 3.0 mmtpa to 9.0 mmtpa. The NSPL upgradation project spans Assam and West Bengal, comprising five pump stations and one receipt terminal.

The company operates in over 92,888 sq km of total acreage, which includes 39,624 sq km in overseas producing assets. It has a wide presence in seven different countries, comprising ten projects. These countries are Russia, Venezuela, Nigeria, Mozambique, Libya, Bangladesh and Gabon.

Giving an account of its investments in Russia’s Vankorneft and Taas Yuryakh projects, Dr Ranjit Rath, Chairman & MD, said, “We had invested about $1 billion in these two projects and have recovered $ 942 million, representing over 91% of the original investment, with full recovery expected in the coming year. However, about $ 330 million worth of dividends remain stuck in OIL’s bank accounts in Russia due to US sanctions.”

Elaborating on the company’s overseas ventures, he said, “OIL maintains a strong presence in producing and developing assets across Russia, Venezuela and Mozambique through joint ventures. These assets contribute significantly to the company’s reserves and production portfolio, with cumulative production of 2.097 mmtoe (metric million tonnes of oil equivalent) during FY25, primarily from Russia.” OIL, ONGC Videsh and Bharat PetroResources Ltd hold a 23.9% stake in JSC Vankorneft and 29.9% in LLC Taas-Yuryakh, subsidiaries of Rosneft Oil Company.

TotalEnergies with a 26.5% stake is the project operator of the Mozambique LNG project, followed by Mitsui & Company with 20%, Mozambique’s state-owned ENH with 15%, Indian state firms ONGC Videsh, Bharat Petro Resources and OIL together with 30%, and the remaining 8.5% held by PTTEP of Thailand. As such, OIL itself holds a 4% stake in this particular project. Going by the estimated total valuation of $ 20 billion, the company’s share is valued at $ 800 million (Rs 7,120 crore).

On the LNG project, Dr Rath said, “Construction is expected to resume by 2025. The company has invested in a world-scale LNG project which will establish a 13.12 mmtpa, low-carbon, integrated two-train LNG facility. With improved security conditions, the project is well-positioned to start to meet the growing demand of the Indian gas market.”

OIL and Bharat Petroleum Corporation Limited (BPCL) both formalised a joint venture company (JVC). The JVC will create a gas distribution network in Arunachal Pradesh, which includes the establishment of compressed natural gas (CNG) stations and the provision of piped natural gas (PNG) to domestic, commercial and industrial consumers. This initiative aims to enhance access to clean energy with the vision of fostering a gas-based economy.

Speaking on the occasion, Dr. Rath stated, “The establishment of city gas distribution in Arunachal Pradesh is a significant step in OIL’s ongoing initiative to realise the vision of bringing clean and reliable energy to the region. OIL has a long-standing legacy of hydrocarbon production in the state and with the commissioning of the Kumchai-Kusijan gas pipeline last year, we successfully reinforced our role as an anchor in advancing the Government of India’s hydrocarbon vision for the North-East.”

In a significant step towards strengthening India’s self-reliance in critical and strategic mineral sourcing, OIL and Hindustan Copper Limited (HCL) have signed an MoU to cooperate and collaborate for exploration and development of critical and strategic minerals, including copper and associated minerals. Given the increasing importance of critical minerals, OIL has diversified into critical minerals apart from its present portfolio of oil and gas. HCL, a miniratna PSU under the aegis of the Ministry of Mines, is engaged in mining, production, processing and marketing of copper and related products. HCL is currently focusing on mining and beneficiation of copper ore and selling of copper concentrate.

OIL and HCL’s partnership marks a crucial milestone in India’s pursuit of self-reliance in critical and strategic minerals, including copper and associated minerals. To support the objectives of the national critical mineral mission of the Government of India, this collaboration will play a vital role in securing strategic mineral resources essential for the nation’s energy security and technological advancement.

OIL and Rajasthan Rajya Vidyut Utpadan Nigam Limited (RVUNL), under the government of Rajasthan, have established a joint venture company (JVC). The JVC will develop 1.2 GW of renewable energy projects, comprising 1,000 MW of solar and 200 MW of wind, within RVUNL’s renewable energy park in Rajasthan.

The JVC will harness OIL’s energy sector expertise and RVUNL’s extensive experience in power project development to deliver sustainable energy solutions. The partnership will focus on solar, wind, green hydrogen and other renewable energy initiatives, supplying clean power to distribution companies (DISCOMs) and commercial customers. To strengthen India’s renewable energy ecosystem and support the nation’s green energy transition, OIL has established a wholly owned subsidiary, OIL Green Energy Limited (OGEL).

OIL has announced the reported occurrence of natural gas in its 2nd exploratory well, Vijayapuram-2 (Loc. OAEA), drilled in the offshore Andaman block AN-OSHP-2018/1 under the open acreage licensing policy (OALP). The preliminary analysis of gas samples collected during intermittent inflow of gas as part of initial production testing has confirmed the presence of natural gas. Further gas isotope studies are being undertaken so as to understand the genesis of the gas. As per preliminary assessments, this could be a leading indicator of presence of source or migration pathway or accumulation of hydrocarbons, which will help in the future exploration and drilling strategy. The company is also undertaking additional testing of higher-up prospects to further evaluate the reported occurrence of gas.

OIL has signed an MoU with GAIL (India) Limited (GAIL) to strengthen cooperation across the natural gas value chain and unlock synergies for expanding access to cleaner energy across the country. On this occasion, the Secretary, MoPNG, stated that the MoU is a timely step towards enhancing domestic gas availability and ensuring its seamless access to demand centres across India. He emphasized that collaborations such as this between OIL and GAIL are crucial in realizing the government’s vision of a gas-based economy and in accelerating the country’s energy transition. Dr Rath said the MoU represents a significant step in leveraging OIL’s upstream strengths, alongside GAIL’s proven expertise in marketing and gas distribution infrastructure, to accelerate the country’s progress towards a gas-based economy while creating value for all stakeholders.

OIL and Mahanagar Gas (MGL) have signed an MoU. OIL has an expansive hydrocarbon exploration and development programme with plans to significantly ramp up gas production, alongside a defined roadmap for advancing clean energy projects. MGL, having successfully forayed into the LNG value chain, operates LNG retail stations and is actively pursuing other clean energy initiatives. Under the MoU, the two organisations will collaborate to explore opportunities across the LNG value chain and in emerging clean energy areas. The collaboration will focus on assessing the technical and commercial viability of LNG in the heavy-duty transport segment, and on exploring projects in clean energy, with an aim to take feasible pilots to commercial scale, which seems crucial going forward.

OIL has extended a long-term gas sale and purchase agreement (GSPA) with North Eastern Electric Power Corporation Limited (NEEPCO) for continued supply of 1.4 mmscmd (million metric standards cubic metres per day) of natural gas to NEEPCO’s Assam Gas Based Power Station (AGBPS) at Bokuloni, Dibrugarh for another 15 years. The new agreement succeeds the earlier 10-year arrangement between the two companies. AGBPS is the largest gas-based power plant in Assam and plays a vital role in meeting the power demand of the region. The signing of this extended-term agreement reaffirms OIL’s commitment and confidence in its strong reserve base and its capability to ensure sustained gas supply from its domestic sources.

Recently, OIL inaugurated the world’s first bamboobased 2G bio ethanol plant, which is a landmark project aligned with the government’s import substitution policy and demonstrates the company’s pioneering role in bio-energy transition and value addition to local resources. The company has also laid the foundation stone of a 360 ktpa polypropylene plant at Numarligarh, which will be implemented by NRL and will cost over Rs 7,000 crore — juxtaposed with the expanded refinery, it will raise NRL’s petrochemical intensity index by 4.0.

FY25 proved to be a landmark year for the company, marked by the highest ever oil and natural gas production, supported by operational excellence and strategic growth. It recorded oil and oil equivalent gas (O+OEG) production of 6.710 mmtoe (metric million tonnes of oil equivalent) along with natural gas production of 3,252 mmscm (million metric standard cubic metres), whereas the total area drilled was 1,74,000 metres.

For FY26, OIL is aiming at 4 million tonnes of oil production and 5 billion cubic metres of gas output. It also plans to drill over 80 wells in the year and expand offshore exploration, including deep-water and ultra-deep water areas. The company is targeting 10 mmtoe of oil and gas production by 2030, with a cumulative capex of Rs 1.3 trillion.

The company has made progress towards a net zero 2040 target, including a 59% reduction in flaring over the previous year, abatement of Co2 emissions, and energy efficiency measures. Similarly, using cutting-edge technologies of propellant stimulation, fishbone drilling and AI-based reservoir modelling is being deployed to unlock reserves, optimize costs and enhance recovery.

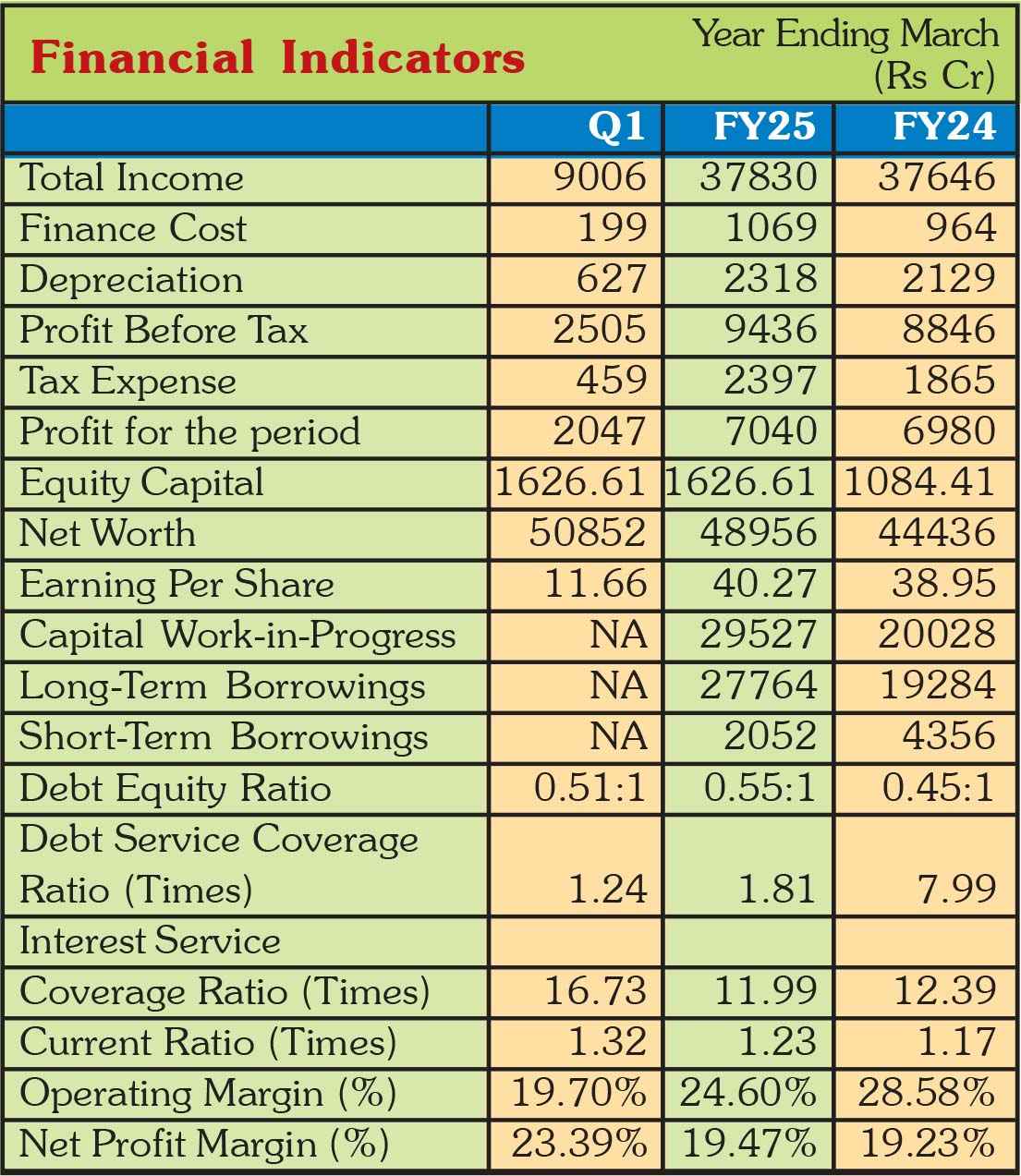

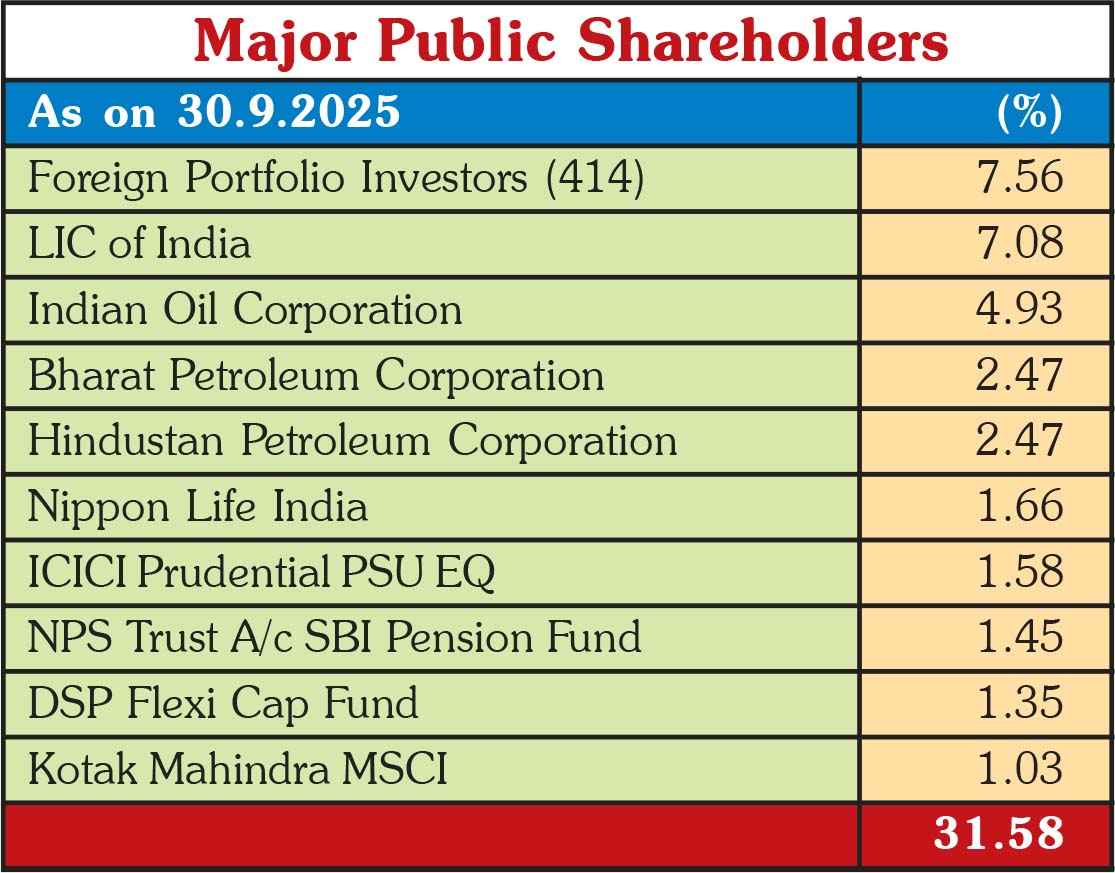

On a consolidated basis, the company reported a total income of Rs 37,830 crore with net profit of Rs 7,040 crore in the FY25 period. During Q1 of the current FY26, the total income stood at Rs 9,006 crore and PAT at Rs 2,047 crore, vis-à-vis Rs 9,582 crore and Rs 2,016 crore in Q1 of the previous financial year. In FY25, it had a capex of Rs 18,170 crore and has planned Rs 17,000 crore for FY26. The equity capital stood at Rs 1,626.61 crore and net worth at Rs 48,956 crore. The government of India holds 56.66% as its promoter and the balance of 43.34% is spread amongst 5,03,842 public shareholders. The company issued bonus shares in 2024 in a 1:2 ratio.

This may seem a little premature, but it appears that the sound business strategy adapted by OIL will make it a big player, especially in the natural gas segment. The company will also continue generating revenue, profits and sizeable cash flow with the help of its own exclusive oil and gas assets mainly located in Assam, Arunachal Pradesh and Rajasthan. In addition, it will continue earning from its existing joint ventures-participating interest assets as well. Moreover, the newly lined up MoUs and Joint Ventures will also start contributing later. All these will eventually help in containing the fresh borrowing required to meet its big planned capex.

Undoubtedly, OIL is well-positioned to build a resilient, diversified, clean and sustainable energy future for India, aligning with national priorities. A clear road map and a planned strategy supported with meticulous execution, despite having a PSU tag, have become its big strength in accelerating its growth. Crude oil, natural gas, LPG, pipeline transportation and renewable energy — all these five verticals provide huge potential to scale up. Likewise, NRL’s capacity expansion by 200% and new investments in ventures like green hydrogen, CBG, 2G bio-ethanol, and critical minerals, including copper, will also start contributing to OIL reaching its ambitious revenue target of Rs 1 lakh crore by 2030.

Currently, the stock price is ruling at Rs 435, with market capitalisation of Rs 70,716 crore. Investors with patience can enter the stock at the current price and keep adding in small lots for a good appreciation.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives