Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2025

Updated: September 30, 2025

EXCITING and challenging times are in store for the $ 125 billion Indian metals market as the world negotiates an unprecedented geopolitical, economic and energy scenario.

THE ‘China’ factor is on everybody’s mind as the Dragon is the world’s largest consumer of metals, and any shift in its economic policies will have a serious ripple effect across the globe. For that matter, the RussiaUkraine conflict has already impacted the palladium and aluminium scene as Russia is a major producer of both metals. Besides, in the current inflationary scenario, central regulators like the US Fed are keeping monetary policies tight, thereby raising the cost of borrowing and dampening speculative investment by metals traders.

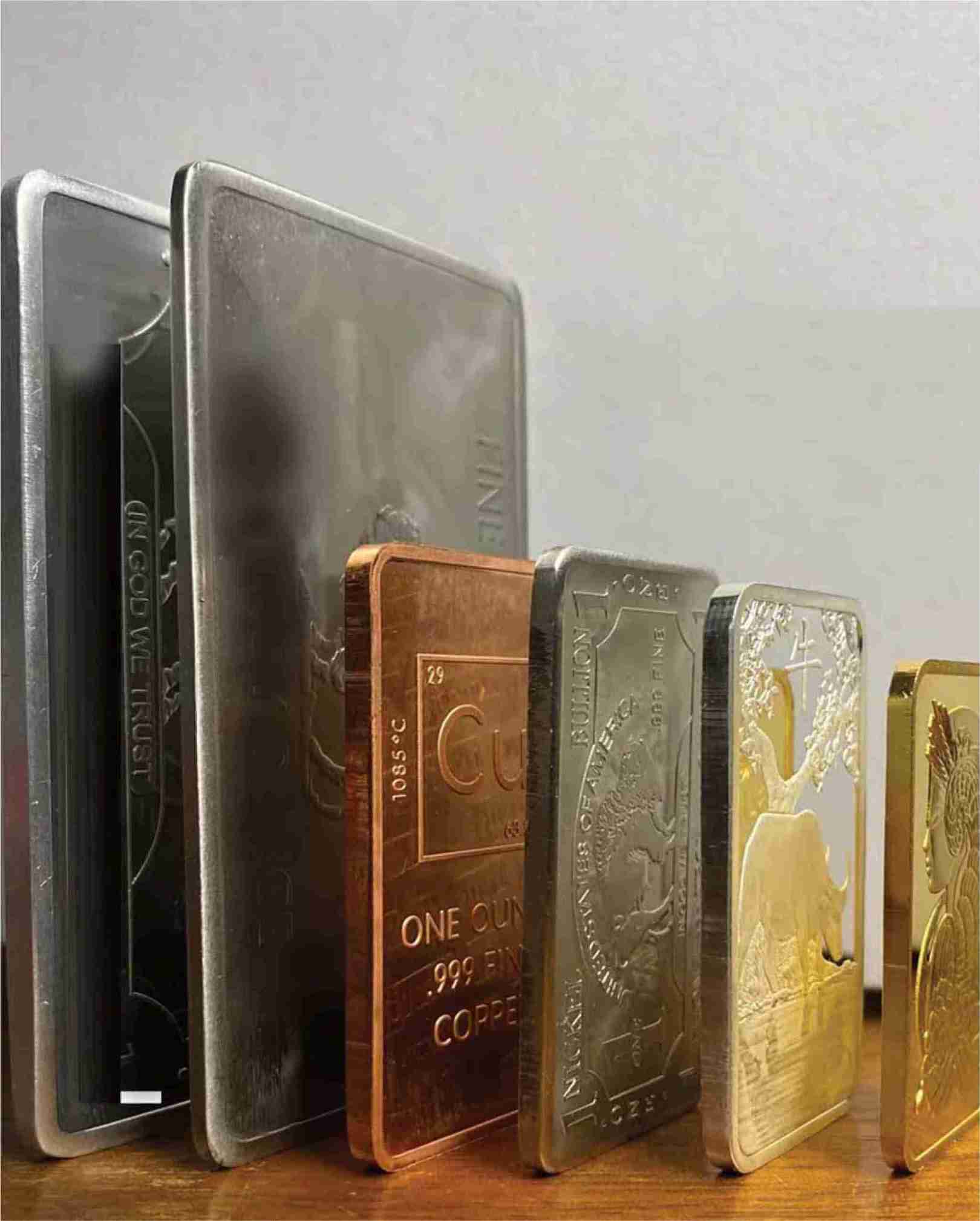

ON the flip side, metals like copper, lithium, and nickel will see surging demand as the world moves toward green tech. Traders who can position themselves in these markets early will likely see significant returns.

ADDITIONALLY, adopting new technologies like blockchain for more transparent trading practices will give early movers a competitive edge.

Keeping in step with the $ 2 trillion global metals market, the $ 125 billion Indian metals market has entered a fascinating phase. In fact, it is undergoing an unprecedented period in recent history of volatility and transactions greatly influenced by shifting global economic conditions and rising geopolitical tensions. Even more importantly, the global energy scenario is moving fast to a green energy transition, which is increasing demand for specific metals like copper, lithium and cobalt that essential for electric vehicles (EVs) and renewable energy.

Another factor is the economic influence of China, the world’s largest consumer of metals. Any shift in China’s growth strategy or infrastructure spending is bound to impact global demand. Besides, the ongoing macro-economic environment, including inflation and tight monetary policies, are creating market volatility. For example, central banks like the US Federal Reserve and the European Central Bank are keeping monetary policies tight, thereby raising the cost of borrowing and dampening speculative investment in commodities, including metals. Finally, geopolitical factors, particularly China’s slow recovery post-Covid, have impacted metal consumption and production worldwide.

Geopolitical events play an important role in the metals market. For example, the Russia-Ukraine conflict has already had a profound impact, especially on metals like palladium and aluminium, as Russia is a major producer of both. Sanctions and supply chain disruptions have led to price hikes and volatility.

China, as both consumer and producer of metals, is another critical factor. Any shift in its economic policies, particularly related to infrastructure and real estate, is bound to influence global demand. Moreover, the ongoing US-China tensions, especially in trade and technology, could further disrupt supply chains, particularly for critical metals like rare earth elements (REE) used in high tech industries.

At the same time, technology is also reshaping metal trade in two major ways. First, on the trading side, innovations like blockchain and artificial intelligence (AI) are enhancing transparency and improving efficiency. Blockchain helps ensure that metals are ethically sourced, which is increasingly important for consumers, as well as for companies that are focused on sustainability.

Secondly, in mining and production, AI and automation are optimising processes and reducing costs. Autonomous equipment like trucks and drilling machines are already being used in large-scale mining operations to improve safety and lower environmental impact. Sustainability is also driving development of green metals – those produced with minimum environmental harm. This will be a growing trend as the world continues to focus on reducing its carbon footprint.

Maintains an expert, “With so many factors affecting metal prices, like geopolitical risks, supply chain disruptions and even technological changes, metal traders will need to adapt to a constantly shifting landscape, using more sophisticated hedging strategies to manage risk. On the other hand, the energy transition offers tremendous opportunities. Metals like copper, lithium, and nickel will see surging demand as the world moves toward greener technologies. Traders who can position themselves in these markets early will likely see significant returns. Additionally, adopting new technologies like blockchain for more transparent trading practices will give early movers a competitive edge.”

As far as precious metals go, they are getting pricier by the day. Gold, silver and platinum are performing exceptionally well on account of safe-haven demand, increased buying by central banks, and growing industrial applications, especially in green technology. The market sentiment in precious metals is extremely bullish and their prices are all set to scale still newer heights.

During the current year, gold has been glittering all the more. During the first fortnight of October 2025, the yellow metal's prices have climbed new historic highs. In the UK, prices have reached £ 96.58 per gram for 24 carat gold, £ 88.53 per gram for 22 carat gold and £ 72.40 per gram for 18 carat gold. In dollar terms, the price of the yellow metal in London crossed $ 4,000 per ounce on October 8, 2025.

In the US, gold prices on October 9 shot up to $ 133 per gram for 24 carat gold, $ 126 per gram for 22 carat gold and $ 103.10 per grams for 18 carat gold. Gold prices in the US largely reflect global gold prices, which is turn have been displaying a distinctly firm trend. Spot gold rates in the global markets have crossed $ 1,800 per ounce, pushing gold rates across the US even higher.

As far as India is concerned, gold prices in Mumbai on October 9, 2025 hit a new all-time high of Rs 1,24,150 per 10 gm for 24 carat gold, Rs 1,13,800 for 22 carat gold, and Rs 93,110 for 18 carat gold. On the same day, prices in Ahmedabad were Rs 1,24,200 per 10 gm for 24 carat gold, Rs 1,13,850 for 22 carat gold, and Rs 93,160 for 18 carat gold. In Chennai, the prices were Rs 1,24,640 for 24 carat, Rs 1,24,250 for 22 carat, and Rs 94,550 for 18 carat.

The yellow metal's prices literally it skyrocketed on October 8, with 24 carat gold crossing the Rs 1,00,000 mark and reaching Rs 1,22,020 per 10 gm. In fact, gold prices in India's phenomenal rally mirrored the record-breaking surge in prices of precious metals worldwide. The sharp surge in gold prices was in tandem with the uncertainty prevailing over the US government 'shut down'. As investors anticipate another US Fed rate cut and are unable to fathom the macro-economic environment due to a delay in the release of key US data, gold's safe haven rally is likely to continue in the coming days.

Notes Aksha Kamboj, Vice-President, India Bullion & Jewellers Association (IBJA) and Executive Chairperson, Aspect Global Ventures, "There is an additional layer to the increased price. The tradition of festival buying of gold and other precious metals could provide an additional element of ongoing momentum, given that buying precious metals is perceived as 'auspicious' and they are considered 'victorious' assets. Given the current geopolitical uncertainties, gold remains a compelling hedge asset and could push even further in the weeks ahead.

Rahul Kalantri, VP-Commodities at Mehta Equities, also believes the momentum may continue. He adds that central banks have added 15 tonnes of gold in September 2025, signalling long-term confidence in the metal. Gold is often seen as a shield during troubled times, and that behaviour is clearly visible again. With inflation concerns still lingering and conflicts such as the RussiaUkraine war showing no signs of easing, investors across the world are choosing stability over risk.

Ponmudi R, CEO of Enrich Money, explains, "Gold remains around $ 3,900 an ounce, signalling steady safehaven demand but without unsettling broader risk appetite, keeping overall market sentiment constructive." Even gold-backed exchange-traded funds (ETFs) have seen increased inflows, suggesting that institutional investors are also joining the rally.

While prices are at record highs, analysts say that small corrections may occur along the way. Many believe such dips could be used as buying opportunities, especially for long-term holders. Gold may not offer quick returns, but it has traditionally served as a strong insurance against inflation, currency weakness, and economic shocks. Those looking to invest should consider their financial goals rather than trying to time the market perfectly.

For individuals planning for weddings, future expenses or diversification, buying in small amounts, either through jewellery, coins or digital gold, may be a sensible approach. Simply put, gold remains a reliable safety net -- just make sure you buy it wisely.

While gold prices during the current year so far have climbed up 51 per cent, silver prices have outperformed at around 68 per cent. The price has reached a record all-time high of Rs 150,000 per kg and is inching closer to the Rs 2 lakh mark in India mainly because of the festive season spike in demand. The unprecedented rally in silver has been driven by robust industrial demand, a five-year supply deficit, a favourable gold-silver ratio and expectations of US Fed policy easing.

Experts at Tata Mutual Fund suggest that silver could outperform gold over the medium term (3 to 5 years), though shortterm volatility remains a key risk. Strong investment demand, a large supply deficit and a US Fed rates cut may continue to support silver prices over the medium to long term. Silver's growth story is closely tied to industrial demand recovery - particularly from China and the global supply deficit, the fund house adds.

The buoyancy in silver is expected to continue going ahead as the rally is fuelled by a combination of investment appeal and robust industrial demand, especially from the electronics, electrical vehicle (EV) and solar panel sectors. With persistent supply deficits, silver is outperforming equities and may outperform even gold in the medium term. At the same time, it is seen as an affordable entry point for investors.

After years of stagnant performance, platinum, which has for long played second fiddle to its more attractive cousins like gold and silver, is coming into its own and experiencing a strong resurgence in 2025. It is supported by a structural supply deficit, recent global conflicts like RussiaUkraine and Israel-Hamas, and growing demand from the petrochem, automotive and jewellery sectors, and investors, even as supplies dwindle. These, combined with natural tendency of most people to lose confidence in their national currencies and invest in precious metals in times of crisis, has sent the price of platinum soaring, even as supplies are expected to further dwindle from the 2023 deficit of 7,49,000 ounces.

Currently, platinum's price in the international market has crossed $ 1,500 per gram - a ten-year high. It has outperformed gold as well as silver. During the current year so far, while gold prices have climbed 51 per cent and silver prices 68 per cent, platinum prices have shot up 80 per cent. As a result, the size of the platinum market, which was valued at $ 7.10 billion in 2024, is expected to cross the $ 10 billion mark by 2033.

The outlook for industrial/base metals is mixed, with some like nickel facing price pressure and over-supply, while others are ruling strong on a long-term bullish trend on the back of electrification. Metals like copper and aluminium are in demand and are expected to gain further strength going ahead.

Demand for copper remains robust, driven by the clean energy transition, including EV wiring, charging infrastructure and grid expansion. However, the market is highly sensitive to macro-economic factors and trade volatility. Global production cuts and supply distributions are also influencing the market.

In the international market, copper prices surged to $ 11,000 per tonne, reaching a peak not seen since May 2024. This milestone reflects a dramatic increase fuelled by several converging factors influencing the metals market. The rise marks a more than 21 per cent gain in copper prices for 2025 so far, highlighting the dynamics of supply disruption, robust demand, and macroeconomic conditions, including currency weakness and interest rates.

Copper futures on the London Metal Exchange (LME) climbed by 3.1 per cent on October 9, reaching the $ 11,000 per tonne marker, only slightly below the record high of $ 11,104.50 set in May 2024. By mid-trading, prices adjusted marginally to around $ 10,970. The price rise is part of a sustained upward trend in 2025, with copper's value increasing steadily throughout the year. The surge was driven by multiple factors, with market participants increasingly concerned about supply shortages and engaging in speculative inflows as prices rose.

On the demand side, copper's extensive applications across multiple industries continue to support its elevated prices. The metal, often called 'the metal of civilization', is essential for electrical wiring, construction, infrastructure, agriculture, and especially in the burgeoning renewable energy and electric vehicle sectors. Global efforts to transition toward cleaner energy sources are driving demand for copper, which is used in green infrastructure and technologies.

The surge to $11,000 per tonne is also influenced by macro-economic conditions such as a weakening US dollar and declining interest rates. A weaker dollar makes commodities priced in that currency cheaper for holders of other currencies, fuelling international buying interest. Meanwhile, lower interest rates reduce the cost of holding inventories and financing speculative purchases in commodities. These factors have encouraged capital inflows into the copper market, intensifying its upward momentum.

As the world's largest consumer of copper, China's market behaviour significantly influences global prices. In recent months, there has been a return of Chinese investors and industrial buyers to the copper market, adding strength to price gains. Concerns over supply shortages have kept market participants watchful, with China's imports rising sharply in anticipation of further demand growth and potential tariffs affecting other sources.

The $ 11,000 per tonne level is the highest copper price point since May 2024, when prices peaked just above $11,100. Prices had dipped after that peak, but began a steady climb again throughout 2025. According to World Bank data, copper prices were around $ 9,984 per tonne in September 2025, up from about $ 9,670 the month before and $ 9,237 one year earlier, indicating an 8.08 per cent increase year-on-year and a steady month-on-month rise. The steady upward trend reflects the ongoing tightening between supply and demand, combined with periodic external shocks such as mine incidents, geopolitical tensions, and macro-economic shifts influencing investor behaviour.

The outlook for aluminium prices is supported by China's self-imposed production capacity limits and rising demand from the transportation and renewable energy sectors. Like other industrial metals, it faces risks from global growth uncertainty and trade tensions.

Aluminium futures rose past $ 2,750 per tonne in October, the highest in over three years, amid tight supply and bullish bets on longer-term demand. Chinese authorities cut their annual output growth target for base metals to an average of 1.5 per cent annually for 2025 and 2026, compared to the 5 per cent target previously. The curb was in line with China's aluminium output cap of 45 million tonnes, which is set to be breached this year under current capacity, amid Beijing's 'anti-involution' campaign to slow capacity for manufacturers in an effort to control deflationary pressures. Elsewhere, Alcoa Corp announced it would shut its Kwinana alumina refinery in Australia due to deteriorating bauxite ore grades. In the meantime, bets of aluminium consumption in the longer-term were supported by corporate pledges of expenditure in new data centres, which take a large volume of aluminium.

Aluminium futures are mostly traded on the London Metal Exchange (LME), the New York Mercantile Exchange (COMEX), and the Shanghai Futures Exchange. The standard future contract size is 5 tonnes. Aluminium is used widely in aerospace applications, packaging, automobiles and railroad cars, and as a construction material. The biggest producers of aluminium are: The Aluminium Corporation of China (Chalco), Alcoa and Alumina Ltd, Rio Tinto from Australia, UC Rusal of Russia, Xinfa from China, Norsk Hydro ASA from Norway, and South 32 from Australia. China accounts for nearly 60 per cent of global aluminium output. The biggest resources of bauxites, the raw material for aluminium, are located in Australia, China and Guinea. The aluminium prices displayed on the Trading Economics portal are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments.

Smelter issues and production cuts are tightening the market, but prices face downward pressure from slowing global demand. Its use in infrastructure and galvanization remains a stable demand driver. Zinc futures are available for trading on the London Metal Exchange (LME). The standard contract size is 25 tonnes. Zinc is often used in die-casting alloys, castings, brass products, sheeting products, chemicals, medicine, paints and batteries. The biggest producers of zinc are China, Peru, Australia, the United States, Canada, India and Kazakhstan. Zinc prices displayed on the Trading Economics portal are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments.

Zinc futures in the UK were above $ 3,015 per tonne mark for the first time this year, erasing its sharp losses yearto-date amid compounding threats to supply. The International Lead and Zinc Study Group noted that mined zinc production rose 6.3 per cent annually in the first half of 2025. Zinc increased to $ 3002.00/T, the highest since December 2024. Over the past four weeks, zinc gained 4.61 per cent, and in the last 12 months it decreased 3.8 per cent.

An oversupply, particularly in Class 2 nickel, is keeping prices subdued, though a recovery is possible as Indonesia reduces production. The long-term trend remains positive due to its critical role in EV batteries, particularly high-grade Class 1 nickel.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives