Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 15, 2025

Updated: September 15, 2025

US President Donald Trump’s import tariffs sword may well turn out to be a Damoclean sword hanging over the heads of Americans themselves, going by projections of leading US think tanks.

According to the Yale University Budget Lab Study, the Trump tariff policy will add over 875,000 people to the list of poor Americans. Besides, inflation has already started raising its head in the US.

A forecast by USDA Economic Research Service suggests that overall food prices in 2025 are anticipated to rise by 3 per cent, with prices for eggs, beef & veal, sugar & sweets, and nonalcoholic beverages predicted to grow faster than their 20- year historical average rate of growth.

The Yale analysis indicates that US consumers will absorb the majority of the burden through higher prices. Besides, the Congressional Budget Office has also noted a potential reduction in the overall size of the US economy.

Analysts are asking whether the US President has paused to consider the fact that his own countrymen will be hard hit by his ‘America First’ tariffs.

Since taking office as US President for the second time, Donald Trump has signed off on a growing list of tariffs on specific countries and commodities — a move Mr Trump says is aimed at protecting US interests and improving the economic condition of Americans. In fact, the opposite could happen – his tariff policy could worsen the living standards of his own people by leading to an inflationary price spiral, growing unemployment and increasing poverty. This has been vividly revealed by various US economic studies, including some by leading universities. According to the Yale University Budget Lab Study, the Trump tariff policy will add over 875,000 people to the list of the poor, with the number of poor Americans rising from the current level of 35 million to the plus-40 million mark by December 2026 and reaching 50 million within the next few years.

The Trump tariff policy has ignited international resistance, increasing market volatility and creating major headwinds that JP Morgan Global Research believes will weigh on economic growth.

According to this report, “our updated estimate of the average effective US tariff rates at 15.8 per cent is a significant increase from the 2.3 per cent rate at the end of 2024 but roughly six percentage point lower than the 22 per cent recorded on Liberation Day (April 2, 2025, when Mr Trump announced his tariff policy),” said Nura Szentivanyi, senior global economist at JP Morgan. She added, “Based on our expectation that sectoral tariffs will be imposed later this year, we still anticipate that the US effective tariff rate will approximate 18-20 per cent while the observed tariff rate (based on actual customs duties) is likely to level off slightly higher than 15 per cent.”

Uncertainty still surrounds currently exempt sectors, notably pharmaceuticals and electronics. The Trump administration has signalled that tariffs on pharmaceuticals could potentially rise toward 200 per cent by mid-to-late 2026.

In addition, regulatory risks remain. “An eventual court ruling against the administration’s reliance on the International Emergency Economic Powers Act (IEEPA) as the basis for these tariffs could significantly alter the implementation path. If the IEEPA is deemed inadmissible, the legal status of the trade deals themselves could come into question,” Szentivanyi noted.

While global growth is still expected to experience a downshift in the second half of 2025, JP Morgan Global Research expects less impact on supply chains and household purchasing power than was initially expected based on Liberation Day tariffs. “Tariff hikes are being implemented in a gradual fashion, and US policymakers have eschewed potentially disruptive barriers to trade within North America and with China,” said Bruce Kasman, chief global economist at JP Morgan. “The antici-pated retaliation to higher US tariffs has not materialized, reducing the drag on global growth. In addition, the trade war has depressed business sentiment, but the risk that this prompts retrenchment is being tempered by easier global financial conditions.”

Even as the new tariff chapter of President Trump has not been completed, the monster of inflation has started raising its head in the US. Middle-class and low-income Americans have started feeling the pinch of the rising prices of essential commodities. According to figures provided by a US-based Indian family, egg prices have been jacked up by 12 per cent to $ 3.65 (Rs 325), potato prices have moved up to Rs 95 per kg, rice prices have gone up to Rs 95 per kg and milk prices have shot up to $ 4.50 per gallon.

According to a forecast made by USDA Economic Research Service in August, overall food prices in 2025 are anticipated to rise at about the historical average rate of growth. In 2025, prices for all foods are predicted to increase 3 per cent. In 2026, prices for all food are predicted to rise 2.5 per cent. According to this forecast, during 2025 as a whole, prices for eggs, beef & veal, sugar & sweets, and non-alcoholic beverages are predicted to grow faster than their 20-year historical average rate of growth.

The Yale Budget Lab reports that President Trump's policies, particularly tariffs, impose costs on US consumers and businesses, potentially leading to higher prices for goods like clothing and electronics, with consumers absorbing most of the costs. The Budget Lab's analysis is based on trade models and projects significant impacts on specific sectors, as well as potential decreases in income for lowerincome households.

The analysis indicates that US consumers and businesses will bear the costs of tariffs, with consumers absorbing the majority of the burden through higher prices.

Beyond immediate price effects, the lab's work suggests broader macro-economic impacts, with the Congressional Budget Office also noting a potential reduction in the overall size of the US economy.

1) Because tariffs directly reduce the purchasing power

of low-income households (either by decreasing nominal

incomes or by increasing prices), they also affect poverty.

2) The Yale report estimates that the Trump

administration's new 2025 tariffs will increase the number

of Americans living in poverty by between 650,000 and

875,000 (between 0.2 and 0.3 per cent of the U.S. population), depending on the poverty measure used.

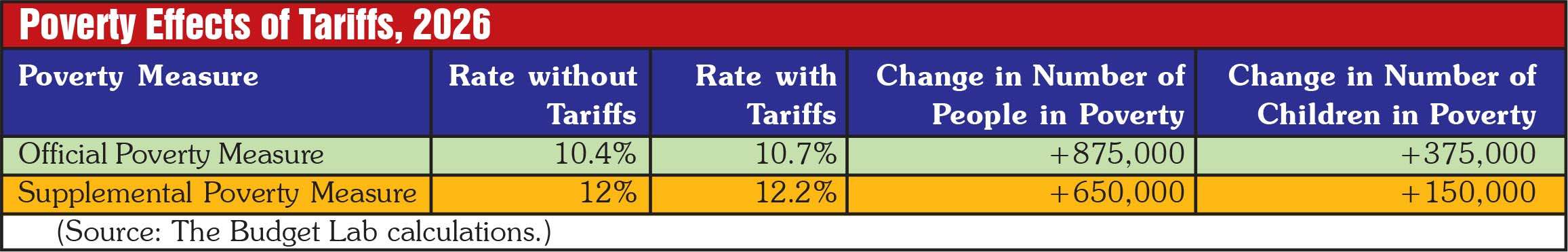

There are two major measures of poverty in the US produced by the Census Bureau. The first is the Official Poverty Measure (OPM), a long-running measure of poverty that compares cash income to an inflation-indexed threshold. The other is the Supplemental Poverty Measure (SPM), a more comprehensive measure which takes into account more information on household resources and the cost of living. The Yale report produces estimates for both the OPM and the SPM.

Table 1 shows the results of the exercise. The report estimates that the Trump administration's tariffs, in place as of September 3, will lead to about 875,000 more people, about 375,000 of whom are children, living in poverty according to the OPM. This number reflects an increase in the OPM from 10.4 to 10.7 per cent. The picture is similar for the SPM, where the rate would rise from 12.0 to 12.2 per cent-an increase of about 650,000 people, including 150,000 children.

This means that the US tariff hikes will not only hit the pace of growth of the countries exporting to the US but also the US economy itself. Thus, the trillion-dollar question is: Will a headstrong, tariff-hungry US President pause to consider the damage caused to his own country and fellow Americans?

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives