Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 15, 2025

Updated: September 15, 2025

This fortnight we have selected an extraordinary multibagger as the Fortune Scrip. It is PTC Industries, which has showered immense wealth on its investors. During the last six decades of its existence, it has offered fantastic returns of over 19,500 per cent on their investment. As a result, a shareholder who had invested Rs 1 lakh six years ago is the owner of Rs 1.95 crore today. But this is not the end of this incredible story. If current trends and the future outlook for the company are any indication, there is a lot of steam left in the scrip as yet. The company, which was below Rs 100 six years ago, is in demand today at Rs 15,518. Knowledgeable research analysts expect the price to touch the Rs 20,000 mark in the near future, before charting upward journey.

Incorporated way back in 1963, PTCIL is engaged in the production of high-precision metal components and materials for critical and super-critical applications.

Promoted as Precision Tools Castings Ltd at Aichbaug, Lucknow, the company manufactures industrial castings of various grades of steel, stainless steel and super alloys (cobalt, nickel, tungsten-based metallurgy).

The castings manufactured by the company are used in various industries like valves and pipe fittings, cement, fertilisers, chemicals, thermal and nuclear power, mining and geology, railways, road and sea transport, among others. It is a leading manufacturer of high-precision metal components for critical and super-critical applications.

The company offered equity shares in May 1995 to fund the modernisation and expansion of its installed capacity from 1,800 mtpa to 3,600 mtpa, and to set up casting facilities. Commercial production on the expanded capacity commenced in March 1995.The company exports to hard-currency areas of the UK, the US, Germany, Spain and Finland. It received the Best Exporter shield from the Engineering Export Promotion Council (EEPC) (Northern Region) in 1990, 1991 and 1993. It was accorded the German Quality Audit Certification (RWTUV), and is certified as a ‘Well-Known Foundry’ under the Indian Boiler Regulations. The company’s expansion plan in 1994-95 has yielded superb results.

Another project of steel fabrications is also on the cards. Total forex earnings during 1995-96 was Rs 16.55 crore. In 1999-2000, it implemented a new project at Mehsana in Gujarat. In 2012- 13, it implemented a new Production and Planning ERP software at the Lucknow plant in Aishbagh. In addition, it acquired a 3-tonne fully automated zero-harm ladle, minimizing the risk and providing zero accident tolerance for the operators. It sold the Bhiwadi (Rajasthan) unit, effective from March 31, 2013, on a slump sale basis as a going concern to M/s Precon Technology Castings Limited. All assets and liabilities related to this unit got transferred to the buyer. In 2013-14, Modrany Power PTC Piping Systems Pvt Ltd was incorporated as a subsidiary of the company. During 2016- 17, it commercialized the rapid cast technology for manufacture of stainless steel castings weighing up to 6,000 kg and made it operative. In 2023-24, the companys Advanced Manufacturing Technology Centre, (AMTC) in Lucknow was made operational.

The company formed a new 100%-owned subsidiary, Aerolloy Technologies Limited, for entering the aerospace components market effective from February 17, 2020. Its Rs 51-crore project for acquisition and customisation of technology for development and commercialisation of titanium castings with ceramic shelling was commissioned during the year.

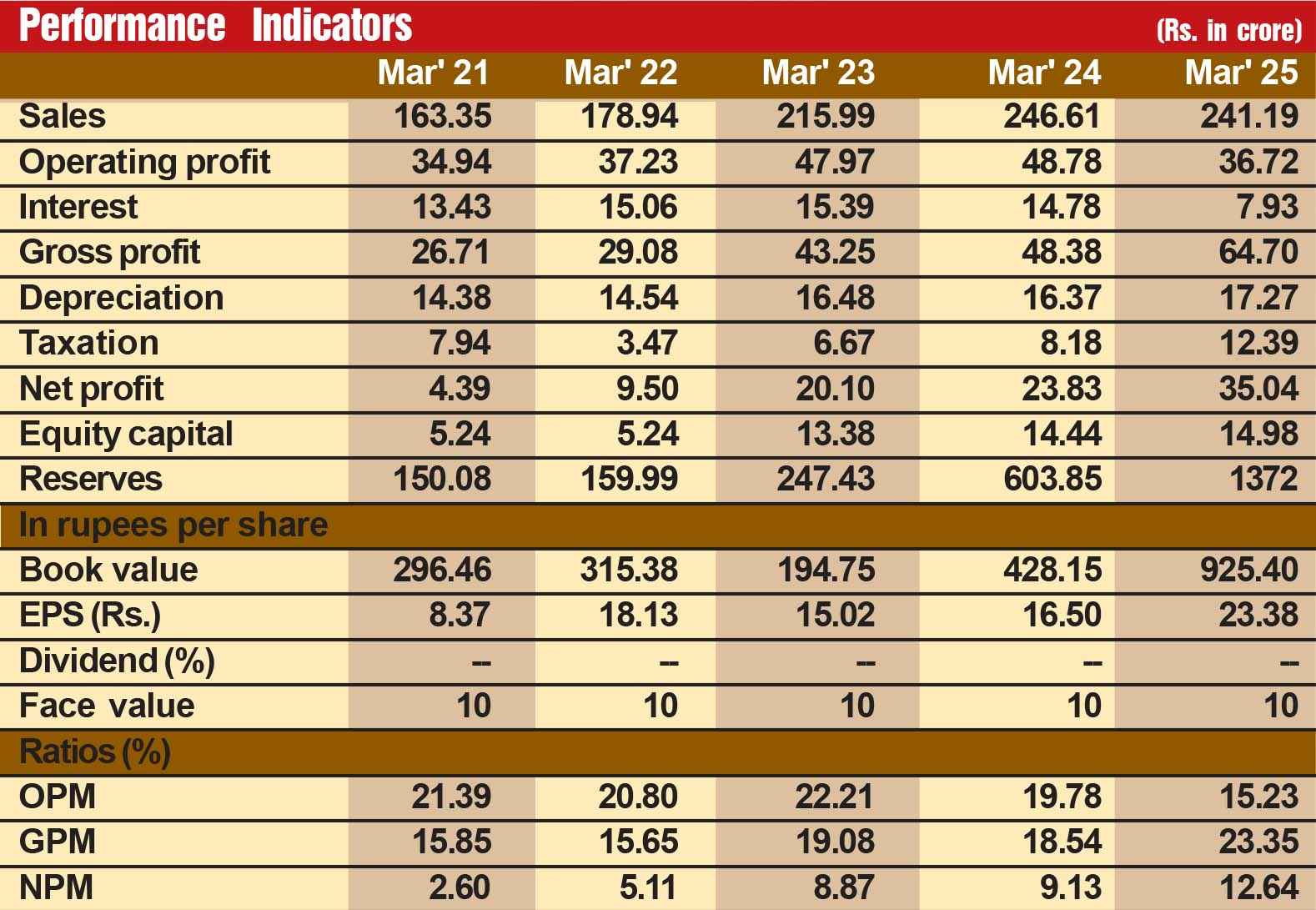

The company has been making rapid strides in its financial performance. During the last 13 years, its sales turnover has almost trebled from Rs 138 crore in fiscal 2013 to Rs 335 crore in fiscal 2025, with operating profit more than trebling from Rs 23 crore to Rs 75 crore and the profit at net level shooting up more than seven times from Rs 8 crore to Rs 61 crore. The 5-year compounded sales growth has registered a rise of 33 % and CAGR profit growth has crossed the 100% mark to reach at 105 %. Its financial position is extremely strong, with reserves at the end of March 2025 standing at over 91 times its tiny equity capital of Rs 150 crore. The company’s debt burden is negligible, with financial costs (interest) for fiscal 2025 being just Rs 9 crore.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives