Fortune Scrip

Published: January 15, 2026

Updated: January 15, 2026

Bharti Airtel Ltd

Smorgasbord of digital offerings

With the stock market passing through an uncertain phase, with a downward inclination, it has

becomes very difficult to select a stock as the fortnightly Fortune Scrip. Even fundamentally strong,

financially stable and well-managed companies lack fresh buying support, and no one knows how

long the current phase of uncertainty and widespread selling pressure, led by foreign institutional

investors (FIIs) and foreign portfolio investors (FPIs), will continue. In this scenario, we have

selected a company which continues to attract stable demand. It is Bharti Airtel, a leading Indian

telecom multinational that provides mobile (4G/5G), broadband (fibre, air fibre), DTH (Direct to

Home) and digital services across India and Africa, serving over 600 million customers globally

Headquartered in New Delhi, Bharti is a major global telecom player and India’s second

largest telecom operator, with 33.5 crore wireless customers in India and 14 crore subscribers

across 14 African countries. It offers solutions from basic connectivity to Enterprise Cloud IoT

(Internet of Things) and digital payments, making it India’s largest integrated telecom provider.

The company operates in India, Africa, Bangladesh and Sri Lanka, among other regions, with

an Avast network. Bharti Airtel boasts of having led the 4G/5G roll-out in India, focusing on digital transformation for consumers and businesses. As far as the digital ecosystem is concerned, the company offers integrated digital experiences via the Airtel Thanks app, including OTT subscriptions (Sony Liv, Zee5) and AI (artificial intelligence) tools like Perplexity Pro.

DIGITAL FORCE

Founded by Sunil Bharti Mittal in 1995 with a strong global partnership (e.g. Singtel), Airtel is

a comprehensive digital lifestyle company that has evolved from a traditional telecom provider into

a major force in emerging markets that is known for its expansive network and customer-centric

digital offerings.

The stock is attracting heightened market activity. On December 29, 2025, Bharti Airtel witnessed a notable 11.2% increase in Open Interest in its derivatives segment, signalling heightened market activity and shifting investor positioning. The OI rose sharply to 172,148 contracts

from 164,795 contracts the previous day. This increase in OI was accompanied by futures volume

of 101,231 contracts, reflecting sustained trading interest. The futures value stood at Rs 337,228

lakh, while the options segments exhibited a substantial value of Rs 68,220 crore, underscoring

the stock’s prominence in the derivatives market. The combined derivatives turnover amounted

to Rs 339,671 lakh, indicating strong liquidity and active participation from institutional and retail

traders alike.

FINANCES BOOM

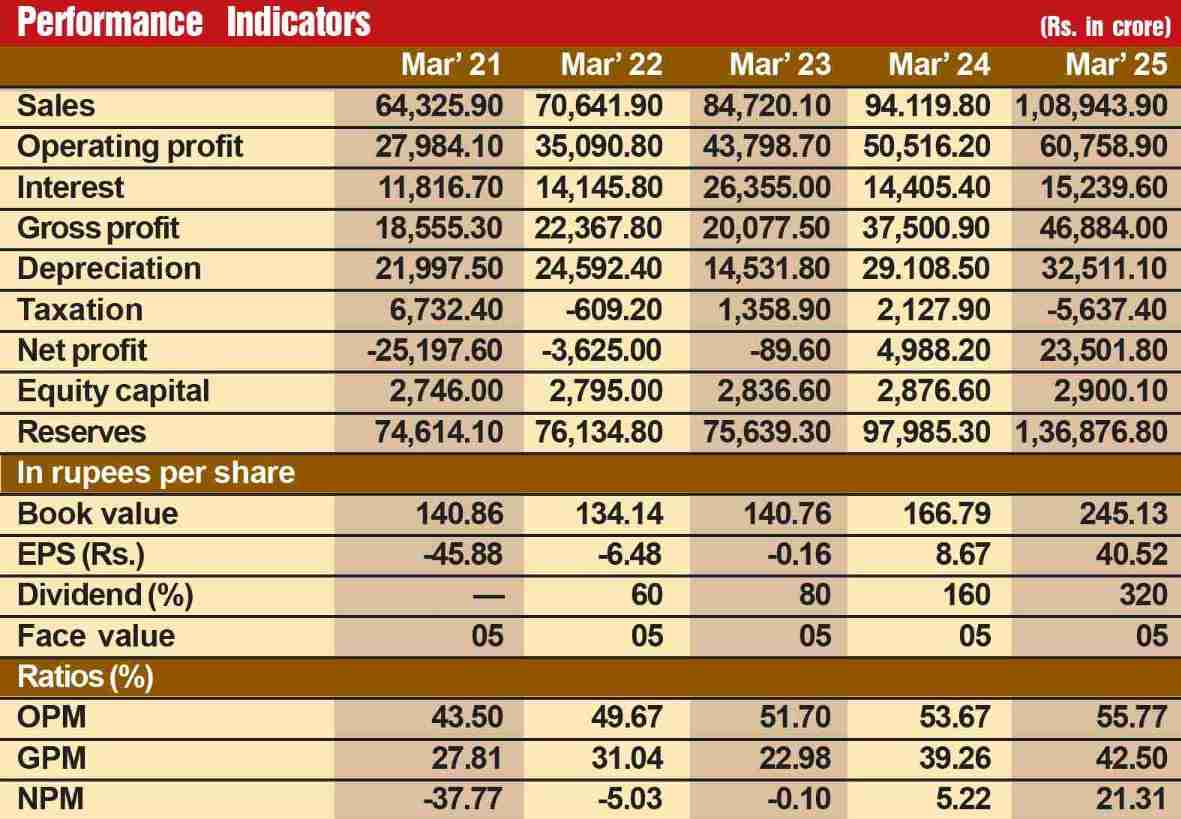

The company has made rapid strides on the financial front. During the last 12 years, its sales

turnover has more than doubled from Rs 85,864 crore in fiscal 2014 to Rs 172,985 crore in fiscal

2025, with operating profit more than trebling from Rs 26,512 crore to Rs 85,060 crore and the

profit at net level shooting up over 12 times from Rs 3,019 crore to Rs 37,481 crore. But we have

not selected this stock as the Fortune Scrip on account of its past laurels. We are highly confident that

the future prospects for this company are all the more promising. Consider:

- Prospects of the telecom industry are very strong, driven by the fact that along with daily

essentials, mobile phones have become an essential item for people, particularly in urban and

semi-urban areas. In fact, mobile connections are growing in rural areas too. Again, the growth of

the sector is being driven by massive 5G/6G rollouts, AI-powered automation, rising data demand

(Internet of Things, Edge Computing) and diversification into B2B digital services (health, education), key growth areas like APIs for developer monetisation, satellite com, and secure quantum

tech, positioning telcos as foundational for the digital economy and requiring strategic investment

and innovation to capture new value. What is more, the industry’s role is shifting from mere connectivity providers to enablers of

digital ecosystems (healthcare, education, B2B, solutions). The industry is transforming into a

platform for digital services, relying on deep tech like AI, Quantum and networks.

DUOPOLY SCENE

- With most small operators shutting shop, the industry is moving towards a duopoly of two

major players – Reliance Jio and Bharti Airtel. In order to ensure that both these giant operators do

not take advantage of the duopoly situation, the government is trying to keep alive Vodafone Idea,

which is heavily in debt. Thus, Bharti Airtel has very limited competition while demand for its

products in steadily rising. The major factor that will influence the pace of growth of the telecom

industry is government policy. With a favourable industry structure of three players, Bharti is in a

sweet spot to maintain its relative strength among its peers with a formidable digital ecosystem

offering. The company enjoys industry-leading ARPU in the wireless business in India.

- Renowned stock market analysis platform MarketsMojo has upgraded Bharti to platform

grade, and from ‘hold’ to ‘buy’ as of December 16, 2025, reflecting improved fundamentals and

technical indicators. The stock’s major score stands at 71, signalling a favourable risk-reward profile, despite a very large market capitalisation of Rs 11,88,945.98 crore seeking exposure to the

telecom sector’s growth potential.

- Institutional investors play a pivotal role in shaping Bharti Airtel’s market trajectory. The

company’s large-cap status and Nifty50 membership attract significant participation from mutual

funds portfolio investors. Changes in institutional holdings can influence liquidity and price stability,

especially given the stock’s sizeable market capitalisation of nearly Rs 12 lakh crore.

- Bharti Airtel’s inclusion in the Nifty50 index underscores its stature as one of India’s leading blue chip companies. This membership not only reflects the company’s sizeable market

capitalisation but also ensures heightened visibility among institutional investors and index funds.

The stock’s presence in this benchmark results in increased liquidity and trading volumes, as many

passive funds replicate the index composition.

Being part of Nifty50 also means that Bharti’s stock movements can have a material impact on

the index’s overall performance. This relationship is particularly relevant, given the company’s

substantial weighting within the telecom sector, which itself is a key component of the broader

market.

CARTOON MENU

- Bharti Airtel has launched an exclusive ad-free Cartoon Network Classics, a value-added,

ad-free channel on Airtel digital TV developed in partnership with Warner Bros’ Discovery. The new

service offers a curated slate of Looney Tunes, the Flintsones, Scooby Doo and Johny Bravo,

targeting nostalia-driven adults and families as well as introducing classic franchises to younger

viewers. This cartoon service has deepened Bharti’s family entertainment offering and has boosted

viewer engagement.

- Prospects of the telecom industry are very strong driven by the fact that along with the Roti

Kapada and Makan, mobile phone has also become an essential item for day to day life of the people

particularly in urban and semi-urban areas. What is more of late mobile has started strengthening its

footprints in rural areas also. Again the pace of growth of the sector is driven also massive 5G/6G

rollouts, AI-powered automation, rising data demand (Internet of Things, Edge Computing) and

diversification into B2B digital services (health, education) key growth area involvement work APIs

for developer monetisation, satellites comms, open rans, and secure quantum tech, positioning

telcos as foundational for the digital economy requiring strategic investment and innovation to

capture new value.

What is more, the industry role is shifting from mere connectivity providers to enablers of digital

ecosystems (healthcare, education, B2B, solutions). The industry is transforming into a platform for

digital services relaying on deep tech like AI, Quantum and networks.

- Institutional investors play a pivotal role in shaping Bharti Airtel's market trajectory. The

company's large-cap status and Nifty 50 membership attract significant companies from mutual

funds portfolio investors. Changes in institutional holdings can influence liquidity and price stability,

especially given the stock's sizeable market capitalisation of nearly Rs. 12 lakh crore.

- Bharti Airtel's sustained outperformance relative to Sensex over multiple timeframes highlights capacity to deliver long-term value. The stock's 10-year return of 584.63% notably suprpasses

the Sensex's 226.21 per cent, reflecting the company's successful navigation of industry challenges

and its strategic investments in network expansion and digital services. Investors evalualing Bharti

Airtel should consider the company's market leadership robust capitalisation and benchmark status

along with sectoral trends and valuation metrics. While short-term volatility may persist, the stock's

positioning within the Nifty 50 and its relative valuation suggest it remains a key player in India's

telecom landscape.

Shares of Bharti are quoted around Rs. 2110, just around 3% below its 52-week high. As the

current market situation is full of uncertainties on account of growing global geopolitical tensions,

spreading tariff war initiated by the US President Donald Trump, the stock price may face volatility

with a downward inclination but once this tumulus period is over, the Bharti Airtel's stock price will

tend to move up. Discerning investors who are ready to take risk and cherish long-term perspective

can accumulate these stocks at every decline.

![]() Unlock Unlimited Access

Unlock Unlimited Access

![]() Unlock Unlimited Access

Unlock Unlimited Access