Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: October 31, 2025

Updated: October 31, 2025

Investors have welcomed the new Vikram Samvat with mixed feelings as global tensions and domestic political bickerings continue, accentuated by punitive US tariffs, an inflationary price spiral and growing unemployment.

While ‘safe haven’ avenues like bank deposits are barely keeping pace with inflation, precious metals like gold, silver and platinum are witnessing new price highs. However, the current yen for precious metals rests on the shaky assumption that global geopolitical tensions will continue indefinitely.

Caution and realism imply that the stock market remains the best avenue for multiplying investor wealth – with the caveat of cautious stock selection. If traditional sectors have lost their vigour, there are other sectors which indicate robust days ahead for their stocks this Samvat, especially in the case of fundamentally strong companies with efficient managements.

Among these sectors are: Banking & Financial Services, Infrastructure, Aerospace & Defence, Renewable Energy, Healthcare & Pharmaceuticals, and Automotive. Corporate India research bureau has selected promising stocks for our readers.

The new Vikram Samvat 2082 has started on a shaky note as domestic uncertainties and global tensions refuse to calm down. The Russia-Ukraine war continues unabated, the Israel-Hamas ceasefire is marked by uncertainty, and the recent Pakistan-Afghanistan skirmish has created new tensions close to India. On the trade front, US President Donald Trump’s ‘tariff sword’ has unsettled the global economic climate and, if not put back in its ‘sheath’, will adversely affect global economic growth.

At home, the political and economic climate has been vitiated by opposition parties’ charges of vote rigging, the punitive US tariffs, an inflationary price spiral, and growing unemployment.

In such a situation, it goes without saying that the Indian stock market is meandering aimlessly, with a downward inclination.

Ergo, investors are obviously in a dilemma. The question agitating their minds is where to invest in Vikram Samvat 2082. Returns on bank deposits – savings or fixed – are negligible viewed in the context of rising prices of every product. Real estate has not remained as attractive as it was a few years back. By and large, investors have no trust in company deposits as several companies have been known to drag their feet in returning deposits. The culture of investing in art has not picked up in India as few people are familiar with the intricacies involved in this mode of investment. In these circumstances, investors, for all practical purposes, have a choice of only two avenues of investment – precious metals and the stock market.

Growing geopolitical tensions have given a boost to demand for precious metals. In times of war and uncertain political environments, people start losing faith in currencies and go for accumulating precious metals like gold, silver and platinum.

Little wonder that the recent growing demand for gold, silver and platinum has pushed up prices of these precious metals to all-time high levels. In London, gold prices scaled a new high of £ 2986.81 per ounce (£ 96.208 per gram). In the New York market, the price of the yellow metal has for the first time crossed $ 4,000 per ounce. As far as India is concerned, the gold price in Mumbai – after stagnating through mid-2024 — shot up steeply starting in November 2024, climbing nearly Rs 9,000 in three months, then skyrocketed in 2025 to cross the milestone of Rs 1,00,000 per 10 gm, and reached to Rs 123,420 by Diwali.

Along with gold, silver prices have also zoomed to scale new peaks. At the same time, silver’s fundamentals have been driven largely by rapidly growing industrial demand. Roughly speaking, two-thirds of global silver use comes from industrial requirements like semi-conductors, photovoltaics (colour panels), water purification, batteries and touchscreen displays, as well as e-automobiles. The solar PV sector alone is growing at 12 per cent annually, creating secular demand for silver, especially in Asia. Little wonder that the price of the precious white metal has zoomed to cross the Rs 1,00,000-mark. The spurt in silver prices aligns with a broad uptick in manufacturing and green energy expansion globally

Traders eyeing undervalued silver was another driving factor for silver prices. A key market signal has also played a role. The gold-silver ratio, a traditional valuation metric, currently stands at over 90:1, meaning one ounce of gold buys more than 90 ounces of silver. The historical average is around 60:1. This implies that silver is significantly undervalued relative to gold, encouraging traders to rotate allocations. Retail interest has surged as gold ETF assets in India rose 82 per cent year-on-year to Rs 62,452.94 crore by June 2025, from a much higher base than silver. Combined with record folios in silver, ETFs and pre-budget buying frenzy ahead of anticipated tax hikes, the trend suggests broad-based public participation.

One more reason for the gold and silver surge is the weakening rupee in 2025, from Rs 79 per dollar in 2023. In 1947, when India got independence from the British, one rupee fetched one dollar. Since India imports nearly all of its gold and silver, any devaluation of the rupee inflates domestic prices, even when global pries remain constant. This currency effect has contributed to India’s domestic gold hitting record highs – faster than the global average.

At the same time, central banks have added to the frenzy globally. In 2024, over 1,000 tonnes of gold were bought by central banks worldwide for the third year in a row, according to the World Gold Council. The Reserve Bank of India also added to its reserves, increasing institutional demand and tightening the global supply situation.

With growing geopolitical tensions making gold a safe haven, demand for precious metals is bound to continue. Investors in these circumstances can certainly go for gold, silver and platinum, but with a cautious approach. If geopolitical tensions go down noticeably, the frenzy for demand in gold may weaken. However, silver is likely to rule firm on account of the growing industrial demand.

In these circumstances, the stock market remains the best investment avenue for multiplying investor wealth. But there are a lot of danger signals on this route too. Hence, investors will have to tread extremely cautiously and make selection of stocks with foresight.

First of all, stocks mean companies and the outlook for companies depends on the prospects for the sectors to which these companies belong. So, at the outset, we need to find out the sectors which are expected to fare well in Vikram Samvat 2082.

In an environment where geopolitical tensions have been mounting, market volatility and stock valuations pose challenges. Several research analysts say the grass is greener in several areas in the new Vikram Samvat. If traditional sectors have lost their vigour, certain sectors like textiles, engineering, and gems & jewellery have been hit by the tariff war waged by US President Donald Trump. However, there are certain sectors which exude remarkable optimism in this Samvat, indicating robust days ahead for stocks belonging to these sectors. With the passage of time in the new Samvat, these sectors are expected to put up an exciting performance, and stocks of fundamentally strong companies helmed by enlightened and efficient managements are bound to put up a heartening show.

The sectors which are expected to do very well in the new Samvat are:

According to financial experts, the asset quality of the banking and finance sector has improved considerably of late with a marked drop in non-performing assets. At the same time, liquidity in the sector in quite high and the lending environment is highly favourable. These factors are bound to drive growth of the sector in the new year.

As infrastructure development is essential for transforming our developing economy into a developed one, it will benefit substantially on account of the robust economic growth story and strong government spending. The continued government focus on infrastructure development, including housing and construction of roads, is a major tailwind. Along with public sector investment, the government is encouraging and pushing private sector investment which had slowed down of late. Steadily rising demand and improving corporate earnings have also aided capital formation. Little wonder that many infrastructure companies have built up robust order books.

The $ 27 billion Indian aerospace and defence industry is engaged in building aircraft, ships, spacecraft, weapon systems and defence equipment. Of late, this sector is rapidly growing and propelling the growth of the manufacturing sector from the front by manufacturing defence equipment of international quality standards and establishing technologically advanced manufacturing facilities.

In recent years, the Indian aerospace and defence industry is at an inflection point because of a spurt in demand for defence equipment and modernisation and indigenisation programmes undertaken by all three services - Army, Navy and Air Force - of the Indian military which has emerged among the largest forces in the world. Little wonder that in these circumstances India's defence budgets in recent years have swelled.

Demand for defence equipment has shot up at home as well as abroad on account of growing geopolitical tensions, increasing military conflicts like those between India and Pakistan, Pakistan and Afghanistan, Israel and Gaza, Israel and Iran, and in parts of the Middle East. Indian has started exporting its defence equipment in a very big way, and several countries, whether involved in military conflicts or not, have started buying defence equipment in order to strengthen their defence mechanism.

Other factors that will aid the growth of the aerospace and defence sector include growing commercialisation in the aerospace and defence sector. Growing international collaborations, a growing focus on space exploration missions, expansion of defence and aerospace services, and development of advanced technologies are expected to boost production and sale of aerospace and defence equipment in India, thereby driving market growth.

The aerospace and defence industry is on the priority list of the government and the industry is a focus area for the 'Make in India' and 'Atmanirbhar Bharat' initiatives as well as production boosting schemes like the Production-Linked Incentive (PLI). According to research institution CMI (Custom Market Insights), the Indian aerospace and defence sector, which is around $ 29 billion in size today, is expected to reach $ 54.4 billion by 2033.

Beset by growing environmental problems, the world has turned from fossil fuels to renewable sources of energy. The Indian government is heartily supporting this change by devising its own policies. These government initiatives are aimed at promoting renewable energy sources such as solar and wind to drive growth. The growing need for infrastructure development is also boosting demand for utility companies in this space. Electric vehicle (EV) manufacturers and component suppliers are gaining traction, signalling substantial growth potential.

Considered to be defensive play, the healthcare and pharma sector performs well during volatile market conditions. Healthcare and pharma companies offer essential products and services that remain in demand regardless of the economic as well as political climate. In any environment, the sector has delivered strong earnings and is viewed favourably due to its defensiveness.

The automotive industry, which faced challenges for some time in Vikram Samvat 2081, is all set to put up a robust performance in V.S. 2082. Growing urbanisation, rising incomes, improving standards of living and escalating aspirations will give a push to the auto industry and the trend will be aided by GST rationalisation. Premiumization trends and an expected recovery in rural demand are expected to provide tailwinds. Supportive government policies like the production-linked incentives (PLI) scheme will push up the pace of growth of the industry.

Finally, coming to the stock market, investors will have to be highly selective as both the domestic and global environments have vitiated market sentiment. The return of Donald Trump to the White House has led to newer uncertainties. Even if you ignore President Trump, the global environment is full of geopolitical tensions. The Russia-Ukraine wars refuses to come to an end, the Israel-Gaza ceasefire could end any time, and nobody knows when the Israel-Iran conflict will erupt once again. Pakistan and Afghanistan were recently involved in a military conflict, while India and Pakistan have arrived at a ceasefire, with President Trump taking the credit for it. However, an inflationary price spiral, growing unemployment and an economic slowdown have dampened investor sentiment.

In these circumstances, proper selection of scrips for investment has become an essential exercise. In order to make such an exercise easy for our readers, we have selected 6+10 scrips for investment in Vikram Samvat 2082 and also presented a list of scrips if our readers would like to have alternative choices. Here goes the list. Happy investing.

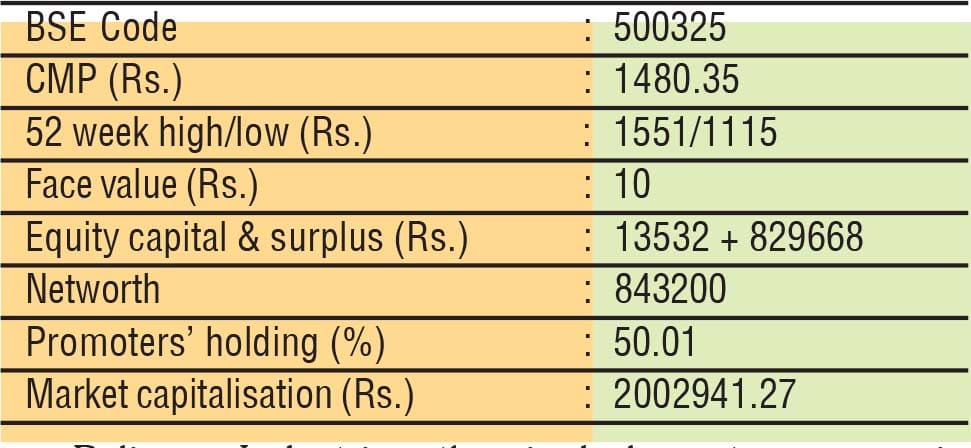

Reliance Industries, the single largest company in the Indian corporate sector at present, which has been dawdling along armlessely in the Rs 1,300-1,400 range, is all set for re-rating in Vikram Samvat 2082. The company, which went public in 1977, is going to celebrate its first 50 years in 2027 and this two-year period will be a bonanza for its shareholders. The outlook for RIL for the next two years is considered robust on account of its sustained momentum in the high-growth consumer business (Jio and retail) and impending monetisation of its energy venture. These developments are expected to translate to strong consolidated revenue /EBIDTA growth at a CAGR of 10%/15% over FY2025-27, according to analysts at Religare, as resilient O2C (oil to chemicals) cash flows continue to fund new growth engines. Also, the current valuation, with the price hovering around Rs 1,300-1,400, does not fully capture the immense value unlocking potential from the new energy and the consolidated media businesses.

The outlook for the company is highly promising. RIL supremo Mukesh Ambani has gone on record saying that the strategic vision of the management for the company's four key businesses - telecom, retail, O2C and new energy -- is also robust. The management aims to double EBIDTA in the next five years, powered by 5G opportunities, increased investments in Artificial Intelligence (AI) and data centres, further expansion in retail (physical + digital), and the start of PV/battery facilities in new energy.

The company will leverage the AI-based opportunity (Jiobrain) presently used by RJio internally. It aims to launch a powerful AI service platform and AI models at affordable prices for other enterprises. The company will drive a similar transformation across other Reliance operating companies. Post-performing Jiobrain within Reliance, they will create powerful AI service platforms that can be offered to other enterprises as well. RJio is developing a comprehensive suite of tools and platforms that spans the entire AI life cycle.

Subsequently the company will aim as creating a national AI infrastructure. With this view, the company plans to establish GW-scale AI ready data centres at Jamnagar. The company will partner with leading global technology companies and innovators to bring the most advanced AI models and solutions and tools to India.

The company has made rapid strides in its financial performance. During the last 12 years, its sales turnover has expanded from Rs 433,521 crore in fiscal 2014 to Rs 962,820 crore in fiscal 2025, with operating profit shooting up from Rs 34,935 crore to Rs 165,398 crore and the profit at net level spurting from Rs 22,548 crore to Rs 81,309 crore.

The company's stock is quoted around Rs ------ at present with a market capitalisation of Rs ------, making RIL the most valuable company in the Indian corporate sector. The share price is expected to reach Rs 1,600 within the next two years and then skyrocket to cross Rs 3,000 within the next five years or so.

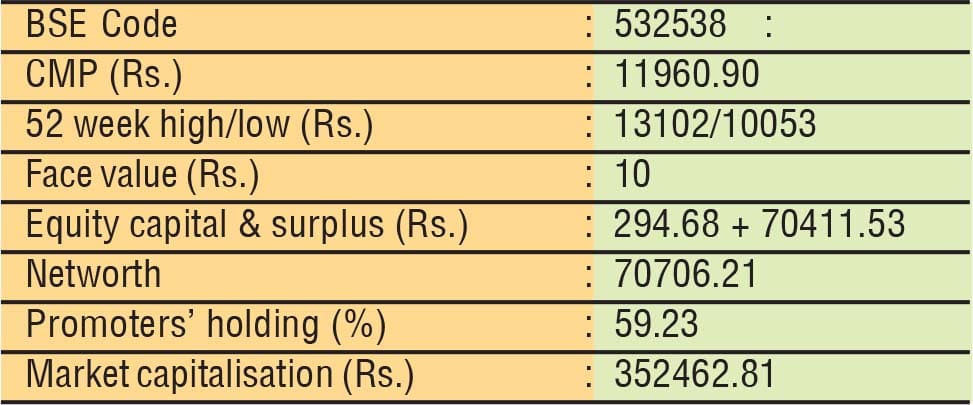

The cement flagship company of the Aditya Birla group, Ultratech Cement is an Indian multinational company which is the largest manufacturer of grey cement, ready-mix concrete (RMC) and white cement in India, and among the largest in the world with an installed capacity of 188.4 mtpa.

The company was originally promoted by technology giant Larsen & Toubro as a division of L&T. Thanks to its technical expertise, the company improved the quality of its cement to make it the best in the country. Driven by his ambition to emerge as the king of the Indian cement industry, Kumar Mangalam Birla, the supremo of the Aditya Birla group, acquired this business from L&T and made it the cement flagship company of the group. After this, the Birla group started an acquisition drive and took over several companies to emerge as the numero uno cement producer in the country. The company then spread its footprint overseas in the United Arab Emirates, Bahrain and Sri Lanka, taking Ultratech's consolidated grey cement capacity to 186.4 mtpa. Today, the company boasts a network of over 1,45,000 retailers and dealers across India, with a market reach of more than 80% of the country. In the case of RMC, with 397 ready-mix concrete plants across 135 cities, Ultratech is the largest producer of RMC in India.

Thanks to rising demand for cement in the country and the sustained increase in Ultratech's production capacity, the company has put up an excellent performance on the financial front. During the last 12 years, its sales turnover has spurted more than three and a half times from Rs 20,730 crore in fiscal 2014 to Rs 75,955 crore in fiscal 2025, with operating profit shooting up almost three times from Rs 4,035 crore to Rs 12,800 crore and the profit at net level inching up from Rs 2,213 crore to Rs 6,040 crore.

What is more, prospects for the company going ahead are all the more promising. The company is expanding capacity organically as well as well as through acquisitions. At the same time, demand for cement is steadily going up and has reached 435 million tonnes in 2025. Ultratech, being the numero uno cement company in the country, is bound to benefit a lot on account of this rising demand.

Shares of the company with a face value of Rs 10 are quoted around Rs 11,960. Leading research analysts expect the price to cross Rs 15,000 within the next six to seven months.

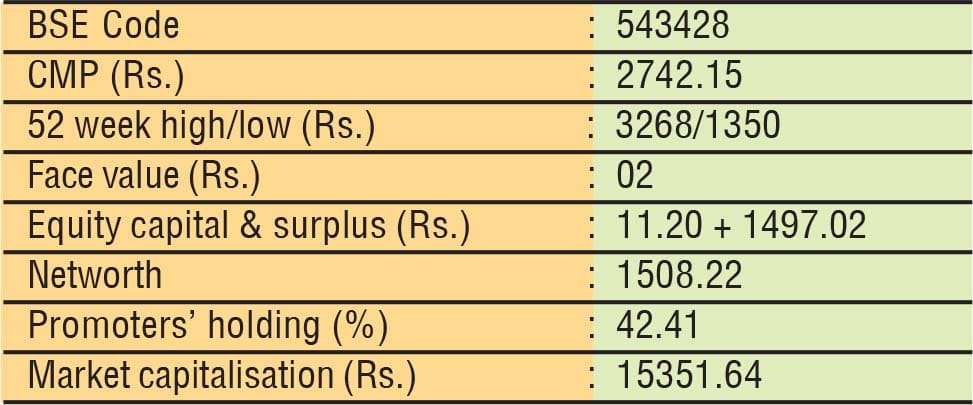

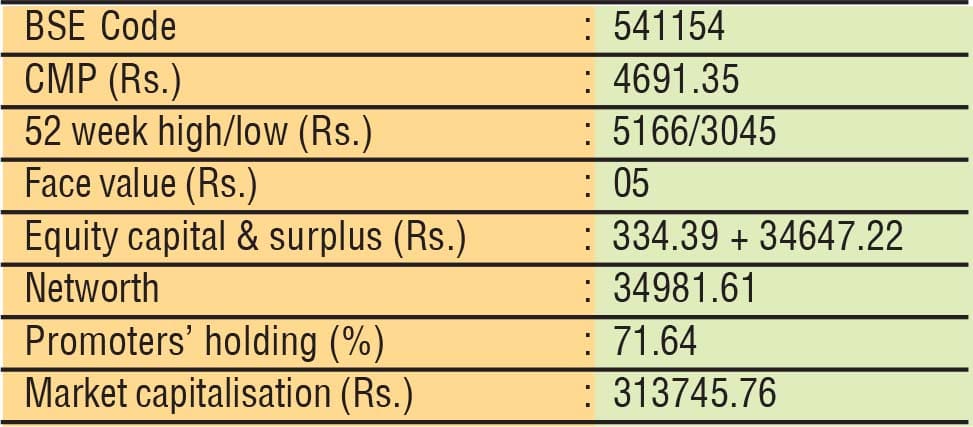

Data Patterns is one of the fastest growing defence and aerospace providers catering to domestic defence products demand. It has developed several electronics systems for its customers with the support of its captive manufacturing facility and attention to detail.

As of FY25, radar is the key revenue contributor (~52% of total), followed by electronic warfare (~17% of total). The company provides products & services to government entities (including MoD, DRDO and PSUs) and the private sector (including international clients).

The order backlog was healthy at ~ Rs 1,080 crore as of June 25 (1.5xTTM revenue), and provides medium-term revenue visibility.

The company has delivered an excellent performance on the financial front. During the last 12 years, its sales turnover has spurted more than 11 times - from Rs 63 crore in the fiscal 2014 to Rs 708 crore in fiscal 2025, with operating profit shooting up 16 times from Rs 17 crore to Rs 275 crore and net profit skyrocketing more than 31 times from Rs 7 crore to Rs 222 crore.

Prospects for the company going ahead are highly promising. The company's order book is very healthy. The management has guided fresh order inflows of Rs 2,000-3,000 crore in the next 2 years (including Rs 1,000-1,500 crore in FY26E).

With the increasing requirement of hi-tech and modernised defence platforms, the company has a huge long-term potential in terms of continuous order inflows for electronic systems/sub-systems from both the domestic and export markets.

In the coming years, the company sees strong opportunities in supplying its products across defence platforms like upcoming fighter aircraft (including Sukhoi, Tejas, Advanced Medium Combat Aircraft etc.), missile systems (like Brahmos), and naval warships. In the space segment too, the company foresees a sizable opportunity in micro satellites and space-based radar.

A strong order backlog, improving execution and a robust pipeline provide healthy growth visibility for the coming period. Shares of the company are quoted around Rs 2,740. Within a year, the price is expected to exceed Rs 3,500.

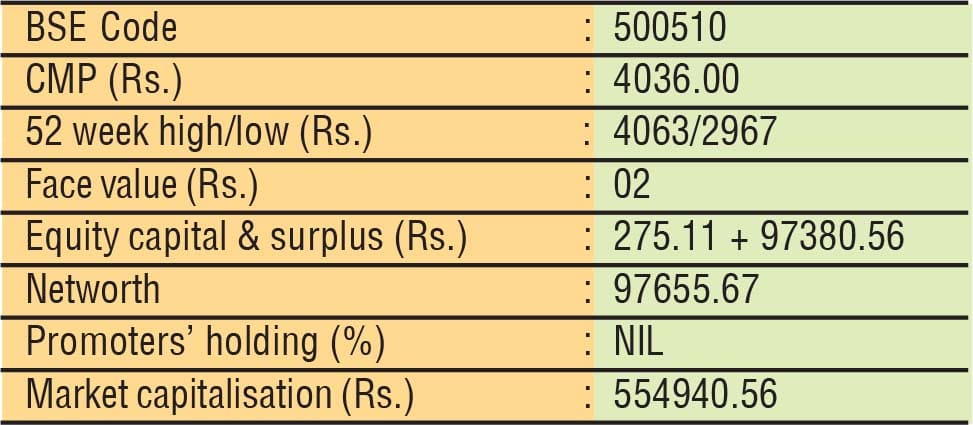

Larsen & Toubro (L&T) is India's largest engineering & construction (E&C) colossus, with interests in Engineering, Procurement & Construction (EPC) projects, hi-tech manufacturing, and services. L&T primarily operates in the infrastructure, heavy engineering, defence engineering, power, hydrocarbon, and services segments. The infrastructure segment contributes ~45% of consolidated revenue, followed by services (~26%), energy projects (20%) and international markets (46% of backlog from international markets).

The company has been going from strength to strength in its financial performance. During the last 12 years, its sales turnover has more than trebled - from Rs 85,054 crore in fiscal 2014 to Rs 255,734 crore in fiscal 2025, with operating profit more than doubling from Rs 14,086 crore to Rs 28,758 crore and the profit at net level shooting up three and a half times from Rs 4,885 crore to Rs. 17,673 crore. Viewed in the context of the company's robust performance, strong order book position, expansion in international and domestic markets and its growing technical capabilities, we strongly believe that L&T is well-positioned for continued growth. The company had an order backlog of Rs 6,12,761 crore in Q1FY26. This momentum is expected to continue as L&T has bagged several large orders in Q2FY26 as well across segments. L&T has significant order prospects of Rs 14 trillion, and we believe it will surpass its order inflow guidance of 10% on a larger base in FY26E. Overall, we expect revenues and PAT to grow at CAGR of 14.9% and 16.5% over FY25-FY27E.

L&T has also entered into a business sale agreement with the government of Telangana for transferring the Hyderabad metro. This is a step in the right direction and is expected to free up resources, improving profitability and RoE of L&T. Given the backlog growth and pick-up in execution, there remains a strong revenue growth over the medium term. With a continued focus on improvement of overall return ratios, an 18% RoE by 2026E looks probable. Shares of the company are quoted around Rs 4,030, and within a year the price is expected to cross Rs 4,500.

Hindustan Aeronautics (HAL), the largest defence PSU in India, is engaged in design, development, manufacture, repair, overhaul, upgrade and servicing of a wide range of products including aircraft, helicopters, aero engines, avionics accessories and aerospace structures. HAL has a strategic place in India's defence story as it is a dominant supplier of aircraft, helicopters and accessories. It is also the leading provider of maintenance, repair and overhaul services to India's defence forces. The company is doing very well in its financial performance. During the last 11 years, its sales turnover has almost doubled from Rs 15,939 crore in fiscal 2015 to Rs 30,981 crroe in fiscal 2025, with operating profit jumping more than four times - from Rs 2,379 crore to Rs 9,621 crore and the net profit inching up over three times from Rs 2,399 crore to Rs 8,364 crore.

After delays in the execution of the Tejas Mk1A contract due to GE-404 engine delivery issues, it seems HAL's revenue growth will pick up substantially from this year, led by a pick-up in execution in the manufacturing segment. We expect GE engines' supply to ramp up, speeding up delivery of Tejas Mk1A aircraft to the IAF. The company is expected to deliver six aircraft in FY26 and 16 from FY27. The order backlog stands strong ~Rs 1.9 lakh crore (6xTTM revenue), which provides healthy revenue growth visibility over FY26E-27E. The order pipeline remains robust for HAL with Rs 1 lakh crore expected to be placed with the company in the coming 1-2 years. This pipeline gives longer-term revenue growth visibility in the coming years.

Thus, prospects for the company are robust in view of strong growth in profitability, led by a well-executed healthy order backlog and sustained margins, a strong balance sheet and a double-digit returns ratio. This is bound to reflect in the market valuation of the company. The shares of the company are quoted around Rs 5,410. Experts believe that within a year, the price will cross Rs 6,000.

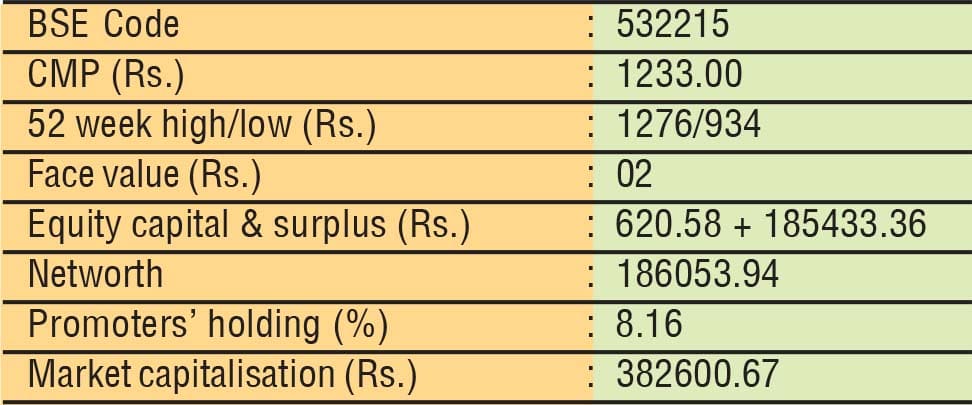

Mumbai-headquartered Axis Bank, an Indian international banking and financial company, is India's third largest private sector bank by assets and fourth largest by market capitalisation. It caters to large and mid-sized companies, SMEs and retail businesses. Formerly known as UTI Bank, Axis Bank was promoted jointly by the administrator of Unit Trust of India, Life Insurance Corporation, General Insurance Corporation, National Insurance Company, The New India Assurance, The Oriental Insurance Corporation and United Insurance Company. All these companies own 30.81 per cent of the equity capital, while the balance 69.19 per cent is held by mutual funds, FIIs, banks, insurance companies, corporate bodies and individual investors.

The bank, which was set up in 1993 with its registered office at Ahmedabad, has made steady progress. Listed on the London stock exchange, it opened its overseas branch in Singapore, an office in Shanghai, and branches in Dubai and Hong Kong. A couple of years ago, the bank acquired Citi Bank's India consumer banking business for Rs 12,325 crore. Earlier this year (2025), the bank partnered with JP Morgan to provide real-time US dollar payment capabilities for commercial clients' businesses. The bank is expanding its footprint in India's thriving startup ecosystem, offering entrepreneurs seamless access to banking, advisory and capital through a hub-and-spoke model. It's efforts include contributing to the evolving fund ecosystem in collaboration with VCs, incubators and policy platforms to support early and growth-stage ventures.

The 'One Axis' ecosystem integrates Axis Bank's entire suite of financial services - including asset management, retail broking, insurance, consumer lending, fintech, and investment banking - into a seamless, unified platform. Among the universal banks, Axis Bank is preferred due to its attractive valuation relative to its peers, offering a favourable risk-reward setup. The bank has made rapid strides in its financial performance. During the last 12 years, its revenues have expanded four times from Rs 30,736 crore in fiscal 2014 to Rs 127,374 crore in fiscal 2025, with financial profit shooting up almost five times from Rs 2,089 crore to Rs 9,943 crore and the profit at net level surging ahead four and a half times from Rs 6,311 crore to Rs 28,191 crore.

The company's stock is quoted around Rs 1,200. Leading research analysts expect the price to touch the Rs 1,500 mark within a year. Apart from the above-mentioned scrips, readers who would like other options can buy any of the following 10 stocks.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives