Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2025

Updated: September 30, 2025

Following a request for proposal (RFP) by Hemisphere Properties India Ltd (HPIL) with regard to the e-auction of land of Bopkhel, Pune, the eauction process concluded recently without any bids for the plots. The company land is spread over 524 acres and the villages in these notified areas are Dighi, Kalas, Bopkhel and Bhosari. The land is adjacent to College of Military Engineering (CME) and is bordered by Tata Communications Ltd and STT Global Data Centre India Pvt Ltd.

The Collector of Pune had given an approval to the company for sale of the land on September 26, 2025, upon the payment of Rs 130.56 crore to the authorities. It appears that the issue of 7.50 crore cumulative redeemable preference shares on September 15, 2025 on a private placement basis to the promoter (Government of India) to raise Rs 75 crore was meant to part-finance the total cost of Rs 130.56 crore that was paid.

HPIL was incorporated in 2005 as a real estate entity with the mandate to hold, manage and monetise surplus land identified during the disinvestment of the erstwhile Videsh Sanchar Nigam Limited (VSNL), presently known as Tata Communications Limited (TCL). These surplus land parcels were earmarked for transfer to a separate company to ensure their optimal utilisation in a transparent and structured manner.

In 2012, the President of India acquired a majority shareholding in HPIL, granting it the status of a Central Public Sector Enterprise (CPSE). Subsequently, a Scheme of Arrangement between TCL and HPIL was formulated and approved by the National Company Law Tribunal (NCLT) in 2018, enabling the legal transfer of the identified land parcels to HPIL.

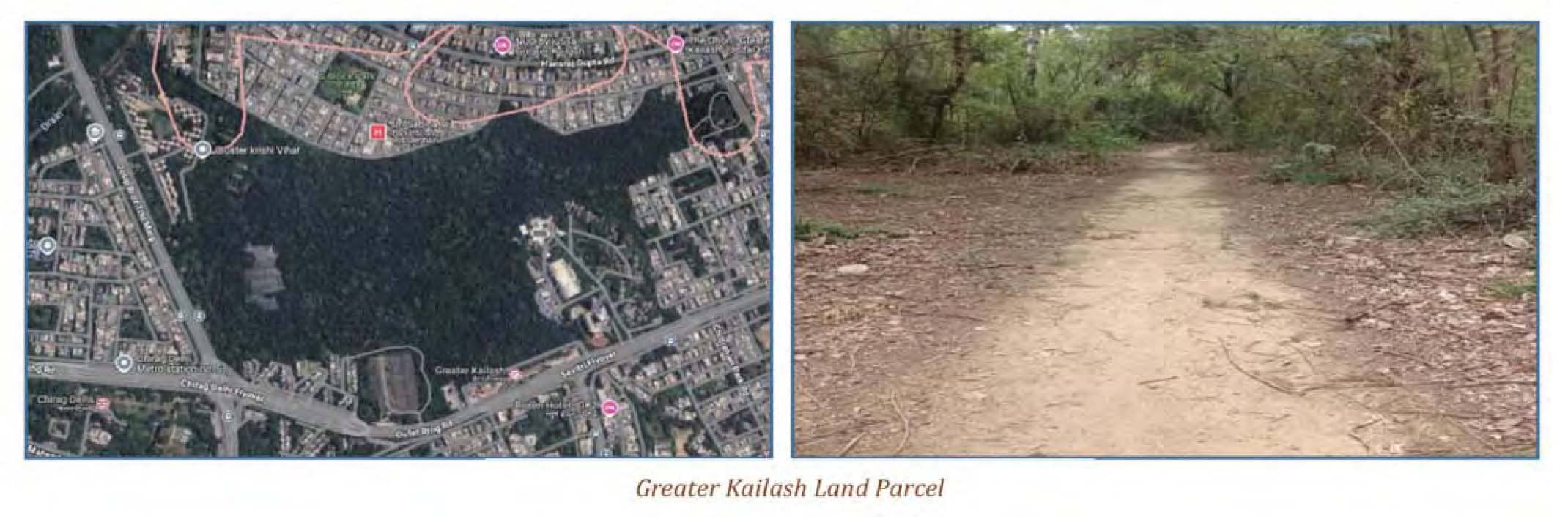

At present, HPIL owns approximately 2.99 million square metres (equivalent to 739.69 acres) of prime land located across four states and five locations in India. These land parcels, with significant development potential, are strategically situated in key urban and semi-urban areas, offering opportunities for residential, commercial, mixed-use, and institutional development. The break-up of land holdings is:

The company has completed demarcation of the Pune land, including the Bopkhel area. It has also obtained approval of layout and land classification for Bopkhel village from public/semi-public to residential, to enhance its development potential. Likewise, a professional transaction adviser has been appointed for evaluating market opportunities, structuring deal and value creation in addition to completion of mutation of land parcels and commencement of infrastructure development.

HPIL’s paid-up equity capital is Rs 285 crore with government holding at 51.12% and the balance 48.88% being held among 1,41,271 public sharesholders. Panatone Finvest Ltd and Tata Sons Pvt Ltd, two Tata group companies, hold 9.70% and 8.34% respectively. At the current market price of Rs 148 (Rs 10 face value), the market capitalisation rests at Rs 4,234 crore. The yearly high-low price is Rs 200 and Rs 109.

It is worth noting that as per the valuation done in 2020, the total land area of 739.69 acres under the ownership of HPIL was valued at Rs 19,000 crore, visà-vis its current market capitalisation of Rs 4,234 crore, leaving a huge potential for value unlocking. Especially during FY25, the management has initiated various steps to monetise these huge land assets. However, so far not a single land parcel has been disposed of.

As an alternative, the Government of India, which owns 51.12% in the company, could pay off public shareholders (48.88%) at a ready reckoner rate or at any other fair value method and delist HPIL from both the stock exchanges.

This issue demands urgent attention because, in addition to VSNL’s surplus land, there are two other central PSU listed companies holding surplus land and demerged into separate companies. They are SCI Land and BEML Land Assets of Shipping Corporation of India and BEML Ltd respectively, with their current market capitalisation of Rs 2,315 crore and Rs 875 crore.

In general, public shareholders are not very keen to continue their investments in land bank companies owned by the state. Hence, as a matter of policy, the government should discourage formation of such companies and give public shareholders an exit by paying them at a justifiable good valuation. The cash outgo will also be only to the extent of the public holding, and the government can then enjoy 100 per cent ownership. It would be a winwin for both sides and could help in avoiding a long-drawn process and the possibility of misappropriation.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives