Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: September 15, 2025

Updated: September 15, 2025

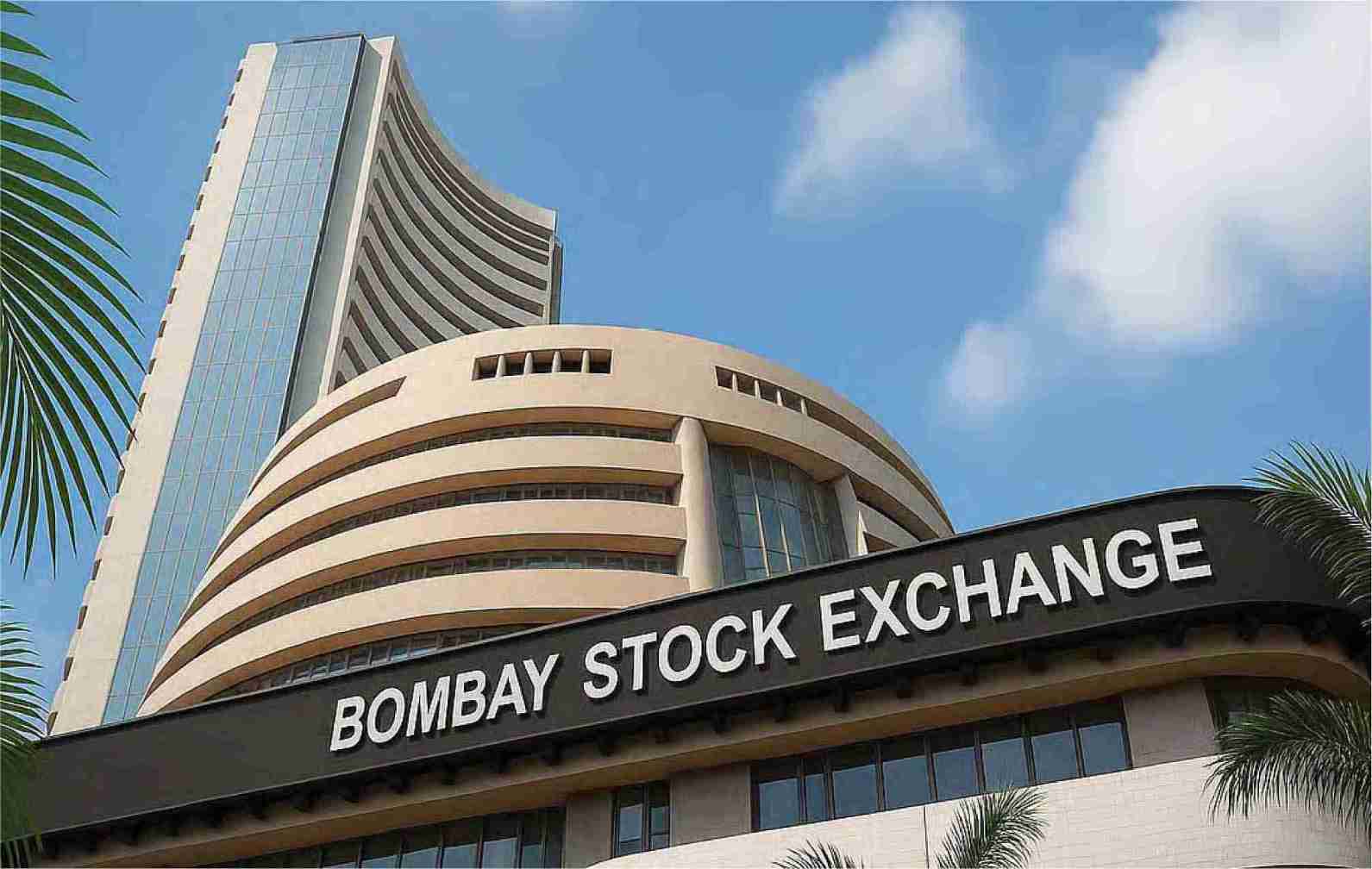

As we analyze current market conditions, several key indices in the Indian equity markets are displaying strong, bullish price action on their weekly charts, signalling a potential for sustained upside momentum. This technical analysis aims to provide a strategic outlook for the Nifty Smallcap 250 Index, Midcap 150 Index, Nifty 500 Index and the PSU Banks Index. By focusing on significant price patterns and trends, we will delve into the underlying technical structures that suggest that these indices could be poised for further gains in the coming weeks.

Nifty, as the benchmark index, continues to hold a crucial position in shaping market sentiment. Alongside, the Smallcap 250 and Midcap 150 indices are showing signs of robust recovery and accumulation, supported by strong sectoral rotations. Meanwhile, the Nifty 500 Index, representing broader market participation, is also demonstrating patterns indicative of broader market strength. The PSU Banks Index, often a barometer for the performance of publicsector financial stocks, is forming a strong base, suggesting potential Prakash Chandresh Padalia (CA) breakout opportunities.

In this report, we explore the technical set-up and price action in detail to arrive at bullish targets for each of these indices, providing a roadmap for traders and investors looking to capitalize on the current market conditions. So, here goes:

Now, the question is: Has this pattern played out in Nifty before ? YES!! Have a look – The entire bull run of year 2023-24 was because of this Cup-and-Handle pattern. We are going to witness the same kind of run again… brace yourself!

(The writer Mr. Prakash Padalia, a chartered accountant is a knowledgeable market analyst and an expert in technical)

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives