Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: January 15, 2026

Updated: January 15, 2026

2026 has started on a cautious note for the Indian stock market as global geopolitical tensions continue, what with the ongoing Ukraine-Russia military conflict and US President Donald Trump even dropping hints of a Third World War.

What’s more, the Trump tariff sword has created widespread global uncertainty.

As for Indian investors, the question agitating their minds is: Where to invest in 2026? Traditional avenues like bank deposits, company deposits and real estate have lost their appeal, leaving two choices — precious metals and the stock market.

Growing geopolitical tensions have led to gold prices reaching all-time highs in international markets, while the domestic gold price reached Rs 123,420 per 10 gm by Diwali last year.

Silver’s growing demand comes mostly from industry, and the white metal crossed the Rs 1 lakh/kg mark. However, if geopolitical tensions calm down, the frenzy for gold may weaken.

In these circumstances, the stock market remains the best investment avenue – with an extra measure of caution.

started with high hopes for investors but, following huge volatility in market sentiment, ended with a whimper. At the beginning of the year, the sentiment was bullish, creating hopes that investors would reap a rich harvest as the year progressed, what with market prices scaling newer highs. But halfway through, market sentiment underwent a dramatic change, what with growing global geopolitical tensions, US President Donald Trump swinging his tariff sword at India (among other countries), volatile foreign flows with FIIs and FPIs unloading their holdings and taking away dollars to other destinations like the US and China (with Beijing offering liberal sops to foreign investors), a sharp drop in the value of the Indian currency against the greenback, and Mexico copying the US by imposing higher tariffs on Indian goods and services.

A mix of monetary easing, retail-driven liquidity, sectoral leadership and scattered structural reforms did help Dalal Street to absorb these shocks, but overall market sentiment remained mixed, with pivotal index stocks finding scattered support which helped leading indices stay steady while thousands of other shares continued to sink to lower levels. On the other hand, investor participation moved decisively beyond Tier-I cities into smaller states and Union territories, with household participation reaching record levels in non-metro regions and Andaman-Nicobar (17.1%), Puducherry (16.4%) and Dadra and Nagar Haveli (15.4%) leading the way. This ‘democratisation’ of the stock market, as one expert put it, provided a stable floor, allowing the Nifty to recalibrate rather than crash even when FPIs pulled out massive funds to reinvest in other countries.

In 2025, Indian IT and manufacturing companies moved beyond testing artificial intelligence (AI) and began using it in day-to-day operations. According to Ernst & Young, agentic AI — which can carry out multi-step tasks on its own rather than just respond to queries — saw rapid adoption, with more than 47% of Indian enterprises taking several AI applications into full production.

This shift had a visible impact on manufacturing, with AI-driven smart factories using tools such as computer vision to improve efficiency. These gains supported a stronger performance in auto stocks, which contributed to the Nifty Auto index’s outperformance during the year.

A major factor that helped the stock market remain resilient even amidst headwinds was the rate cuts which anchored market confidence. Monetary easing emerged as one of the major market stimulants in 2025, with the US Federal Reserve cutting interest rates thrice during the year by 25 basis points to 4% on September 17, October 29 and December 10 – taking the rate down to 3.50%. Likewise, the Reserve Bank of India cut the repo rate by 25 basis points in February and April, bringing the rate down to 6%. In June, the RBI cut the repo rate by 50 basis points to 5.50%. These rate cuts helped the stock market stay resilient even during the sharp corrections on account of the heavy unloading by FPIs.

Despite the numerous headwinds, the stock market managed to deliver respectable returns in 2025. While Nifty50 advanced over 10%, reaching a new all-time high of 26,325.80, the Sensex climbed around 9% to scale a record high of 86,159. Bank Nifty turned out to be an outstanding performer, surging over 16% to touch an all-time high of 60,114.30.

One of the major factors that hit market sentiment very badly was the heavy unloading by foreign investors, mainly FIIs and FPIs, during 2025. During the year, the net outflows exceeded Rs 1.5 lakh crore. However, domestic institutional investors (DIIs) tempered the adverse impact of this sale avalanche by pouring Rs 5,65,456.3 crore into the market. Steadily rising SIP contributions, rapidly growing demat accounts, and a ‘buy on dips’ approach helped the stock market absorb global shocks and sustain momentum.

With this tumultuous background, 2026 has started on a cautious note for the stock market as global geopolitical tensions continue unabated. The Ukraine-Russia military conflict continues, and the US President is even dropping hints of a Third World War. In fact, the US turned the global playbook upside down by entering Venezuela and capturing its President, while Mr Trump continues to be obsessed with acquiring a small country like Greenland. On the economic front, the Trump tariff sword has created widespread global uncertainty. In this scenario, it is pleasantly surprising that a developing country like India has emerged as the fastest growing economy with 6 per cent GDP growth, as forecast by the International Monetary Fund (IMF).

Clearly, cautious optimism is the watchword for the Indian stock market in 2026. As for Indian investors, the question agitating their minds is: where to invest in 2026? Returns on bank deposits – savings or fixed deposits — are negligible, viewed in the context of the rising prices of almost everything. Real estate has not remained an attractive investment, as was the case a few years ago. And investors have lost trust in company deposits as several companies have been known to drag their feet in returning deposits. The culture of investing in art has not picked up in India, as few people are familiar with the intricacies involved in this mode of investment. In these circumstances, investors, for all practical purposes, have a choice of only two avenues of investment – precious metals and the stock market.

Growing geopolitical tensions have given a boost to demand for precious metals. In times of war and uncertain political environments, people start losing faith in currencies and opt for accumulating precious metals like gold, silver and platinum.

Little wonder then that the recent growing demand for gold, silver and platinum has pushed up prices of these precious metals to all-time high levels. In London, gold prices scaled a new high of £ 3,338 per ounce (£ 107 per gram). In the New York market, the price of the yellow metal for the first time crossed $ 4,485 per ounce. As far as India is concerned, the gold price in Mumbai – after stagnating through mid-2024 — shot up steeply starting in November 2024, climbing nearly Rs 9,000 in three months, and then skyrocketed in 2025-26 to cross the milestone of Rs 1 lakh per 10 gm, reaching Rs 1,40,790 by January 9, 2026.

Along with gold, silver prices have zoomed to new peaks. Contrastingly, silver’s fundamentals have been driven largely by rapidly growing industrial demand. Roughly speaking, two-thirds of global silver use comes from industrial requirements like semi-conductors, photo- voltaics (colour panels), water purification, batteries and touchscreen displays, as well as e-automobiles. The solar PV sector alone is growing at 12 per cent annually, creating secular demand for silver, especially in Asia. Little wonder that the price of the precious white metal has zoomed to cross the Rs 2 lakh/ kg mark to reach Rs. 2.50 lakh per kg. The spurt in silver prices aligns with a broad uptick in manufacturing and green energy expansion globally.

Traders eyeing undervalued silver was another driving factor for silver prices. A key market signal has also played a role. The gold-silver ratio, a traditional valuation metric, currently stands at over 90:1, meaning one ounce of gold buys more than 90 ounces of silver. The historical average is around 60:1. This implies that silver is significantly undervalued relative to gold, encouraging traders to rotate allocations. Retail interest has surged as gold ETF assets in India rose 187% year-on-year to Rs 1.27 lakh crore by January 2, 2026, from a much higher base than silver. Combined with record folios in silver, ETFs and a pre-budget buying frenzy ahead of anticipated tax hikes, the trend suggests broadbased public participation.

One more reason for the gold and silver surge is the weakening rupee in 2025, from Rs 79 per dollar in 2023. In 1947, when India got independence from the British, one rupee fetched one dollar. Since India imports nearly all of its gold and silver, any devaluation of the rupee inflates domestic prices, even when global prices remain constant. This currency effect has contributed to India’s domestic gold consumption hitting record highs – faster than the global average.

At the same time, central banks have added to the frenzy globally. In 2024, over 1,000 tonnes of gold were bought by central banks worldwide for the third year in a row, according to the World Gold Council. The Reserve Bank of India also added to its reserves, increasing institutional demand and tightening the global supply situation.

With growing geopolitical tensions making gold a safe haven, demand for precious metals is bound to continue. Investors in these circumstances can certainly go for gold, silver and platinum, but with a cautious approach. If geopolitical tensions go down noticeably, the frenzy for demand in gold may weaken. However, silver is likely to rule firm on account of the growing industrial demand.

In these circumstances, the stock market remains the best investment avenue for multiplying investor wealth. But there are a lot of danger signals on this route too. Hence, investors will have to tread extremely cautiously and make selection of stocks with foresight.

Needless to say, stocks are synonymous with companies, and the outlook for companies depends on the prospects of the sectors they belong to. Thus, at the outset, we need to know the near-term and long-term prospects of various sectors. Pertinently, the fortunes of various sectors undergo changes on account of trade cycles, business cycles and various economic, political and social developments. For example, yesterday's prosperous sectors like iron & steel, textiles and shipping have lost their sheen currently. Companies manufacturing gramophone records, music cassettes and tape recorders became redundant years ago with the emergence of new technologies. On the other hand, several new industries have come into prominence and some of them have bright prospects. Industries like textiles, engineering and gems & jewellery will face challenges in 2026 on account of the tariff war being waged by the US President.

Sectors which are marked by optimism in 2026 include aerospace & defence, renewable energy, artificial intelligence, cloud technology and machine building, and stocks of companies helmed by enlightened managements are bound to put up a heartwarming performance this year. Industries which are expected to do very well in 2026 include:

According to financial experts, the asset quality of the banking and finance sector has improved considerably of late with a marked drop in non-performing assets. At the same time, liquidity in the sector is quite high and the lending environment is highly favourable. These factors are bound to drive growth of the sector in the new year and stocks of fundamentally strong and well-managed companies should put up a robust performance.

As infrastructure development is essential for transforming our developing economy into a developed one, it will benefit substantially on account of the robust economic growth story and strong government spending. The continued government focus on infrastructure devel opment, including housing and construction of roads, is a major tailwind. Along with public sector investment, the government is encouraging and pushing private sector investment which had slowed down of late. Steadily rising demand and improving corporate earnings have also aided capital formation. Little wonder that many infrastructure companies have built up robust order books.

The $ 27 billion Indian aerospace and defence industry is engaged in building aircraft, ships, spacecraft, weapon systems and defence equipment. Of late, this sector is rapidly growing and propelling the growth of the manufacturing sector from the front by manufacturing defence equipment of international quality and establishing technologically advanced manufacturing facilities. In recent years, the Indian aerospace and defence industry is at an inflection point because of a spurt in demand for defence equipment and modernisation and indigenisation programmes undertaken by all three services -- Army, Navy and Air Force -- of the Indian military which has emerged as one of the largest forces in the world. Little wonder that in these circumstances India's defence budgets in recent years have expanded.

Demand for defence equipment has shot up at home as well as abroad on account of growing geopolitical tensions, increasing military conflicts like those between India and Pakistan, Pakistan and Afghanistan, Israel and Gaza, Israel and Iran, and in parts of the Middle East. India has started exporting its defence equipment in a very big way, and several countries, whether involved in military conflicts or not, have started buying defence equipment in order to strengthen their defence mechanism.

Other factors that will aid the growth of the aerospace and defence sector include growing commercialisation in the aerospace and defence sector. Growing international collaborations, a growing focus on space exploration missions, expansion of defence and aerospace services, and development of advanced technologies are expected to boost production and sale of aerospace and defence equipment in India, thereby driving market growth.

The aerospace and defence industry is on the priority list of the government and the industry is a focus area for the 'Make in India' and 'Atmanirbhar Bharat' initiatives as well as production-boosting schemes like the Production-Linked Incentive (PLI).

According to research institution CMI (Custom Market Insights), the Indian aerospace and defence sector, which is around $ 29 billion in size today, is expected to reach $ 54.4 billion by 2033.

Beset by growing environmental problems, the world has turned from fossil fuels to renewable sources of energy. The Indian government is strongly supporting this change by devising its own policies. These government initiatives are aimed at promoting renewable energy sources such as solar and wind to drive growth. The growing need for infrastructure development is also boosting demand for utility companies in this space. Electric vehicle (EV) manufacturers and component suppliers are gaining traction, signalling substantial growth potential.

Considered to be defensive play, the healthcare and pharma sector performs well during volatile market conditions. Healthcare and pharma companies offer essential products and services that remain in demand regardless of the economic as well as political climate. In any environment, the sector has delivered strong earnings and is viewed favourably due to its defensiveness.

The automotive industry, which faced challenges for some time in 2024 and 2025, is all set to put up a robust performance in 2026. Growing urbanisation, rising incomes, improving standards of living and escalating aspirations will give a push to the auto industry, and the trend will be aided by GST rationalisation and easier availability of bank credit. Premiumization trends and an expected recovery in rural demand are expected to provide tailwinds. Supportive government policies like the productionlinked incentive (PLI) scheme will push up the pace of growth of the industry in 2026.

State Bank of India (SBI) is an Indian international public sector bank and financial services body. The Mumbaiheadquartered banking entity is the country's oldest (200 years old) and largest commercial bank, with a 23 per cent marketshare by assets and a 25 per cent share of the loan and deposits market. It is also the tenth largest employer in India with near 250,000 employees. Globally, SBI is the 47th largest bank by total assets and was ranked 178th in the Fortune Global 500 list of the world's largest corporations of 2024. In Forbes' Global 2000, SBI was ranked 55th.

SBI has a rich history behind it. It descends from Bank of Calcutta. A contemporary at that time, Bank of Madras, was merged with the other two presidency banks in British India, Bank of Calcutta and Bank of Bombay, to form the Imperial Bank of India, which in turn became the State Bank of India after the country's independence. Over the course of its 200-year history, the bank has grown from the mergers and acquisitions of more than 20 banks. In 1955, the government of India took control of the bank, with Reserve Bank of India, the country's central bank, taking a 60 per cent stake and renaming Imperial Bank of India 'State Bank of India'.

The bank has made rapid strides on the financial front. During the last 12 years, its revenues have more than doubled from Rs 189,062 crore in fiscal 2014 to Rs 490,938 crore in fiscal 2025, with the profit at net level taking an almost five-fold jump from Rs 14,807 crore to Rs 69,543 crore.

Prospects for the company going ahead are all the more promising. The bank itself is doing very well. What is more, its mutual fund (SBI Mutual Fund) and its insurance (SBI General Insurance) and payments arms (SBI Capital Markets) are seen as prime IPO candidates, and analysts see these as accounting for a meaningful chunk of SBI's embedded value. According to the fiscal 2025 annual report, the PBT contribution from subsidiaries and associates stood at Rs 14,217 crore, reflecting a 15 per cent yoy rise. For a bank that clocks over Rs 70,000 crore in annual profit, the growth story is evolving. It is no longer just about net interest margins or slippages, it is now about how the market values the sum of SBI's parts, especially the unlisted ones that have matured into cash-generating businesses. If SBI moves ahead with IPOs, it will be a valuation inflection point with significant re-rating potential.

"SBI's subsidiaries contribute nearly Rs 3 lakh crore to its SOTP value, based on market cap and AUM (Assets Under Management) benchmarks. Our overvaluation and applying a holding company discount assume a realisable value of around Rs 2.5 lakh crore," maintains Vikas Gupta, CEO of Omniscience Capital. That would be roughly onethird of SBI's current market capitalisation of Rs 7.1 lakh crore. The share price of SBI is quoted around Rs 800-810. This price is bound to shoot up by at least 20 per cent. Discerning investors with a long-term perspective can include this banking scrip in their portfolio.

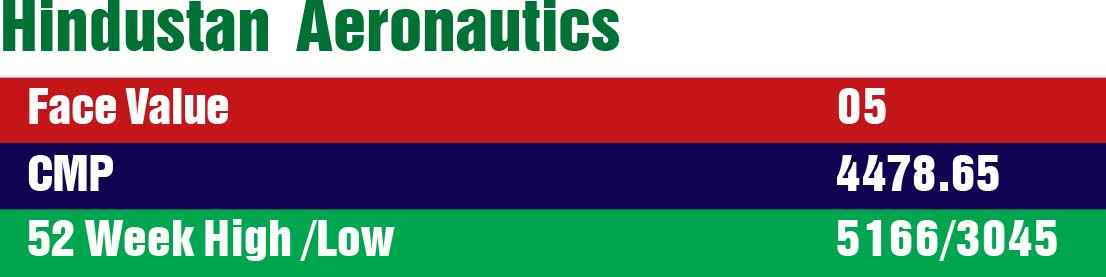

Bengaluru-headquartered Hindustan Aeronautics, a PSU, is one of the oldest and largest aerospace and defence manufacturers in the world, starting with aircraft manufacturing as early as in 1942 with the licensed production of the Harlow PC-5, the Curtiss P-36 Hawk, and the Vultee A31 Vengeance for the Indian Air Force. HAL currently has 11 dedicated R&D centres and 21 manufacturing divisions under 4 production units spread across India. The company has a 'Maharatna' status. At present, the company is engaged in designing and manufacturing fighter jets, helicopters, jet engines, marine gas turbine engines and avionics, as well as in hardware development, spares supply, and overhauling and upgrading Indian military aircraft.

HAL is performing very well on the financial front. During the last 11 years, its sales turnover has almost doubled -- from Rs 15,939 crore in fiscal 2015 to Rs 30,931 crore in fiscal 2025, with operating profit shooting up over 4 times from Rs 2,379 crore to Rs 9,608 crore and the profit at net level surging over 3 times from Rs 2,399 crore to Rs 8,364 crore.

Prospects for the company are all the more promising going ahead. HAL enjoys a robust order book. By March 2025, it stood at Rs 94,000 crore. What is more, the company is going to be awarded orders worth Rs 1.5 lakh crore in the next 2-3 years. This provides low double-digit revenue growth visibility over the next few years. Again, the government's push for the purchase of domestic defence aircraft under the 'Make in India' initiative will create long-term, sustainable demand growth for HAL as it is India's main supplier of military aircraft. HAL has strong government support, a robust order book and proven execution capabilities. Shares of the company (face value Rs 5 per share) are quoted around Rs 4,990. Discerning investors should not ignore these stocks, which can be added to their portfolio in 2026 to reap a rich harvest.

Hyderabad-headquartered Azad Engineering is a qualified and established supplier to global Original Equipment Manufacturers (OEMs) like Honeywell, Baker, Hughes, Eaton, Aerospace, Rolls Royce, Siemens Energy, GE Vernova and Mitsubishi Heavy Industry across sectors like aerospace, defence, energy and oil & gas, which have high entry barriers and strict quality control standards. Azad is well positioned to retain its competitive lead. As of December 2025- end, the company had in place 45+ qualified parts. It generates 92% of its revenue from international clients while he balance 8% is generated from the domestic market. The company is making rapid strides in its financial performance. During the last six years, its sales turnover has expanded by three and a half times from Rs 122 crore in fiscal 2020 to Rs 453 crore in fiscal 2025, with operating profit shooting up over four times from Rs 41 crore to Rs 161 crore and the profit at net level inching up almost four times from Rs 21 crore to Rs 81 crore.

Prospects for the company in fiscal 2026 and ahead are all the more heartwarming. With government policy giving a big boost to the aerospace and defence sectors, the company's pace of growth has quickened in 2026. Thanks to the government's initiatives like 'Make in India' and 'Atmanirbhar Bharat', as well as global geopolitical issues, demand for the company's products at home and abroad has shot up. This was reflected in its performance in Q2FY2026 (July to September 2025), when revenues spurted 30.6% to Rs 145.6 crore as compared to Rs 115.2 crore, and the profit at net level skyrocketed by over 60% from Rs 20.5 crore to Rs 33 crore. In the first half of Q2 FY2026, the energy and oil & gas segments contributed Rs 226.1 crore, as compared to Rs 166.6 crore. The main driving force was expanded capacity, and the trend is expected to continue as operations scale further Again, Azad generates 92% of its revenue from international markets, and is well-positioned to benefit significantly from healthy global demand from the targeted industries. The total addressable market (TAM), which was around Rs 1,500 billion in CY2023, is expected to reach Rs 3,430 billion by CY2029, led by the aerospace and defence sector. The company aims to reach the significant level of 1.5% of the total market.

Little wonder that Azad's order book has grown substantially over the last two years, led by strong order inflows. Rakesh Chopdar, Chairman and CEO, elaborates, "We have three customer-specific plants that showcase our ability to align closely with our global OEMs and scale with agility. These plants are aligned with our customers in the energy and oil & gas space, resulting in a 35.7% growth in this segment's revenues during the first half of FY2026. Parallelly, the aerospace and defence segment registered a healthy 30.3% improvement on the back of commercialisation of new products.

The company's order book position has further strengthened with the signing of phase 2 of the Mitsubishi contract, which has a combined contract value of Rs 1,387 crore. At present, the total order book is estimated to be Rs 6,000 crore -- almost 14 times FY2025 revenues. This provides strong revenue growth visibility.

What is more, Azad is expanding its capacity to propel further growth. It recently commissioned two new manufacturing facilities, primarily for GE Vernova and Mitsubishi, with a total area of 14,800 sq m at Hyderabad. With these two facilities, the company now operates six state-of-the-art manufacturing facilities in Hyderabad, which are equipped to produce high-precision forged and machined components across a combined manufacturing area of 34,800 sq m. Additionally, it plans to establish multiple sub-facilities at Hyderabad in two phases, dedicated to specific customers. Overall, Azad aims to transition itself from being a component supplier to undertaking full engine assemblies through strengthening capabilities across the value chain and expanding growth opportunities. With these opportunities and strategies in place, the management aims to boost its wallet share to 2-2.5% in the medium term (from 1-1.5% at present), with a long-term goal of increasing it to 10%. The company's shares are quoted around Rs 1,636, and knowledgeable analysts expect the price to swiftly cross Rs 2,000 mark within a year.

A well-diversified conglomerate with interests in oil refining, telecom, retail and petrochemicals, Reliance Industries, headed by far-sighted and dynamic businessman Mukesh Ambani, is India's largest and most profitable private sector company. Promoted by legendary first- generation entrepreneur Dhirubhai Ambani, who had during the half-century of his leadership catapulted the company into the coveted list of Fortune500, RIL is today one of India's most valuable companies. Fully subscribing to its vision growth is a way of life, and evolving into green energy, retail and digital platforms could be a defining long-term growth engine. With a mammoth market capitalisation of over Rs 20 lakh crore, it stands out for strong execution across sectors.

The company is going from strength to strength on the financial front. During the last 12 years, its sales turnover more than doubled from Rs 433,521 crore in fiscal 2014 to Rs 962,820 crore in fiscal 2025, with operating profit shooting up almost five times from Rs 34,935 crore to Rs 165,398 crore and the profit at net level spurting three and a half times from Rs 22,548 crore to Rs 81,309 crore. Prospects for RIL during fiscal 2026 and further are all the more promising. The company, which had gone public in 1977, is going to celebrate its first golden jubilee in 2027. Sustained momentum in the high-growth consumer business (Jio Telecom and retail) and impending monetisation of its energy venture are expected to translate to strong consolidated revenue /EBIDTA growth at a CAGR of 10%/15% over FY2025-27, according to analysts at Religare, as resilient O2C (oil to chemicals) cash flows continue to fund new growth engines.

The outlook for the company is highly promising. RIL supremo Mukesh Ambani has gone on record saying that the strategic vision of the management for the company's four key businesses -- telecom, retail, O2C and new energy -- is also robust. The management aims to double EBIDTA in the next five years, powered by 5G opportunities, increased investments in Artificial Intelligence (AI) and data centres, further expansion in retail (physical + digital), and the start of PV/battery facilities in new energy. The company will leverage the AI-based opportunity (Jiobrain) presently used by RJio internally. It aims to launch a powerful AI service platform and AI models at affordable prices for other enterprises. RIL will drive a similar transformation across other Reliance operating companies. Postperforming Jiobrain within Reliance, they will create powerful AI service platforms that can be offered to other enterprises as well. RJio is developing a comprehensive suite of tools and platforms that spans the entire AI life cycle.

Subsequently, the company will aim at creating a national AI infrastructure, with plans to establish GW-scale AIready data centres at Jamnagar. The company will partner with leading global technology companies and innovators to bring the most advanced AI models and solutions & tools to India. The company has made rapid strides in its financial performance. During the last 12 years, its sales turnover has expanded from Rs 433,521 crore in fiscal 2014 to Rs 962,820 crore in fiscal 2025, with operating profit shooting up from Rs 34,935 crore to Rs 165,398 crore and the profit at net level spurting from Rs 22,548 crore to Rs 81,309 crore.

The company's stock is quoted around Rs Rs 1,497 at present with a market capitalisation of Rs 19.88 lakh crore, making RIL the most valuable company in the Indian corporate sector. The share price is expected to reach Rs 1,600 within the next two years and then skyrocket to cross Rs 3,000 within the next five years or so.

An undisputed leader in private sector banking, with a long record of disciplined growth, best asset quality in its class with low NPAs, and remarkable innovative digital banking practices, HDFC Bank has, following its merger with parent company HDFC, become all the more formidable. The Mumbai-headquartered bank has delivered strong deposit growth with average deposits increasing 16 per cent yoy. In fact, deposits grew faster than loans, enabling the bank management to make progress in normalising its CD (credit deposit) ratio. As far as the CASA (current account-savings account) ratio is concerned, it is among the highest in the industry. It stands out in the banking sector on account of credit growth and tech-forward banking.

According to the bank management, HDFC has sufficient liquidity and capital to support loan growth comfortably when the macro-economic environment becomes more favourable. The bank has not exited any product or geography and is leveraging its liquidity and capital tailwind, awaiting the right time to scale up loans. During the last quarter of fiscal 2025, despite the slowdown in the loan book, key ratios have remained stable due to high-quality origination and effective collections. Shares of the company with a face value Re 1 per piece are quoted around Rs 1,980, as the long-term prospects are highly promising. If an investor is building a portfolio of shares for long-term investment, HDFC Bank is hard to ignore.

An industrial development and investment organisationturned-commercial bank, ICICI Bank is India's second largest private sector bank, occasionally threatening to displace the number one bank. The bank enjoys an undisputed leadership position in various financial services. It offers the entire spectrum of financial services to customer segments covering large and mid corporates, MSMEs, and agri and retail businesses, with half of them in rural and semi-urban areas. It has 16,125 ATMs spread across India. It is an international bank with subsidiaries in the UK and Canada, and branches in the US, Singapore, Bahrain, Hong Kong, Qatar, Oman, Dubai, China and South Africa. It also has representative offices in half a dozen countries. The company's UK subsidiary has set up branches in Germany and Belgium. The bank has acquired several small banks, including Anagram Finance, the Darjeeling and Shimla branches of Grindlays Bank, IKB (Russia), Sangli Bank and Bank of Rajasthan.

ICICI Bank was making good progress when the Chanda Kochchar fraud case hit its pace of growth. But the new management succeeded in staging a fast recovery and put the bank on a growth path once again. During the last 12 years, the bank's revenues have more than trebled from Rs 49,479 crore in fiscal 2014 to Rs 186,331 crore in fiscal 2025, with the profit at net level shooting up more than four times from Rs 11,677 crore to Rs 46,081 crore. The share price of the bank is in the Rs 1,440-45 range. The bank has tremendous growth potential. Discerning investors can include this stock in their portfolio. For details please see Fortune Scrip in this issue.

Besides these six 'power' stocks that are undeniably worth investing in for 2026, we give a list of 10 other investment-worthy stocks for the new year, widening the choice for our readers:

January 31, 2026 - Second Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives