Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 30, 2025

Updated: September 30, 2025

This fortnight, we have selected a PSU with tremendous growth potential as the Fortune Scrip. It is Gujarat Mineral Development Corporation, one of India’s leading mining and mineral processing companies. The Ahmedabad-headquartered GMDC is the second largest lignite manufacturing company in India and is also engaged in the exploration of bauxite, fluorspar, manganese, silica sand, limestone, bentonite and ball clay. The company also has a sizeable presence in the energy sector.

Promoted over six decades ago in 1963, the company commenced operations with a small silica sand quarry. It was followed by bauxite mines in Kutch, and today it operates six bauxite mines. In 1971, a beneficiation plant was commissioned to process 500 tonnes of fluorspar ore and produce calcium fluoride, which is used for the manufacture of hydrofluoric and as flux in metallurgical industries. A captive mine was established in Amubadungar to feed the plant.

In 1973, lignite was discovered in Gujarat and GMDC started its first lignite mines in Panandhro. This was followed by a captive refining plant with copper mines set up near Ambaji. In 1983, another lignite mine was discovered and the company started operations at Rajpardi near Bharuch. This was followed up with setting up a calcination plant to add value to the bauxite plant at Gadhsisha in Kutch. In order to use the lignite mined by it, GMDC started a thermal power plant at Nanichhar in Kutch. In 2005 and 2009, more lignite mills were started at Ankleshwar near Surat and near Bhavnagar. Meanwhile, it developed a manganese ore mine at Shivrajpur near Panchmahals. It also set up an alumina plant with Raytheon Corporation of the US.

Today, GMDC has six lignite mines, of which three will soon reach the end of their life, but six new mines will be added and thus the company will have nine operating lignite mines. For 2023, the company produced 10 million tonnes of lignite, against 8.5 million tonnes in fiscal 2022. In the case of bauxite, the company has nine mines, of which eight are in Kutch and one in Dwarka.

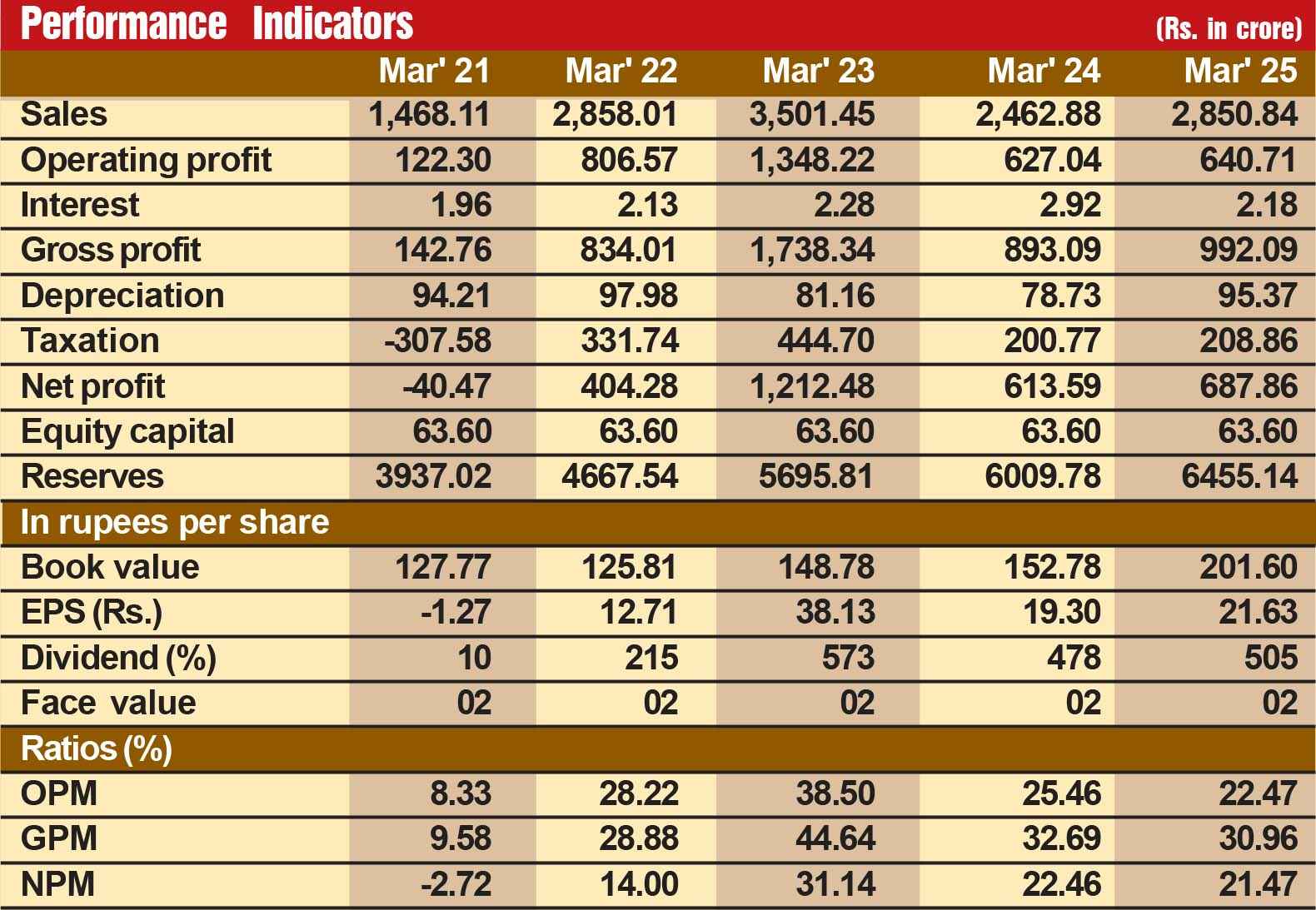

GMDC was making steady progress for the first 55 years, with sales turnover in fiscal 2018 crossing the Rs 2,000-crore milestone and operating profit reaching near Rs 500 crore. But thereafter, the company’s financial performance started deteriorating and the balance sheet for fiscal 2020-21 stunned observers as a profit-making company plunged into the red, incurring an operating loss of Rs 10 crore and a net cash loss of Rs 39 crore. Observers were shocked at the slump in the performance of the company, which has the only lignite mine in Gujarat. Hundreds of small and medium-sized industrial units in Gujarat would obviously prefer to buy lignite frome GMDC, instead of importing coal from Coal India, which is 700 km away and involves high transportation costs, besides logistic problems.

The government decided to adopt a professional approach to transform the fortunes of the company. Instead of instituting a departmental enquiry, it embarked on a remarkable transformative exercise by roping in four top global management consulting firms — Boston Consulting Group (BCG), McKinsey & Co, AT Kearney, and Deloitte — to find the reasons for the debacle and suggest concrete steps needed to take the company back on a robust growth path.

To begin with, on the recommendation of the four consultants, the top management of the company was changed. Gujarat’s Additional Chief Secretary Rajkumar was appointed Chairman and Gujarat Commissioner of Geology and Mining Roopwant Singh was given charge as Managing Director. Both bureaucrats are known for their far-sightedness and professional approach.

Among the consulting groups, BCG was asked to look into the company’s transformation – from being known as a lignite miner to its aspiration of becoming a diverse mineral resources player in the niche as well as volume segment. McKinsey was entrusted with the task of helping the company build a portfolio of rare earth elements (REE). ATK was asked to help the company transform its thermal power projects, and Deloitte was supposed to speed up the company’s new lignite mining projects. It was indeed an intelligent task allotment exercise as these renowned consultation groups could give their best in the area entrusted to them.

The new management implemented the suggestions of the expert groups with remarkable sincerity and utmost efficiency. The outcome was as expected. The company not only turned the corner but quickly went on to the growth path. In the next four years, GMDC came out with an extraordinary performance — sales turnover which had declined from Rs 2,051 crore in fiscal 2018 to Rs 1,326 crore in 2021 more than doubled, rocketing to Rs 2,851 crore in fiscal 2025, with operating profit skyrocketing to Rs 637 crore in striking contrast to a loss of Rs 10 crore in 2021. At the net level, the loss of Rs 39 crore transformed into a net profit of Rs 798 crore – the highest in the over six-decade history of the company.

Currently, the company’s financial position has become very strong, with reserves at the end of March 2025 standing at around 100 times its equity capital of Rs 64 crore. GMDC is now a virtually debt-free company with its interest for fiscal 2025 being just Rs 2 crore on a sales turnover of Rs 2,851 crore. What is more, the share price during the last one year or so has shot up by over 160 per cent to Rs 588.

But we have not picked GMDC as the Fortune Scrip because of its past laurels. We are of the strong opinion that the company’s future outlook is all the more promising. Consider:

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives