Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Published: January 31, 2026

Updated: January 31, 2026

Headquartered at Noida, NSE-BSE listed United Drilling Tools (UDTL) is one of the few well-established early entrants in the manufacture of tools and equipment required in oil & gas exploration and drilling activities, primarily in upstream operations.

The company was promoted in 1985 by technocrat Pramod Kumar Gupta, a firstgeneration entrepreneur with a Master’s in industrial engineering from the United States. Its diversified product portfolio includes casing pipes, connectors, wireline winches, gas lift equipment and downhole tools. It enjoys a leadership position in some of them with an over 40% market share in India.

The company along with its subsidiary M/s. P Mittal Manufacturing Pvt. Ltd. manufactures wireline winches and allied products at two office locations. Envisaging demand, it has also developed new products in-house like circulating heads, crossover pup joints and anti-rotation devices. The revenue from these will contribute to the company’s growth, going forward.

UDTL has successfully created an agents’ network in more than 20 countries to strengthen its global presence, including the USA, the UK, Brazil, Kuwait, Oman, Taiwan, Vietnam, Indonesia, Russia, the UAE, Nigeria, Libya, Bahrain, Algeria, Malaysia, Romania, Venezuela, Maxico, Columbia, Turkmenistan and Thailand. In the last three years, it has substantially expanded its global network.

Five API certificates, one Cal-1 certificate and all the required ISO certificates, along with approval from government authorities, pre-qualifications and its huge experience, vindicate the company’s optimism. Major clients include ONGC, Oil India, Cairn Vedanta, Haliburton, Schlumberger, Baker Hughes, CPC Taiwan, PEMEX, Petrobras and Vietsovpetro, Argentera, Dailem, USB Services, APDS, Jindral Drillling, Aban Offshore, Shelf Drilling, Quippo, Acquterra Energy, ACT (USA), Tatweer Petroleium, EGPC, Essem Corporation, Geonpro, Focus Energy Ltd, Well Care Oil Tools Ltd., Jindal Saw Ltd, Weafri, MSL, Adani Welspun, Man Industries, Cactus, Magitech International Ltd.,. It also acts as a single-source supplier for some domestic clients.

Notes Mr. Gupta, “Manufacturing of highquality and precision-engineered products comparable with the best global peers is our real strength. We don’t compromise on quality. In fact, with our strong R&D set-up led by a senior team, we have been constantly working on innovation and product improvements.”

Says Managing Director Kanal Gupta, “Now we are in a much better position compared to MNC peers catering to Indian clients. Relatively lower manpower costs and overheads go in our favour. Further, government tenders upto Rs 2 billion are reserved for domestic players. Likewise, as per government guidelines, PSUs and projects funded by PSUs in India are required to procure steel prod ucts only from domestic suppliers (most of UDTL’s products are steel-based). All these, in addition to a longproven track record with virtually all leading clients in the country, work as a big booster for a company like ours.”

He notes, “We have six state-of-the-art manufacturing facilities strategically located either in SEZs or near key seaports, at Noida in Uttar Pradesh and at Kandla and Mundra in Gujarat. Further, we have land of 1.22 lakh sq m, including 90,000 sq.m of vacant land in Luni, Mundra (Gujarat) for future expansion.” He adds, “We are equally comfortable in terms of manufacturing capacity for our current product portfolio. The annual installed capacity for casing pipes with connectors is 216 km, for sets of connectors 17,000+ units, gas lift equipment 14,000+ units, stabilizers 1,250+ units, and wireline winches 48 units.”

As per a Verified Market Research report for 2024, the global connectors market size is estimated to go up from $ 1,074 million in 2024 to $ 1,651 million in 2031. This augurs well for UDTL because the requirement for casing pipes with connectors will be 2.1 times the value of connectors. Another favourable factor is the government’s push to increase production of oil & gas in India. In fact, various steps to incentivize this sector have been taken, including allowing 100% FDI in oil & gas upstream, the launch of the hydrocarbon exploration and licensing policy, and a renewed policy framework for providing production incentives for domestic fields using enhanced oil recovery (EOR) technologies.

Major projects like ONGC’s $ 3 billion deep-water exploration in the KG basin and Oil India’s ambitious plans of drilling 80+ wells, targeting 4 mmt oil/5 BCM gas by FY26 will continue to provide strong demand for cutting-edge oilfield equipment, and UDTL will be a direct beneficiary

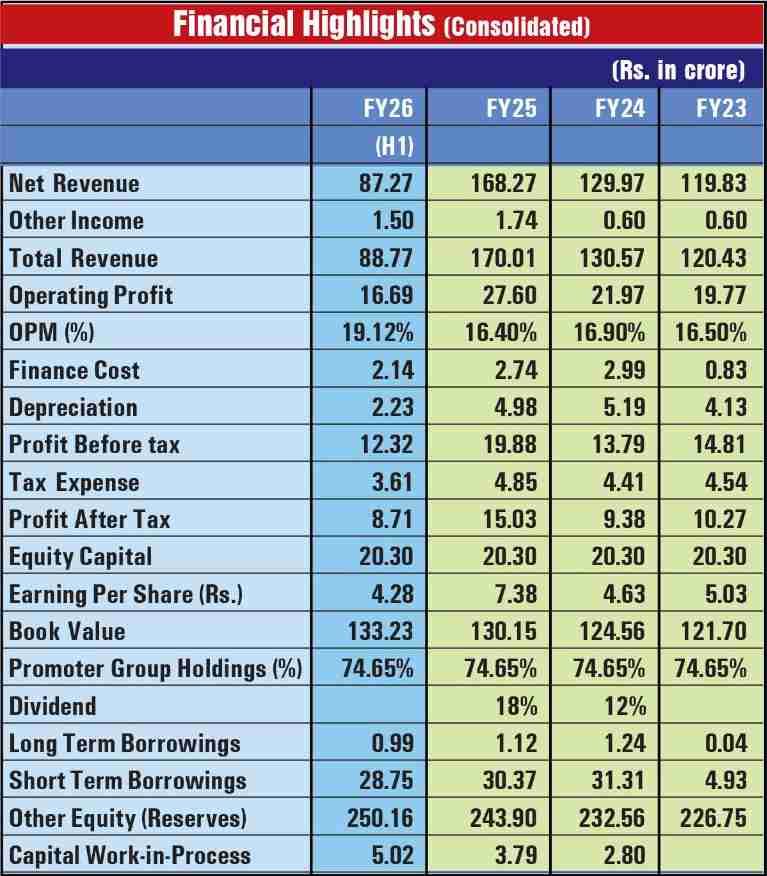

During FY25, the company achieved net revenue of Rs 168 crore and PAT of Rs 15.03 crore, vis-à-vis Rs 130 crore and Rs 9.38 crore respectively in FY24. The equity capital is Rs 20.30 crore and Rs 133 is the book value per share on a face value of Rs 10. The promoter group holds a 74.65% stake.

In the first half of FY26, on revenue of Rs 87 crore the company has earned PAT of Rs 8.71 crore with EBITDA rising to 19.12% against 16.40% in the previous full year.

With a strong product portfolio, adequate manufacturing capacities and the enormous prospects that the domain offers, UDTL is poised for accelerated growth with improved profitability.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives