Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Editorial

US President Donald Trump stunned the tech world in general, and Indian technology professionals working in the US in particular, last week by announcing a 50-fold hike in the cost of skilled workers’ permits to $ 100,000 (nearly Rs 89 lakh). The unprecedented hike in the H-1B visa fee caused turmoil over the September 20-21 weekend for thousands of Indians on H-1B visas, with Silicon Valley IT firms urging Indian staff not to leave the US and trying their level best to stop an India-bound exodus.

On the heels of the draconian announcement, the White House sought to calm the widespread panic by clarifying that the fee of $ 100,000 applied only to new applicants and was a one-off measure. Even so, the long-standing H-1B programme – which has been criticised for undercutting American workers but praised for attracting global talent – still faces an uncertain future. Even with the White House clarification, the policy effectively narrows down the H-1B pipeline that for three decades has powered the American dream of millions of Indians and, just as importantly, has supplied much-needed talent to American companies.

This pipeline has had a salutary effect on both countries. For India, the H-1B became a fulfiller of aspirations as small-town coders turned dollar earners and families vaulted into the middle class, and entire industries from airlines to real estate catered to a new class of globe-trotting young Indians. For the US, it meant an infusion of talent that filled laboratories, classrooms, hospitals and start-ups. Today, Indian-origin executives run Google, Microsoft and IBM, and Indian doctors make up nearly 7 per cent of the US physician workforce. Indians dominate the H-1B programme with more than 70 per cent of these visas. China, the second largest source of knowledge imports to the US, is far behind at 12 per cent.

In the technology segment, the Indian presence is even more pronounced. A Freedom of Information Act request in 2015 showed that over 80 per cent of computer jobs went to Indian nationals, a share industry insiders say hasn’t shifted much as yet.

The medical sector picture is just as eye-opening. In 2023, more than 8,200 H-1B visas were for work in general medicine and surgical hospitals. India is the single largest source of international medical graduates (who are typically in the US on H-1B visas) and contributes 22 per cent of all international doctors. With international doctors forming up to a quarter of US physicians, Indian H-1B holders likely account for around 5-6 per cent of the total.

Experts opine that pay data shows why Mr Trump’s new $ 100,000 fee is unworkable. In 2023, the median salary for new H-1B employees was $ 94,000, compared with $ 129,000 for those already in the system. Since the new fee targets new hires, most won’t even earn enough to cover it.

Though the nerves of the initially rattled tech industry have been calmed by the White House clarification that the new fee will be a one-time payment imposed only on new applicants, experts feel that though there will not be an immediate adverse impact over the next 6-12 months, there can be a deferred impact requiring eventual reassessment of business strategies by the IT companies — if the new rule stays.

With Indian aspirants reeling from the US President’s H-1B fee bomb, both visa seekers and Indian opposition parties are pointing fingers at an ‘evasive’ Prime Minister Narendra Modi for not taking up the issue vigorously with Mr Trump. Meanwhile, political pundits see the exorbitant hike in the H-1B visa fee as part of President Trump’s manoeuvring to force India to accept his ‘killer’ import tariff terms. For now, India is truly between a rock and a hard place.

Cover story

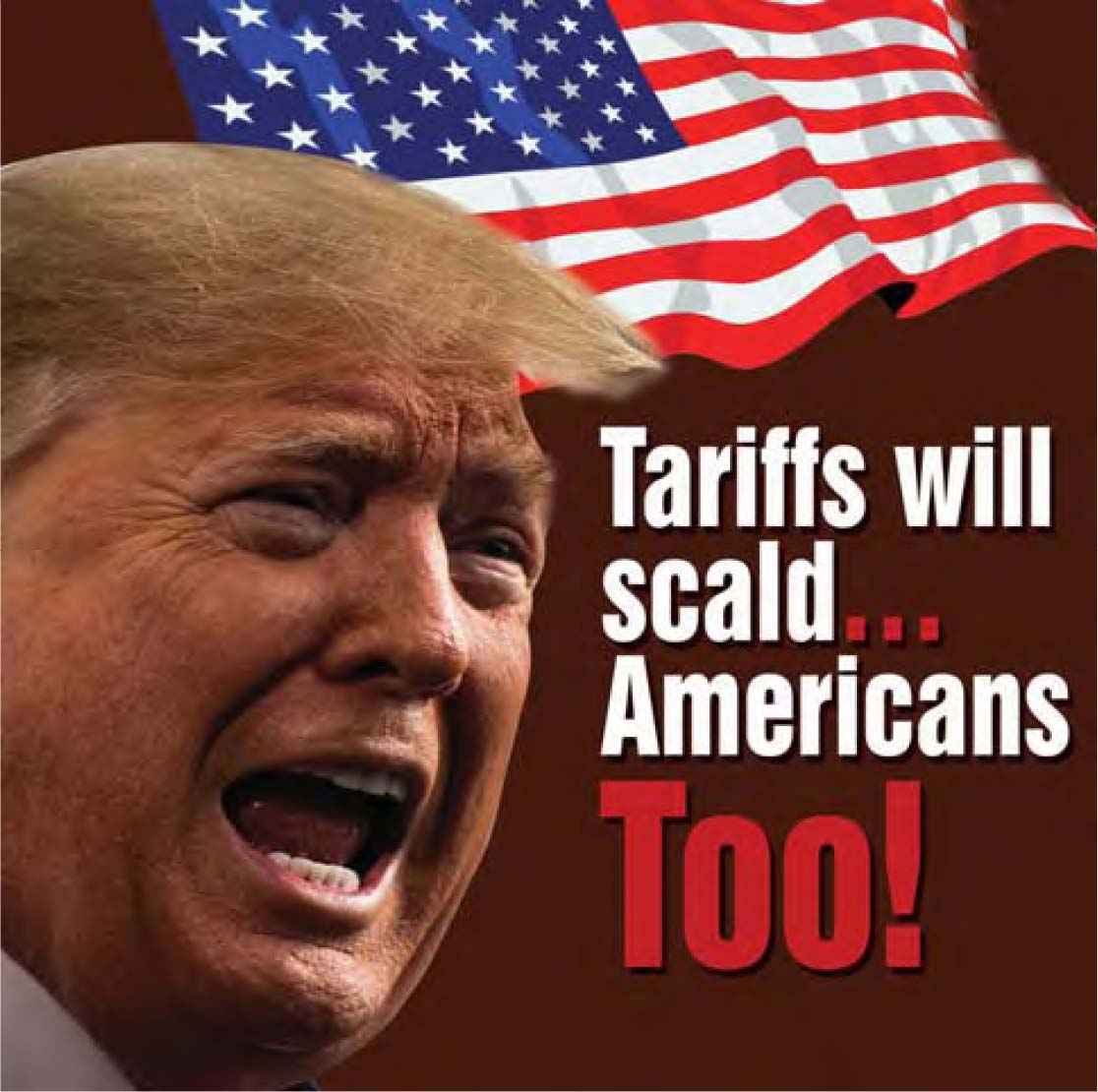

US President Donald Trump’s import tariffs sword may well turn out to be a Damoclean sword hanging over the heads of Americans themselves, going by projections of leading US think tanks.

Market Trends

As we analyze current market conditions, several key indices in the Indian equity markets are displaying strong, bullish price action on their weekly charts, signalling a potential for sustained upside momentum. This technical analysis aims to provide a strategic outlook for the Nifty Smallcap 250 Index, Midcap 150 Index, Nifty 500 Index and the PSU Banks Index. By focusing on significant price patterns and trends, we will delve into the underlying technical structures that suggest that these indices could be poised for further gains in the coming weeks.

Fortune Scrip

This fortnight we have selected an extraordinary multibagger as the Fortune Scrip. It is PTC Industries, which has showered immense wealth on its investors. During the last six decades of its existence, it has offered fantastic returns of over 19,500 per cent on their investment.

Corporate Report

A new star has risen in the construction material skies of India. The Goregaon (Mumbai)-headquartered Aquaproof group, promoted by far-sighted and dynamic first-generation entrepreneur Dr. Bajranglal Maheshwari, is an ISO-certified construction chemicals company which provides a complete range of wall care, tile care, dry mix mortar, water proofing and coating solutions for building and other civil constructions. Promoted in 2002, the group aimed at becoming a pioneer, front-runner and undisputed market leader in its segment.

Primary Market

With its registered office in Raipur (Rajasthan) and corporate office in Kolkata (West Bengal) BSE-listed Mehai Technology will enter the capital market with a rights issue to raise upto Rs. 74 crore.

Corporate Feature

BSE-listed Nihar (531083) Info Global Ltd is transforming from a marketplace seller into a multi-sector growth company with strong footholds in the following areas: e-commerce (ONVO, Goldensilver), digital healthcare (Life108 ePharmacy & Private Labels), and media tech (Beastbells CSR Podcast & AI Transparency Tool).

News & Events

Though we are proud that India can boast of the one of the world’s largest road networks of nearly 7 million km, catering to 70 per cent of freight and 85 per cent of passenger traffic, we are still far behind developed countries in road maintenance. At many places, including national highways, the condition of roads is so bad that travellers’ safety is at risk.

February 15, 2026 - First Issue

Industry Review

Want to Subscribe?

Read Corporate India and add to your Business Intelligence

![]() Unlock Unlimited Access

Unlock Unlimited Access

Lighter Vein

Popular Stories

Archives